1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle UBI?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Vehicle UBI

Electric Vehicle UBIElectric Vehicle UBI by Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD)), by Application (Passenger Vehicle, Light Commercial Vehicles, Heavy Commercial Vehicles), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Electric Vehicle Usage-Based Insurance (UBI) market is experiencing robust growth, driven by the increasing adoption of electric vehicles (EVs) globally and the inherent benefits of UBI for both insurers and policyholders. The market's expansion is fueled by several key factors. Firstly, the rising number of EVs on the roads necessitates innovative insurance solutions tailored to their specific characteristics, such as lower maintenance needs and different driving patterns compared to internal combustion engine (ICE) vehicles. Secondly, UBI's ability to personalize premiums based on actual driving behavior allows insurers to offer more competitive rates to safer drivers, thus attracting a broader customer base. This data-driven approach also benefits insurers by reducing risk assessment uncertainties and improving profitability. Finally, technological advancements in telematics and data analytics are enabling more accurate risk profiling and the development of sophisticated UBI models. The market, while currently relatively nascent, is projected to experience substantial growth over the next decade, propelled by government incentives for EV adoption, evolving consumer preferences for personalized insurance, and continuous improvements in UBI technology.

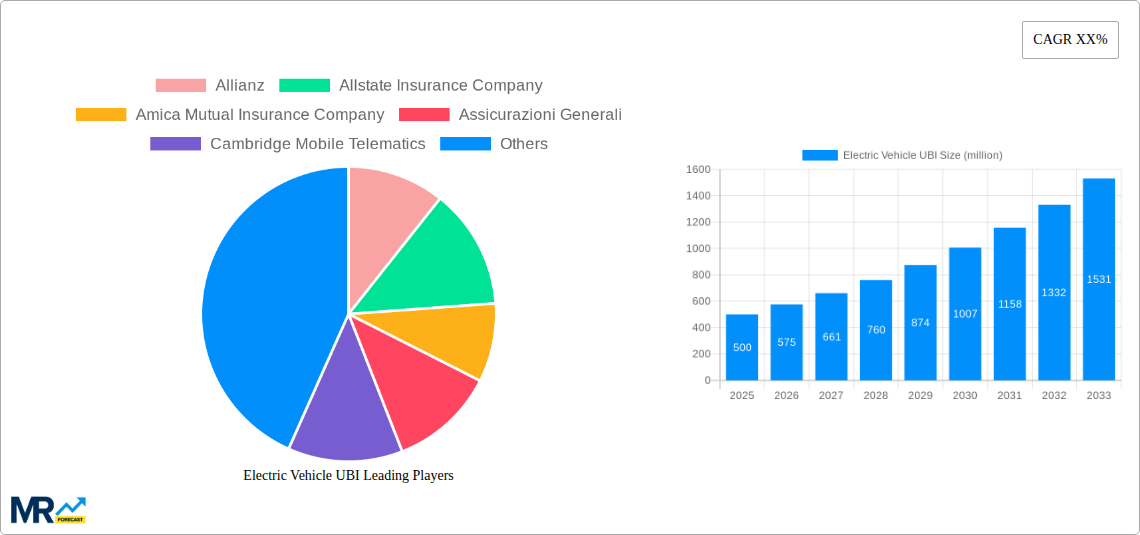

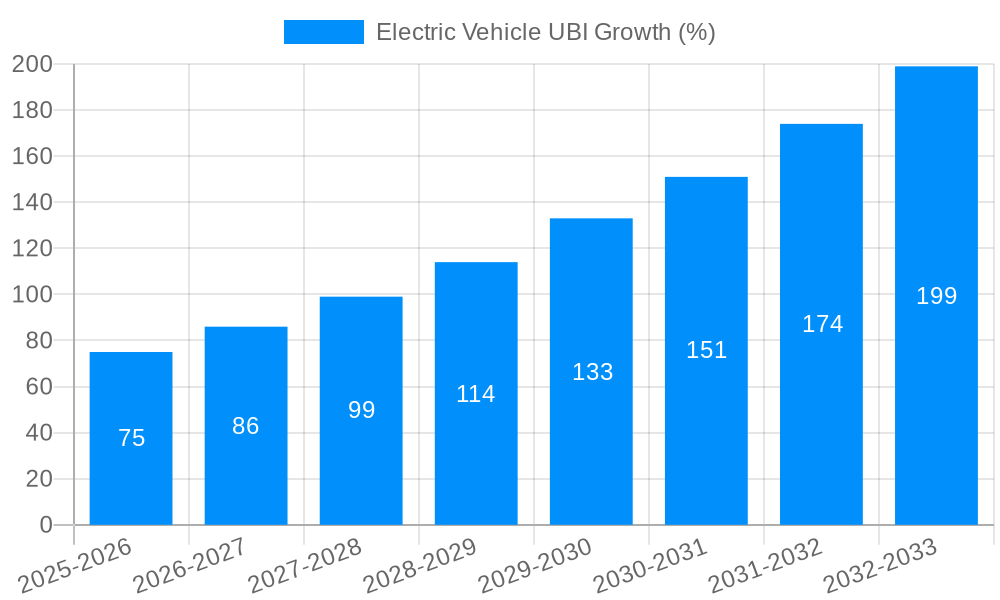

While precise market size figures are unavailable, considering a reasonable CAGR (let's assume a conservative 15% based on industry trends for similar emerging technologies) and a 2025 market size of, for example, $500 million, we can anticipate substantial growth. The inclusion of prominent players like Allianz, State Farm, and Progressive signals strong industry interest. However, challenges remain. Data privacy concerns, the need for robust telematics infrastructure, and the potential for biases in driving behavior data pose significant hurdles to broader market penetration. Overcoming these challenges through regulatory clarity, technological innovation, and transparent data usage practices will be critical for sustainable market growth. Competitive pressures amongst established insurance providers and tech firms will also shape the market landscape in the coming years. The continued penetration of EVs, coupled with technological advancements and consumer adoption, will be crucial factors in realizing the full potential of this dynamic market.

The global Electric Vehicle Usage-Based Insurance (UBI) market is experiencing exponential growth, projected to reach XXX million units by 2033. This surge is driven by a confluence of factors, including the rapid adoption of electric vehicles (EVs), advancements in telematics technology, and the increasing demand for personalized and cost-effective insurance solutions. The historical period (2019-2024) witnessed a steady increase in EV UBI adoption, primarily in developed nations with robust EV infrastructure and a higher penetration rate of connected cars. However, the forecast period (2025-2033) promises even more significant growth, particularly in emerging markets where EV adoption is accelerating. Key market insights reveal a strong correlation between EV sales and UBI adoption; as more EVs hit the road, the demand for tailored insurance solutions that accurately reflect individual driving behavior increases. This trend is further fueled by the increasing affordability and sophistication of telematics devices, which enable insurers to collect granular driving data for more precise risk assessment. Consequently, this allows insurers to offer customized premiums based on actual driving habits rather than broad demographic profiles, resulting in cost savings for safe drivers and fairer pricing overall. The competitive landscape is dynamic, with established insurance giants alongside specialized telematics providers vying for market share. This competition is driving innovation and pushing the boundaries of data analytics and risk modeling within the EV UBI space. The market is witnessing a shift towards data-driven insurance models, impacting traditional actuarial approaches and reshaping the overall insurance value chain. The shift away from traditional risk-pooling models towards more individualistic, data-driven pricing is driving this change, leading to a more efficient and equitable insurance market.

Several key factors are accelerating the growth of the EV UBI market. The proliferation of EVs is a primary driver, creating a significant demand for insurance solutions tailored to their unique characteristics. Furthermore, advancements in telematics technology are continuously improving the accuracy and granularity of driving data collected, allowing for more precise risk assessment and personalized pricing. These advancements not only enhance the effectiveness of UBI but also increase consumer trust and acceptance. Government regulations and incentives aimed at promoting EV adoption also play a crucial role. Many governments worldwide are implementing policies that encourage the use of EVs, indirectly boosting the demand for UBI. Moreover, consumer preference for personalized and transparent insurance solutions aligns perfectly with the value proposition of EV UBI. Consumers are increasingly demanding insurance products that reflect their individual driving behaviors and reward safe driving habits, making EV UBI an attractive alternative to traditional insurance models. This demand, coupled with the increasing availability of connected car technology, creates a fertile ground for the expansion of this market. The decreasing cost of telematics devices and the improvement in data analytics capabilities make EV UBI more accessible and cost-effective for both insurers and consumers, further driving market growth.

Despite the significant growth potential, the EV UBI market faces several challenges. Data privacy concerns represent a major hurdle. The collection and use of vast amounts of driving data raise ethical and legal questions about consumer privacy, requiring robust data protection measures and transparent data handling practices. Cybersecurity risks associated with connected car technology are another critical concern. The vulnerability of telematics systems to hacking and data breaches could lead to significant financial losses and reputational damage for insurers. Integrating EV UBI with existing insurance systems can also pose a technological challenge for insurers. Legacy systems often lack the flexibility and scalability required to effectively handle the large volumes of data generated by telematics devices. Furthermore, establishing consumer trust and awareness remains crucial. Many consumers may be unfamiliar with UBI or hesitant to share their driving data, requiring effective marketing and education initiatives to build trust and overcome misconceptions. The variability in EV adoption rates across different regions and the lack of standardized data collection practices add further complexity to the market landscape. Finally, the regulatory environment surrounding data privacy and insurance pricing can significantly influence the growth trajectory of the EV UBI market.

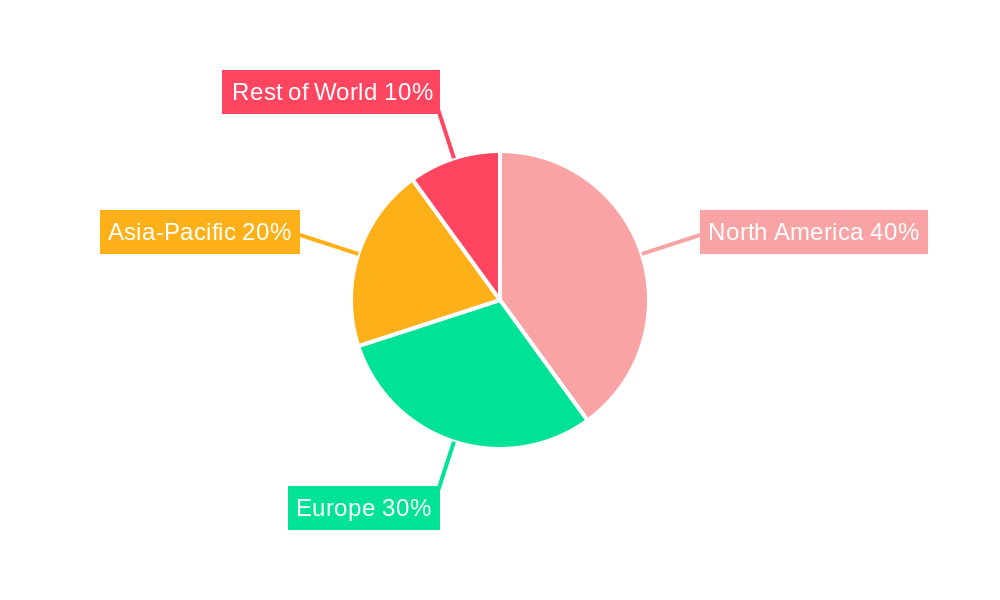

North America: The region is expected to lead the market due to high EV adoption rates, advanced telematics infrastructure, and a relatively receptive regulatory environment. The US, in particular, is a significant market due to a large fleet of connected vehicles and the presence of major insurance players actively developing EV UBI products. The presence of innovative technology companies in Silicon Valley contributes to technological advancements in this area as well.

Europe: Strong government support for EV adoption and stringent data privacy regulations are shaping the European EV UBI market. Several European countries are leading the way in terms of implementing policies to promote EV usage and data protection, creating a dynamic environment. The integration of EV UBI with existing insurance models is being undertaken by many European insurers.

Asia-Pacific: While currently smaller than North America and Europe, the Asia-Pacific market is poised for significant growth due to the rapid expansion of the EV market in China and other Asian countries. However, regulatory hurdles and infrastructural limitations might present temporary setbacks.

Segments: The Commercial Fleet segment is likely to experience the fastest growth within the EV UBI market. Businesses can significantly benefit from using telematics data to improve driving efficiency, reduce fuel costs, and enhance safety. This data allows for optimized fleet management, reduced insurance premiums, and a substantial reduction in operational expenditure.

The substantial growth of the EV UBI market is driven by the concurrent adoption of connected car technology and the rise of telematics and analytics capabilities. This allows for effective risk assessment and better-personalized pricing. The market is expected to further expand as autonomous driving technology develops, enhancing the possibilities for personalized insurance options.

The convergence of several key factors fuels the rapid expansion of the EV UBI industry. Increased consumer awareness of the benefits of personalized insurance, coupled with falling telematics device costs, broadens market accessibility. Government initiatives promoting EV adoption further stimulate demand, while technological advancements in data analytics refine risk assessment and pricing models. This overall synergy creates a positive feedback loop, accelerating market growth and creating new opportunities for insurers and technology providers.

This report provides a comprehensive analysis of the Electric Vehicle UBI market, encompassing historical data, current market trends, and future projections. It covers key market drivers, challenges, and opportunities, offering valuable insights for stakeholders across the industry. The report includes detailed profiles of leading players and an in-depth analysis of key regional and segmental trends, equipping readers with the information necessary to navigate the evolving landscape of EV UBI.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allianz, Allstate Insurance Company, Amica Mutual Insurance Company, Assicurazioni Generali, Cambridge Mobile Telematics, Insure the Box Limited, Liberty Mutual Insurance Company, Mapfre, Metromile, Modus Group, Nationwide Mutual Insurance Company, NTUC Income Insurance Co-operative Limited, Octo Group, Progressive Casualty Insurance Company, Sierra Wireless, State Farm Mutual Automobile Insurance Company, The Floow, Trak Global Group, Unipolsai Assicurazioni, Verizon, Webfleet Solutions, Zubie, Inc, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Electric Vehicle UBI," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Vehicle UBI, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.