1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Factory Solution?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Factory Solution

Digital Factory SolutionDigital Factory Solution by Type (/> Designing, Manufacturing, Testing), by Application (/> Automobile, Machine Manufacturing, Electronics, Appliances, Foundry, Pharmaceutical, Chemical, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

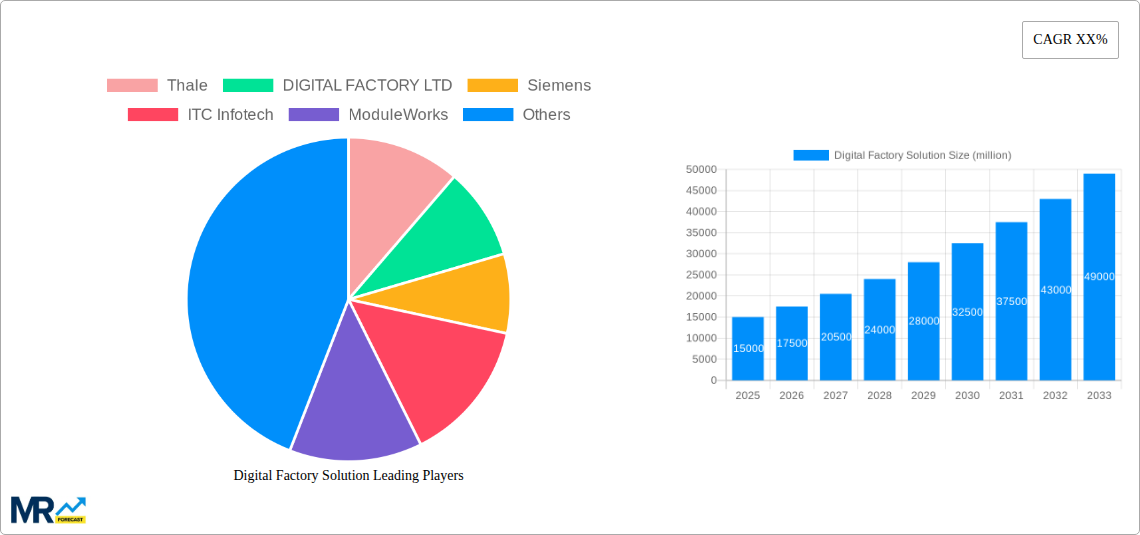

The global Digital Factory Solution market is poised for substantial expansion, projected to reach an estimated $XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This dynamic growth is fundamentally driven by the escalating demand for enhanced operational efficiency, reduced production costs, and improved product quality across various industries. The inherent ability of digital factory solutions to enable real-time monitoring, predictive maintenance, and streamlined supply chain management makes them indispensable for businesses aiming to remain competitive in an increasingly automated and data-driven landscape. Key segments driving this market include the design, manufacturing, and testing phases of the production lifecycle, with significant adoption anticipated in sectors such as automobile manufacturing, machine manufacturing, electronics, and appliances. The integration of advanced technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and cloud computing is further fueling innovation and creating new opportunities for market players.

The market is characterized by several compelling trends, including the increasing adoption of Industry 4.0 principles, the rise of smart factories, and a growing focus on cybersecurity within digital manufacturing environments. These solutions empower manufacturers to achieve greater agility, personalize production, and optimize resource allocation. However, certain restraints may temper the pace of widespread adoption, such as the high initial investment costs associated with implementing comprehensive digital factory systems and the need for a skilled workforce capable of managing and leveraging these advanced technologies. Nonetheless, the long-term benefits in terms of productivity gains, waste reduction, and enhanced decision-making capabilities are expected to outweigh these challenges. Companies like Siemens, Intel, and HP are at the forefront, investing heavily in research and development to offer integrated solutions that cater to the evolving needs of a global manufacturing sector striving for digital transformation.

The digital factory solution market is poised for unprecedented growth, transforming the very essence of industrial operations. This report delves deep into the intricate landscape of digital factories, providing a data-driven analysis of market trends, driving forces, challenges, regional dominance, key players, and significant developments shaping this transformative industry. Spanning the historical period of 2019-2024 and projecting growth through the forecast period of 2025-2033, with a base year of 2025, this report offers invaluable insights for stakeholders.

The digital factory solution market is experiencing a profound metamorphosis, driven by the relentless pursuit of enhanced efficiency, agility, and intelligence within manufacturing environments. Over the historical period of 2019-2024, early adopters began integrating foundational digital technologies, laying the groundwork for the more sophisticated solutions seen today. The base year of 2025 marks a pivotal point, with a significant increase in the adoption of integrated digital solutions across various manufacturing sectors. Key market insights reveal a dominant trend towards the proliferation of the Industrial Internet of Things (IIoT), enabling real-time data collection and analysis from every facet of the production process. This interconnectedness allows for predictive maintenance, minimizing downtime and optimizing resource allocation. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is becoming indispensable, powering advanced analytics, enabling intelligent automation, and driving informed decision-making. Digital twins, virtual replicas of physical assets and processes, are emerging as critical tools for simulation, optimization, and scenario planning, allowing manufacturers to test and refine operations virtually before implementation. The rise of cloud computing is facilitating scalability, accessibility, and cost-effectiveness for digital factory solutions, democratizing access for small and medium-sized enterprises (SMEs). Cybersecurity in the digital factory context is no longer an afterthought but a core consideration, with robust security measures being a prerequisite for the successful implementation and operation of these interconnected systems. The focus is shifting from standalone digital solutions to comprehensive, end-to-end digital transformation initiatives. This includes the seamless integration of design, manufacturing, testing, and application phases, creating a holistic digital thread that ensures data consistency and traceability throughout the product lifecycle. The market is witnessing a substantial investment in smart sensors, robotic automation, augmented reality (AR) and virtual reality (VR) for training and operational assistance, and advanced data analytics platforms. The estimated market size in 2025 is projected to be in the hundreds of millions, with a projected compound annual growth rate (CAGR) exceeding 15% throughout the forecast period of 2025-2033, reaching several billion units by the end of the study period. The increasing complexity of product designs, coupled with the demand for faster time-to-market, further fuels the adoption of digital factory solutions. The competitive landscape is characterized by strategic partnerships and acquisitions as companies strive to offer end-to-end solutions and leverage specialized expertise. The emphasis on sustainability and resource optimization is also driving the adoption of digital solutions that enable more efficient energy consumption and waste reduction.

Several formidable forces are acting as powerful catalysts, propelling the rapid advancement and widespread adoption of digital factory solutions. At the forefront is the insatiable global demand for increased manufacturing efficiency and productivity. Companies are under immense pressure to optimize their production processes, reduce operational costs, and enhance output quality to remain competitive in an increasingly globalized marketplace. Digital factory solutions, with their ability to automate tasks, streamline workflows, and provide real-time performance insights, directly address these imperatives. Furthermore, the ever-evolving customer expectations for product customization and faster delivery cycles necessitate a more agile and responsive manufacturing environment. Digital factories, through their inherent flexibility and data-driven approach, enable manufacturers to adapt quickly to changing demands and deliver personalized products with unprecedented speed. The relentless pace of technological innovation, particularly in areas like Artificial Intelligence, Machine Learning, IIoT, and cloud computing, provides the foundational building blocks for sophisticated digital factory implementations. These advancements offer new capabilities for data analysis, automation, and intelligent decision-making that were previously unattainable. Government initiatives and incentives aimed at fostering industrial modernization and digital transformation also play a crucial role. Many nations are actively promoting the adoption of Industry 4.0 technologies to bolster their domestic manufacturing capabilities and economic competitiveness. The pursuit of enhanced product quality and reduced defect rates is another significant driver. Digital solutions enable precise monitoring and control throughout the manufacturing process, leading to fewer errors and a higher standard of finished goods. Finally, the growing emphasis on worker safety and ergonomic improvements within manufacturing facilities is driving the adoption of collaborative robots and automated systems, contributing to the overall digital factory ecosystem. The substantial return on investment (ROI) realized through optimized resource utilization, reduced waste, and improved throughput further solidifies the business case for digital factory adoption.

Despite the compelling advantages, the widespread adoption of digital factory solutions is not without its significant hurdles and restraining factors. A primary concern revolves around the substantial initial investment required for implementing these advanced technologies. The cost of sophisticated hardware, software, integration services, and employee training can be a considerable barrier, especially for small and medium-sized enterprises (SMEs) with limited capital. The complex integration of disparate legacy systems with new digital solutions presents a major technical challenge. Ensuring seamless data flow and interoperability between existing infrastructure and advanced digital platforms requires significant expertise and careful planning, often leading to extended implementation timelines and increased costs. Cybersecurity threats remain a persistent and growing concern. As factories become more interconnected, they become more vulnerable to cyberattacks that can disrupt operations, compromise sensitive data, and lead to significant financial losses. The lack of skilled personnel capable of designing, implementing, and maintaining these complex digital systems is another critical restraint. There is a widening gap between the demand for digital manufacturing expertise and the available talent pool, necessitating significant investment in upskilling and reskilling the existing workforce. Resistance to change from employees accustomed to traditional manufacturing methods can also impede adoption. Overcoming this inertia requires strong leadership, effective communication, and comprehensive change management strategies. The standardization of digital factory technologies and protocols is still evolving, leading to potential interoperability issues and vendor lock-in concerns, which can deter companies from making long-term commitments. Furthermore, the perceived complexity of these solutions can create a psychological barrier for some organizations, leading them to delay or abandon their digital transformation journeys.

The digital factory solution market's dominance is projected to be shaped by a confluence of technologically advanced regions and specific industry segments that are early and enthusiastic adopters of these transformative technologies.

Key Regions/Countries Poised for Dominance:

Dominant Segments:

Manufacturing (as a Type): This is the most fundamental segment where digital factory solutions find their primary application. The core of any manufacturing operation, from raw material handling to the final assembly, benefits immensely from digital transformation. This includes:

Automobile (as an Application): The automotive industry is a leading adopter due to the complexity of its supply chains, the demand for customization, and the constant pressure to innovate.

Machine Manufacturing (as an Application): This segment focuses on the production of industrial machinery, which often involves complex designs and high precision requirements.

The synergy between these regions and segments, driven by factors like technological readiness, government support, and industry-specific demands, will be instrumental in shaping the global digital factory solution market landscape throughout the study period of 2019-2033. The estimated market value within these dominant segments is projected to contribute significantly to the overall market size, with the automotive sector alone expected to represent several hundred million dollars by 2025 and grow substantially.

The digital factory solution industry is propelled by several potent growth catalysts. The increasing imperative for operational efficiency and cost reduction across all manufacturing sectors is a primary driver, pushing companies to embrace automation and data-driven decision-making. The growing demand for personalized products and faster delivery cycles necessitates greater agility and flexibility in production, capabilities that digital factories excel at providing. Rapid advancements in technologies such as IIoT, AI, ML, and cloud computing are continuously lowering the barriers to entry and enhancing the functionalities of digital factory solutions, making them more accessible and powerful. Government initiatives and incentives worldwide promoting industrial modernization and digital transformation further accelerate adoption. The need to improve product quality and reduce manufacturing defects, driven by stringent market demands and competitive pressures, also fuels the adoption of advanced digital solutions for precise monitoring and control.

This comprehensive report offers an in-depth analysis of the digital factory solution market, spanning the historical period of 2019-2024 and projecting growth through the forecast period of 2025-2033, with 2025 serving as the base year. It provides a granular understanding of market trends, including the pervasive adoption of IIoT, AI, ML, and digital twins. The report meticulously examines the driving forces behind this growth, such as the demand for efficiency, customization, and technological advancements. It also critically assesses the challenges and restraints, including high initial investments and cybersecurity concerns. Furthermore, the report identifies key regions and countries, alongside dominant industry segments like Manufacturing and Automobile, that are set to lead the market. With a detailed look at growth catalysts and a comprehensive list of leading players like Siemens and Intel, this report equips stakeholders with the knowledge to navigate this dynamic landscape. The inclusion of significant developments and a robust methodology ensures a data-driven and forward-looking perspective. The estimated market size in 2025 is valued in the hundreds of millions, with projections indicating substantial growth throughout the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Thale, DIGITAL FACTORY LTD, Siemens, ITC Infotech, ModuleWorks, Havas, Intel, HP, Nokia, Ericsson, Navvis, Linkwin, Elco, Getech, InRoad.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Digital Factory Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Factory Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.