1. What is the projected Compound Annual Growth Rate (CAGR) of the Department Stores?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Department Stores

Department StoresDepartment Stores by Application (/> Clothing and Footwear, Home and Kitchen Appliances, Bags, Wallets and Luggage, Watches and Jewelry, Cosmetics and Fragrances, Toys, Others), by Type (/> Large Size, Small Size), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

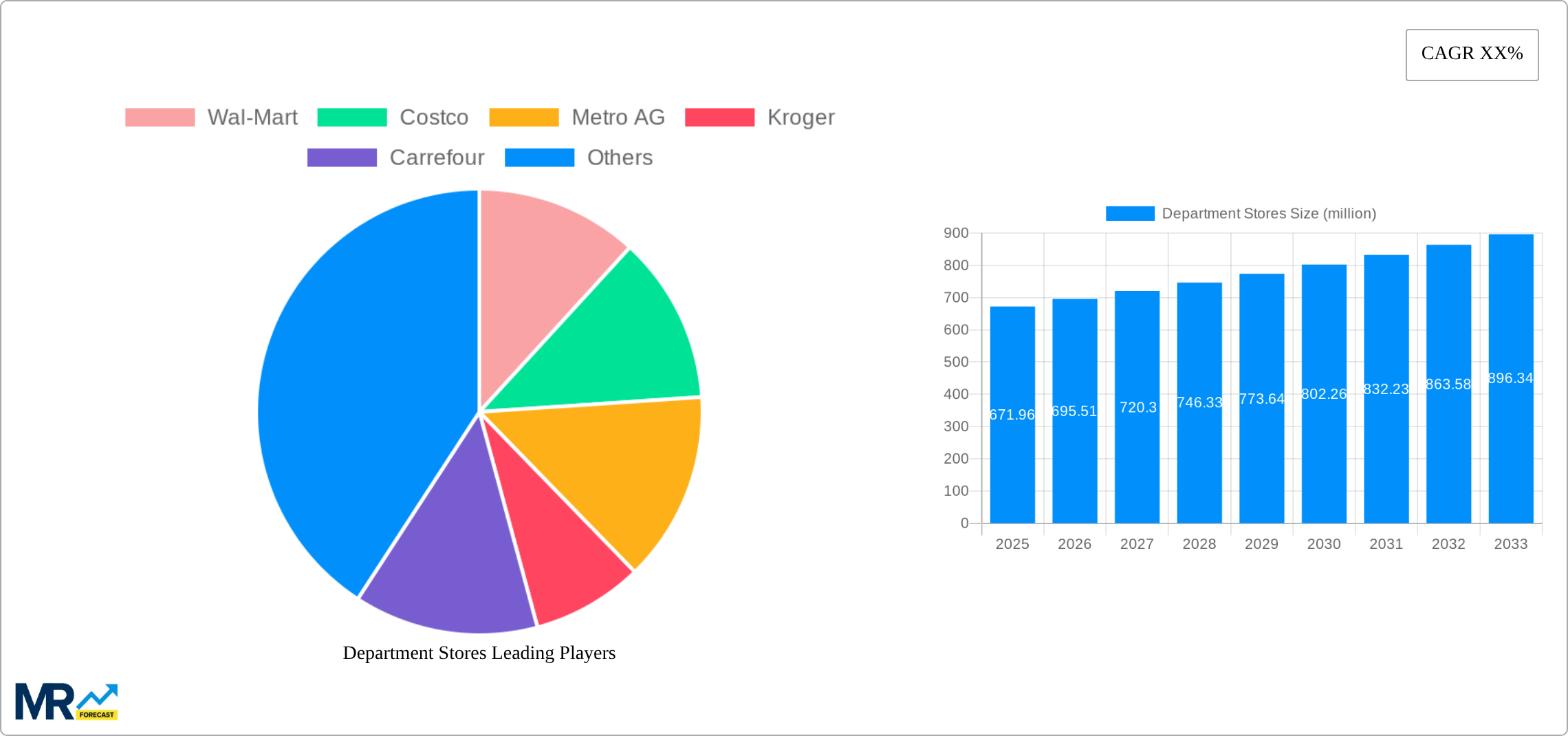

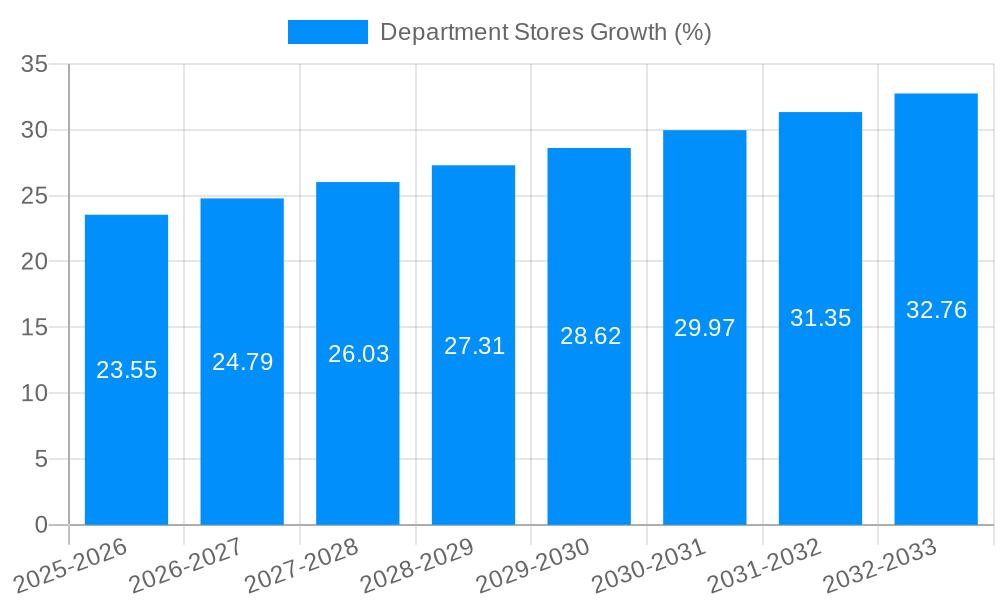

The global department store market, valued at $671.96 million in 2025, is poised for moderate growth over the forecast period (2025-2033). While a precise CAGR is unavailable, considering the competitive landscape and evolving consumer preferences, a conservative estimate of 3-5% annual growth seems reasonable. Key drivers include the ongoing shift towards omnichannel strategies, leveraging both online and physical stores to enhance customer experience. This includes investments in enhanced e-commerce platforms, personalized marketing, and seamless in-store and online integration. Furthermore, strategic partnerships and collaborations with smaller brands and designers allow department stores to offer unique and exclusive products, differentiating them from online-only retailers. However, the market faces challenges from the rise of e-commerce giants, shifting consumer preferences towards specialized retailers, and increased operating costs, particularly in maintaining physical store networks. The market is segmented by region (North America, Europe, Asia-Pacific, etc.), product category (apparel, cosmetics, home goods, etc.), and price point. Major players like Walmart, Costco, and Carrefour are adapting to changing market dynamics through innovative strategies such as personalized shopping experiences, loyalty programs, and data-driven inventory management.

The competitive landscape is intense, with established players facing pressure from both e-commerce behemoths and fast-fashion retailers. Success will hinge on the ability to adapt to rapidly evolving consumer behavior, efficiently manage supply chains, and cultivate a strong brand identity that resonates with target demographics. The forecast period will likely witness a consolidation of the market, with larger players acquiring smaller chains to expand their reach and market share. Strategic investments in technology, logistics, and customer relationship management will be crucial for department stores to maintain competitiveness and ensure sustained growth. Focusing on experiential retail, fostering community engagement, and offering value-added services will play significant roles in shaping the future of the department store industry.

The global department store industry, valued at XXX million units in 2025, is experiencing a complex interplay of trends during the study period (2019-2033). While the historical period (2019-2024) witnessed a decline for many established players due to the rise of e-commerce and shifting consumer preferences, the forecast period (2025-2033) presents opportunities for adaptation and growth. The market is witnessing a significant shift towards omnichannel strategies, with department stores increasingly investing in their online presence and integrating it with physical stores to offer a seamless shopping experience. This includes click-and-collect options, personalized online experiences, and leveraging data analytics to understand consumer behavior and tailor offerings. The focus is moving beyond simply selling goods to creating engaging customer experiences, incorporating events, personalized services, and community building within their stores. Luxury department stores are thriving due to their ability to provide exclusive experiences and high-touch customer service that online retailers struggle to replicate. Meanwhile, more budget-conscious retailers are focusing on value propositions and private labels to compete with discounters and online marketplaces. The industry is seeing increasing consolidation, with mergers and acquisitions reshaping the competitive landscape as weaker players are forced out or acquired by stronger entities. This dynamic market requires constant innovation and agility to survive and thrive, emphasizing the need for flexible business models and a deep understanding of evolving consumer demands. The estimated year (2025) shows a stabilization and even slight growth in some segments, indicating a potential market rebound fueled by strategic adaptations and evolving consumer expectations.

Several key factors are propelling the department store industry's transformation. The rise of omnichannel retail is a major driver, forcing traditional players to adapt and compete with the convenience and reach of online platforms. Investment in technology, including advanced analytics and personalized marketing, is allowing department stores to better understand customer needs and tailor their offerings accordingly. The increasing demand for experiential retail is another crucial factor; consumers are looking for more than just a transactional experience, seeking engagement, entertainment, and a sense of community within retail spaces. This has led to the incorporation of events, restaurants, and other non-retail elements within department stores. Furthermore, the growth of luxury and premium segments is supporting the continued success of certain players who cater to high-net-worth individuals. Finally, a greater focus on sustainability and ethical sourcing is appealing to an increasingly conscious consumer base, prompting department stores to incorporate these values into their operations and product offerings. This multifaceted approach, combining technological advancements with a focus on the customer experience, is vital for driving growth in the coming years.

The department store sector faces significant challenges. E-commerce continues to be a major disruptive force, offering unparalleled convenience and price competition. This has led to a decline in foot traffic for many traditional brick-and-mortar stores. High operating costs, including rent and staffing, create significant pressure on profitability, especially for less efficient or poorly located stores. The need for significant investments in technology and infrastructure to support omnichannel strategies also presents a financial hurdle. Intense competition from discount retailers and specialized stores further complicates the landscape, making it difficult for department stores to maintain market share. Shifting consumer preferences, particularly towards smaller, more specialized retailers or online marketplaces, necessitates adaptability and a thorough understanding of emerging trends. Finally, economic fluctuations can significantly impact consumer spending and negatively affect the profitability of department stores, requiring robust financial planning and risk management.

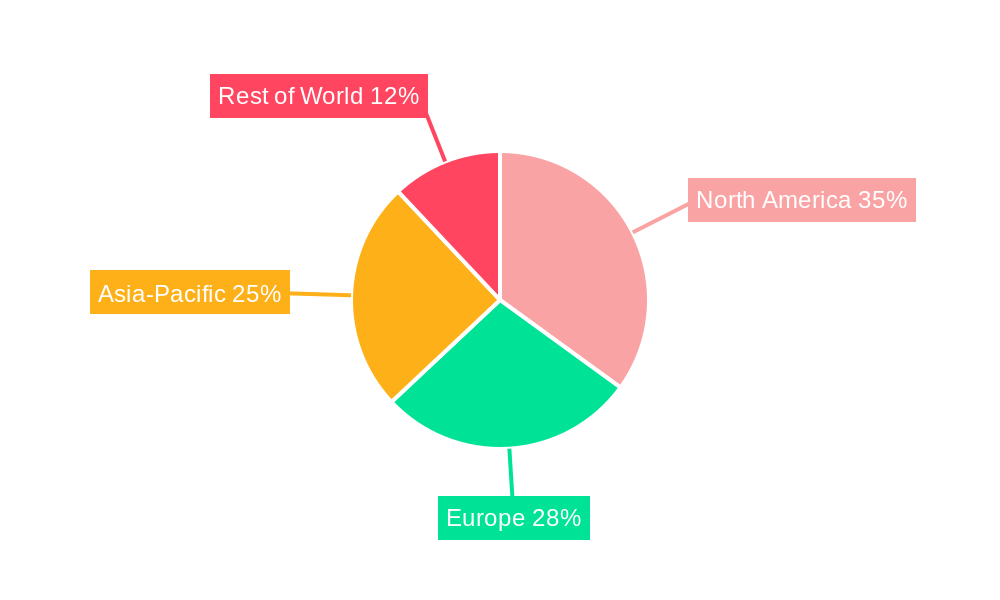

North America: The US market, with major players like Macy's, Target, and Kohl's, remains a significant contributor, although facing challenges from e-commerce. The market demonstrates resilience through omnichannel strategies and focus on experiential retail.

Asia-Pacific: This region shows considerable growth potential, driven by rising disposable incomes and a burgeoning middle class in countries like China. Companies such as RT-MART, BHG, Bailian Group, Yonghui Superstores, and Trust-Mart are key players in this dynamic market. The segment is witnessing a rise in online shopping alongside the continued significance of physical stores.

Europe: Mature markets like those in Western Europe present challenges due to saturated competition and economic volatility. However, players such as Metro AG and Carrefour are adapting and finding success in specific niche markets.

Luxury Segment: This segment consistently demonstrates strong performance, relatively unaffected by the challenges faced by more mass-market department stores. The emphasis on exclusive brands, personalized service, and unique experiences drives its growth.

The dominance of a specific region or segment depends on multiple factors. However, the Asia-Pacific region, particularly China, and the luxury segment demonstrate the most potential for growth in the forecast period, due to a combination of economic development, increased consumer spending, and the enduring appeal of high-end products and services. The continued success in these areas depends on effectively navigating the evolving landscape of retail and effectively responding to changing consumer behaviors.

Key growth catalysts include the successful implementation of omnichannel strategies, providing seamless online and offline shopping experiences. Investing in technology, personalized marketing, and data analytics allows for better understanding and targeting of consumer needs. The creation of engaging in-store experiences, shifting from transactional retail to experiential retail, helps attract and retain customers in an increasingly competitive environment. Finally, a focus on sustainability and ethical sourcing strengthens brand image and resonates with an increasingly conscious consumer base.

This report offers a comprehensive overview of the department store industry, examining historical trends, current market dynamics, and future growth prospects. It provides insights into key driving forces, challenges, and opportunities, offering a detailed analysis of leading players and significant developments shaping the sector. The report is crucial for businesses and investors seeking a comprehensive understanding of this evolving market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Wal-Mart, Costco, Metro AG, Kroger, Carrefour, Target, Macy's, Sears, Kohl's, Nordstrom, JCPenney, CR Vanguard, RT-MART, BHG, Bailian Group, Yonghui Superstores, Trust-Mart.

The market segments include Application, Type.

The market size is estimated to be USD 671960 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Department Stores," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Department Stores, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.