1. What is the projected Compound Annual Growth Rate (CAGR) of the Document Version Control Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Document Version Control Software

Document Version Control SoftwareDocument Version Control Software by Type (Cloud-Based, On-Premise), by Application (Large Enterprises(1000+ Users), Medium-Sized Enterprise(499-1000 Users), Small Enterprises(1-499 Users)), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

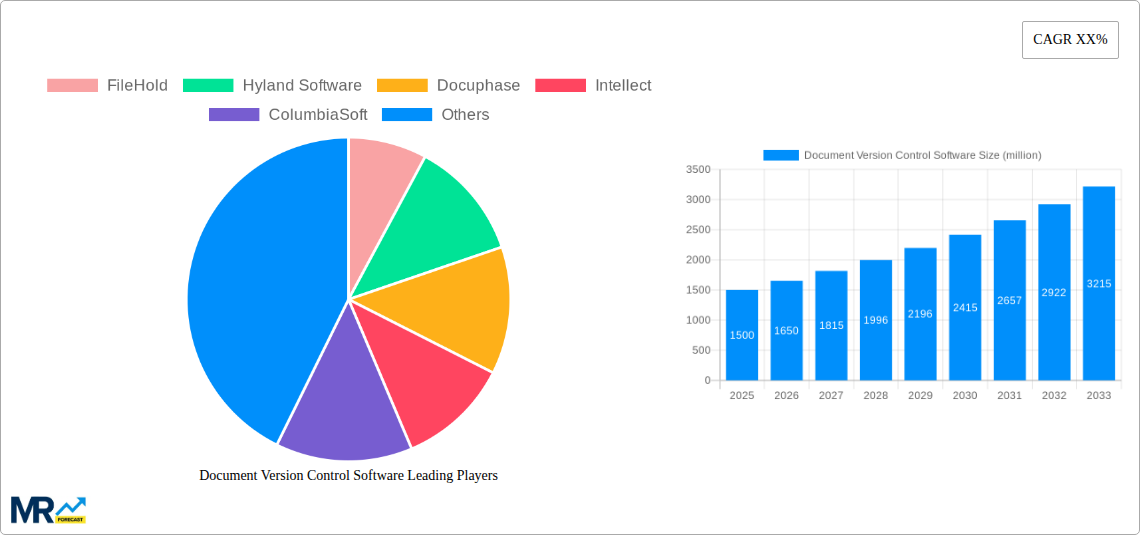

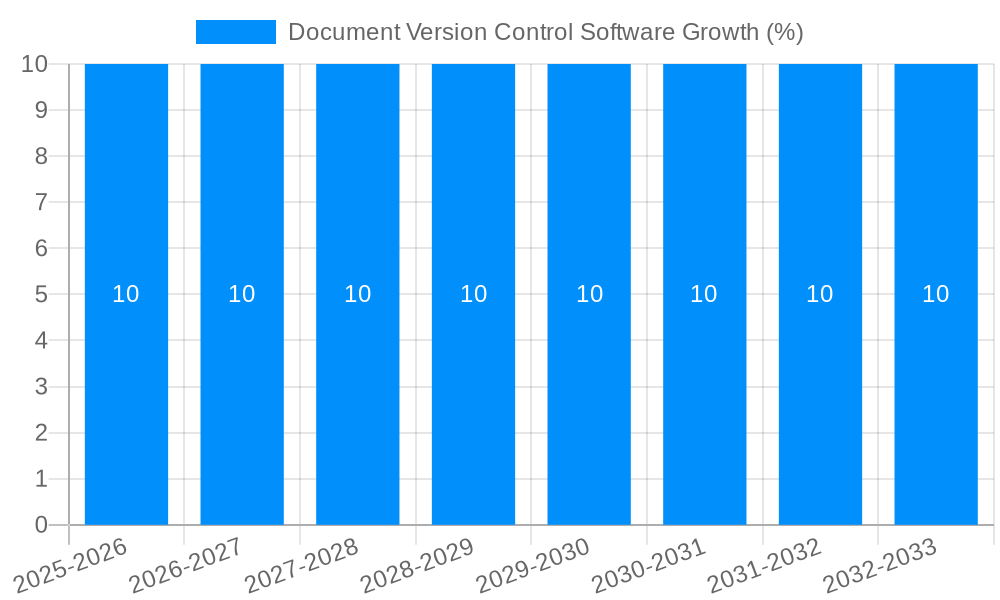

The global Document Version Control Software market is poised for significant expansion, projected to reach an estimated market size of XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This growth is primarily fueled by the increasing need for efficient document management across organizations of all sizes. Key drivers include the escalating volume of digital content, the demand for enhanced collaboration and streamlined workflows, and the critical requirement for audit trails and compliance with regulatory mandates. As businesses continue to embrace digital transformation and remote work models, the adoption of sophisticated version control solutions becomes indispensable for maintaining data integrity, reducing errors, and ensuring seamless project execution. Cloud-based solutions are expected to dominate the market, offering scalability, accessibility, and cost-effectiveness, while on-premise solutions will cater to organizations with stringent data security requirements.

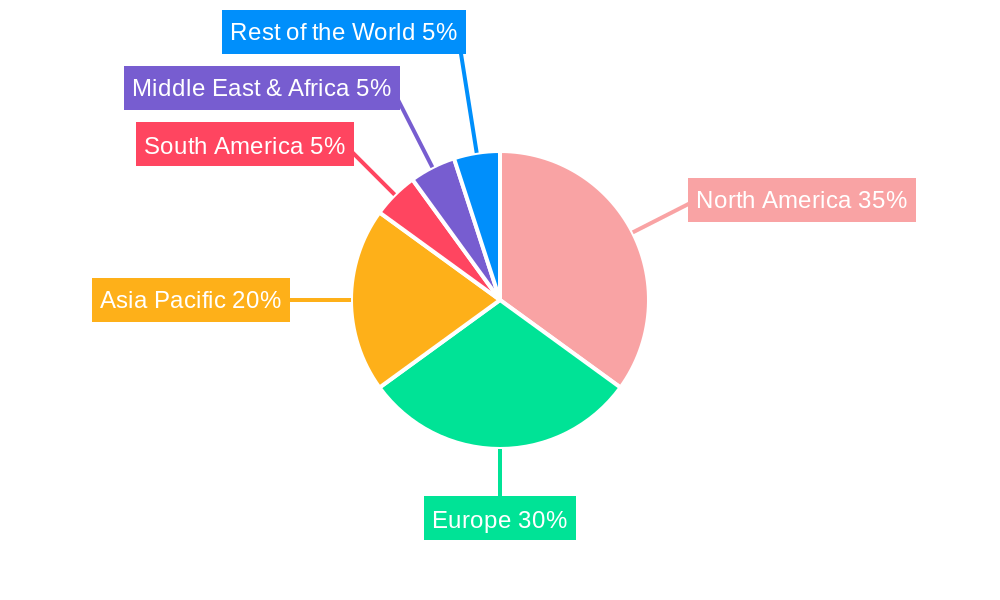

The market segmentation by enterprise size reveals a strong demand from large enterprises (1000+ users), where complex projects and large teams necessitate advanced version control capabilities. Medium-sized enterprises (499-1000 users) are also significant contributors, seeking to improve operational efficiency and collaboration. Small enterprises (1-499 users) are increasingly adopting these solutions to professionalize their document management processes and gain a competitive edge. Notable players like Hyland Software, Alfresco, and FileHold are at the forefront, offering innovative features and comprehensive solutions. Geographically, North America and Europe are expected to lead the market, driven by early adoption of technology and strong regulatory frameworks. However, the Asia Pacific region is anticipated to exhibit the fastest growth, propelled by the rapid digitization initiatives and expanding business landscape in countries like China and India. The market's trajectory is further supported by emerging trends such as integration with AI and machine learning for intelligent document analysis and the growing emphasis on cybersecurity within document management systems.

Here is a unique report description on Document Version Control Software, incorporating the requested elements:

This comprehensive report offers an in-depth analysis of the global Document Version Control Software market, charting its trajectory from the historical period of 2019-2024 through to the projected growth up to 2033. With a base year of 2025, the report meticulously forecasts market dynamics, size, and key trends, estimating the market to reach a significant valuation in the millions of USD by the end of the study period. The report delves into the intricacies of this critical software category, examining its impact across various business functions and industries, and providing actionable insights for stakeholders.

XXX: The global Document Version Control Software market is experiencing a significant evolution, driven by an increasing need for organizational efficiency, regulatory compliance, and enhanced collaboration. Over the historical period (2019-2024), the market witnessed a steady adoption as businesses recognized the inherent risks associated with unmanaged document lifecycles. The transition from manual, often error-prone, tracking methods to automated, sophisticated version control systems has become a paramount concern. The study period (2019-2033) highlights a transformative phase, with a strong emphasis on cloud-based solutions, offering greater scalability, accessibility, and cost-effectiveness. This shift is particularly evident as companies move away from solely on-premise deployments, although hybrid models remain relevant for specific security and control requirements. The increasing complexity of business processes, particularly in industries with stringent compliance mandates such as finance, healthcare, and legal sectors, further fuels the demand for robust version control. Furthermore, the integration of AI and machine learning capabilities into these platforms is emerging as a key trend, enabling intelligent document classification, automated metadata generation, and advanced search functionalities. The forecast period (2025-2033) is anticipated to see a continued acceleration in these trends, with advanced analytics and predictive capabilities becoming more mainstream. Companies are actively seeking solutions that not only manage versions but also provide insights into document usage patterns and potential compliance gaps. The growing remote workforce paradigm also necessitates accessible and secure document management, solidifying the importance of cloud-native version control. The market's expansion is also being propelled by a greater awareness of intellectual property protection and the need for audit trails that can withstand rigorous scrutiny. The foundational elements of document version control – tracking changes, managing revisions, and preventing overwrites – are now being augmented with intelligent features that streamline workflows and enhance overall productivity. This evolving technological landscape promises a more integrated and automated approach to document lifecycle management, making version control an indispensable component of modern business operations. The market's growth is therefore intrinsically linked to the digital transformation initiatives undertaken by organizations worldwide.

The upward trajectory of the Document Version Control Software market is propelled by a confluence of critical business imperatives. Foremost among these is the escalating demand for enhanced operational efficiency and productivity. In today's fast-paced business environment, organizations are acutely aware of the productivity drains caused by lost documents, outdated versions, and inefficient collaboration. Version control software directly addresses these pain points by ensuring that all users are working with the most current and approved versions of documents, thereby minimizing errors and rework. Furthermore, the increasing complexity of regulatory landscapes across various industries is a significant driver. Compliance with regulations such as GDPR, HIPAA, and SOX necessitates meticulous record-keeping and auditable trails, which robust version control systems inherently provide. The ability to track every change, who made it, and when, is crucial for demonstrating adherence to legal and industry standards. The global shift towards remote and hybrid work models has also amplified the need for accessible and secure document management solutions. Employees working from different locations require seamless access to the latest versions of critical documents, and version control software facilitates this securely, preventing data silos and ensuring continuity. Moreover, the growing emphasis on intellectual property protection and risk mitigation plays a vital role. By providing a clear history of document creation and modification, organizations can safeguard their proprietary information and mitigate the risks associated with unauthorized changes or data loss. The integration of these software solutions with other enterprise systems, such as CRM, ERP, and project management tools, further enhances their value proposition, streamlining workflows and fostering better interdepartmental collaboration. This interconnectedness makes version control not just a document management tool, but a critical enabler of broader business process optimization.

Despite its evident benefits, the Document Version Control Software market faces several challenges that can temper its growth. A primary restraint is the initial cost of implementation and ongoing maintenance, particularly for smaller enterprises with limited IT budgets. While cloud-based solutions offer a more attractive subscription model, the upfront investment for on-premise deployments or extensive customization can be a significant hurdle. Another challenge is the complexity of integration with existing legacy systems. Many organizations operate with a patchwork of older software, and ensuring seamless interoperability with new version control solutions can be technically demanding and time-consuming, often requiring specialized expertise. User adoption and training also present a considerable challenge. Even the most sophisticated software will fail to deliver its full potential if employees are not adequately trained or are resistant to adopting new workflows. The learning curve associated with advanced version control features can deter some users, leading to underutilization. Furthermore, data security concerns, especially with cloud-based solutions, can act as a restraint. While reputable providers offer robust security measures, some organizations remain apprehensive about storing sensitive documents outside their own secure networks, fearing potential data breaches or unauthorized access. The sheer volume of documents within larger enterprises can also present scalability challenges, requiring significant infrastructure and robust system architecture to manage effectively without performance degradation. Finally, the availability of free or built-in version control features within other software platforms, such as cloud storage services, can sometimes lead organizations to forgo dedicated, more feature-rich solutions, especially for less critical document management needs.

The global Document Version Control Software market is characterized by a dynamic interplay of regional adoption patterns and segment-specific demand. However, North America is poised to emerge as a dominant region in this market, driven by a confluence of factors. The region boasts a highly developed technological infrastructure, a strong presence of large enterprises across diverse sectors, and a proactive approach to digital transformation. Companies in the United States and Canada are early adopters of advanced software solutions, prioritizing efficiency, compliance, and robust data management.

Within North America, the Cloud-Based segment is expected to witness the most significant growth and dominance. This is attributed to several key drivers:

Furthermore, within the Application segments, Large Enterprises(1000+ Users) will continue to be significant drivers of market growth. These organizations typically handle an immense volume of complex documents, have stringent compliance requirements, and often operate across multiple departments and geographical locations. The need for centralized, secure, and efficient document version control is paramount for their operations. Companies like FileHold, Hyland Software, Alfresco, and ColumbiaSoft are well-positioned to cater to the needs of these large enterprises by offering comprehensive suites of document management features. Their solutions are designed to handle the scale, complexity, and security demands inherent in large organizational structures. The adoption of cloud-based solutions by these large enterprises is accelerating, driven by the desire to leverage the scalability and advanced capabilities that cloud platforms offer. This trend reinforces North America's dominance, as it houses a substantial number of these large-scale organizations that are willing and able to invest in sophisticated document management systems. The emphasis on audit trails, regulatory compliance, and streamlined workflows makes advanced version control an essential component for these entities.

Several factors are acting as potent growth catalysts for the Document Version Control Software industry. The increasing digital transformation initiatives across all sectors are a primary driver, pushing organizations to adopt more efficient and automated document management practices. Growing regulatory compliance mandates, such as those related to data privacy and industry-specific record-keeping, necessitate robust audit trails and version tracking. The proliferation of remote and hybrid work models further accentuates the need for accessible, secure, and collaborative document environments, which version control software readily provides. Moreover, advancements in artificial intelligence and machine learning are being integrated into these platforms, offering enhanced features like automated document classification, intelligent search, and predictive analytics, thereby increasing their appeal and utility.

This report provides a holistic overview of the Document Version Control Software market, meticulously analyzing its historical performance, current state, and future potential. It delves into the intricate market dynamics, identifying key growth drivers such as the escalating need for operational efficiency, stringent regulatory compliance, and the pervasive adoption of remote work. Simultaneously, the report critically examines the challenges and restraints that could impede market expansion, including implementation costs and user adoption hurdles. A significant portion of the report is dedicated to a granular analysis of key regions and dominant market segments, offering valuable insights into where the market is headed. Furthermore, it identifies crucial growth catalysts and provides a comprehensive list of leading players in the industry. The report is enriched with details of significant developments, offering a historical perspective on the sector's evolution. Overall, this comprehensive coverage aims to equip stakeholders with the knowledge necessary to navigate this evolving market landscape effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include FileHold, Hyland Software, Docuphase, Intellect, ColumbiaSoft, 12d Solutions, Alfresco, Easy Data Access, GetBusy, WebFM, Ultralight Technologies, Coreworx, EQuorum, Blue Ribbon Technologies, Ricoh India, HyperOffice, Synergis Software, IsoTracker Solutions, DocuCollab, RSData, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Document Version Control Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Document Version Control Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.