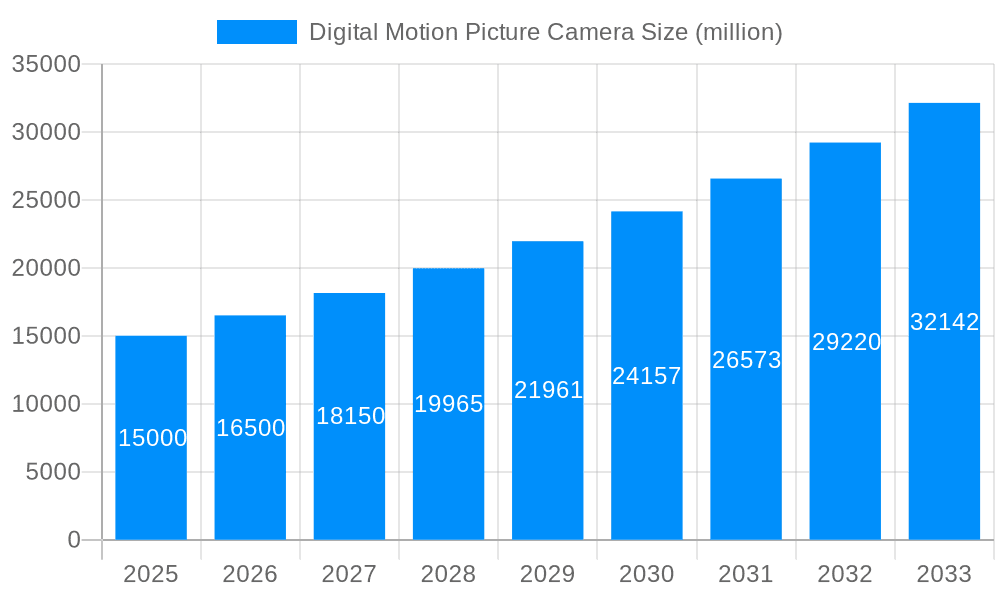

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Motion Picture Camera?

The projected CAGR is approximately 13.48%.

Digital Motion Picture Camera

Digital Motion Picture CameraDigital Motion Picture Camera by Type (4K Type, 6K Type, 8k Type, HD Type), by Application (Amateurs, Professional Application), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

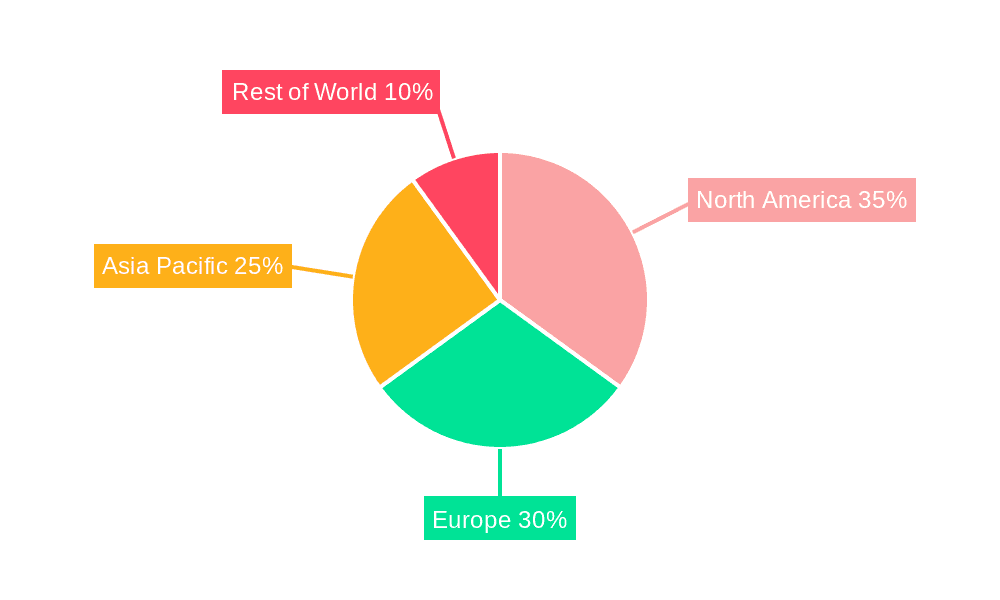

The global digital motion picture camera market is experiencing robust growth, driven by the increasing adoption of high-resolution cameras in filmmaking and the surging demand for professional-grade equipment. The market's expansion is fueled by several key factors: the rising popularity of streaming platforms and online video content creation, necessitating high-quality visuals; advancements in sensor technology leading to improved image quality, dynamic range, and low-light performance; and the integration of cutting-edge features such as advanced autofocus systems, interchangeable lenses, and internal recording capabilities. The market is segmented by resolution (4K, 6K, 8K, HD) and application (amateur, professional), with the professional segment driving significant revenue growth due to its higher spending capacity and demand for sophisticated features. While the amateur segment contributes to overall volume, the professional segment dictates pricing and technological advancement. Geographical distribution reflects established filmmaking hubs like North America and Europe, but growth in Asia-Pacific is rapidly closing the gap driven by emerging markets in India and China.

Technological advancements, particularly in sensor technology and computational imaging, are expected to shape future market trends. The increasing demand for higher resolutions, particularly 8K, is a prominent driver of innovation and will likely lead to further market segmentation and specialization. However, high production costs associated with 8K cameras and limitations in post-production infrastructure may temporarily restrain wider adoption. The ongoing development of lighter, more compact professional cameras is improving accessibility and lowering barriers to entry for independent filmmakers and smaller production houses. The integration of artificial intelligence (AI) features for improved image stabilization, autofocus, and even creative effects will further enhance camera capabilities. Competitive landscape remains dynamic with established players like Sony, ARRI, and Canon continuing to dominate, while smaller innovators are entering the market with specialized offerings, leading to greater diversity and choice for filmmakers.

The global digital motion picture camera market is experiencing robust growth, projected to reach several billion units by 2033. Driven by technological advancements, increasing adoption across diverse applications, and a burgeoning content creation landscape, the market exhibits a dynamic interplay of factors influencing its trajectory. The historical period (2019-2024) showcased a steady rise in demand, particularly for higher-resolution cameras like 4K and 6K models. The base year of 2025 reveals a market already saturated with a variety of offerings from major players like Sony, ARRI, and RED, catering to both amateur and professional users. The forecast period (2025-2033) anticipates a continued expansion, primarily propelled by the growing popularity of streaming platforms, the rise of independent filmmaking, and the increasing accessibility of high-quality cameras at varying price points. This trend is further reinforced by the continuous improvement in image quality, sensor technology, and lens capabilities, making professional-grade features available to a broader user base. The market is seeing a shift towards lightweight and compact cameras, appealing to the increasingly mobile and versatile nature of content creation. This shift, coupled with the integration of advanced features like high dynamic range (HDR) and improved low-light performance, fuels the overall market growth. The emergence of 8K technology represents a significant development, although currently niche, promising to be a dominant force in the coming years. Competition remains fierce, with established players constantly innovating and smaller companies emerging with disruptive technologies. This competitive landscape fosters innovation and keeps prices relatively competitive, benefitting consumers and encouraging wider adoption.

Several key factors contribute to the rapid expansion of the digital motion picture camera market. The proliferation of streaming services like Netflix, Amazon Prime Video, and Disney+ has created a massive demand for high-quality video content, driving up the need for sophisticated cameras capable of capturing stunning visuals. Furthermore, the rise of social media platforms and online video content creation has democratized filmmaking, enabling individuals and smaller production houses to produce professional-grade videos using readily available digital motion picture cameras. Technological advancements, such as the development of larger, higher-resolution sensors, improved image processing capabilities, and the incorporation of advanced features like HDR and 4K/6K/8K recording, have significantly enhanced the quality and capabilities of these cameras. The decreasing cost of these technologies also plays a vital role, making them more accessible to a wider range of users, from amateur enthusiasts to professional filmmakers. Lastly, the increasing affordability and portability of digital cameras, especially mirrorless models, have further fueled market growth. This combination of technological advancements, increased demand for visual content, and greater accessibility is creating a synergistic effect, driving the digital motion picture camera market to new heights.

Despite the impressive growth, the digital motion picture camera market faces certain challenges. The intense competition among established players and emerging companies can lead to price wars, reducing profit margins. The rapid pace of technological advancements necessitates constant innovation and investment in research and development, placing pressure on manufacturers to stay ahead of the curve. The market is also susceptible to economic fluctuations, as consumer spending on high-ticket items like professional-grade cameras can be affected by economic downturns. Furthermore, the rising popularity of smartphone cameras with increasingly advanced features poses a competitive threat, particularly in the amateur segment. While smartphones can capture decent footage, they still lack the versatility, image quality, and control offered by dedicated digital motion picture cameras, but the line is blurring. Finally, the increasing complexity of camera technology can be a barrier to entry for some users, particularly those lacking technical expertise. Overcoming these challenges requires manufacturers to focus on continuous innovation, cost optimization, and user-friendly design to maintain market share and drive future growth.

The professional application segment is expected to dominate the market, driven by substantial demand from film production houses, broadcasting companies, and advertising agencies, accounting for a significant portion (estimated at over 60%) of the market share by 2033. This segment's growth is directly tied to the increasing global demand for high-quality video content across various platforms and industries. Within the types of cameras, the 4K segment currently holds the largest market share, benefiting from its balance of high image quality and relative affordability compared to 6K and 8K options. However, 6K and 8K segments are projected for significant growth throughout the forecast period (2025-2033), propelled by technological advancements that reduce cost and increase accessibility. Geographically, North America and Europe are anticipated to retain their positions as major markets, fueled by high disposable incomes, advanced technological infrastructure, and a thriving film and television industry. However, the Asia-Pacific region is expected to witness substantial growth, driven by rising disposable incomes, a rapidly growing media and entertainment industry, and increasing adoption of digital technology in developing economies.

The digital motion picture camera industry is fueled by several significant growth catalysts. Firstly, ongoing technological advancements in sensor technology, image processing, and lens design continually improve image quality, resolution, and overall camera performance. Secondly, the ever-increasing demand for high-quality video content across various platforms, including streaming services, social media, and traditional television, is driving the adoption of advanced cameras. Thirdly, the declining cost of production and increased accessibility of high-quality cameras further fuel this growth. Finally, the growing number of independent filmmakers and content creators, combined with increasingly sophisticated editing tools, expands the market significantly.

The comprehensive report provides a detailed analysis of the global digital motion picture camera market, encompassing historical data, current market dynamics, and future projections. It offers in-depth insights into market trends, driving factors, challenges, and growth opportunities. Furthermore, it includes detailed profiles of major industry players, their strategies, and market positioning, supplemented by forecasts and regional market analyses. The report ultimately serves as a valuable resource for industry stakeholders seeking a comprehensive understanding of this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.48% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13.48%.

Key companies in the market include Sony, ARRI, Canon, Red, Panasonic, Blackmagic, Nikon, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Digital Motion Picture Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Motion Picture Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.