1. What is the projected Compound Annual Growth Rate (CAGR) of the Discount Brokerage Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Discount Brokerage Service

Discount Brokerage ServiceDiscount Brokerage Service by Type (Online Discount Brokerage Service, Offline Discount Brokerage Service), by Application (Individual, Enterprise, Government Agencies), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

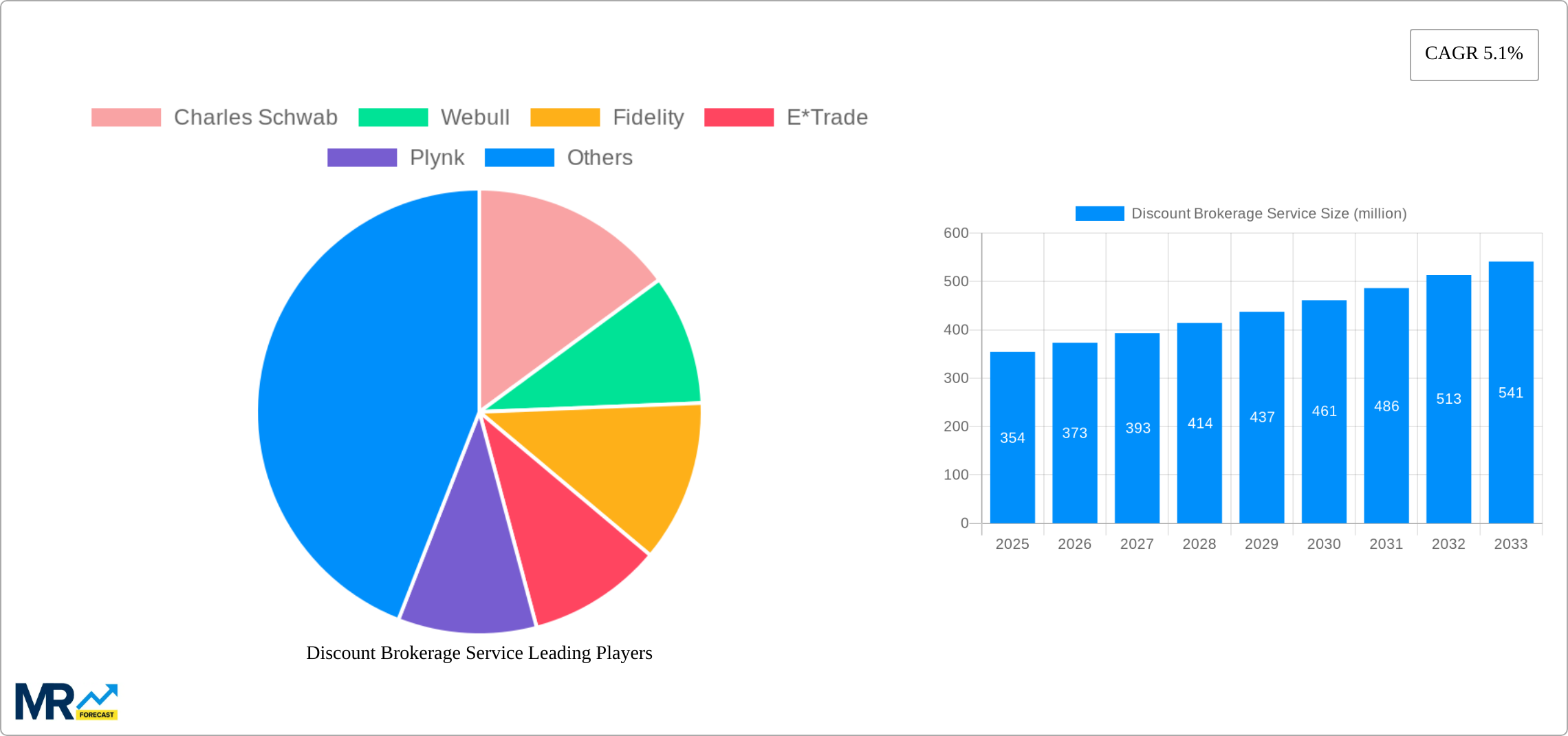

The discount brokerage service market, valued at $500.5 million in 2025, is experiencing robust growth driven by several key factors. The increasing adoption of online trading platforms, fueled by technological advancements and the rise of mobile-first investing, is a major catalyst. Lower commission fees compared to traditional brokerage firms attract budget-conscious retail investors and a growing number of millennials and Gen Z entering the market. Furthermore, the expansion of financial literacy initiatives and the simplification of investment processes are broadening market accessibility. The market is segmented by service type (online vs. offline) and user type (individual, enterprise, government agencies), with online discount brokerage services dominating due to their convenience and cost-effectiveness. While the North American market currently holds a significant share, rapid growth is anticipated in Asia-Pacific regions like India and China, driven by increasing internet and smartphone penetration, coupled with rising disposable incomes. Competition among established players like Charles Schwab, Fidelity, and Webull, as well as emerging fintech companies like Robinhood (though not explicitly listed), is intense, leading to continuous innovation in platform features and service offerings.

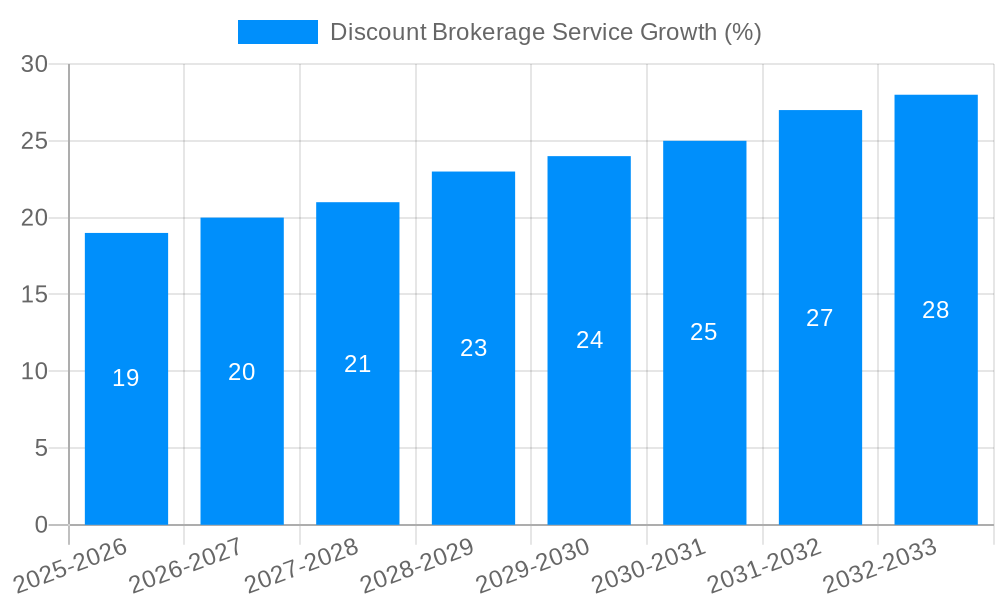

However, regulatory changes and cybersecurity concerns pose significant challenges. Stricter regulations aimed at protecting investors could increase compliance costs for brokerage firms. Additionally, the risk of cyberattacks and data breaches, particularly concerning sensitive financial information, necessitates robust security measures and could impact customer trust. The market's future trajectory hinges on effective risk management, continuous technological innovation, and the adaptation to evolving regulatory landscapes. While a precise CAGR is absent, considering the market dynamics and rapid technological advancements in the fintech sector, a conservative estimate would place the CAGR for the forecast period (2025-2033) in the range of 10-15%. This reflects the sustained growth anticipated in the discount brokerage sector.

The discount brokerage service market experienced explosive growth between 2019 and 2024, driven primarily by the increasing accessibility of online trading platforms and a surge in retail investor participation, particularly among millennials and Gen Z. This period saw a significant shift from traditional, full-service brokerages towards online platforms offering lower commission fees and user-friendly interfaces. The market's value soared into the multi-billion-dollar range, with online platforms like Robinhood (prior to its decline) and Webull experiencing phenomenal user acquisition. However, market volatility and regulatory changes introduced challenges. The year 2021 witnessed a remarkable increase in retail investor activity fueled by meme stock frenzies and government stimulus packages. This led to increased trading volumes and, consequently, higher revenues for many discount brokerages. The subsequent period, however, saw a correction as markets stabilized and regulatory scrutiny intensified. This led to a period of consolidation in the market, with some smaller players struggling to compete against larger, more established firms with greater resources and technological capabilities. The forecast for 2025-2033 projects continued growth, albeit at a more moderate pace than the historical period, driven by the ongoing adoption of digital financial services, increasing financial literacy, and the expanding reach of internet and mobile technology, particularly in emerging markets. The market is expected to reach XXX million by 2033, representing a compound annual growth rate (CAGR) of XX%. This growth will likely be fueled by innovation in areas such as artificial intelligence-driven trading tools and personalized financial advice services integrated into brokerage platforms.

Several key factors are propelling the growth of the discount brokerage service market. The most significant is the widespread adoption of online and mobile trading platforms. These platforms offer unparalleled convenience, accessibility, and transparency compared to traditional brokerage models. Lower commission fees and charges, a direct outcome of technological advancements and increased competition, have significantly reduced the cost of investing for retail investors, making it more accessible to a broader demographic. The rise of fractional share trading further democratizes access, enabling individuals to invest in high-priced stocks with smaller capital outlays. Furthermore, the increasing financial literacy among younger generations and the growth of digital financial services ecosystems are fostering a more engaged and tech-savvy investor base. The pandemic significantly accelerated the adoption of online trading as individuals were forced to engage in remote activities, including investments. Finally, regulatory changes and increased investor protection measures have built greater trust and confidence in the online brokerage sector, encouraging further market participation.

Despite the considerable growth potential, the discount brokerage service market faces several challenges. Increased regulatory scrutiny and compliance costs are a significant concern for businesses operating in this sector. The need to maintain robust cybersecurity measures to protect sensitive client data is paramount, adding to operational expenses. Maintaining profitability in a highly competitive environment with razor-thin margins requires ongoing innovation and efficiency improvements. Furthermore, the market is susceptible to macroeconomic factors, such as interest rate fluctuations and overall market volatility, which can directly impact trading volumes and investor sentiment. Keeping pace with technological advancements and offering cutting-edge trading tools and analytical capabilities is crucial for attracting and retaining clients in a dynamic marketplace. Finally, attracting and retaining experienced professionals within a rapidly changing industry is a challenge faced by many firms. The rise of robo-advisors is transforming the landscape, and discount brokerages need to adapt strategically to compete effectively.

The individual investor segment is undeniably the dominant force in the discount brokerage service market. This segment is experiencing significant growth across all regions, but particularly in developed economies with high internet penetration and financial literacy rates.

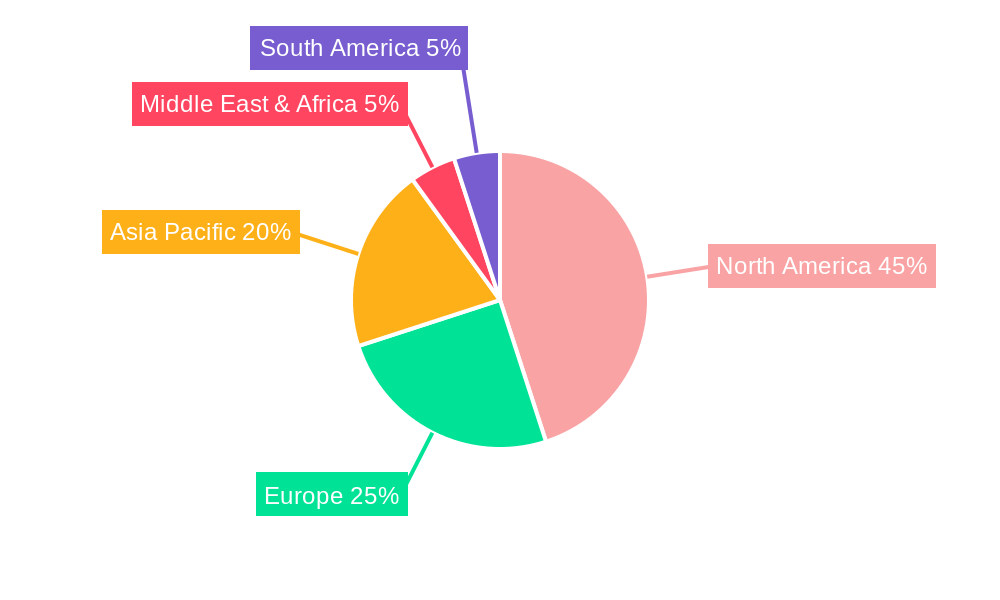

North America: The United States and Canada account for a substantial share of the market due to a large, sophisticated investor base, high technological adoption, and a well-established regulatory framework.

Europe: While slightly behind North America, Europe shows steady growth, driven by increasing smartphone usage, rising internet penetration, and greater participation in online trading. Key markets include the UK, Germany, and France.

Asia-Pacific: This region displays significant growth potential with rapidly expanding middle classes, rising smartphone adoption, and increasing financial literacy in countries such as India, China, and Japan. However, regulatory complexities and differing levels of technological infrastructure create challenges.

The online discount brokerage service segment completely overshadows its offline counterpart in terms of market share. The ease, convenience, and cost-effectiveness of online platforms have made them incredibly popular. Offline platforms continue to exist, but their relevance is waning as technology continues to reshape the industry. The convenience of executing trades and accessing market information from anywhere with an internet connection is a major driver for the widespread adoption of online platforms. Moreover, online platforms offer greater flexibility in terms of account management and access to a wider array of trading tools and educational resources.

The enterprise segment, while smaller than the individual segment, is growing steadily as businesses utilize discount brokerage services for treasury management and investment strategies. This segment requires more sophisticated platforms and services than the individual segment.

Several factors will continue to fuel the growth of the discount brokerage service industry. These include the increasing adoption of mobile trading platforms, the expansion of financial technology (Fintech) solutions, the ongoing development of artificial intelligence (AI)-powered trading tools, and the growing popularity of fractional share trading. Furthermore, increased financial literacy and improved investor education will empower more individuals to participate in the market, stimulating growth across the board. Finally, regulatory changes promoting investor protection and financial inclusion will create a more conducive environment for growth in the sector.

This report provides a comprehensive analysis of the discount brokerage service market, offering valuable insights into market trends, driving forces, challenges, key players, and future growth prospects. The report covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), providing a detailed understanding of market dynamics and potential investment opportunities. The analysis includes a breakdown by key segments – online vs. offline, and by application (individual, enterprise, and government agencies). This report is essential for investors, businesses, and anyone looking to gain a deeper understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Charles Schwab, Webull, Fidelity, E*Trade, Plynk, Zerodha, Groww, Angel One, Interactive Brokers, TD Ameritrade, TradeStation, SoFi, 1DB, J.P. Morgan, Firstrade, .

The market segments include Type, Application.

The market size is estimated to be USD 500.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Discount Brokerage Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Discount Brokerage Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.