1. What is the projected Compound Annual Growth Rate (CAGR) of the Detached House Rental Solutions?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Detached House Rental Solutions

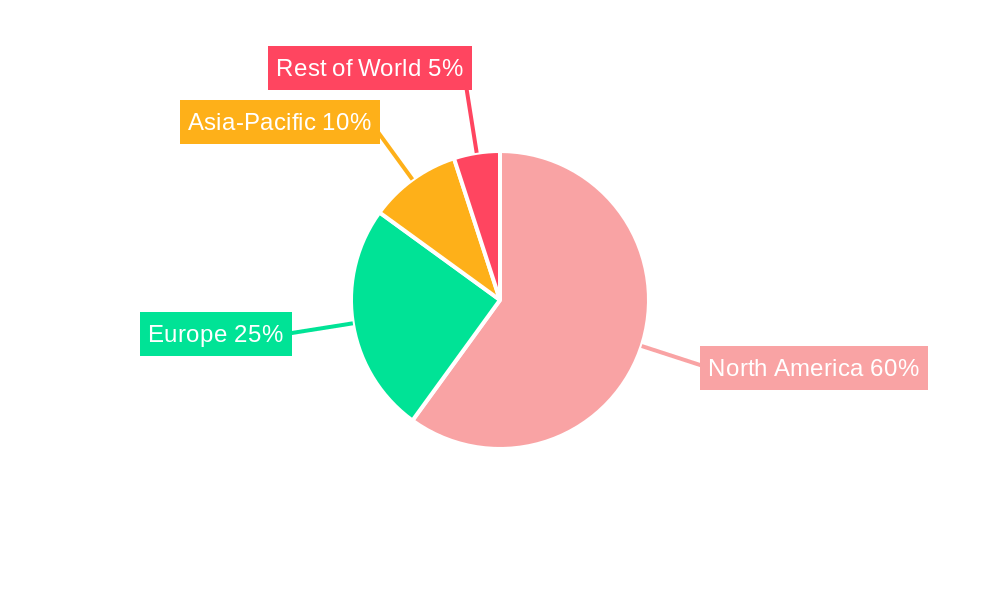

Detached House Rental SolutionsDetached House Rental Solutions by Type (Long Term Rental, Short Term Rental), by Application (Personal, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

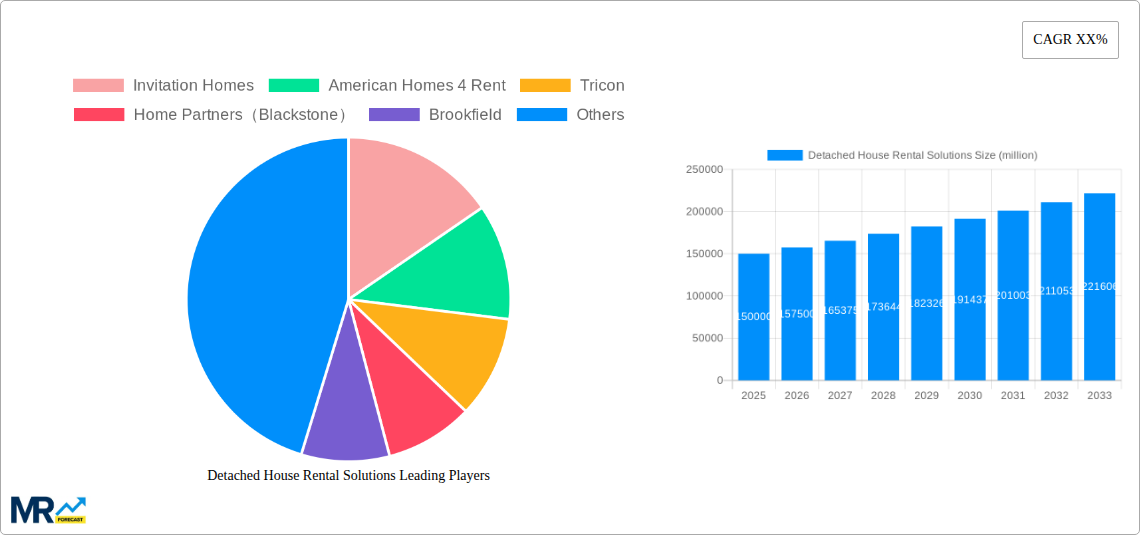

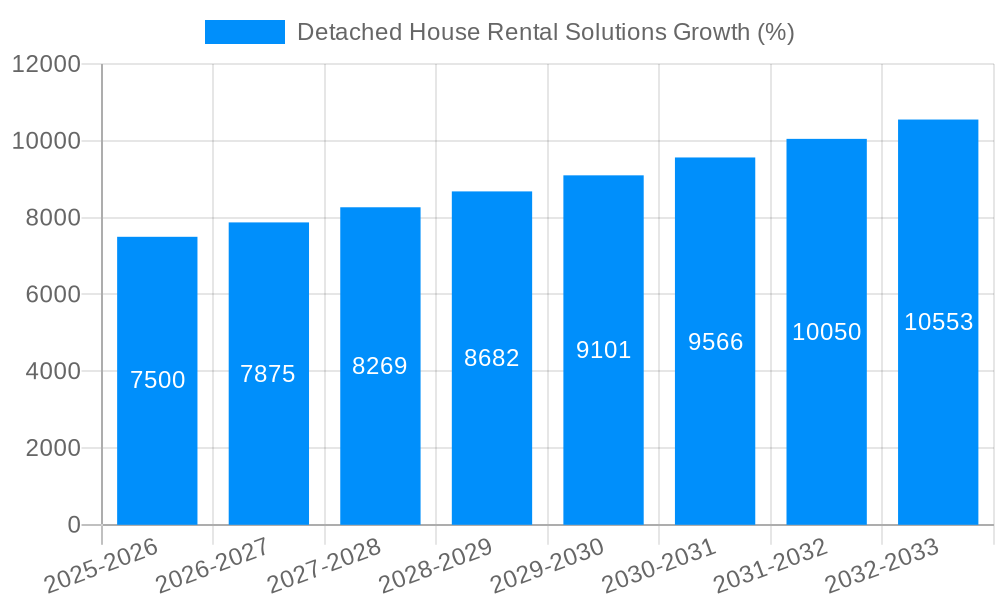

The detached house rental market is experiencing robust growth, driven by several key factors. Increased urbanization, coupled with shifting demographics and a preference for flexible living arrangements, is fueling demand for rental properties. Millennials and Gen Z, in particular, are delaying homeownership, contributing significantly to the rising rental population. Furthermore, the ongoing shortage of affordable housing in many regions is exacerbating the demand, creating a favorable environment for large-scale rental providers. The market is also witnessing innovation, with companies offering enhanced amenities and services to attract and retain tenants, creating a more competitive landscape. We estimate the current market size (2025) to be approximately $150 billion, based on typical market values for similar asset classes and reported company valuations. Assuming a conservative CAGR of 5% (a reasonable estimate given current market conditions), the market is projected to reach approximately $220 billion by 2033.

This growth is not without challenges. Rising interest rates and inflation are impacting construction costs and rental rates, potentially slowing down expansion for some operators. Regulations surrounding rental properties and tenant rights also pose a significant restraint to market growth. The competitive landscape itself presents both opportunities and challenges. Established players like Invitation Homes and American Homes 4 Rent are competing with private investors and smaller rental companies, leading to varied pricing strategies and service offerings. This fragmentation, while generating healthy competition, requires astute market positioning for long-term success. Geographic variations in demand and regulatory environments necessitate targeted strategies for optimal market penetration and profitability. The continued success in this market will rely on efficiently managing operating costs, adapting to regulatory changes, and offering attractive tenant amenities to stand out among competitors.

The detached house rental market, valued at several million units in 2025, is experiencing a period of significant transformation. The historical period (2019-2024) saw steady growth fueled by shifting demographics, increasing urbanization, and a growing preference for single-family homes among renters. This trend is expected to accelerate during the forecast period (2025-2033). Key market insights reveal a substantial increase in demand for detached rental properties, particularly in suburban and exurban areas, driven by factors such as remote work opportunities and a desire for more spacious living environments. The rise of institutional investors, like Invitation Homes, American Homes 4 Rent, and Tricon, has fundamentally reshaped the landscape, injecting significant capital and professional management into the sector. This has led to improvements in property maintenance, tenant services, and overall rental experience, attracting a wider range of renters. However, the market isn't without its complexities. Balancing profitability with tenant satisfaction, navigating fluctuating interest rates, and managing the increasing regulatory scrutiny around fair housing practices remain crucial challenges for industry players. The increasing adoption of technology, from online leasing platforms to smart home integration, is also influencing market trends, creating both opportunities and challenges for established and emerging players alike. Competition is intensifying, with larger corporations vying for market share against smaller, localized rental providers. The overall trend, however, points towards continued growth, albeit with a more nuanced and competitive dynamic than previously observed. By 2033, the market is poised for substantial expansion, propelled by demographic shifts and ongoing investment in the sector. The report provides a comprehensive analysis of these trends and their implications for various stakeholders.

Several powerful forces are accelerating the growth of the detached house rental solutions market. The rise of Millennial and Gen Z renters, who often prioritize flexibility and convenience over homeownership, is a significant contributor. These generations are delaying home purchases due to various factors, including student loan debt, economic uncertainty, and a desire for mobility. Furthermore, the increasing prevalence of remote work is blurring geographical boundaries, allowing renters to seek more spacious and affordable housing options outside of traditional urban centers. This fuels demand in suburban and exurban areas where detached houses are prevalent. The increasing cost of homeownership, including high purchase prices, property taxes, and maintenance costs, is further driving the demand for rental properties, making them a more accessible and financially viable option for a wider segment of the population. The institutionalization of the rental market, with large-scale investors acquiring and managing significant portfolios of detached homes, plays a pivotal role. These investors bring professional management expertise, improved property maintenance standards, and economies of scale, enhancing the overall rental experience and increasing market stability. Finally, technological advancements in property management software, online leasing platforms, and smart home technology are streamlining processes and improving efficiency, making the rental process more convenient for both landlords and tenants. These factors collectively are contributing to sustained growth in the detached house rental market.

Despite the positive growth trajectory, the detached house rental solutions market faces several significant challenges and restraints. Fluctuating interest rates significantly impact both the cost of financing for investors and the affordability of rent for tenants. Rising interest rates can lead to reduced investment in new rental properties and increased rental costs, potentially dampening demand. Regulations concerning fair housing practices and tenant rights are becoming increasingly stringent, requiring landlords to navigate complex legal landscapes and invest in compliance measures. Maintaining and improving the quality of rental properties is also a continuous challenge, demanding significant capital expenditure and effective property management strategies. Competition is fierce, with both large institutional investors and smaller independent landlords vying for market share. This competitive environment requires continuous innovation and efficiency improvements to maintain profitability. Furthermore, the economic climate plays a crucial role. Economic downturns can lead to increased vacancy rates and reduced rental income, impacting the financial performance of rental property investors. Finally, the availability of skilled labor for property maintenance and management is a persistent concern, potentially affecting the quality of service provided to tenants. Addressing these challenges requires proactive strategies and adaptation to the ever-evolving regulatory and economic environment.

Sunbelt States (US): States like Florida, Texas, Arizona, and North Carolina are experiencing rapid population growth and a strong demand for housing, driving significant growth in the detached house rental market. The relatively lower cost of living compared to coastal areas further fuels this demand. These states often boast a favorable climate and an attractive lifestyle, making them popular relocation destinations.

Suburban and Exurban Areas: The shift towards remote work and a preference for more spacious living environments has led to increased demand for detached houses in suburban and exurban areas, situated outside of major metropolitan centers. These locations offer a balance of affordability, space, and proximity to urban amenities.

High-Demand Rental Segments: The segment of higher-quality, renovated, and amenity-rich rental properties is experiencing particularly strong growth. These properties command higher rental rates but also attract a more stable and higher-income tenant base. Features such as modern kitchens, updated bathrooms, and smart home technologies are highly sought after.

Institutional Investors: Large-scale institutional investors are increasingly dominating the market, driving professionalism and economies of scale. Their significant capital investments are boosting the quality and availability of detached rental housing.

The paragraph below summarizes these key factors further. The detached house rental market's dominance is concentrated in regions experiencing population growth, favoring areas with a balance of affordability and lifestyle appeal. The segment showing the most significant growth is characterized by quality, amenities, and professional management, reflecting the increasing influence of institutional investors. These factors coalesce to create a dynamic market with attractive opportunities for both investors and renters but also necessitates navigating the regulatory landscape and maintaining consistent quality for sustained success.

Several factors are fueling the robust growth within the detached house rental solutions industry. The ongoing demographic shift, with increasing numbers of millennials and Gen Z entering the rental market, is a primary driver. The rise of remote work further exacerbates this trend, allowing renters to seek housing in a wider range of locations and price points. The influx of institutional investment is professionalizing the industry, raising standards, and increasing the overall supply of high-quality rental properties. Coupled with technological advancements, particularly in property management software and online leasing platforms, the sector is becoming increasingly efficient and attractive to both landlords and tenants. These combined forces point toward a trajectory of continued market expansion and innovation.

This report provides a comprehensive overview of the detached house rental solutions market, examining historical trends, current market dynamics, and future projections. It delves into the key driving forces, challenges, and growth catalysts shaping the industry. The report also profiles the leading players, analyzing their market strategies and competitive landscape. A detailed regional and segmental analysis provides insights into the most promising investment opportunities. The forecast period extends to 2033, offering stakeholders a long-term perspective on the future evolution of this dynamic market. The report is an invaluable resource for investors, developers, property managers, and anyone seeking a deep understanding of the detached house rental market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Invitation Homes, American Homes 4 Rent, Tricon, Home Partners(Blackstone), Brookfield, Amherst Holdings LLC, ResiHome, Roomless, Renters Warehouse.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Detached House Rental Solutions," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Detached House Rental Solutions, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.