1. What is the projected Compound Annual Growth Rate (CAGR) of the Debt Settlement Solution Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Debt Settlement Solution Service

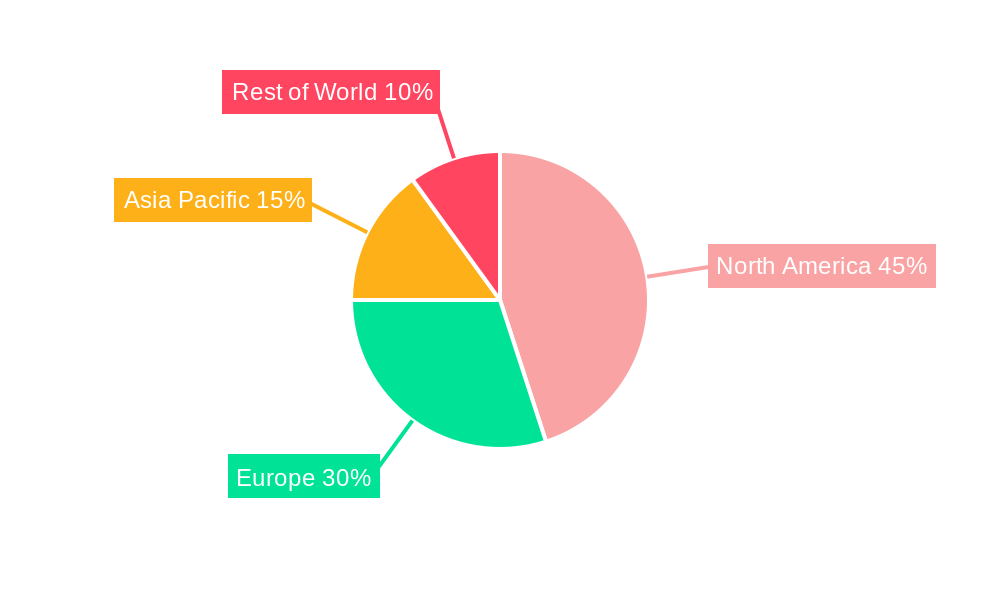

Debt Settlement Solution ServiceDebt Settlement Solution Service by Application (Private Clients/Consumers, Enterprises), by Type (Consultation, Support Services, Managed Services), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

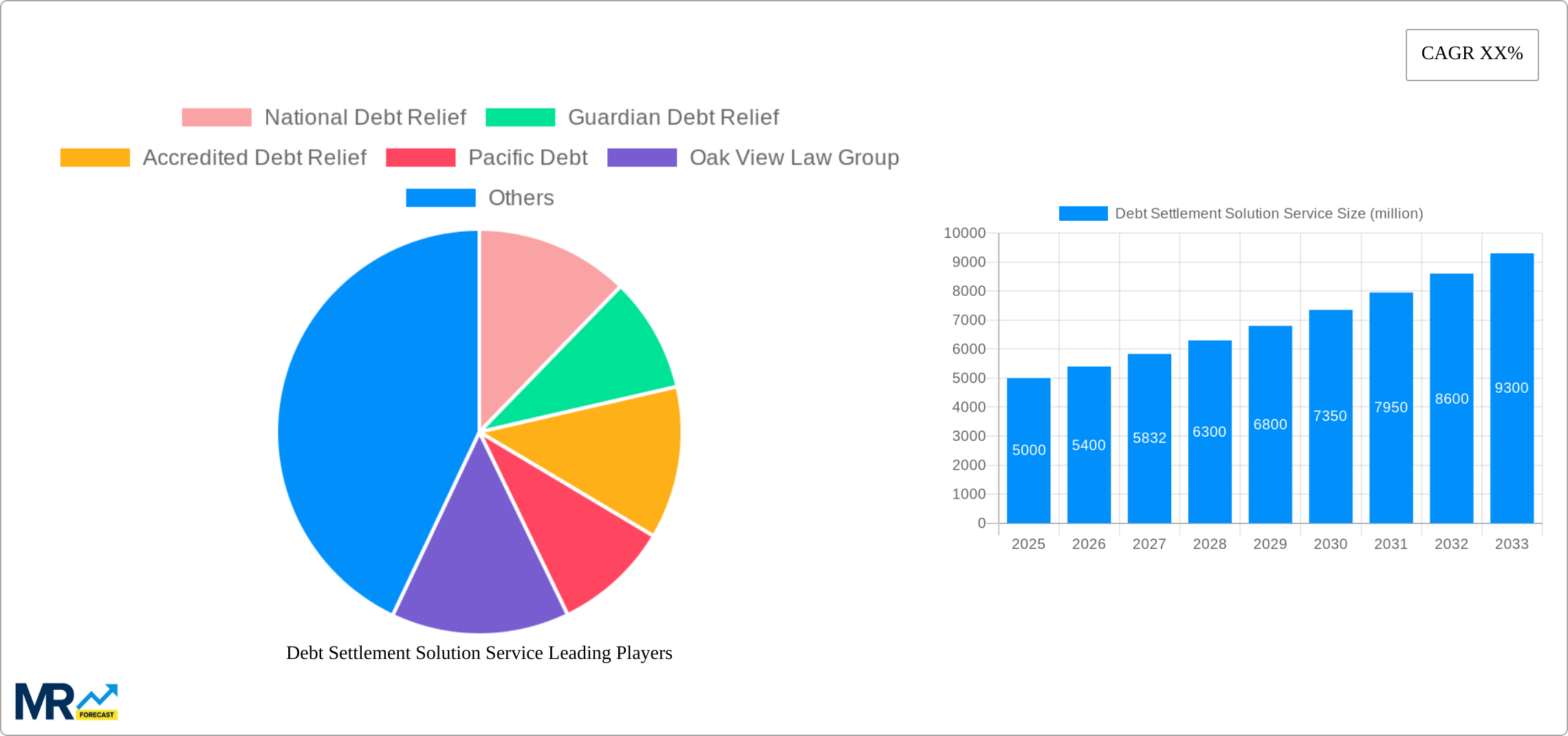

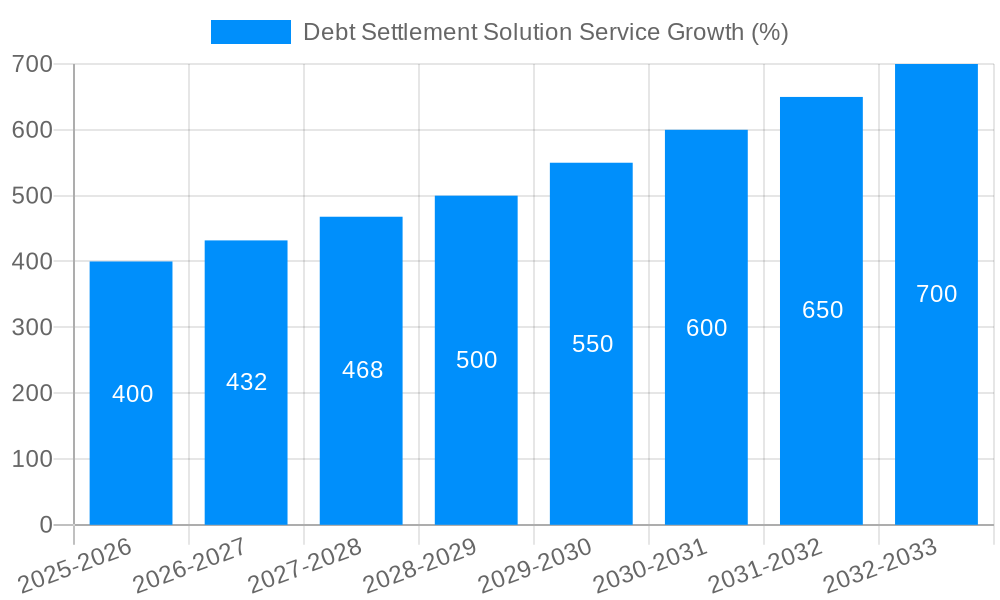

The debt settlement solution service market is experiencing robust growth, driven by increasing consumer debt burdens and a rising awareness of debt relief options. The market, estimated at $15 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033, reaching an estimated market value of $28 billion by 2033. This growth is fueled by several factors. Firstly, economic downturns and unexpected financial hardships continue to push individuals and businesses into significant debt. Secondly, the increasing availability of online debt consolidation and settlement services, coupled with improved marketing and customer outreach, makes these services more accessible. Thirdly, the regulatory landscape, while complex, is fostering a degree of standardization and consumer protection, encouraging further market participation. The market segmentation reveals significant opportunities. The private clients/consumers segment currently dominates, but the enterprise segment is showing promising growth as businesses seek solutions for managing their debt portfolios. Within service types, managed services are witnessing higher demand due to their comprehensive and proactive nature. Geographical expansion presents further potential, with North America currently holding the largest market share, followed by Europe. However, developing economies in Asia-Pacific and emerging markets in Africa are showing considerable potential for future growth, presenting attractive expansion opportunities for existing and new market players.

Despite positive growth projections, the market faces challenges. Stringent regulations and consumer protection laws add complexity and increase compliance costs for service providers. Furthermore, competition is fierce, requiring companies to continuously innovate and differentiate their offerings. The inherent sensitivity around debt and financial vulnerability also necessitates ethical and transparent practices to maintain customer trust. Maintaining data security and addressing privacy concerns are critical operational challenges that companies must overcome. This requires a combination of robust technology and strong customer relationship management strategies. The evolving regulatory environment will continue to be a crucial factor influencing market dynamics, demanding continuous adaptation and vigilance from market participants. Companies specializing in niche solutions, such as those addressing specific debt types or demographics, are expected to witness higher growth rates.

The debt settlement solution service market exhibited robust growth during the historical period (2019-2024), fueled by rising consumer debt levels and increasing awareness of debt settlement as a viable option. The market value, exceeding XXX million in 2024, is projected to reach XXX million by 2025 and continue its upward trajectory, reaching XXX million by 2033. This substantial expansion reflects a growing need for professional assistance in navigating complex debt situations. Key market insights reveal a shift towards digital platforms and online services, increasing accessibility and convenience for consumers. Furthermore, the market is witnessing the emergence of specialized services catering to specific debt types (medical, credit card, etc.), along with bundled services that include credit counseling and financial literacy programs. The rise of fintech companies and their integration of advanced technologies like AI and machine learning are further shaping the market landscape, improving efficiency and personalization of debt settlement solutions. This increasing sophistication is driving customer satisfaction and market penetration, while simultaneously raising the bar for service providers to offer innovative and effective solutions. Competition is fierce, with companies differentiating themselves through pricing strategies, client support models, and success rates. The market is also seeing an increasing focus on regulatory compliance and ethical practices as a response to past industry issues, promoting consumer trust and transparency. The forecast period (2025-2033) promises continued growth, driven by persistent high consumer debt and evolving consumer preferences. The market is expected to consolidate, with larger players acquiring smaller firms and expanding their service offerings. This trend underscores the importance of adapting to changing market dynamics and customer expectations to maintain a competitive edge in this evolving sector.

Several key factors contribute to the rapid growth of the debt settlement solution service market. The escalating levels of consumer debt, particularly credit card and medical debt, are a major driver. Many individuals struggle to manage their debts independently, leading to increased demand for professional assistance. Furthermore, economic downturns and unexpected life events, such as job loss or illness, significantly contribute to debt accumulation and the subsequent need for debt settlement services. The rise in awareness among consumers regarding the benefits of debt settlement, fueled by increased media coverage and online resources, is another vital factor. Many are now recognizing debt settlement as a viable alternative to bankruptcy, offering a chance to regain financial stability. The increasing availability and accessibility of online platforms and mobile applications that provide convenient access to debt settlement services further contribute to market growth. This ease of access makes it easier for consumers to seek help, regardless of their location or technological proficiency. Finally, the increasing sophistication of debt settlement strategies and the integration of technology, like AI-driven negotiation tools, are enhancing efficiency and improving settlement success rates, thereby boosting market demand.

Despite the significant growth potential, the debt settlement solution service market faces certain challenges. Stringent regulatory oversight and compliance requirements present a major hurdle for service providers. Maintaining ethical standards and transparency in operations is crucial to build consumer trust and avoid legal repercussions. The fluctuating economic climate can also impact the market, as economic uncertainty may lead to decreased consumer spending and a lower demand for these services. Competition within the industry is intense, requiring service providers to constantly innovate and enhance their offerings to stay ahead. Negative perceptions or misconceptions about debt settlement, sometimes stemming from past unethical practices, can hinder market penetration. Building consumer trust and educating potential clients about legitimate and effective debt settlement practices is vital. Additionally, the need to effectively manage the complexities of dealing with multiple creditors and navigating legal frameworks associated with debt settlement poses ongoing operational difficulties.

The Private Clients/Consumers segment overwhelmingly dominates the debt settlement solution service market. This segment represents the vast majority of individuals struggling with overwhelming debt and actively seeking professional help. The sheer volume of consumers needing assistance makes this the most significant market share.

The Support Services type also holds a significant position. This category includes a broad range of services beyond simple negotiation, including credit counseling, financial literacy education, and budgeting assistance. This holistic approach caters to the long-term needs of clients, building loyalty and enhancing the overall effectiveness of the debt settlement process.

Several factors fuel growth within the debt settlement service industry. Firstly, rising consumer debt, fueled by economic factors and lifestyle choices, creates significant demand. Secondly, technological advancements, including AI-powered tools and improved online platforms, streamline processes and increase efficiency. Thirdly, increased consumer awareness of legitimate debt settlement options drives market expansion. Finally, the ongoing efforts of reputable companies to improve transparency and ethical standards build trust and boost industry growth.

This report provides a comprehensive overview of the debt settlement solution service market, analyzing its trends, drivers, challenges, and key players. It offers valuable insights into the market's dynamic landscape, providing a detailed forecast for the coming years. The report is an indispensable resource for industry stakeholders, including service providers, investors, and regulators seeking to understand and navigate this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include National Debt Relief, Guardian Debt Relief, Accredited Debt Relief, Pacific Debt, Oak View Law Group, CuraDebt, Premier Debt Help, Freedom Debt Relief, New Era Debt Solutions, Century Support Services, DMB Financial, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Debt Settlement Solution Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Debt Settlement Solution Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.