1. What is the projected Compound Annual Growth Rate (CAGR) of the Dredging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Dredging

DredgingDredging by Type (Maintenance Dredging, Capital Dredging, Mineral Dredging, Environmental Remedial Dredging), by Application (Water Transportation, Energy Engineering, Urban & Tourism, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

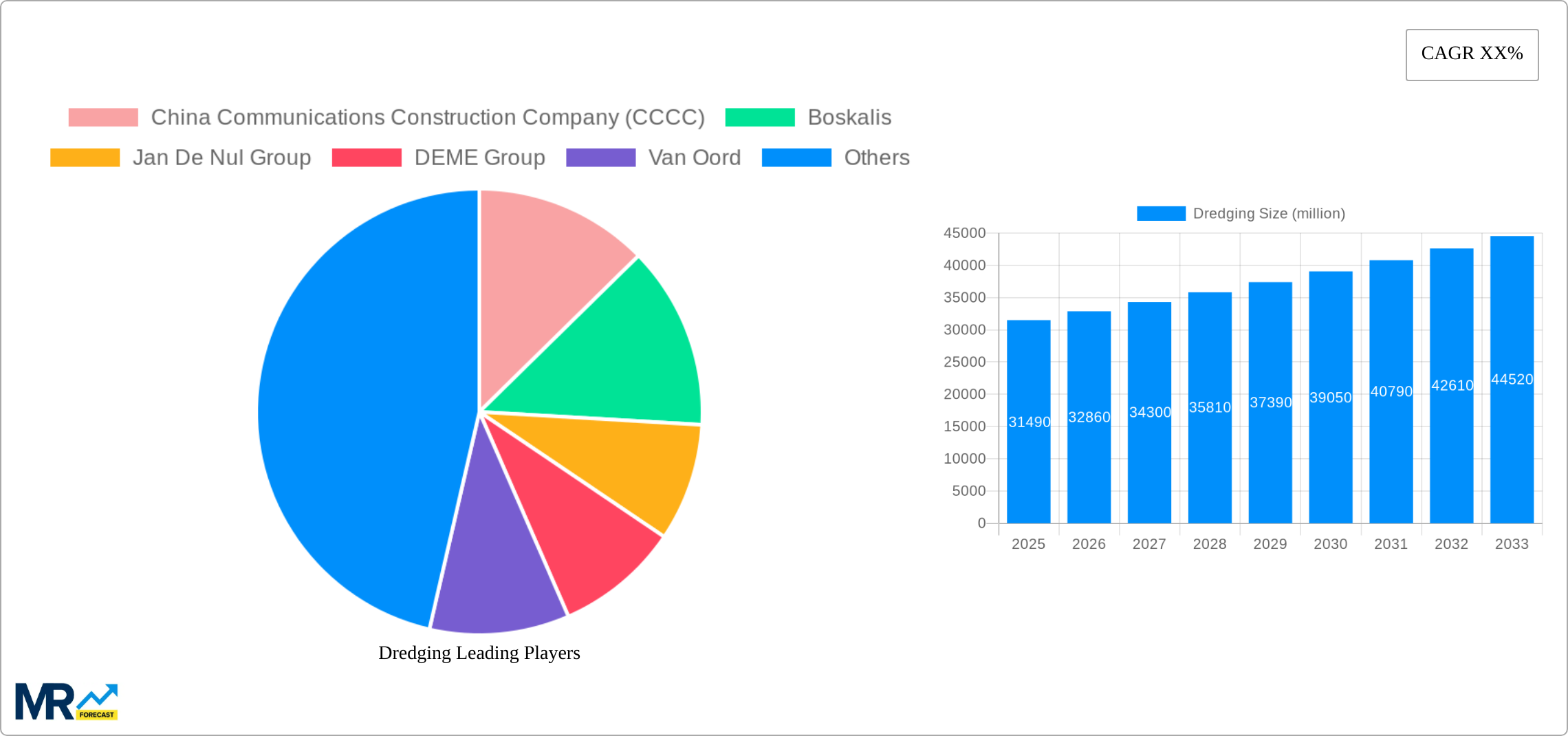

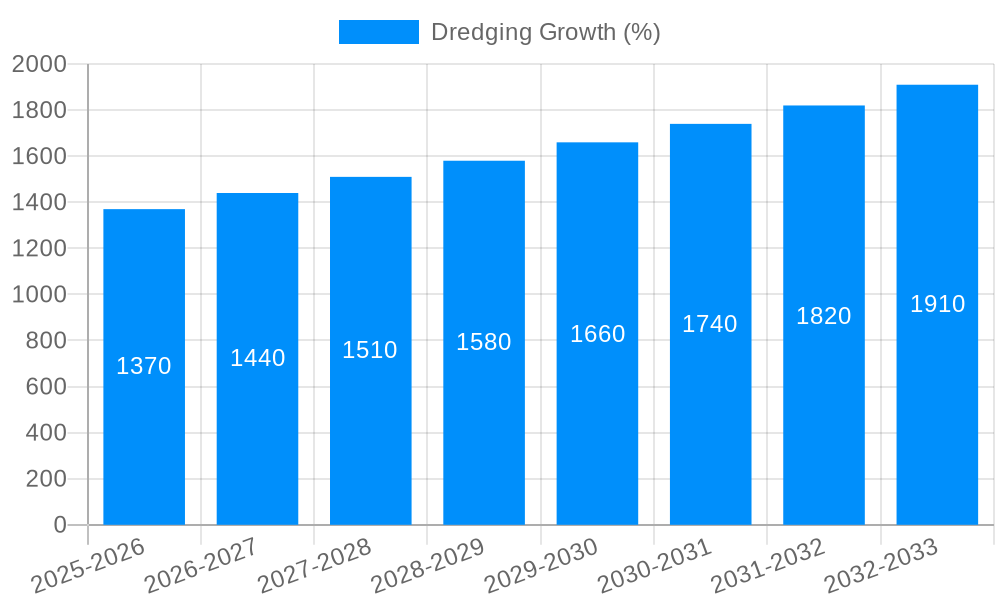

The global dredging market, currently valued at approximately $31.49 billion (2025), is poised for significant growth. While the precise CAGR is unavailable, considering the industry's dependence on infrastructure development (particularly in coastal regions and energy sectors), a conservative estimate places the CAGR between 4-6% for the forecast period (2025-2033). Key drivers include burgeoning port expansion projects globally, the increasing need for coastal protection and environmental remediation, and the ongoing development of offshore energy resources like wind farms. Growth is further fueled by rising government investments in infrastructure and the expanding global shipping industry. Maintenance dredging consistently holds a substantial market share, driven by the continuous need to maintain navigable waterways. Capital dredging, vital for large-scale projects, also contributes considerably. Mineral dredging, while a smaller segment, experiences fluctuations based on commodity prices. Geographical expansion into developing economies, particularly in Asia-Pacific, presents lucrative opportunities. However, environmental concerns regarding dredging's impact on marine ecosystems and the potential for regulatory hurdles pose challenges. Fluctuations in commodity prices, particularly for minerals, affect the mineral dredging segment's growth.

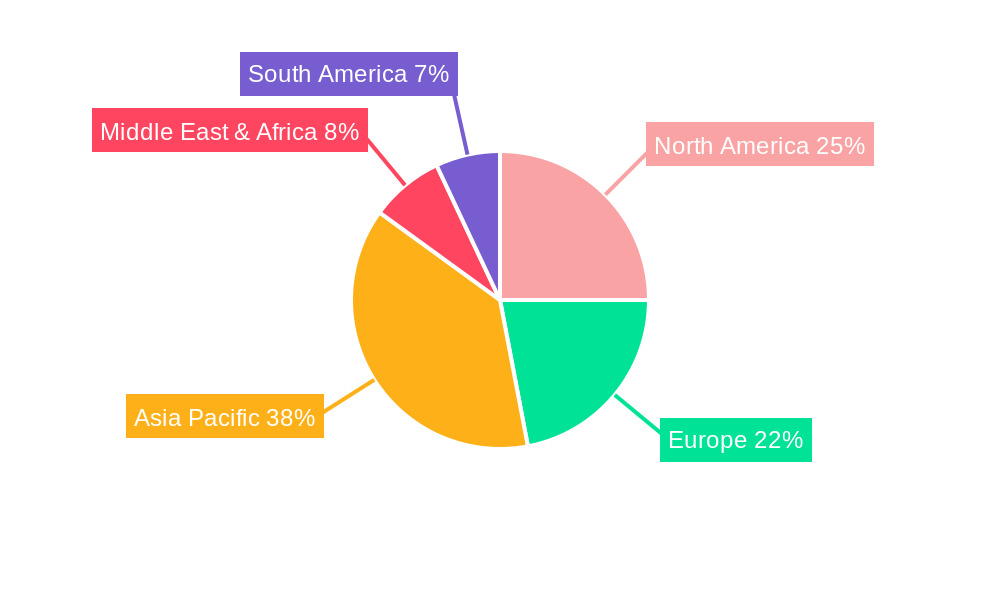

The market is highly competitive, with major players like China Communications Construction Company (CCCC), Boskalis, and Jan De Nul Group dominating the landscape. These companies leverage their expertise and extensive fleets to secure large-scale contracts. However, the emergence of smaller, specialized firms focusing on niche applications like environmental remediation presents competition. Regional variations exist, with North America and Asia-Pacific showing robust growth prospects. North America benefits from robust infrastructure spending, while Asia-Pacific’s rapid economic development and port expansion drive significant demand. Europe, while mature, maintains a substantial market share due to its existing infrastructure and ongoing maintenance needs. The forecast period suggests a steady expansion, with growth primarily driven by ongoing infrastructure projects and a rising focus on sustainable dredging practices.

The global dredging market, valued at $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z%. This robust growth is fueled by a confluence of factors, primarily the burgeoning need for infrastructure development across the globe. Increased maritime trade, coupled with the expansion of ports and harbors to accommodate larger vessels, necessitates extensive dredging operations for maintaining navigable waterways. Furthermore, the energy sector's reliance on offshore oil and gas extraction, along with the ongoing development of renewable energy sources like offshore wind farms, contributes significantly to the demand for dredging services. Coastal protection and land reclamation projects are also significant drivers, particularly in regions prone to erosion or experiencing rapid population growth. The historical period (2019-2024) witnessed considerable market expansion, driven by large-scale infrastructure projects in Asia and the Middle East. However, the forecast period (2025-2033) will likely see a shift in regional focus, with regions like Africa and South America experiencing heightened activity due to increasing investments in port modernization and coastal development. The base year for this analysis is 2025, providing a current snapshot of the market before projecting future trends. The study period encompasses 2019-2033, offering a holistic view of market dynamics. Fluctuations in commodity prices, particularly those of sand and gravel, along with stringent environmental regulations, will undoubtedly influence market growth throughout the forecast period. The market's competitive landscape is characterized by a mix of large multinational corporations and regional players, with considerable consolidation and strategic partnerships expected in the coming years. The interplay of these factors will ultimately determine the market's trajectory in the long term. Technological advancements, such as the adoption of more efficient dredging equipment and advanced dredging techniques, will also play a key role in shaping future market dynamics.

Several key factors are driving the expansion of the global dredging market. Firstly, the ongoing global infrastructure boom, particularly in developing economies, necessitates substantial dredging activities for the construction and expansion of ports, harbors, and waterways. The growth of global trade requires larger, deeper channels to accommodate larger vessels, fueling demand for capital dredging projects. Secondly, the energy sector's increasing reliance on offshore resources, including oil and gas extraction and the development of offshore wind farms, is creating a significant demand for specialized dredging services. The creation of these energy infrastructure projects requires the removal of significant amounts of sediment, making dredging a critical component of project completion. Thirdly, coastal protection and land reclamation projects are becoming increasingly crucial due to rising sea levels and population growth in coastal areas. These projects are significantly reliant on dredging to mitigate erosion, create new landmasses, and enhance coastal resilience. Finally, government initiatives promoting sustainable development and investments in infrastructure upgrades further amplify the demand for dredging services worldwide. These projects are not only focused on traditional applications but also encompass environmental remediation efforts, cleaning up polluted waterways and restoring ecological balance.

Despite the positive growth outlook, the dredging industry faces several challenges and restraints. Firstly, stringent environmental regulations are becoming increasingly strict, increasing the complexity and cost of dredging projects. Meeting environmental standards requires advanced technologies and careful planning, adding to the overall project expense. Secondly, fluctuations in commodity prices, specifically those of materials like sand and gravel, create significant uncertainties in project budgeting and profitability. Price volatility can significantly impact project feasibility and lead to cost overruns. Thirdly, the acquisition of necessary permits and licenses can be a lengthy and complex process, leading to project delays and uncertainties. Navigating bureaucratic procedures requires time and resources. Furthermore, the availability of skilled labor and specialized equipment can be a constraint, particularly in remote locations or for highly specialized dredging projects. Finding qualified personnel and obtaining the right equipment in a timely manner can impact project timelines and costs. Lastly, competition amongst major dredging companies is intense, potentially leading to price wars and reduced profit margins. This intense competition drives the need for companies to constantly innovate and streamline their operations.

The Asia-Pacific region is expected to dominate the dredging market throughout the forecast period (2025-2033). This dominance stems from massive infrastructure development initiatives, particularly in China and India, which require extensive dredging for port expansion, coastal protection, and land reclamation.

Dominant Segment: Capital Dredging Capital dredging, focused on creating new waterways and expanding existing ones, holds a significant market share due to the widespread need for port expansion and infrastructure development across the globe. This segment is closely tied to the overall growth of global trade and the need for larger, deeper ports to accommodate larger vessels. The construction of new ports and the expansion of existing ones represent a major component of global infrastructure investment, driving the high demand for capital dredging services. The extensive infrastructural investments particularly in Asia and the Middle East significantly contribute to the dominance of this segment. The scale of these projects, often involving the excavation of vast volumes of sediment, makes capital dredging a crucial element of successful infrastructure development.

The dredging industry's growth is significantly catalyzed by rising global trade volumes, necessitating deeper and wider ports. Simultaneously, the expansion of offshore energy projects, like wind farms and oil & gas platforms, drives demand for specialized dredging solutions. Government investments in coastal protection and land reclamation initiatives further fuel this growth.

This report provides a comprehensive overview of the dredging market, offering valuable insights into market trends, driving forces, challenges, and future growth prospects. It analyzes key market segments, identifies leading players, and highlights significant developments within the industry. The report utilizes data from the study period (2019-2033), with a base year of 2025, to provide a robust forecast for the period 2025-2033. This detailed analysis empowers businesses to make informed decisions and capitalize on the opportunities presented by this expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include China Communications Construction Company (CCCC), Boskalis, Jan De Nul Group, DEME Group, Van Oord, NMDC Group, Penta - Ocean Construction Co, Great Lakes Dredge & Dock, Inai Kiara, Hyundai Engineering and Construction Co, TOA Corporation, Orion Marine Group, Weeks Marine, Gulf Cobla, Dredging Corporation of India, .

The market segments include Type, Application.

The market size is estimated to be USD 31490 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Dredging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dredging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.