1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Point-and-shoot Camera?

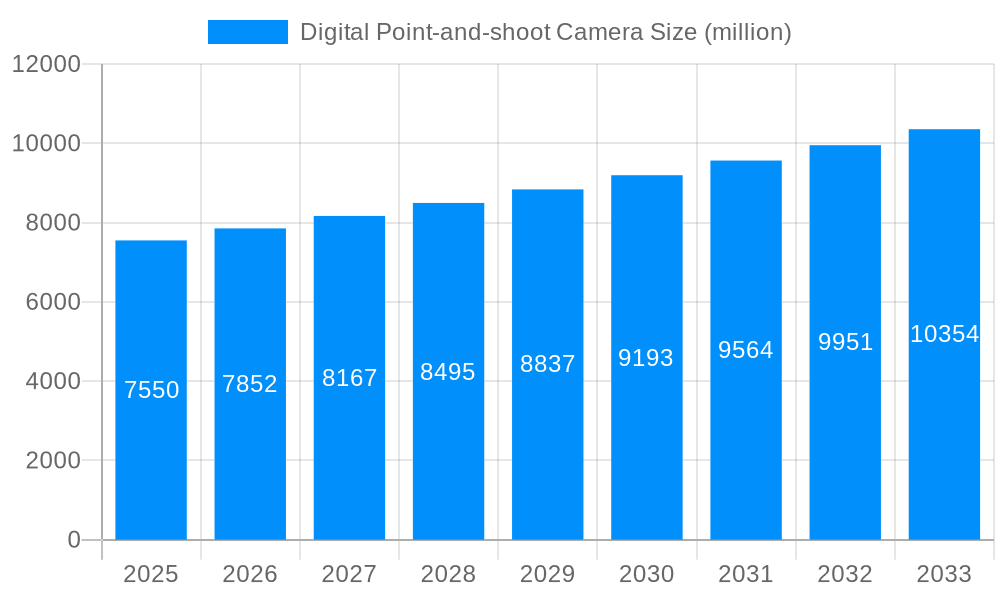

The projected CAGR is approximately 4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Point-and-shoot Camera

Digital Point-and-shoot CameraDigital Point-and-shoot Camera by Type (Polaroid, Film Camera), by Application (Personal, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

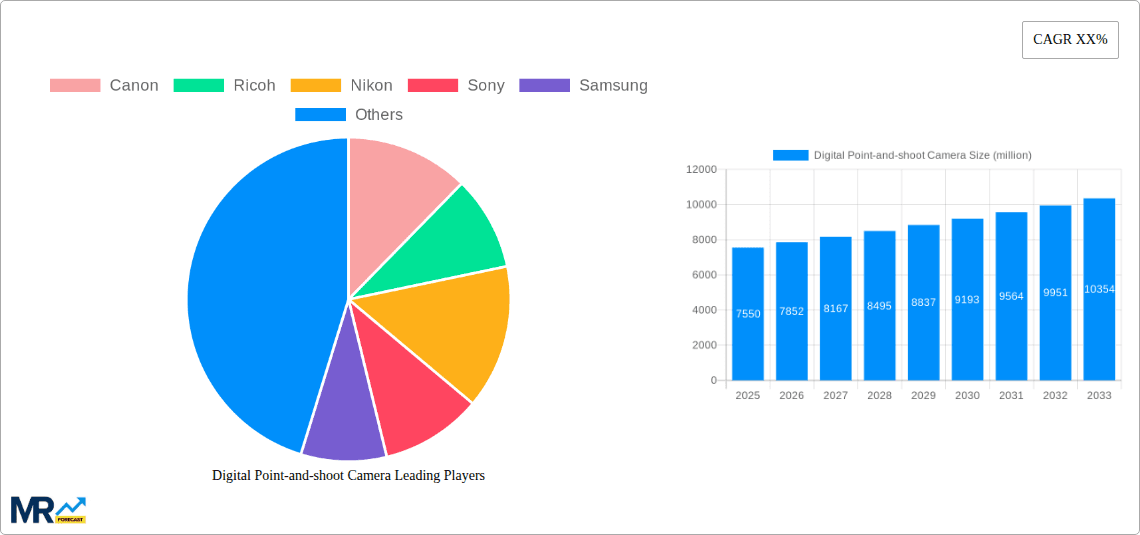

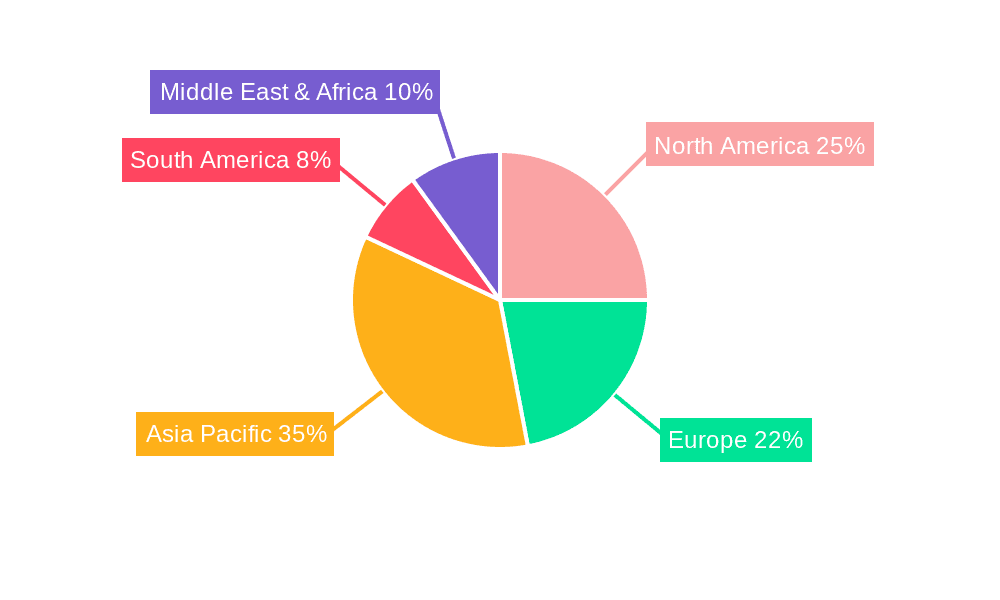

The digital point-and-shoot camera market, while facing challenges from smartphone photography, maintains a niche appeal driven by factors such as superior image quality, advanced features, and dedicated controls. The market, estimated at $2.5 billion in 2025, is projected to experience moderate growth, with a Compound Annual Growth Rate (CAGR) of 5% through 2033. This growth is fueled by the increasing demand for high-quality images in specific applications like professional travel photography and event photography, and a resurgence of interest in analog aesthetics amongst younger consumers. Key market drivers include advancements in sensor technology, improved lens capabilities, and the introduction of models with enhanced connectivity features, such as Wi-Fi and Bluetooth, for easy image sharing. However, restraints include the continued dominance of smartphone cameras, especially amongst casual users, and the overall decline in overall camera sales. Market segmentation reveals a significant share held by personal-use cameras, although commercial applications in specific sectors like real estate and event photography continue to drive demand for professional-grade point-and-shoot models. Established players like Canon, Nikon, Sony, and Fujifilm, along with others, continue to innovate and compete in this space, focusing on premium features and specialized models. Regional data suggests a robust market in North America and Asia Pacific, particularly driven by strong consumer purchasing power and technological adoption.

The competitive landscape is characterized by established players constantly innovating to cater to niche demands. While the overall market size is smaller than other camera segments, its profitability persists due to the higher average selling price of dedicated digital point-and-shoot cameras. The market is expected to see a shift towards more specialized models catering to specific user needs, for example, those with advanced zoom capabilities for wildlife photography or those with weather-sealing for outdoor enthusiasts. Marketing strategies will likely emphasize the unique strengths of point-and-shoot cameras—superior image quality, ease of use, and dedicated features—to counter the ubiquitous nature of smartphone cameras. This strategy may focus on marketing to users who value image quality and usability over convenience and social media integration. A continuous focus on product differentiation and targeted marketing will be crucial for sustained growth within this dynamic market.

The global digital point-and-shoot camera market, while facing significant headwinds from the rise of smartphone cameras, continues to exhibit nuanced trends. Over the historical period (2019-2024), the market experienced a decline, primarily driven by the ubiquitous nature of high-quality smartphone cameras integrated into nearly every mobile device. However, the estimated year 2025 shows a slight stabilization, suggesting a potential bottoming out of the decline. This stabilization is attributed to several factors, including a resurgence of interest in photography as a hobby, a renewed appreciation for image quality beyond that offered by smartphones, and the introduction of innovative features in specific niche segments. The forecast period (2025-2033) projects modest growth, fueled by the ongoing appeal of dedicated cameras for professional-level image quality, superior zoom capabilities, and better low-light performance. This growth, however, is not expected to reach the millions of units sold during the peak years of the market, indicating a long-term shift in consumer preferences. The market is witnessing a gradual segmentation, with a significant portion shifting towards premium, high-end models that offer features unavailable in smartphones. This highlights a move towards a specialized market catering to enthusiasts and professionals, rather than mass consumer adoption. This trend is expected to continue throughout the forecast period, contributing to a slower but steadier growth than the sharp decline observed in the previous years. The overall market size in units, while not reaching the multi-million unit sales of the past, is projected to show a steady, albeit limited, recovery over the coming years.

Several factors are contributing to the modest resurgence and projected growth of the digital point-and-shoot camera market. Firstly, a growing number of photography enthusiasts are seeking higher image quality and advanced features beyond the capabilities of smartphone cameras. Dedicated point-and-shoot cameras often boast superior optical zoom, larger sensors, and better low-light performance, catering to users who demand professional-grade results. Secondly, the market is seeing an increased focus on niche segments. Retro-styled cameras, waterproof cameras, and action cameras are gaining traction, appealing to specific user demographics and use cases. Thirdly, technological advancements are playing a role. Improvements in sensor technology, image processing, and lens design are leading to better image quality and more compact camera bodies. Finally, a shift in marketing strategies from mass-market appeal to targeted campaigns focusing on specific user groups is proving effective in boosting sales. These factors combine to create a sustainable, albeit smaller, market for digital point-and-shoot cameras, a niche that appreciates the distinct advantages these cameras offer over smartphone cameras.

The primary challenge facing the digital point-and-shoot camera market remains the overwhelming dominance of smartphone cameras. Smartphones provide readily accessible, high-quality photography for most users, eliminating the need for a separate camera for casual photography. This inherent convenience poses a significant barrier to entry for point-and-shoot cameras. Furthermore, the high initial cost of many point-and-shoot cameras, especially those offering advanced features, can be a deterrent for budget-conscious consumers. The ongoing technological advancements in smartphone cameras further exacerbate this challenge, as smartphone manufacturers continuously improve their camera capabilities, narrowing the gap in image quality and functionality. Finally, the market saturation and intense competition from established brands and emerging players create pressure on profit margins and necessitate continuous innovation to maintain market share. The combination of these factors makes it challenging for the point-and-shoot camera market to achieve the massive growth seen in previous years.

The personal application segment is expected to dominate the digital point-and-shoot camera market. While commercial and professional applications exist, the majority of sales will still stem from individual consumers. This is primarily due to the convenience and portability offered by point-and-shoot cameras, making them ideal for casual photography and travel.

Asia-Pacific: This region is projected to maintain a significant market share due to a large and growing population with a rising middle class, increasing disposable income, and a burgeoning interest in photography as a hobby. Countries like Japan, China, and South Korea are expected to drive much of this growth.

North America: Although smartphone penetration is high, a segment of users in this region values professional-grade image quality and superior features, supporting consistent demand for high-end point-and-shoot cameras.

Europe: Similar to North America, Europe presents a stable market for point-and-shoot cameras, primarily among photography enthusiasts and those seeking cameras with particular specialized features.

The personal segment's dominance is underpinned by several factors. First, the ease of use of point-and-shoot cameras makes them accessible to a broader range of users compared to more complex DSLRs or mirrorless cameras. Secondly, the versatility of these cameras makes them suitable for various situations, from casual snapshots to travel photography. Thirdly, the continued evolution of point-and-shoot cameras with improved features, like enhanced image stabilization and better low-light capabilities, caters directly to the needs of individual consumers. These factors, coupled with regional growth drivers, contribute to the continued albeit smaller-scale prominence of the personal application segment in the global digital point-and-shoot camera market.

The digital point-and-shoot camera market's growth is fueled by several catalysts. The introduction of innovative features, such as improved image stabilization, superior low-light performance, and advanced zoom capabilities, is enticing consumers. A renewed focus on niche segments, like retro-styled cameras or waterproof action cameras, is also contributing to growth. Marketing efforts that target specific user groups rather than relying on mass-market appeal are proving effective. Finally, technological advancements, such as improvements in sensor technology and lens design, are enabling point-and-shoot cameras to offer increasingly better image quality. These combined efforts are fostering modest but sustainable market growth.

This report offers a detailed analysis of the digital point-and-shoot camera market, covering historical data, current trends, and future projections. It includes insights into key market drivers, challenges, and growth catalysts, providing a comprehensive understanding of the market landscape. The report also profiles leading players in the industry and examines significant developments shaping the market's future. This in-depth analysis is valuable for businesses operating in the digital imaging sector, investors seeking investment opportunities, and anyone interested in understanding this evolving market segment.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4%.

Key companies in the market include Canon, Ricoh, Nikon, Sony, Samsung, Olympus, Konica Minolta, Fujifilm, Panasonic, Eastman Kodak, Nikon, CASIO.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Digital Point-and-shoot Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Point-and-shoot Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.