1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Advertisement Spending?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Advertisement Spending

Digital Advertisement SpendingDigital Advertisement Spending by Type (/> Website, Mobile Application, Video Advertising, E-mail), by Application (/> Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

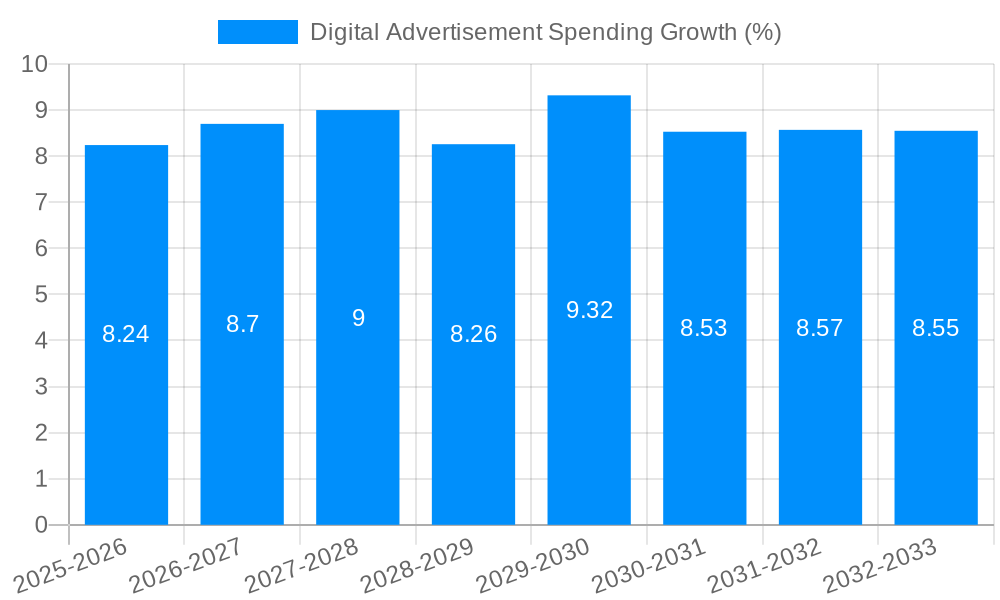

The global digital advertisement spending market is poised for significant expansion, projected to reach approximately \$XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% through 2033. This impressive growth is fueled by the escalating digital transformation across industries, the increasing penetration of smartphones and internet access worldwide, and the undeniable effectiveness of digital channels in reaching targeted audiences. Advertisers are increasingly shifting their budgets from traditional media to digital platforms due to the superior measurability, flexibility, and cost-efficiency offered by digital advertising. The proliferation of social media, search engines, and mobile applications has created a rich ecosystem for advertisers to engage consumers at various touchpoints, driving demand for innovative digital ad solutions. Key drivers include the growing adoption of programmatic advertising for real-time bidding and optimized campaign management, the surge in video advertising due to its high engagement rates, and the continuous evolution of e-commerce, which relies heavily on digital promotion to drive sales.

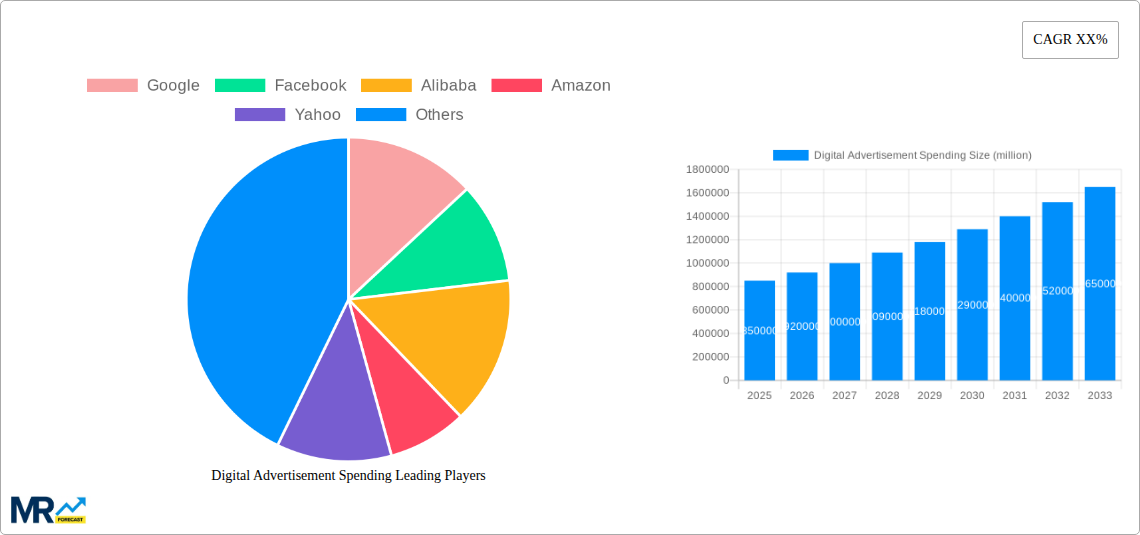

The market is segmented into various types of digital advertising, including website ads, mobile applications, video advertising, and email marketing, with video advertising expected to witness the fastest growth due to its immersive nature. In terms of application, both large enterprises and small and medium-sized enterprises (SMEs) are heavily investing in digital advertising to enhance brand visibility, acquire new customers, and foster loyalty. Major players like Google, Facebook, Alibaba, and Amazon are at the forefront of this market, constantly innovating and offering advanced advertising solutions. However, the market also faces restraints such as increasing ad fraud, concerns over data privacy, and the growing challenge of ad blindness among consumers. Despite these challenges, the sustained innovation by technology providers and the continuous need for businesses to connect with their audiences online ensure a dynamic and expanding digital advertisement spending landscape. The Asia Pacific region, particularly China and India, is expected to emerge as a dominant force in market growth due to its large internet-savvy population and rapidly developing digital infrastructure.

Here's a unique report description on Digital Advertisement Spending, incorporating your specified requirements:

This comprehensive report offers an in-depth analysis of the global digital advertisement spending market, tracing its trajectory from the historical period of 2019-2024, through the estimated base year of 2025, and projecting its dynamic evolution through the forecast period of 2025-2033. With an estimated market size of $XXX million in 2025, this study delves into the intricate interplay of technological advancements, evolving consumer behaviors, and strategic company investments that are reshaping the digital advertising ecosystem.

XXX is at the forefront of a seismic shift in global advertising, with digital channels now commanding a dominant share of marketing budgets. This report projects the digital advertisement spending to reach an impressive $XXX million by 2025, a figure expected to skyrocket to $XXX million by the end of the forecast period in 2033. This sustained growth is not merely incremental; it represents a fundamental reorientation of how brands connect with their audiences. During the historical period of 2019-2024, we witnessed the rapid ascent of platforms like Google and Facebook, which consistently captured significant portions of ad spend. Their dominance, however, is increasingly being challenged by the burgeoning influence of e-commerce giants like Alibaba and Amazon, who are leveraging their vast customer data and integrated shopping experiences to offer compelling advertising solutions. The study highlights a pronounced shift towards mobile-first strategies, with mobile applications accounting for an ever-increasing percentage of overall spending. Video advertising continues its meteoric rise, fueled by the proliferation of streaming services and short-form content platforms, demonstrating its unparalleled ability to capture attention and drive engagement. Even seemingly traditional channels like email advertising are experiencing a renaissance, driven by sophisticated personalization techniques and automation that deliver highly targeted and effective campaigns. Furthermore, the report underscores the growing sophistication of ad tech, with companies like Celtra, Bannerflow, and Adobe innovating in areas such as creative optimization and programmatic advertising, enabling advertisers to achieve greater efficiency and impact. This continuous evolution signifies a market characterized by dynamic innovation and a relentless pursuit of measurable results, with advertisers prioritizing platforms and formats that offer demonstrable ROI and deep audience insights. The digital advertising landscape is no longer just about reach; it’s about precision, personalization, and performance, driven by an insatiable demand for data-backed strategies and cutting-edge technology.

The exponential growth in digital advertisement spending is being propelled by a confluence of powerful factors that are fundamentally altering the advertising paradigm. The ubiquitous nature of internet access and the pervasive adoption of smartphones have created an unprecedented digital footprint for consumers, offering advertisers direct and constant access to their target audiences. This accessibility is amplified by the unparalleled data collection capabilities inherent in digital platforms. Companies like Google, Facebook, Alibaba, and Amazon are leveraging sophisticated algorithms to gather and analyze vast amounts of user data, enabling hyper-targeted advertising campaigns that were once the stuff of science fiction. This granular understanding of consumer behavior, preferences, and purchase intent allows advertisers to deliver highly relevant messages at the opportune moment, significantly boosting conversion rates and return on investment. Furthermore, the demonstrable ROI that digital advertising offers, compared to many traditional channels, is a critical driver. The ability to track, measure, and optimize campaigns in real-time provides advertisers with invaluable insights, allowing them to allocate budgets more efficiently and refine their strategies for maximum impact. The rise of programmatic advertising, facilitated by ad tech providers like Sizmek and Adform, has automated and optimized the buying and selling of ad inventory, making it more accessible and efficient for businesses of all sizes. This democratization of sophisticated advertising tools, from large enterprises to SMEs, further fuels the spending. Lastly, the evolving media consumption habits of consumers, with a clear preference for online content, video, and social media, naturally directs advertising budgets towards these channels.

Despite the robust growth trajectory, the digital advertisement spending landscape is not without its significant hurdles and restraints. A primary concern for advertisers and consumers alike is the escalating issue of ad fraud and bot traffic, which can siphon away significant portions of ad budgets and distort campaign performance metrics. Companies like RhythmOne and Flashtalking are actively working to combat this, but it remains a persistent threat. The increasing fragmentation of the digital media ecosystem, with a multitude of platforms and channels, can also present a challenge for advertisers seeking to achieve a cohesive and consistent brand message across all touchpoints. Ensuring effective reach and engagement across this diverse landscape requires sophisticated media planning and execution. Moreover, growing consumer concerns around data privacy and the implementation of stricter regulations, such as GDPR and CCPA, are forcing advertisers to tread more cautiously in their data collection and utilization practices. This necessitates a shift towards more transparent and privacy-compliant advertising strategies. The rising costs of digital advertising inventory, particularly on premium platforms and for highly competitive keywords, can also act as a restraint for smaller businesses and SMEs, impacting their ability to compete effectively. Additionally, the constant evolution of ad blockers and the increasing ability of consumers to filter out unwanted advertising create an ongoing arms race for advertiser attention. The development of innovative and engaging ad formats, such as those championed by Snapchat (Flite) and Mediawide, is crucial to overcome this challenge. Finally, the ongoing need for skilled professionals capable of navigating the complex digital advertising ecosystem, from data analysis to creative execution, presents a human capital challenge for many organizations.

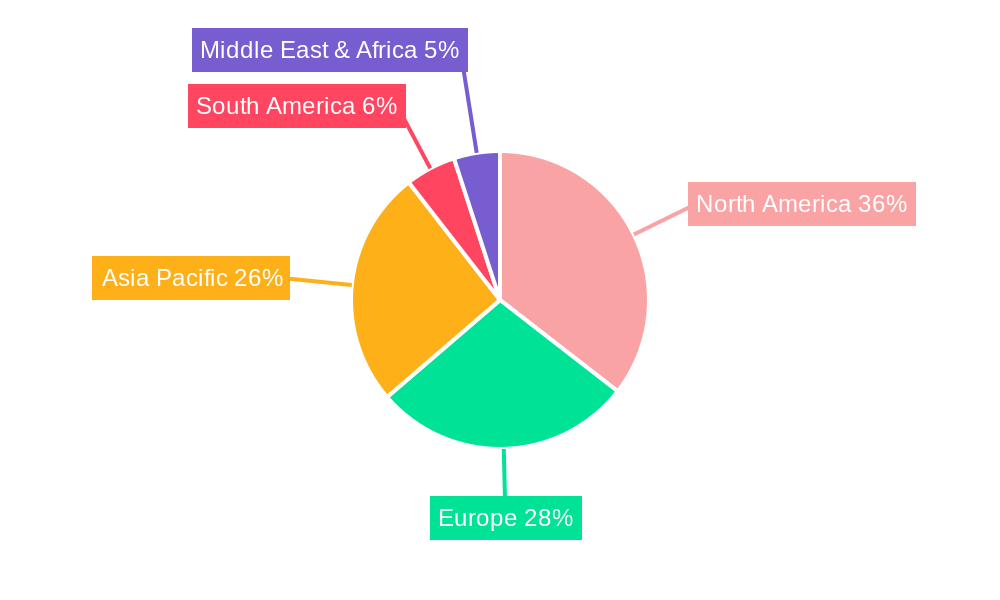

The digital advertisement spending market is characterized by a dynamic interplay of dominant regions and influential segments, with North America and Asia Pacific emerging as pivotal growth engines. Within these regions, specific segments are demonstrating exceptional performance and are poised to lead market expansion.

Dominant Segments:

Mobile Application Advertising: This segment is experiencing a phenomenal surge, driven by the sheer ubiquity of smartphones and the increasing time consumers spend within mobile applications. The ability of mobile apps to deliver highly personalized and contextually relevant advertising, coupled with the effectiveness of in-app video ads and playable ads, makes them an indispensable component of modern advertising strategies. Companies like Snapchat (Flite) are at the forefront of innovation in this space, offering engaging and interactive ad formats. The estimated spending in this segment is projected to reach $XXX million by 2025.

Video Advertising: Video advertising continues its reign as a cornerstone of digital ad spend, fueled by the insatiable demand for video content across platforms like YouTube, TikTok, and various streaming services. The immersive nature of video, its ability to convey complex messages efficiently, and its high engagement rates make it a preferred choice for advertisers seeking to build brand awareness and drive conversions. Both large enterprises and SMEs are heavily investing in video, from short-form social media clips to longer-form brand storytelling. The market for video advertising is estimated to be $XXX million in 2025, with significant growth anticipated.

Website Advertising: While mobile and video command significant attention, traditional website advertising, encompassing display, search, and native ads, remains a robust and essential segment. The evolution of programmatic advertising and sophisticated targeting mechanisms has revitalized website advertising, enabling advertisers to reach specific demographics and interest groups with precision. Platforms like Google continue to dominate search advertising, while the broader ecosystem of websites offers a diverse range of inventory for display and native campaigns. Large enterprises, in particular, leverage website advertising for comprehensive brand campaigns. The estimated spending in this segment is projected to be $XXX million in 2025.

Dominant Regions:

North America: Consistently a frontrunner in digital ad innovation and adoption, North America, led by the United States, represents the largest and most mature digital advertising market. The high disposable income, widespread internet penetration, and a strong culture of online commerce and content consumption contribute to its dominance. Major technology players like Google and Facebook have a significant presence and revenue generation from this region. The estimated digital ad spend in North America is projected to reach $XXX million in 2025.

Asia Pacific: This region is experiencing the most rapid growth in digital advertisement spending, fueled by a burgeoning middle class, increasing smartphone penetration, and the rapid expansion of e-commerce. Countries like China, India, and Southeast Asian nations are key contributors. The unique digital ecosystems in Asia, with giants like Alibaba and Tencent playing a pivotal role, present distinct advertising opportunities. The estimated digital ad spend in Asia Pacific is projected to reach $XXX million in 2025.

The convergence of these dominant segments and regions, driven by technological advancements and evolving consumer behavior, will shape the future of digital advertisement spending, with mobile applications and video advertising leading the charge, supported by the enduring strength of website advertising.

Several key catalysts are fueling the sustained growth within the digital advertisement spending industry. The continuous innovation in Artificial Intelligence (AI) and Machine Learning (ML) is a significant driver, enabling more sophisticated audience targeting, predictive analytics, and automated campaign optimization. The increasing adoption of programmatic advertising across various channels streamlines the ad buying process and enhances efficiency, making it more accessible for businesses of all sizes. Furthermore, the growing emphasis on personalized customer experiences compels advertisers to invest in digital channels that offer granular segmentation and tailored messaging. The proliferation of connected devices and the Internet of Things (IoT) is opening up new avenues for ad placement and engagement, further expanding the digital advertising footprint.

This report provides a comprehensive examination of the digital advertisement spending market, offering granular insights into market dynamics, key growth drivers, and potential hindrances. It analyzes the historical performance from 2019-2024, establishes a robust base for 2025, and extends to a detailed forecast up to 2033. The study meticulously dissects the spending patterns across various advertising types, including Website, Mobile Application, Video Advertising, E-mail, and Application. Furthermore, it segments the market by enterprise size, encompassing Large Enterprises and SMEs, and explores crucial industry developments. With estimated values in the millions, the report delves into the strategic maneuvers of leading players like Google, Facebook, Alibaba, and Amazon, and examines the impact of innovative ad tech companies. This all-encompassing analysis equips stakeholders with the critical intelligence needed to navigate this rapidly evolving and increasingly vital sector of the global economy.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Google, Facebook, Alibaba, Amazon, Yahoo, Microsoft, AOL, Celtra, Bannerflow, Adobe, RhythmOne, Sizmek, Adform, Thunder, SteelHouse, Flashtalking, Snapchat (Flite), Mediawide, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Digital Advertisement Spending," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Advertisement Spending, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.