1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Advertisement Spending?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Advertisement Spending

Digital Advertisement SpendingDigital Advertisement Spending by Type (Website, Mobile Application, Video Advertising, E-mail), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

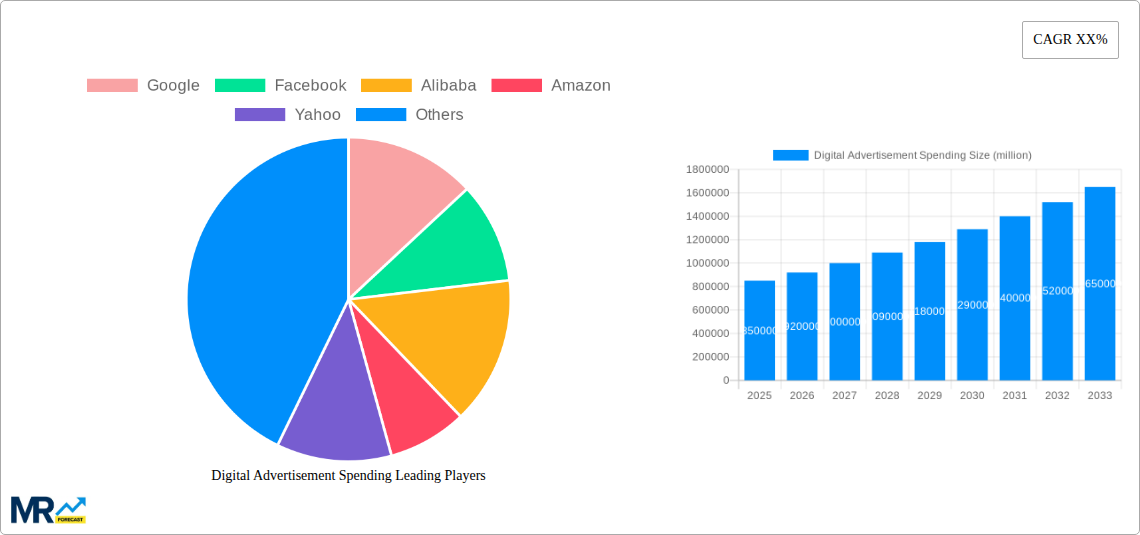

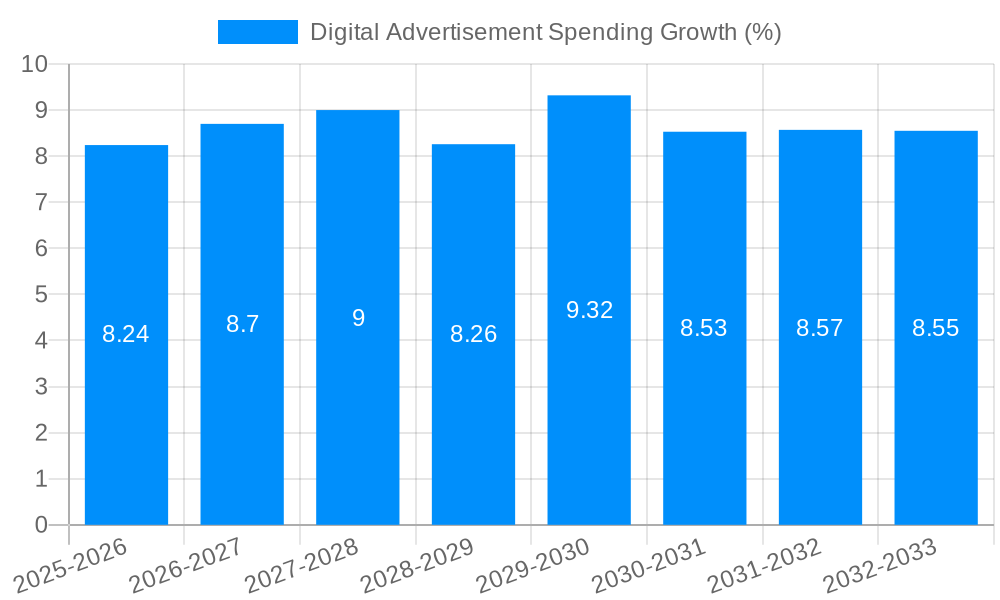

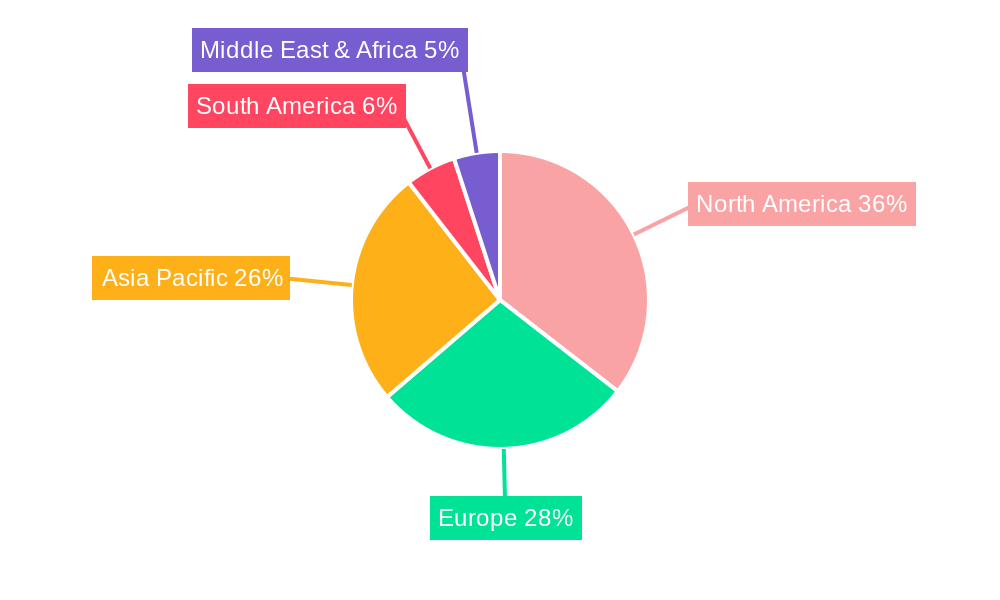

The global digital advertisement spending market is experiencing robust growth, driven by the increasing adoption of smartphones, the proliferation of social media platforms, and the expanding reach of the internet. The market's compound annual growth rate (CAGR) is estimated to be around 12% from 2025 to 2033, indicating significant future expansion. This growth is fueled by several key factors, including the rise of programmatic advertising, the increasing sophistication of targeted advertising techniques, and the growing preference for engaging digital content over traditional media. The shift towards mobile advertising is particularly pronounced, with mobile applications and video advertising witnessing exceptionally high growth rates within this segment. Large enterprises continue to be the largest contributors to market spending, but the increasing digital literacy and online presence of small and medium-sized enterprises (SMEs) is driving a substantial increase in their digital ad spending. Competition in the market is fierce, with major tech giants like Google, Facebook, Amazon, and others holding significant market shares, complemented by a dynamic ecosystem of specialized advertising technology (AdTech) companies. Geographic distribution shows North America and Europe as dominant regions, though the Asia-Pacific region, especially China and India, is exhibiting rapid growth, driven by a burgeoning internet user base and increasing digitalization of the economy. While market growth is expected to continue, potential restraints include increasing regulatory scrutiny surrounding data privacy and the potential for ad-blocking technologies to limit reach.

The segmentation of the digital advertising market reflects the diverse strategies employed by advertisers. Website and mobile application advertising remain prominent channels, benefiting from targeted user engagement. Video advertising is rapidly growing in popularity due to its high engagement levels and suitability for various platforms. Email marketing continues to hold a significant share, leveraging its capacity for direct communication and personalization. The application-based segmentation clearly distinguishes between the different resource capacities and advertising strategies of large enterprises versus SMEs. The competitive landscape remains dynamic with existing giants continuing to innovate and new players emerging, creating an environment of constant evolution and adaptation. The forecast period from 2025-2033 projects sustained growth, but careful consideration must be given to emerging trends, regulatory changes, and the competitive landscape to accurately predict the market's trajectory. Addressing challenges related to data privacy and building trust with consumers will be crucial for sustained growth in the years to come.

The global digital advertisement spending market is experiencing explosive growth, projected to reach staggering heights by 2033. The historical period (2019-2024) witnessed a significant upswing, driven by the increasing adoption of digital platforms and the ever-expanding reach of internet users. Our study, covering the period 2019-2033, with a base and estimated year of 2025, and a forecast period of 2025-2033, reveals a consistently upward trajectory. The shift from traditional advertising methods to digital channels is accelerating, fuelled by the measurable results and targeted advertising capabilities offered by digital platforms. Key market insights show a clear preference for mobile advertising, with significant investment pouring into mobile application and video advertising. Furthermore, the increasing sophistication of ad targeting technologies, leveraging data analytics and AI, is allowing businesses to reach their desired audiences with greater precision and efficiency. This precision translates into higher conversion rates and a better return on investment (ROI), further cementing the dominance of digital advertising. The market is becoming increasingly fragmented, with a wide range of players emerging, offering specialized services catering to different segments. This competition is driving innovation, leading to the development of more interactive and engaging ad formats, creating a dynamic and evolving landscape. The growth is not uniform across all segments, with some experiencing faster growth than others, indicative of specific market trends and user preferences. This necessitates a continuous monitoring of these evolving trends to adapt marketing strategies and maximize returns in the competitive digital advertising arena. The spending across all segments, including website, mobile application, video, and email advertising, is expected to surpass hundreds of billions of dollars in the coming years. Large enterprises continue to be the major spenders, but the growing participation of SMEs is also contributing significantly to the overall market expansion.

Several powerful factors are accelerating digital advertisement spending. Firstly, the proliferation of smartphones and internet access globally has created a massive pool of potential consumers easily reachable through digital channels. This widespread connectivity allows businesses to target specific demographics with tailored ads, maximizing their impact and minimizing wasted ad spend. Secondly, the rise of programmatic advertising, automating the buying and selling of digital ad inventory, has made the process more efficient and cost-effective for advertisers. This automation streamlines the process, allowing companies to allocate their budgets more strategically and accurately. Thirdly, data analytics plays a crucial role in informing advertising strategies. The ability to track ad performance, analyze user behavior, and personalize campaigns enables businesses to continuously optimize their advertising strategies, ensuring higher returns. The increasing sophistication of these analytical tools continues to be a major driver of spending. Finally, the emergence of new advertising formats, such as interactive video ads and influencer marketing, offer innovative ways to engage consumers and enhance brand visibility. The continuous evolution of advertising technologies and the innovative approaches to consumer engagement are vital components contributing to the growth of digital advertisement spending.

Despite the remarkable growth, the digital advertisement spending market faces several significant challenges. One key concern is ad fraud, which involves artificially inflating ad views or clicks, leading to wasted budgets. Combating this sophisticated form of fraud requires continuous innovation in ad verification technologies and strict regulatory frameworks. Secondly, concerns around data privacy and user consent are gaining prominence. Stringent data protection regulations, such as GDPR, are impacting how businesses collect and utilize user data for advertising purposes. Compliance costs are increasing, while the ability to effectively target users may be limited. Thirdly, the fragmented nature of the digital advertising landscape makes it complex to manage and optimize ad campaigns across multiple platforms and channels. Coordinating campaigns across various platforms requires substantial expertise and resources. Finally, the ever-changing algorithm updates from major digital platforms like Google and Facebook constantly impact the effectiveness of ad campaigns, requiring continuous adaptation and optimization. These challenges require businesses to be flexible and proactive, investing in technology and expertise to navigate this complex and dynamic marketplace effectively.

The North American and Western European markets are currently leading in digital advertisement spending, driven by high internet penetration rates and strong economies. However, the Asia-Pacific region is expected to show significant growth in the forecast period, due to a rapidly expanding middle class and increasing mobile internet usage. China, in particular, is a key market to watch, with immense potential for growth.

Mobile Application Advertising: This segment is experiencing the fastest growth rate. The widespread use of smartphones and the increasing time spent on mobile apps are major contributing factors. Mobile apps provide a highly targeted and engaging platform for advertising, leading to high click-through rates and conversion rates. Businesses are increasingly shifting their advertising budgets towards mobile applications to reach their target audiences effectively. The increasing adoption of mobile wallets and in-app purchases further strengthens the appeal of this sector. This trend is visible across all regions, with particularly strong growth in developing economies where mobile penetration often surpasses desktop access. The diverse range of apps, from social media to gaming and e-commerce, provides fertile ground for advertisers to reach their target audiences with highly relevant and personalized ads. The ability to track user behavior within apps allows advertisers to optimize their campaigns and measure ROI with precision, driving further investments in this rapidly expanding segment.

Large Enterprises: Large enterprises have the resources and budgets to invest heavily in digital advertising. They utilize sophisticated strategies, employing a diverse array of channels and techniques, from programmatic advertising to highly targeted social media campaigns. Their significant spending significantly contributes to the overall market growth, especially within complex and data-driven campaign deployments. The ability to leverage vast datasets for audience targeting and the internal expertise to effectively manage large-scale campaigns sets large enterprises apart. The forecast anticipates continued growth in their spending, driven by the need to maintain market share and reach a wide audience.

The increasing sophistication of AI-powered advertising technologies allows for more precise targeting, personalized messaging, and enhanced campaign optimization. Furthermore, the expanding use of video advertising across multiple platforms continues to drive spending growth, due to its strong engagement capabilities. Lastly, the rise of influencer marketing offers another avenue for businesses to connect with consumers authentically and effectively, leading to a further increase in digital advertisement spending.

This report provides a detailed analysis of the digital advertisement spending market, offering valuable insights for businesses and investors alike. It covers key trends, drivers, and challenges, providing a comprehensive overview of the market landscape, and offering a forecast of future growth trajectories, allowing stakeholders to make informed decisions in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Google, Facebook, Alibaba, Amazon, Yahoo, Microsoft, AOL, Celtra, Bannerflow, Adobe, RhythmOne, Sizmek, Adform, Thunder, SteelHouse, Flashtalking, Snapchat (Flite), Mediawide, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Digital Advertisement Spending," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Advertisement Spending, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.