1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital TV and Video?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital TV and Video

Digital TV and VideoDigital TV and Video by Type (SVOD, TVOD, FVOD, IPTV), by Application (Smartphone, Tablet, Desktop and Laptop PCs, Connected TV), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

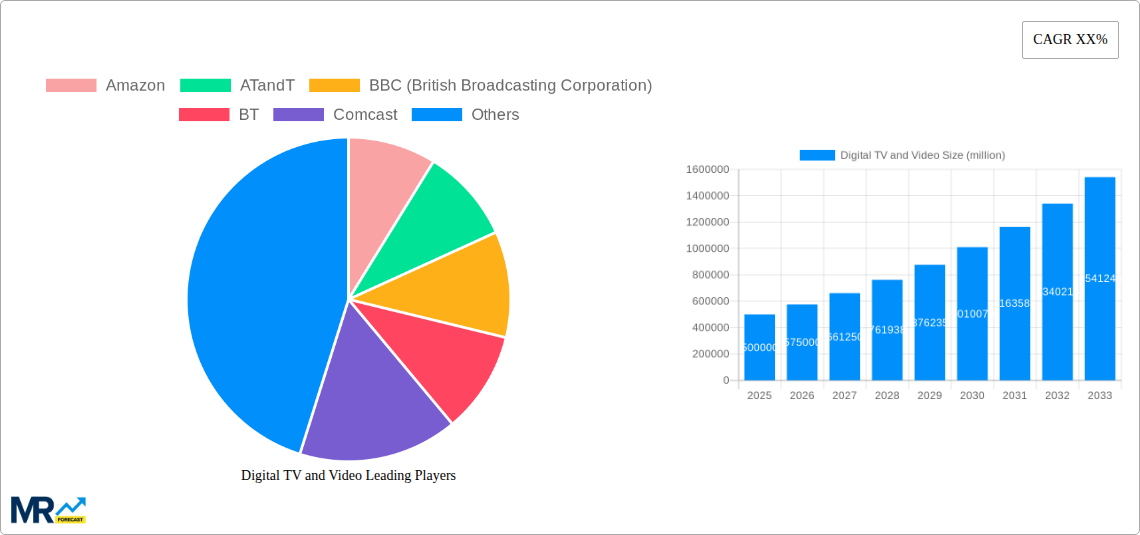

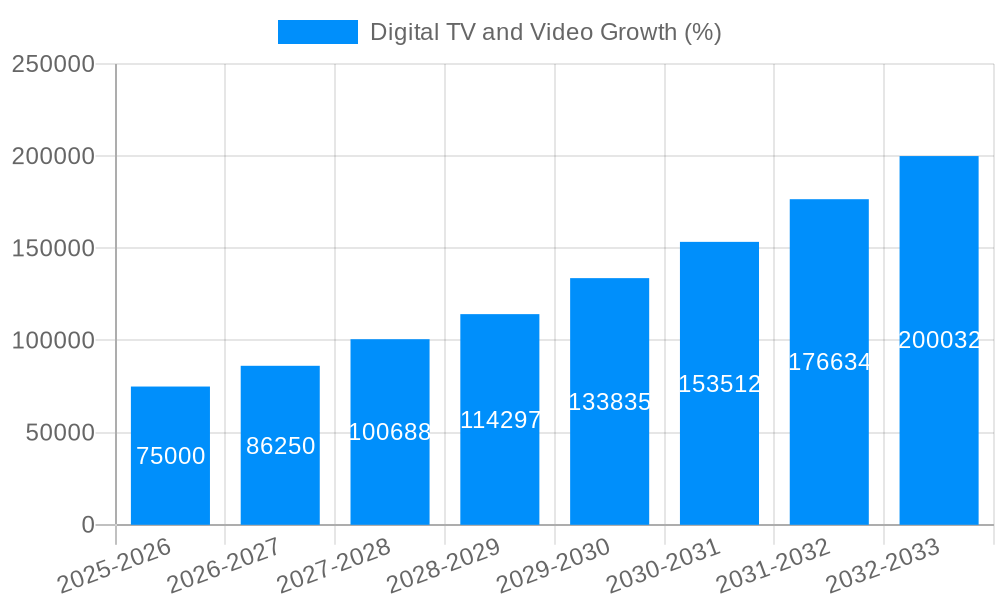

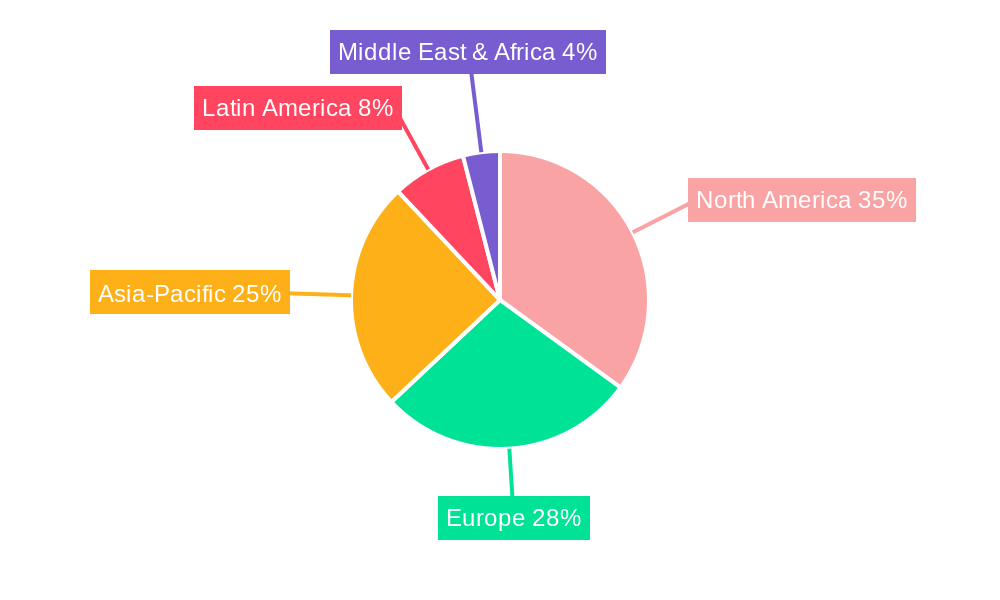

The global digital TV and video market is experiencing robust growth, driven by the increasing adoption of streaming services, the proliferation of smart TVs, and the rising demand for on-demand content. The market, estimated at $500 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching a substantial market value. Key drivers include the affordability and accessibility of high-speed internet, the growing popularity of mobile streaming, and the continuous expansion of content libraries offered by major players like Netflix, Amazon Prime Video, and Disney+. Furthermore, the increasing integration of digital TV and video services into smart home ecosystems fuels market expansion. The market is segmented by delivery method (SVOD, TVOD, FVOD, IPTV) and viewing device (smartphones, tablets, PCs, and connected TVs), with SVOD currently dominating due to its subscription-based model and vast content availability. Competition among established players and new entrants is fierce, fostering innovation and driving down prices, benefiting consumers. However, challenges remain, including concerns about data privacy, network congestion in certain regions, and the ongoing battle against piracy, which needs to be effectively addressed to ensure sustainable growth. Geographic variations in market penetration and technological infrastructure impact growth rates, with North America and Europe currently leading, while Asia-Pacific is experiencing significant growth potential due to its expanding middle class and increasing internet usage.

The future of digital TV and video will be shaped by technological advancements such as 5G and 8K resolution, leading to enhanced viewing experiences. The emergence of personalized content recommendations and interactive features further enhances user engagement. The increasing adoption of advertising-based video-on-demand (AVOD) models indicates a shift towards diversified revenue streams within the industry. Simultaneously, the convergence of traditional broadcasting and digital platforms is leading to innovative hybrid models. Regulatory changes regarding data privacy and content restrictions will continue to influence market dynamics. Companies are strategically investing in original content creation, exploring new distribution channels, and focusing on personalized user experiences to stay competitive in this dynamic landscape. Success in this market requires a combination of strong content libraries, advanced technological infrastructure, effective marketing strategies, and a keen understanding of evolving consumer preferences.

The digital TV and video landscape has undergone a dramatic transformation since 2019, driven by the proliferation of streaming services, the rise of connected TVs, and the increasing consumption of video content across diverse devices. The study period (2019-2033), with a base year of 2025 and an estimated year of 2025, reveals a market characterized by explosive growth, intense competition, and ongoing innovation. The forecast period (2025-2033) suggests continued expansion, with projections indicating a significant increase in the number of digital TV and video subscribers and a corresponding surge in revenue. The historical period (2019-2024) served as a foundation, demonstrating the rapid adoption of streaming platforms and the shift away from traditional linear television. This transition is fueled by the increasing availability of high-quality content, user-friendly interfaces, and on-demand accessibility. Market penetration rates for streaming services have surpassed expectations across various demographics, further solidifying the dominance of digital platforms. The market is currently experiencing a consolidation phase, with major players engaging in strategic mergers and acquisitions to secure market share and expand their content libraries. This competitive environment is expected to continue, driving innovation and improvements in streaming technology, user experience, and content offerings. The estimated value of the market in 2025 exceeds hundreds of millions of units, a testament to its widespread adoption and enduring popularity. The forecast indicates continued significant growth, driven by factors such as increasing internet penetration, rising disposable incomes in key markets, and the constant development of new technologies that enhance the viewing experience.

Several key factors are propelling the growth of the digital TV and video market. The most significant is the widespread availability and affordability of high-speed internet. This allows for seamless streaming of high-definition video content, eliminating the limitations of traditional cable or satellite television. The rise of smartphones and other smart devices has further broadened access, enabling viewers to consume content anytime, anywhere. The increasing popularity of streaming services offering on-demand content, personalized recommendations, and diverse programming caters to individual preferences, exceeding the limitations of traditional broadcast schedules. Competition among providers, while fierce, is also a driving force, as it encourages innovation in technology, content creation, and user interface design. The constant introduction of new features, such as 4K resolution, HDR, and immersive sound, enhances the viewing experience, attracting more users to digital platforms. Moreover, the expanding adoption of connected TVs seamlessly integrates streaming services into the television viewing experience, creating a user-friendly and accessible ecosystem that appeals to a wide range of viewers. This ecosystem is further bolstered by user-friendly interfaces and robust recommendation engines. Finally, the increasing production and demand for high-quality original programming from platforms such as Netflix, Amazon Prime Video, and HBO Max drives ongoing audience growth.

Despite the remarkable growth, the digital TV and video market faces several challenges. Content piracy remains a significant concern, impacting the revenue streams of content creators and distributors. The need for high-bandwidth internet access presents a barrier in regions with limited infrastructure. The rising cost of producing high-quality content puts pressure on profitability, particularly for smaller streaming services. Competition is fierce, with established players and new entrants vying for market share, leading to price wars and a constant need for innovation. Furthermore, ensuring data privacy and security is crucial as users share increasingly sensitive information with streaming platforms. Regulatory hurdles, including differing content regulations across regions, add complexity for content providers attempting to reach global audiences. Finally, managing user expectations regarding the quality and availability of content is important; interruptions and technical glitches can lead to user dissatisfaction and churn. Addressing these challenges requires proactive strategies from players across the value chain.

The North American market, particularly the United States, is expected to continue its dominance in the digital TV and video market throughout the forecast period. This is driven by high internet penetration, high disposable incomes, and early adoption of streaming technologies. However, significant growth is also projected in Asia-Pacific regions, particularly in countries experiencing rapid economic growth and increasing internet accessibility.

Dominant Segment: SVOD (Subscription Video on Demand)

The SVOD segment is forecast to maintain its leading position, driven by its subscription-based revenue model, which offers predictable income streams for providers. The convenience and flexibility offered by SVOD services significantly contribute to its popularity. The wide range of content available across various genres and languages further contributes to the segment's strong position. Growth in this segment will be driven by the continued expansion of streaming libraries, improved recommendation engines, and the addition of interactive features. SVOD platforms are expected to increase their focus on personalized content and user experiences in the coming years to further enhance customer engagement. The high user engagement is partly due to the ability to watch content on various devices and platforms, which extends accessibility significantly. The availability of original programming also plays a key role in attracting and retaining subscribers.

Dominant Application: Connected TV

Connected TVs are rapidly becoming the preferred device for consuming streaming content, surpassing smartphones and tablets in market share. The large screen size, ease of use, and immersive viewing experience makes them highly appealing to consumers. This segment's growth is fueled by the decreasing costs of smart TVs and their increasing integration with streaming services. The integration of voice assistants further enhances the user experience, making content discovery easier and more intuitive. The large screen format offers a superior viewing experience and is well suited to the increasing demand for high-resolution content. This trend will continue to drive growth in the coming years.

The industry is poised for continued expansion, fueled by the convergence of several factors. The increasing affordability and accessibility of high-speed internet are expanding the market's reach into new demographics and geographic areas. Advances in streaming technology, such as 4K resolution and HDR, continue to enhance the user experience, attracting more viewers. The ongoing production of high-quality original content from major players and smaller independent producers further fuels demand. The increasing popularity of immersive technologies, like Virtual Reality (VR) and Augmented Reality (AR), offers opportunities for innovation in content delivery and user engagement.

The digital TV and video market is undergoing rapid expansion, driven by technological advancements, increased internet penetration, and evolving consumer preferences. The growth is further fueled by the rise of streaming services, the proliferation of connected devices, and the continuous production of high-quality content. The industry is characterized by fierce competition, continuous innovation, and a constant need to adapt to changing market dynamics. This report provides a detailed analysis of the market trends, driving forces, challenges, and future outlook, offering valuable insights for stakeholders across the value chain.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amazon, ATandT, BBC (British Broadcasting Corporation), BT, Comcast, HBO (Home Box Office), Hulu, iFlix, Netflix, Roku, Sky, YouTube, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Digital TV and Video," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital TV and Video, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.