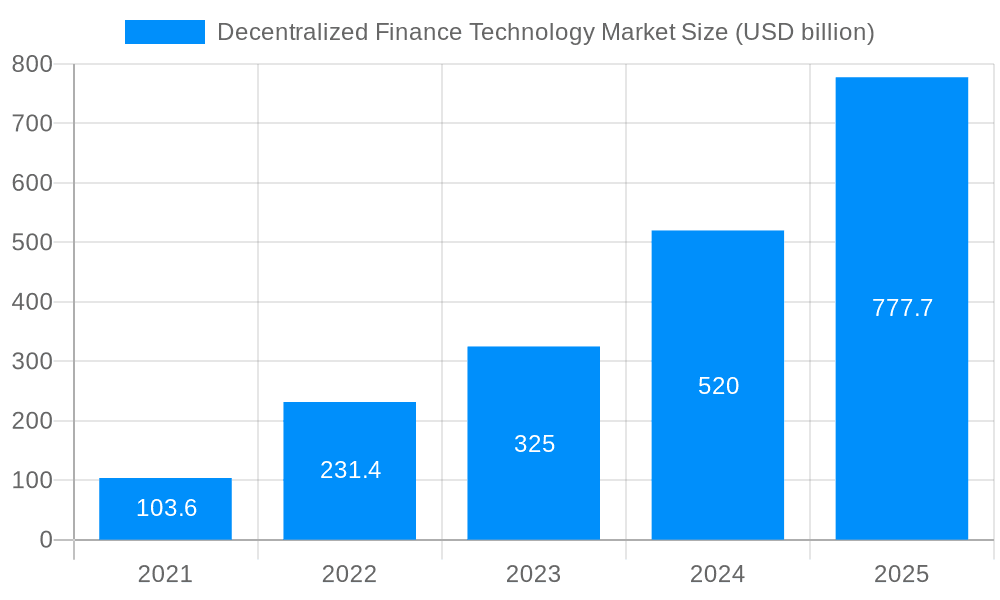

1. What is the projected Compound Annual Growth Rate (CAGR) of the Decentralized Finance Technology Market?

The projected CAGR is approximately 28.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Decentralized Finance Technology Market

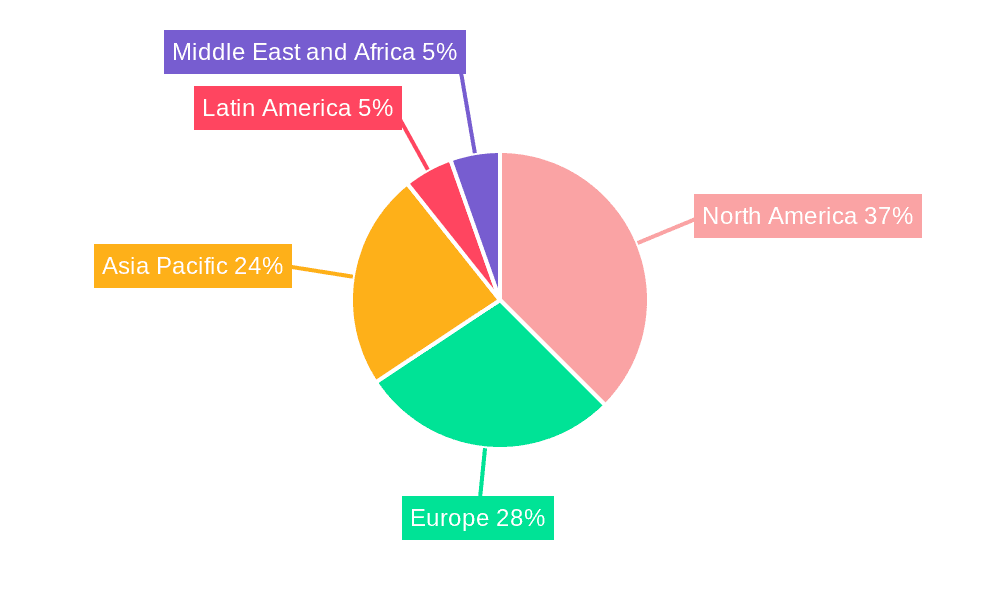

Decentralized Finance Technology MarketDecentralized Finance Technology Market by Component (Decentralized Applications (dApps), by Application (Asset Management, Compliance, KYT, Data Analytics, Payments, Gaming), by Industry (BFSI, Retail & E-commerce, Media & Entertainment, Automotive, Others), by North America (U.S., Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (U.K., Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, Japan, India, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Decentralized Finance Technology Market size was valued at USD 55.58 USD billion in 2023 and is projected to reach USD 316.33 USD billion by 2032, exhibiting a CAGR of 28.2 % during the forecast period. The rising popularity of cryptocurrencies and blockchain technology, along with the demand for decentralized financial services, is driving the growth of this market. Decentralized Finance (DeFi) is an umbrella term for applications and projects in the public blockchain space geared toward disrupting the traditional finance world. DeFi refers to financial applications built on blockchain technologies, typically using smart contracts. Smart contracts are automated enforceable agreements that do not need intermediaries to execute. Anyone with an internet connection can access them to perform financial transactions and many other activities. DeFi consists of applications and peer-to-peer protocols developed on decentralized blockchain networks that require no access rights. The decentralized apps (dApps) are used for easy lending, borrowing, or trading of financial tools. Most DeFi applications today are built using the Ethereum network, but many alternative public networks are emerging that deliver superior speed, scalability, security, and lower costs.

Component

Application

Industry

The decentralized finance technology market is poised for significant growth in the coming years. Rising cryptocurrency adoption, decentralized financial services demand, and regulatory clarity will drive market expansion. However, it's important to address challenges such as security vulnerabilities and liquidity constraints to ensure the sustainability and long-term growth of DeFi.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 28.2%.

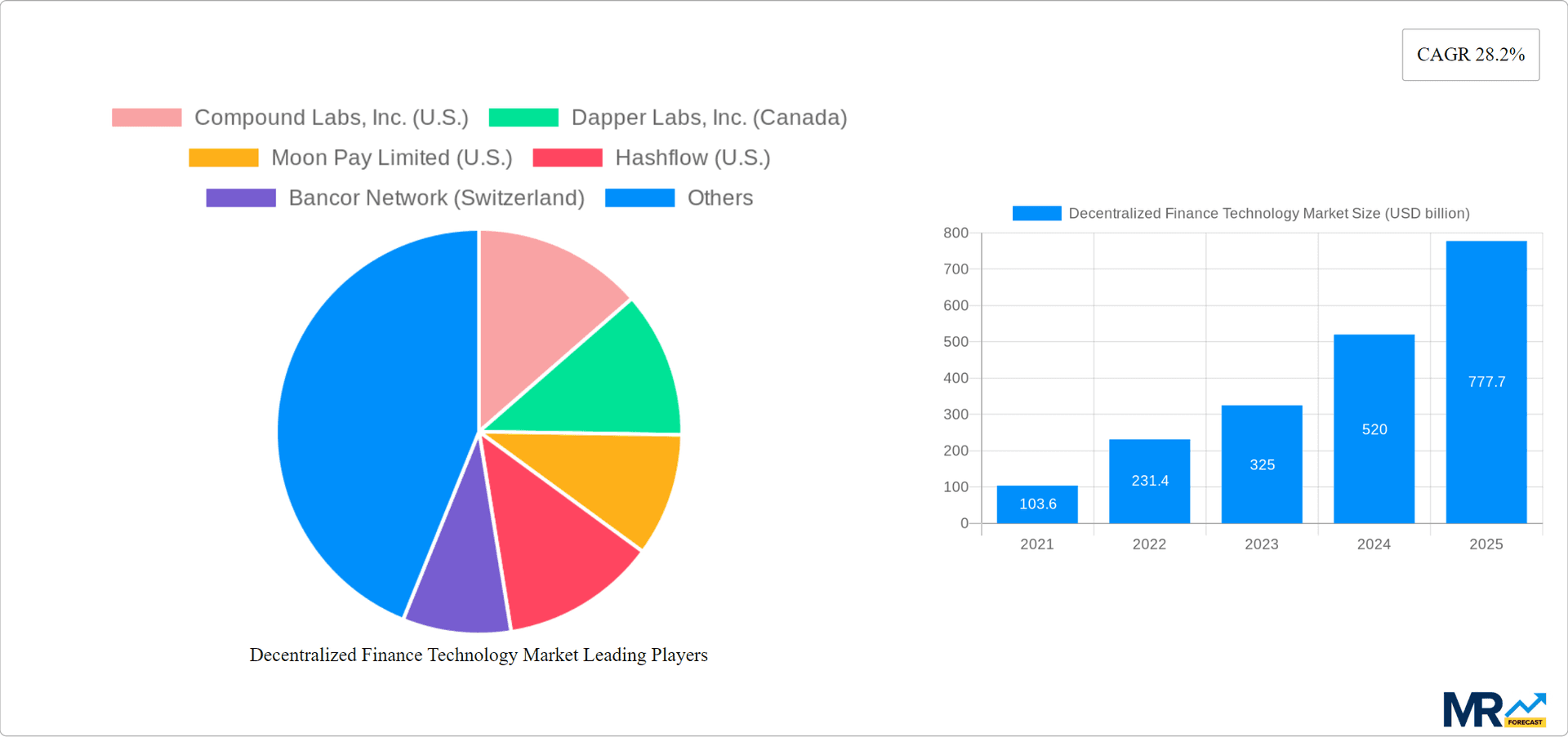

Key companies in the market include Compound Labs, Inc. (U.S.), Dapper Labs, Inc. (Canada), Moon Pay Limited (U.S.), Hashflow (U.S.), Bancor Network (Switzerland), MetaMask (U.S.), Uniswap (U.S.), Aave (U.K.), SushiSwap (Japan), Synthetix (Australia).

The market segments include Component, Application, Industry.

The market size is estimated to be USD 55.58 USD billion as of 2022.

Re-Platforming of Cloud by SaaS Vendors to Yield Better Hyperscale Benefits Drives Market Growth.

Growing Implementation of Touch-based and Voice-based Infotainment Systems to Increase Adoption of Intelligent Cars.

Security Vulnerability and Regulatory Uncertainty to Hamper Market Growth.

Compound's launch of Compound Treasury to enable institutional investors to participate in DeFi. Uniswap's integration with Layer 2 solutions to improve scalability and reduce transaction costs. Aave's partnership with Mastercard to bridge the gap between DeFi and traditional finance.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4850, USD 5850, and USD 6850 respectively.

The market size is provided in terms of value, measured in USD billion.

Yes, the market keyword associated with the report is "Decentralized Finance Technology Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Decentralized Finance Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.