1. What is the projected Compound Annual Growth Rate (CAGR) of the Dining Convenience Store?

The projected CAGR is approximately 7.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Dining Convenience Store

Dining Convenience StoreDining Convenience Store by Application (Commercial Area, Residential Area, Tourist Attraction), by Type (Chain Store, Franchise Store, Independent Store), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

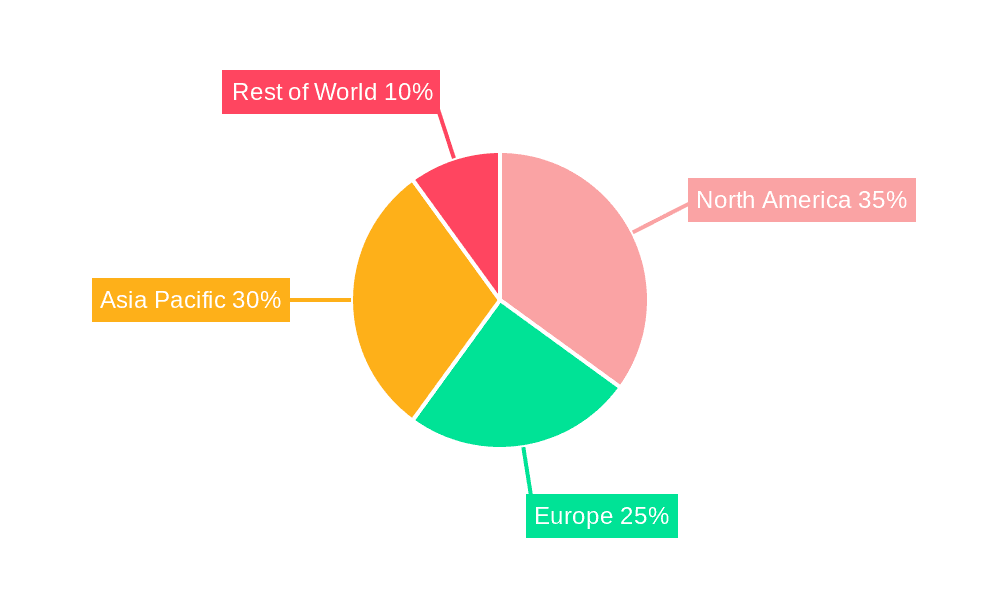

The global dining convenience store market is experiencing significant expansion, driven by consumer demand for swift, accessible, and economical food solutions. Rising urbanization and fast-paced lifestyles are key contributors to the increasing need for ready-to-eat options available at convenience stores. Advancements in technology, including mobile ordering and delivery platforms, are further amplifying convenience, attracting a wider demographic. The market is segmented by application (commercial, residential, tourist attractions) and store type (chain, franchise, independent), enabling focused strategies and product innovation. Leading entities such as 7-Eleven, Lawson, and FamilyMart are actively broadening their food portfolios, capitalizing on their extensive reach and brand recognition. North America and Asia-Pacific currently lead the market, propelled by dense populations, robust infrastructure, and strong consumer spending. Conversely, nascent markets in South America and Africa present substantial growth prospects due to rising disposable incomes and evolving consumer habits. Despite intense competition, independent stores can differentiate through specialized offerings and localized menus. The market is poised for continuous growth, supported by innovative products and strategic alliances within the food and beverage industry.

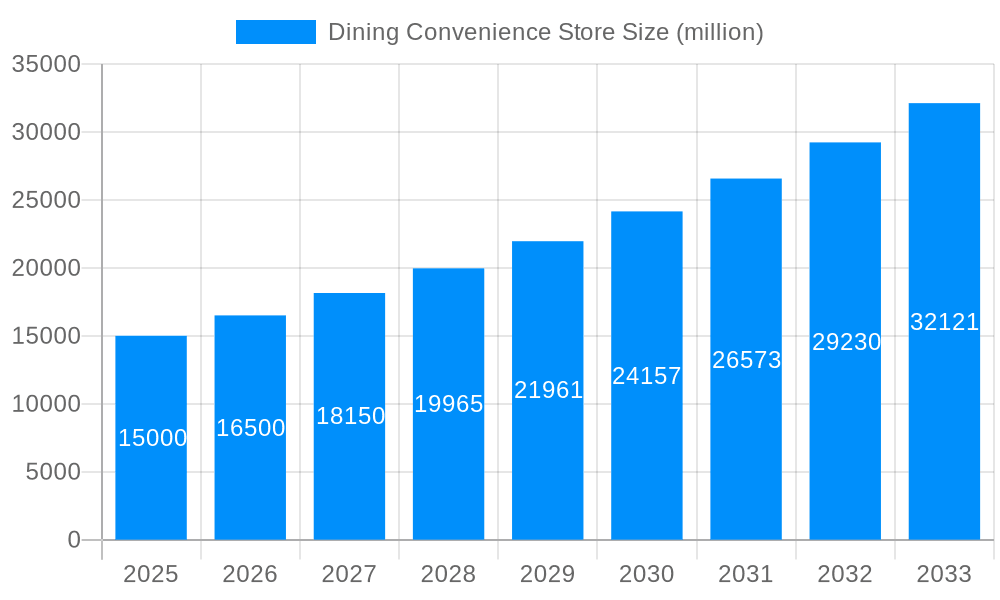

The projected Compound Annual Growth Rate (CAGR) highlights a sustained expansion of the dining convenience store market. The current market size is estimated at 722.63 billion, with a base year of 2025. The forecast period (2025-2033) anticipates a CAGR of 7.1%. This growth reflects the increasing integration of food services within convenience store models, blurring the distinction between traditional convenience retailers and quick-service restaurants. This trend is expected to persist as convenience stores innovate by offering healthier food choices, accommodating specific dietary requirements, and adopting sustainable practices to engage environmentally conscious consumers. The competitive environment includes large multinational corporations and smaller regional chains. Key competitive tactics will likely involve optimizing store formats, enhancing customer loyalty initiatives, and leveraging technological advancements for a competitive advantage. The market's regional segmentation offers valuable insights for investment strategies and the identification of high-potential emerging markets.

The dining convenience store sector, encompassing established players like 7-Eleven and emerging brands, experienced significant evolution from 2019 to 2024. The market, valued in the millions, witnessed a shift towards offering more diverse and higher-quality food options beyond traditional snacks and beverages. This trend is fueled by changing consumer preferences, demanding greater convenience and healthier choices. The historical period (2019-2024) saw a notable increase in the integration of prepared meals, healthier snacks, and customized food offerings within these stores. This is reflected in the expansion of partnerships with established food brands and the introduction of in-store food preparation facilities. The estimated market size in 2025 showcases a substantial increase compared to previous years, indicating a positive trajectory. This growth is partly driven by the increasing urbanization and busy lifestyles leading to higher demand for quick and convenient meal solutions. The forecast period (2025-2033) anticipates continued expansion, influenced by factors like technological advancements in food preparation, personalized ordering systems, and evolving consumer demands for ethically sourced and sustainable food options. The rise of delivery services and mobile ordering further enhances convenience and accessibility, contributing to the market's projected growth. Competition is intensifying, with both established chains and smaller, independent stores vying for market share by focusing on unique selling propositions – whether that's a specific culinary niche, exceptional customer service, or a strong commitment to local sourcing. This creates a dynamic landscape with ongoing innovation and adaptation crucial for survival and success. Overall, the dining convenience store sector presents a compelling investment opportunity due to its consistent growth, adaptability to consumer preferences, and the potential for further technological integration.

Several factors are propelling the growth of the dining convenience store sector. The increasing prevalence of busy lifestyles and limited time for meal preparation is a primary driver. Consumers are increasingly seeking quick, convenient, and readily available food options, making dining convenience stores an attractive choice. The rising popularity of on-the-go consumption further fuels this trend, with consumers often purchasing meals and snacks while commuting or during breaks. The expansion into healthier and more diverse food offerings beyond traditional snacks and beverages is another significant driver. Consumers are increasingly conscious of their health and wellness, demanding healthier alternatives and more nutritious food choices. Dining convenience stores are responding to this demand by incorporating fresh produce, salads, and healthier snack options into their offerings. Technological advancements, such as mobile ordering and delivery services, enhance convenience and accessibility, driving further growth. These technologies allow consumers to easily order and receive food from their preferred dining convenience stores, adding to the overall appeal. Furthermore, strategic collaborations and partnerships between convenience stores and established food brands or restaurants broaden the variety of offerings and improve the perceived quality of food available. These partnerships leverage the strengths of both parties, resulting in a mutually beneficial outcome and a more appealing offering for consumers.

Despite the positive growth trajectory, the dining convenience store sector faces several challenges. Maintaining consistent food quality and freshness across multiple locations presents a significant operational hurdle. Ensuring consistent quality control across geographically dispersed stores, especially for prepared meals, requires substantial investment in training, supervision, and efficient supply chain management. Competition from other quick-service restaurants (QSRs) and fast-casual dining establishments remains a key challenge. These competitors offer a wider range of meal options and often provide a more dine-in friendly environment. Fluctuating food costs and supply chain disruptions can significantly impact profitability. The industry's reliance on readily available ingredients makes it vulnerable to price volatility and potential shortages. Managing labor costs is also a significant concern, particularly in regions with high minimum wages or labor shortages. Attracting and retaining qualified staff to handle food preparation and customer service is vital for maintaining quality and operational efficiency. Furthermore, consumer perception of convenience store food as less healthy or of lower quality compared to dedicated restaurants can be a barrier to growth. Overcoming this perception requires strategic marketing efforts to highlight the improved quality and health-conscious options offered by modern dining convenience stores.

The dining convenience store market is geographically diverse, with growth varying across regions. However, regions with high population density, strong urbanization trends, and a high proportion of working professionals show the highest potential for market expansion.

Chain Stores: This segment is expected to dominate the market due to economies of scale, brand recognition, and standardized food quality. Chain stores benefit from centralized procurement, efficient logistics, and consistent marketing efforts. Their ability to invest in technological advancements and superior food quality contributes significantly to their market dominance. The established brand recognition and widespread presence of major chains such as 7-Eleven, Lawson, and FamilyMart offer a significant competitive advantage. Consumers associate these brands with convenience and readily available options, leading to higher customer loyalty and repeat business. The ability of chain stores to maintain consistent food quality and service across numerous locations also contributes to their dominance, building a reputation for reliability and dependability.

Commercial Areas: High foot traffic and dense populations in commercial areas create significant demand for quick and convenient dining options. The concentration of office buildings, retail outlets, and other businesses creates a captive market for dining convenience stores catering to busy professionals and shoppers. The strategic location of these stores near workplaces and transportation hubs enhances accessibility and convenience for consumers, making them a natural choice for meals and snacks throughout the day.

Asia (particularly Japan, South Korea, and China): Asia is projected to be a key region due to its high population density, rapidly growing urban centers, and a strong culture of convenience-driven consumption. The popularity of convenience stores in Asian markets as a primary source of everyday needs, including meals and snacks, significantly contributes to their growth in this region. The widespread adoption of mobile payment systems and delivery services further enhances the convenience factor, driving market expansion.

The combination of chain store business models and their strategic presence in bustling commercial areas within key Asian markets sets the stage for a commanding market share in the coming years.

Several factors contribute to the ongoing growth of the dining convenience store industry. The increasing demand for convenience and ready-to-eat meals fueled by busy lifestyles and urbanization is a key catalyst. Technological advancements in food preparation and service, including mobile ordering and automated kiosks, are streamlining operations and improving customer experience. Furthermore, the introduction of healthier and more diverse food choices is broadening the consumer base and attracting a wider range of customers. Finally, strategic partnerships with food brands and restaurants expand menu variety and improve the overall dining experience.

This report provides a comprehensive overview of the dining convenience store industry, covering market trends, driving forces, challenges, key players, and future growth prospects. The report analyzes the market based on geographical location, store type, and application, offering valuable insights for businesses operating in or considering entering this dynamic sector. Detailed forecasts are provided for the period from 2025 to 2033, giving readers a clear picture of potential market growth and investment opportunities. The comprehensive analysis within the report makes it an invaluable resource for investors, business strategists, and anyone interested in gaining a deeper understanding of the dining convenience store industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.1%.

Key companies in the market include 7-Eleven, Lawson, FamilyMart, Circle K, BGF Retail, Mini Stop, Wawa, McDonald's, Yum! Brands, Dunkin' Brands Group, Subway IP Inc., Oporto, .

The market segments include Application, Type.

The market size is estimated to be USD 722.63 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Dining Convenience Store," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dining Convenience Store, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.