1. What is the projected Compound Annual Growth Rate (CAGR) of the Decentralized Finance(DeFi) Platform?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Decentralized Finance(DeFi) Platform

Decentralized Finance(DeFi) PlatformDecentralized Finance(DeFi) Platform by Application (Assets Tokenization, Compliance & Identity, Others), by Type (Blockchain Technology, Decentralized Applications (dApps), Smart Contracts), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

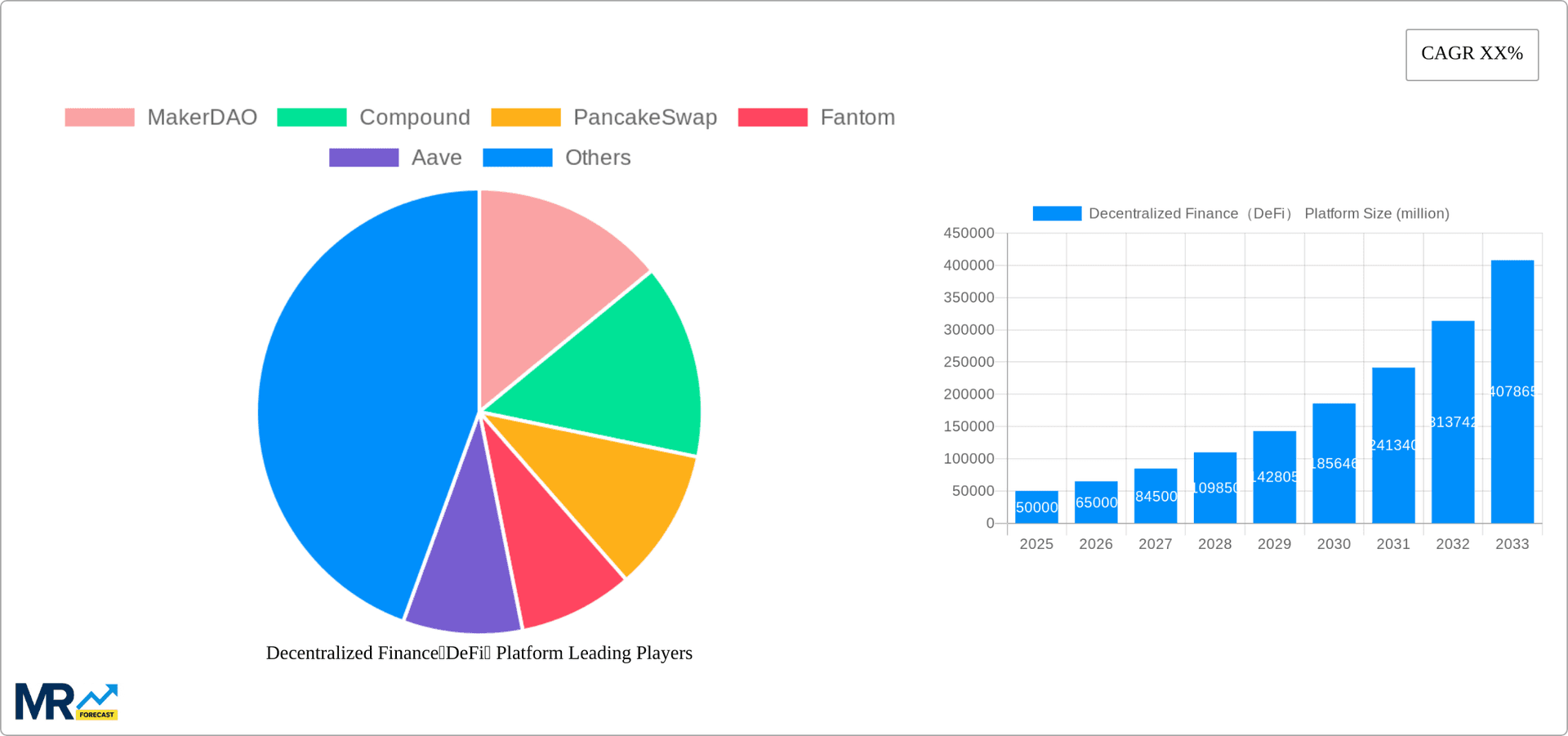

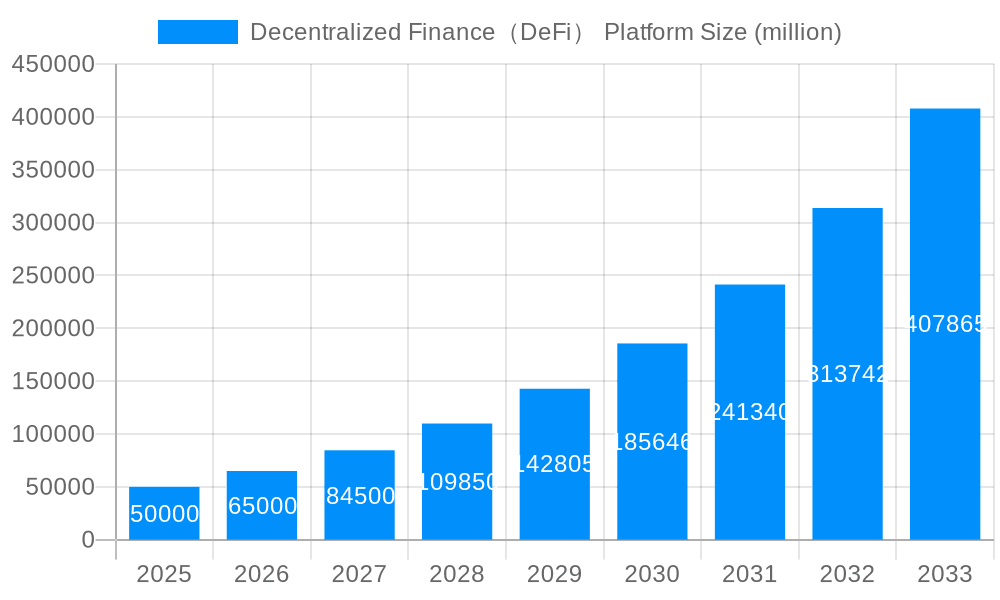

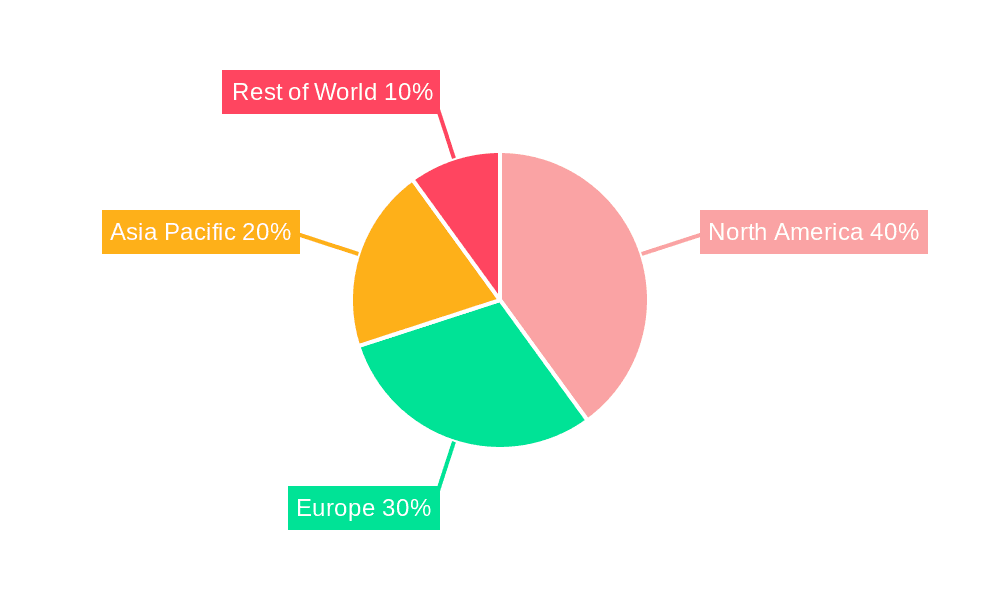

The Decentralized Finance (DeFi) platform market is experiencing explosive growth, driven by increasing adoption of blockchain technology, the rise of decentralized applications (dApps), and the growing demand for transparent and efficient financial services. The market, estimated at $50 billion in 2025, is projected to witness a robust Compound Annual Growth Rate (CAGR) of 30% from 2025 to 2033, reaching an estimated market size of $300 billion by 2033. Key drivers include the increasing demand for asset tokenization, improved compliance and identity solutions within the DeFi ecosystem, and the growing sophistication of smart contracts enabling complex financial instruments. The adoption of DeFi across diverse segments, including lending, borrowing, trading, and decentralized exchanges (DEXs), fuels this growth. Leading players like MakerDAO, Aave, Uniswap, and Compound are shaping the market landscape through continuous innovation and expansion of their offerings. However, challenges remain, including regulatory uncertainty, security vulnerabilities, and scalability issues which are actively being addressed by the industry. Geographical distribution reveals strong growth across North America and Europe, fueled by early adoption and regulatory clarity in certain regions. However, the Asia-Pacific region is anticipated to experience rapid expansion in the coming years driven by increasing technological awareness and substantial user base. Furthermore, the emergence of innovative solutions within the DeFi sector such as decentralized stablecoins and yield farming strategies will continuously shape market dynamics.

The diverse application of DeFi across asset tokenization for real-world assets, enhanced compliance and identity solutions ensuring regulatory adherence, and other innovative applications, is expanding its market reach. The technological foundation of DeFi, largely encompassing blockchain technology, decentralized applications (dApps), and sophisticated smart contracts, ensures its scalability and adaptability to evolving market needs. While existing challenges remain, the industry's focus on security enhancements, interoperability improvements, and regulatory engagement contributes to the sustained growth of the DeFi platform market. The ongoing evolution of DeFi protocols and the integration with traditional financial systems position the market for continued expansion, making it an attractive and dynamic sector for investment and development.

The Decentralized Finance (DeFi) platform market witnessed explosive growth during the historical period (2019-2024), driven by increasing adoption of cryptocurrencies and blockchain technology. The total value locked (TVL) in DeFi protocols soared into the billions, showcasing a massive surge in user interest and investment. While the market experienced periods of volatility, reflecting the inherent risks associated with nascent technologies and market sentiment, the overall trajectory points towards sustained expansion. Key market insights reveal a shift from early-stage experimentation towards more sophisticated and institutional-grade DeFi applications. This includes the emergence of advanced protocols offering complex financial instruments like decentralized exchanges (DEXs) with automated market makers (AMMs), lending and borrowing platforms, and decentralized stablecoins. The estimated market value in 2025 is projected to reach tens of billions of dollars, indicating continued growth and mainstream acceptance. The forecast period (2025-2033) anticipates an even more pronounced expansion, fueled by innovations in scalability solutions, regulatory clarity (in select jurisdictions), and broader institutional participation. This expansion will likely be driven by increasingly sophisticated applications of DeFi, such as decentralized autonomous organizations (DAOs) and the integration of DeFi with other sectors like supply chain finance and digital identity verification. The continued development and refinement of smart contracts, coupled with improvements in user experience, will be crucial in fostering broader adoption and driving market growth towards the projected hundreds of billions of dollars by 2033.

Several factors are propelling the growth of the DeFi platform market. Firstly, the inherent limitations of traditional finance, such as high fees, slow transaction times, and lack of accessibility, have created a demand for alternative solutions. DeFi offers a permissionless and transparent system, allowing anyone with an internet connection to participate in financial activities. Secondly, the increasing adoption and maturation of blockchain technology provides a secure and transparent foundation for DeFi applications. Advancements in smart contract technology enable the creation of complex financial instruments and protocols that are self-executing and tamper-proof. Thirdly, the growing popularity of cryptocurrencies and the expanding digital asset ecosystem fuel demand for DeFi services. As more individuals and institutions invest in digital assets, the need for decentralized financial tools to manage, trade, and leverage these assets increases exponentially. Furthermore, the emergence of innovative DeFi protocols that offer unique functionalities and improved user experiences is attracting new users and expanding the market. The development of decentralized stablecoins, for example, addresses the volatility often associated with cryptocurrencies and increases the usability of DeFi services. The overall trend of increasing financial inclusion through accessible and borderless financial services further contributes to the DeFi platform's growth.

Despite the significant growth potential, the DeFi platform market faces several challenges and restraints. Regulatory uncertainty is a major hurdle, as many jurisdictions are still developing frameworks for governing cryptocurrencies and DeFi protocols. This uncertainty can deter institutional investors and limit the adoption of DeFi applications. Scalability remains a concern, as many blockchain networks struggle to handle the increasing transaction volume associated with the growing popularity of DeFi. High gas fees on some networks can make transactions expensive and inhibit widespread adoption. Security remains a critical issue, as DeFi protocols are susceptible to hacks and exploits, which can result in significant financial losses for users and damage the reputation of the industry. The complexity of DeFi protocols can make them difficult for average users to understand and navigate, creating a barrier to wider adoption. Finally, the inherent volatility of cryptocurrencies introduces significant risk for users, as the value of their assets can fluctuate dramatically. Overcoming these challenges through regulatory clarity, technological advancements, improved security measures, and user-friendly interfaces will be crucial for the continued growth and maturation of the DeFi platform market.

The DeFi market is globally distributed, but certain regions and segments exhibit more significant growth potential.

Dominating Segments:

Decentralized Applications (dApps): This segment is leading the market due to the diverse applications of dApps in lending, borrowing, trading, and yield farming. The ease of creating and deploying dApps on various blockchains fuels this dominance. Millions of users interact with dApps daily, highlighting the segment’s significance. The value generated through dApp usage is projected to reach hundreds of millions within the next few years. This segment's continued growth is predicated on innovations improving user experience, enhancing interoperability between different blockchain ecosystems, and integrating dApps with existing financial infrastructure. Improvements in scalability and security will be crucial to sustaining this growth trajectory.

Smart Contracts: The core functionality of DeFi depends on smart contracts. The rising complexity and functionality of smart contracts are directly correlated with the expansion of the DeFi ecosystem. The value generated through smart contract execution within the DeFi space is substantial and projected to increase manyfold over the coming decade. As smart contract technology matures, we anticipate more sophisticated DeFi applications that manage complex financial operations with higher levels of automation and efficiency. This segment's growth will rely heavily on continued research into advanced smart contract programming languages and enhanced security protocols to prevent vulnerabilities and exploits.

Dominating Regions (Qualitative Assessment):

While precise market share data at the regional level is difficult to obtain due to the decentralized nature of DeFi, certain regions are emerging as key players. East Asia (particularly China and South Korea, though regulations are impactful), North America, and Western Europe are showing significant levels of adoption and investment in DeFi. The robust developer ecosystems in these regions and the presence of large pools of capital contribute to their dominance. However, the decentralized nature of the ecosystem means growth is occurring globally, with emerging markets in Africa and Latin America showing promise, albeit from a lower base. Regulatory clarity and digital infrastructure development will play a key role in determining future regional dominance.

Several factors will catalyze the growth of the DeFi platform industry. Increasing institutional adoption, driven by the potential for higher returns and increased efficiency, will significantly expand the market. Advancements in blockchain scalability and interoperability will improve the user experience and attract a wider range of users. The development of regulatory frameworks that provide clarity and mitigate risks will foster greater investor confidence and encourage widespread participation. Furthermore, the integration of DeFi with traditional finance will lead to the creation of hybrid models that combine the benefits of both worlds. These factors will work together to propel the DeFi market towards even more significant growth in the coming years.

This report provides a comprehensive overview of the Decentralized Finance (DeFi) platform market, analyzing historical trends, current market dynamics, and future growth prospects. It includes detailed information on key market segments, leading players, and significant developments. The report also identifies key growth catalysts and challenges, providing valuable insights for investors, businesses, and policymakers. It is a critical resource for understanding the evolving landscape of DeFi and its potential impact on the global financial system.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include MakerDAO, Compound, PancakeSwap, Fantom, Aave, Uniswap, Bancor Network, Badger DAO, SushiSwap, Curve Finance, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Decentralized Finance(DeFi) Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Decentralized Finance(DeFi) Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.