1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Analytic Software?

The projected CAGR is approximately 17.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Analytic Software

Digital Analytic SoftwareDigital Analytic Software by Type (On-premises, Cloud Based), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

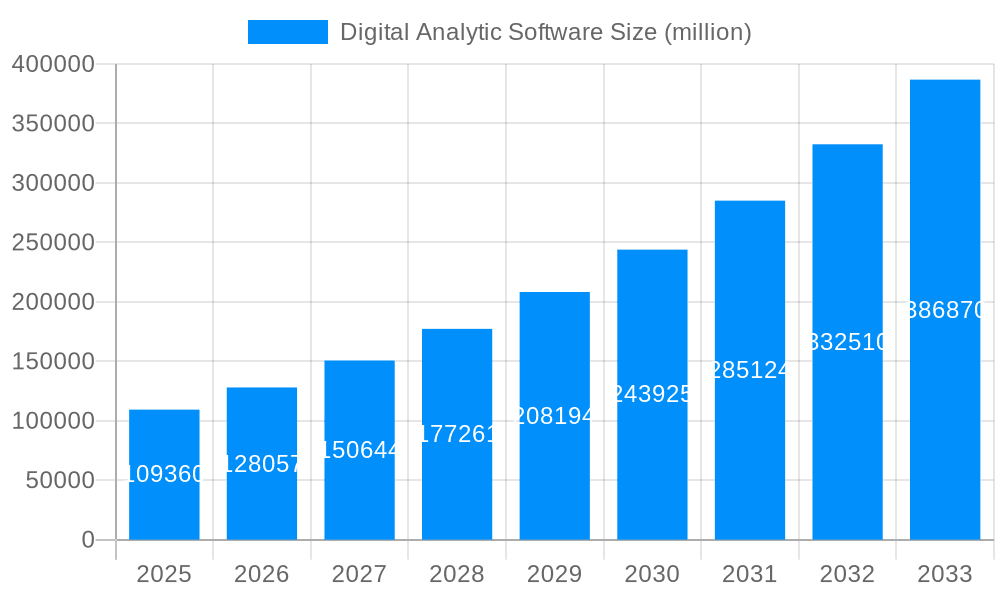

The global Digital Analytic Software market is poised for substantial expansion, projected to reach an impressive \$109.36 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 17.8%. This robust growth is fueled by the escalating need for businesses across all sectors to understand customer behavior, optimize online strategies, and make data-driven decisions. The increasing digital transformation initiatives, coupled with the proliferation of online channels and e-commerce, are creating an insatiable demand for sophisticated tools that can process vast amounts of user data. Companies are increasingly investing in digital analytics to gain a competitive edge, improve customer experience, and enhance marketing ROI. This surge in adoption is further supported by advancements in AI and machine learning, which are enabling more accurate predictive analytics and personalized insights. The market is witnessing a dynamic interplay between on-premises and cloud-based solutions, with cloud offerings gaining significant traction due to their scalability, flexibility, and cost-effectiveness, particularly for Small and Medium-sized Enterprises (SMEs) looking to leverage advanced analytics without substantial upfront infrastructure investment.

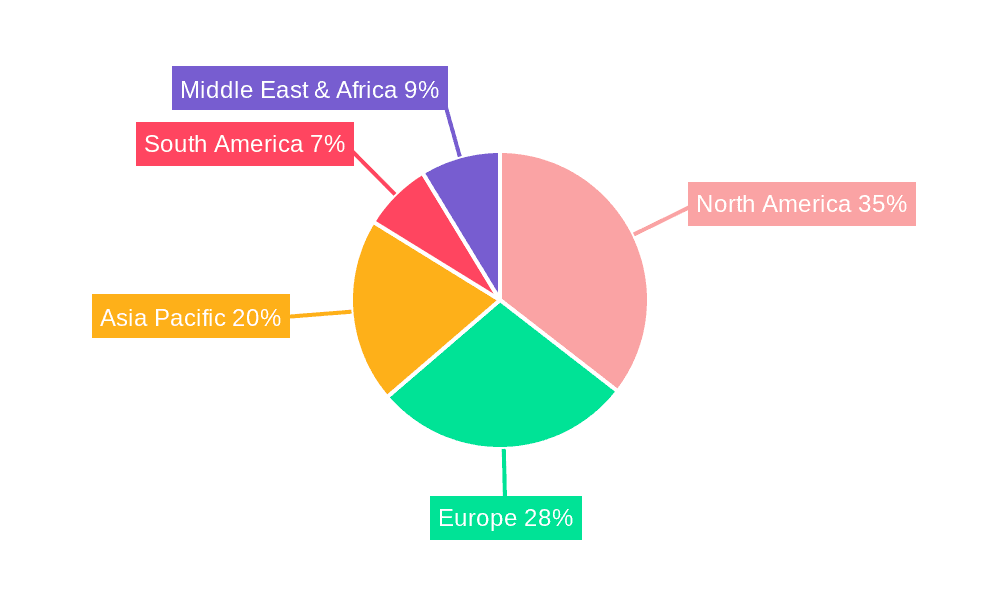

The market landscape is characterized by fierce competition among established technology giants like Google and Adobe, alongside specialized analytics providers such as Amplitude and Mixpanel. These companies are continuously innovating, introducing features like real-time dashboards, AI-powered anomaly detection, and advanced segmentation capabilities. Key growth drivers include the burgeoning e-commerce sector, the rise of digital marketing, and the growing emphasis on customer journey mapping. However, challenges such as data privacy concerns and the need for skilled data analysts may temper the growth pace in certain regions. Despite these hurdles, the overwhelming benefits of digital analytics in driving business performance and customer engagement are expected to propel the market forward. North America and Europe currently lead in adoption, but the Asia Pacific region, driven by its rapidly expanding digital economy, is expected to emerge as a significant growth engine in the coming years.

The digital analytics software market is poised for unprecedented growth, projected to reach an astounding $50 billion by 2033. This surge is fueled by an ever-increasing volume of digital interactions and the critical need for businesses to extract actionable insights from this data deluge. Over the Study Period of 2019-2033, the market has witnessed a transformative evolution, moving from basic website traffic monitoring to sophisticated, AI-driven platforms capable of predicting user behavior and optimizing customer journeys. The Base Year of 2025 represents a pivotal moment, with the market already demonstrating robust momentum, expected to reach approximately $20 billion. This report delves deep into the dynamics shaping this expansive landscape, analyzing the key trends, driving forces, challenges, and the dominant players that are collectively shaping the future of digital analytics.

XXX: The digital analytic software market is experiencing a profound metamorphosis, transitioning from merely observing digital footprints to proactively shaping them. One of the most significant trends is the pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML) across all facets of these platforms. This isn't just about automating reporting; it's about enabling predictive analytics that can forecast customer churn with remarkable accuracy, identify emerging market opportunities before they become mainstream, and personalize user experiences at an individual level. The shift from descriptive analytics (what happened) to diagnostic (why it happened) and, crucially, to prescriptive analytics (what should we do) is accelerating at an exceptional pace. We're seeing a move towards unified data platforms that can consolidate data from disparate sources – websites, mobile apps, CRM systems, social media, and even IoT devices – offering a truly holistic view of the customer. This eliminates data silos and provides a single source of truth for marketing, sales, and product development teams. Furthermore, there's a growing emphasis on real-time analytics, allowing businesses to react instantaneously to market shifts, campaign performance, and customer sentiment, rather than relying on delayed batch processing. The demand for enhanced data visualization and storytelling capabilities is also on the rise, empowering even non-technical users to understand complex data sets and derive actionable insights. This democratization of data analytics is crucial for fostering a data-driven culture across organizations of all sizes. The increasing focus on privacy-centric analytics, driven by evolving regulations like GDPR and CCPA, is another critical trend. Solutions are being developed with built-in privacy controls, anonymization techniques, and consent management features, ensuring compliance while still delivering valuable insights. The rise of no-code/low-code analytics platforms is democratizing access to powerful analytics tools, enabling a wider range of professionals to engage with data effectively. As the digital landscape becomes more fragmented and complex, the need for intuitive, accessible, and intelligent analytics solutions will only intensify, driving further innovation and market expansion. The market's trajectory is firmly set towards highly sophisticated, AI-powered, and privacy-conscious platforms that empower businesses to not just understand their digital world but to actively influence and optimize it for sustained success.

The exponential growth of the digital analytic software market is propelled by a confluence of powerful forces, each contributing to the escalating demand for data-driven decision-making. At its core, the ever-increasing volume of digital interactions serves as the foundational driver. Every website visit, app interaction, online purchase, and social media engagement generates a treasure trove of data, creating an imperative for businesses to harness this information for competitive advantage. Coupled with this data explosion is the growing realization of the ROI of data analytics. Companies are no longer viewing analytics as a cost center but as a strategic investment that directly impacts revenue, customer acquisition, retention, and operational efficiency. The intensifying competition in the digital space further necessitates advanced analytics. Businesses must understand their customers intimately, personalize their experiences, and optimize their marketing efforts to stand out in a crowded marketplace. This is where digital analytics software plays a pivotal role, providing the insights needed to achieve these objectives. The advancements in technology, particularly in AI and ML, are also acting as significant catalysts. These technologies are making analytics more powerful, predictive, and accessible than ever before, enabling sophisticated analyses that were previously impossible. Finally, the evolving customer expectations are pushing businesses towards more data-informed strategies. Customers expect seamless, personalized, and relevant experiences across all digital touchpoints, and analytics software provides the tools to deliver on these expectations.

Despite its impressive growth trajectory, the digital analytic software market faces several significant challenges and restraints that could temper its full potential. A primary hurdle is the shortage of skilled data professionals. While the software itself is becoming more intuitive, the ability to interpret complex data, build advanced models, and derive truly actionable insights still requires specialized expertise, which is in high demand and short supply. This skills gap can limit the adoption and effective utilization of even the most advanced analytics platforms. Another significant restraint is the increasing complexity of data privacy regulations. With stringent rules like GDPR and CCPA, businesses must navigate a labyrinth of compliance requirements, which can be costly and time-consuming. This also necessitates a shift in how data is collected, stored, and analyzed, potentially impacting the breadth and depth of available insights. Data integration challenges remain a persistent obstacle. Many organizations struggle with fragmented data sources, legacy systems, and incompatible data formats, making it difficult to achieve a unified view of customer behavior. The cost of implementing and maintaining sophisticated analytics solutions can also be a barrier, particularly for Small and Medium-sized Enterprises (SMEs), where budget constraints may limit their ability to invest in enterprise-grade platforms. Furthermore, resistance to change and a lack of data-driven culture within organizations can impede adoption. Employees may be hesitant to embrace new tools or rely on data for decision-making, preferring traditional methods. Finally, data security concerns continue to loom large. As businesses collect and store more sensitive customer data, the risk of breaches and cyberattacks increases, necessitating robust security measures which can add to the overall cost and complexity.

The digital analytic software market is characterized by a dynamic interplay of regions and segments, with certain areas and enterprise types exhibiting a pronounced dominance. Among the segments, Cloud-Based solutions are unequivocally leading the charge. The flexibility, scalability, and cost-effectiveness of cloud-based platforms, compared to their on-premises counterparts, make them the preferred choice for businesses of all sizes. This shift is particularly pronounced within Large Enterprises. These organizations are generating massive datasets and require robust, scalable solutions to manage and analyze this information. Cloud-based digital analytics platforms enable them to handle complex data volumes, integrate with existing cloud infrastructure, and deploy advanced AI/ML capabilities without the significant capital expenditure and ongoing maintenance associated with on-premises deployments. The ability to access sophisticated analytics tools and adapt to changing business needs rapidly through the cloud provides a critical competitive edge. The demand for advanced features like real-time analytics, predictive modeling, and sophisticated data visualization is highest among these large enterprises, further driving the adoption of cloud-native solutions.

However, SMEs are not far behind, and their adoption rates are also surging. While they may not require the same level of complexity as large enterprises, the accessibility and subscription-based models of cloud analytics make them highly attractive. SMEs are increasingly recognizing the need to understand their online presence, customer behavior, and marketing effectiveness to compete effectively. Cloud solutions offer them a powerful yet affordable way to gain these crucial insights, democratizing access to analytics previously only available to larger corporations. The growth in this segment is further propelled by the availability of specialized SME-focused analytics tools and integrated marketing platforms.

In terms of regions, North America is currently the dominant force in the digital analytic software market. This leadership is attributed to several factors: the early adoption of digital technologies, a highly developed IT infrastructure, a significant concentration of large enterprises and technology innovation hubs, and a strong culture of data-driven decision-making. The presence of major technology players and a substantial investment in research and development further solidify North America's leading position. The region's robust ecosystem of cloud service providers and a proactive approach to embracing new technologies like AI and ML contribute significantly to this dominance.

Following closely, Europe represents another significant market. While facing a more fragmented regulatory landscape compared to North America, European businesses are increasingly investing in digital analytics to optimize their operations and understand their diverse customer bases. The growing awareness of data privacy and the implementation of regulations like GDPR have, paradoxically, also spurred the development and adoption of privacy-compliant analytics solutions, further boosting the market in this region.

The Asia-Pacific (APAC) region, particularly countries like China, India, and Southeast Asian nations, is emerging as the fastest-growing market for digital analytic software. Rapid digital transformation, a burgeoning e-commerce sector, a massive internet-connected population, and increasing investments in technology are fueling this growth. As businesses in APAC mature digitally, the demand for sophisticated analytics to understand consumer behavior and optimize digital strategies is escalating exponentially. The increasing penetration of smartphones and the rise of mobile-first economies further amplify the need for mobile analytics, a key component of comprehensive digital analytics. This region's vast potential and rapid adoption rates suggest it will play an increasingly crucial role in shaping the global digital analytics landscape in the coming years.

The digital analytic software industry is experiencing significant growth catalysts that are reshaping its trajectory. The relentless surge in digital data generated from various online touchpoints is a primary driver, creating an undeniable need for tools to interpret this information. The widespread adoption of AI and Machine Learning is revolutionizing analytics, enabling predictive insights and hyper-personalization. Furthermore, the increasing emphasis on customer experience (CX) is compelling businesses to leverage analytics for deeper customer understanding and improved engagement. The growing competition across all sectors, especially in e-commerce and digital marketing, necessitates data-informed strategies for market differentiation and customer acquisition.

This comprehensive report offers an in-depth analysis of the digital analytic software market, meticulously examining its evolution from 2019 to 2033. With a Base Year of 2025 and an Estimated Year of 2025, the report provides a robust understanding of the current market landscape and projects future trends with accuracy. It delves into the driving forces propelling this dynamic sector, including the exponential growth of digital data and the integration of advanced AI/ML capabilities. Simultaneously, it addresses the prevailing challenges and restraints, such as data privacy concerns and the skills gap, offering strategic insights for mitigation. The report highlights key regions and segments, such as the dominance of Cloud-Based solutions and the significant roles of Large Enterprises and SMEs, providing a granular view of market penetration and growth opportunities. Furthermore, it identifies key growth catalysts and profiles the leading players, offering a holistic perspective on the competitive environment. This report is an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within the digital analytic software industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 17.8%.

Key companies in the market include Google, Adobe, Siteimprove, IBM, Amplitude, Pendo, StatCounter, Funnel, Mixpanel, GoSquared, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Digital Analytic Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Analytic Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.