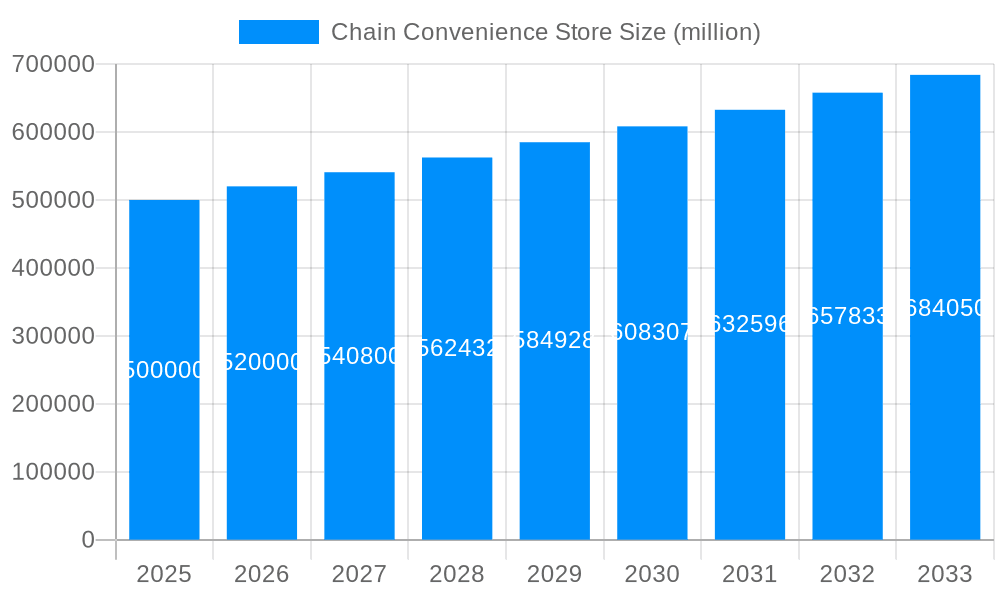

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chain Convenience Store?

The projected CAGR is approximately 4.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chain Convenience Store

Chain Convenience StoreChain Convenience Store by Type (Traditional Convenience Stores, Gas Station Convenience Stores, Other), by Application (Office Building, Train Station, Petrol Station, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

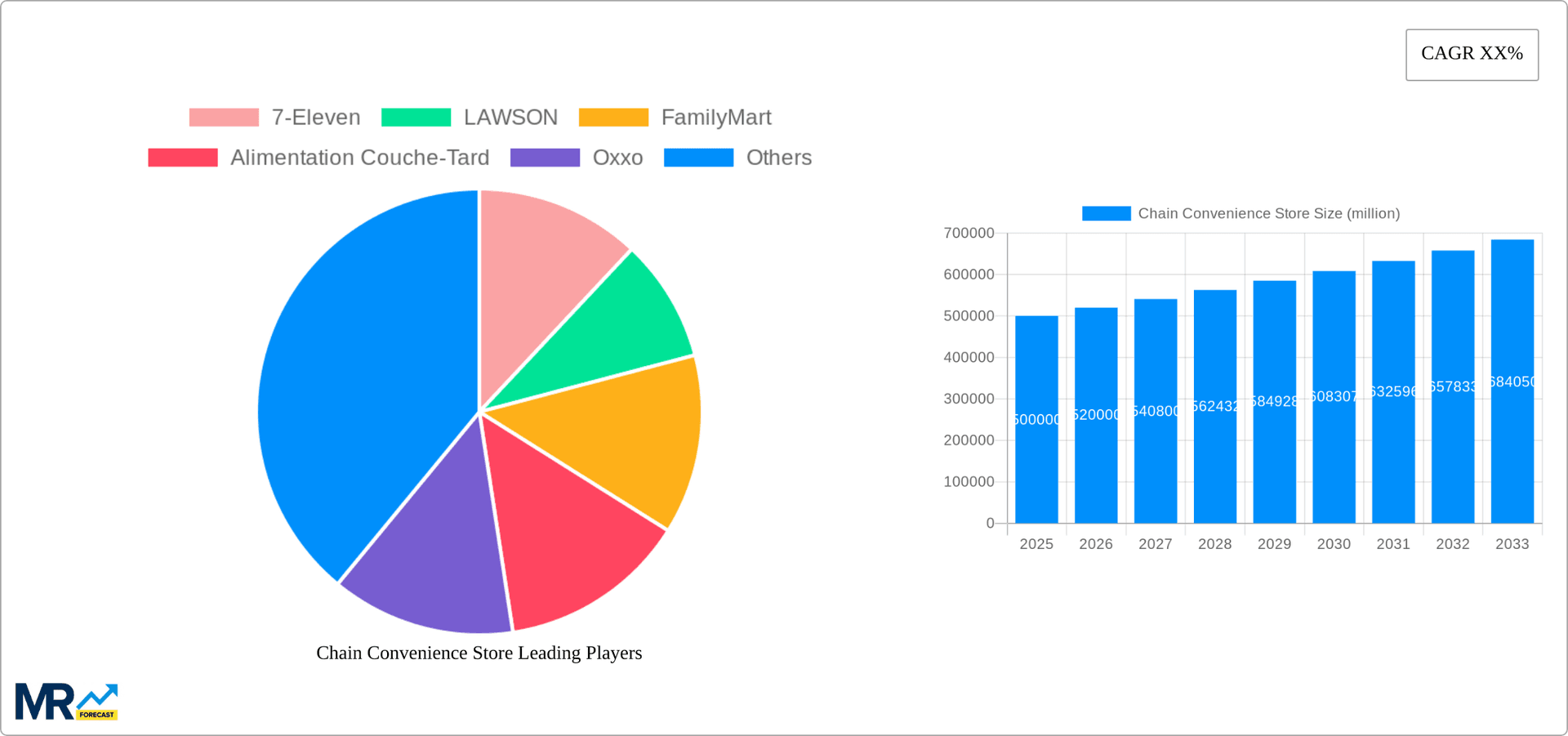

The global chain convenience store market is experiencing robust expansion, driven by urbanization, rising disposable incomes, and the escalating demand for on-the-go food and beverage solutions. The market is forecasted to achieve a size of $45.9 billion by 2025, with a compound annual growth rate (CAGR) of 4.7% from 2025 to 2033. Key segments, including traditional outlets and those co-located with fuel stations, serve diverse consumer needs. Leading global brands such as 7-Eleven, Lawson, and FamilyMart underscore the significance of brand equity and efficient supply chain management. Future growth will be propelled by technological integration, including mobile payments and loyalty programs, expansion into food delivery, and a growing consumer preference for healthier and sustainable options.

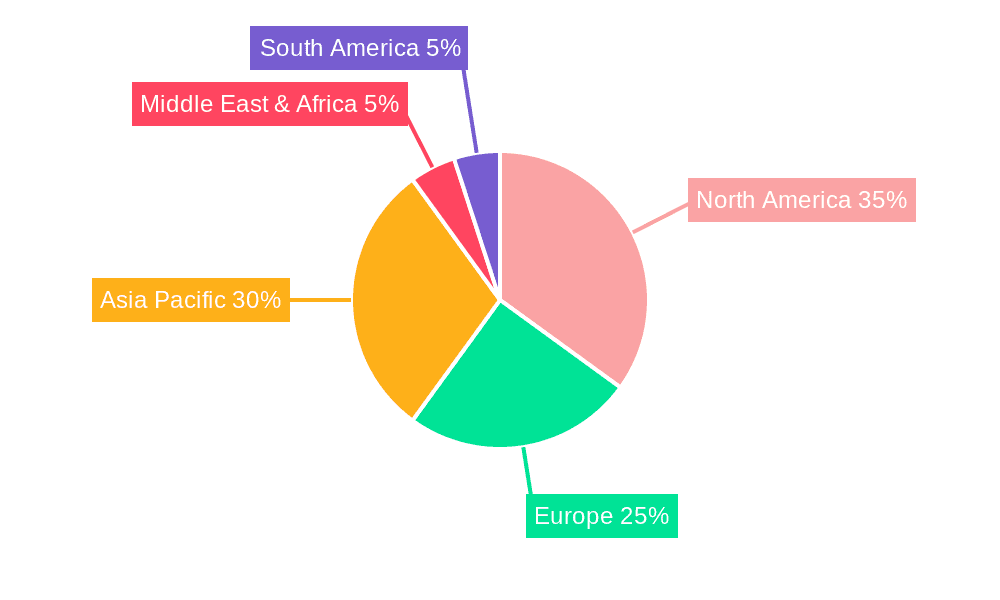

Geographically, North America commands a significant market share due to its mature infrastructure and high consumer spending. However, the Asia Pacific region, particularly China and India, is poised for the highest growth, fueled by rapid economic development and an expanding middle class. Europe and other regions will also witness considerable growth. Key challenges include rising operational costs, fierce competition, and the necessity to adapt to evolving consumer demands and regulatory environments. Overcoming these hurdles is crucial for market participants aiming to leverage the substantial opportunities.

The global chain convenience store market is experiencing robust growth, projected to reach several trillion units by 2033. This expansion is fueled by several converging factors, including increasing urbanization, changing consumer lifestyles, and technological advancements. The historical period (2019-2024) witnessed significant market expansion, particularly in Asia and North America, driven by the success of established giants like 7-Eleven and Lawson, and the emergence of strong regional players. The estimated market value in 2025 is expected to be in the multiple trillions of units, a clear indication of the sector's health. This growth is not uniform across all segments; gas station convenience stores have been a significant contributor, although traditional convenience stores continue to hold a substantial market share. The forecast period (2025-2033) anticipates continued growth, driven by factors like strategic partnerships, expansion into new geographical markets, and the integration of innovative technologies. The Base Year for our analysis is 2025, providing a strong foundation for projecting future trends. Key market insights indicate a strong preference for convenience and speed, with consumers increasingly demanding a wider range of products and services beyond traditional convenience store offerings. This has led to significant diversification within the sector, with many chains incorporating fresh food options, prepared meals, and even financial services into their offerings. Furthermore, the industry is witnessing a rise in the adoption of digital technologies to enhance customer experience and operational efficiency, such as mobile ordering, loyalty programs, and automated checkout systems. The shift towards healthier and more sustainable product choices is also influencing the market, pushing chains to adapt their offerings accordingly. The competition remains intense, with both established players and new entrants continuously vying for market share through innovative strategies and strategic acquisitions. This dynamic landscape makes it a rewarding, albeit competitive, market for established players and new entrants alike.

Several key factors are propelling the growth of the chain convenience store market. Firstly, the increasing urbanization across the globe leads to higher population densities and consequently, greater demand for quick and convenient access to everyday essentials. This is further amplified by the rise in dual-income households and busy lifestyles, where time constraints influence purchasing behavior. Secondly, the continuous innovation within the convenience store sector itself plays a crucial role. The introduction of new product lines, such as ready-to-eat meals, fresh produce, and healthier options, caters to evolving consumer preferences. The implementation of technology, including mobile ordering apps and self-checkout kiosks, enhances convenience and operational efficiency. Thirdly, strategic acquisitions and mergers are consolidating market share, leading to increased brand recognition and wider market penetration. This allows larger chains to leverage their economies of scale and expand their reach more efficiently. Finally, the expansion into new geographical markets and untapped customer segments is another significant driver. This allows chains to diversify their revenue streams and minimize reliance on any single region or market. The focus on providing a complete customer experience, encompassing convenience, variety, and value, is paramount for success within this competitive landscape.

Despite its positive growth trajectory, the chain convenience store market faces several challenges. Intense competition among established players and new entrants creates pressure on profit margins and necessitates continuous innovation to retain market share. Economic fluctuations and rising input costs (especially for food and fuel) can negatively impact profitability. Furthermore, changing consumer preferences and the increasing demand for healthier and more sustainable options require businesses to adapt their product offerings and sourcing strategies. Maintaining a consistent supply chain across various locations, particularly for perishable goods, presents a significant logistical hurdle. Labor shortages and rising labor costs in many regions contribute to operational challenges and increased expenses. Finally, stringent regulations concerning food safety, environmental sustainability, and labor practices can add to the operational complexity and compliance costs. Effectively navigating these challenges requires robust strategic planning, efficient supply chain management, and a commitment to adapting to the evolving needs and preferences of the consumer market.

The Asia-Pacific region, particularly countries like China, Japan, and South Korea, is projected to dominate the chain convenience store market due to rapid urbanization, rising disposable incomes, and a growing preference for convenience. North America also holds a significant market share, driven by the strong presence of established players like 7-Eleven and Wawa.

Dominant Segment: Gas Station Convenience Stores are expected to maintain a significant market share due to their strategic locations and the high volume of traffic they attract. The synergy between fuel sales and convenience store purchases contributes significantly to revenue streams.

Traditional Convenience Stores will also remain a dominant segment, especially in densely populated urban areas, benefiting from a wide range of product offerings and their proximity to residential areas.

Application: Petrol stations will remain a key application due to the high traffic they receive and the inherent opportunity to capture a significant portion of consumers looking for immediate necessities such as drinks, snacks, and quick meals.

The integration of technology is transforming the market. This includes:

The expansion of prepared food offerings, the focus on healthier and more sustainable options, and the growth of private-label brands are all contributing to the dynamism of this sector. The increasing adoption of franchising models allows for faster expansion into new markets and locations. The ongoing battle for market share will see companies competing on price, selection, convenience, and brand loyalty, creating a dynamic competitive landscape.

The chain convenience store industry's growth is fueled by a confluence of factors: rising urbanization leading to increased demand, technological advancements offering enhanced customer experience and operational efficiency, strategic acquisitions consolidating market share, expansion into new geographical markets, and the increasing diversification of product and service offerings to meet evolving consumer demands. These factors create a synergistic effect, accelerating market expansion and driving future growth.

This report provides a comprehensive analysis of the chain convenience store market, covering key trends, driving forces, challenges, and growth opportunities. It profiles leading players, examines regional market dynamics, and explores future growth prospects, offering valuable insights for stakeholders in the industry. The detailed segmentation allows for a nuanced understanding of the diverse aspects of this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.7%.

Key companies in the market include 7-Eleven, LAWSON, FamilyMart, Alimentation Couche-Tard, Oxxo, Circle K Stores, Carrefour City, Ministop, SPAR International, EG America LLC, GPM Investments LLC, Daily Yamazaki, Wawa Inc., QuikTrip Corp., Kwik Trip, Sheetz, Pilot Co., Love's Travel Stops & Country Stores Inc., RaceTrac, United Pacific/Rocket, Anabi Oil/Rebel, BW Gas & Convenience Holdings LLC/Yesway, Allsup's, Sunshine Gasoline Distributors, Meiyijia, Easy Joy Convenience Store, uSmile, Tianfu, Hongqi Chain, Bianlifeng, Everyday Chain, .

The market segments include Type, Application.

The market size is estimated to be USD 45.9 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Chain Convenience Store," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chain Convenience Store, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.