1. What is the projected Compound Annual Growth Rate (CAGR) of the Debt and Credit Collection Services?

The projected CAGR is approximately 1.3%.

Debt and Credit Collection Services

Debt and Credit Collection ServicesDebt and Credit Collection Services by Type (Early Out Debt, Bad Debt), by Application (Healthcare, Student Loans, Financial Services, Government, Retail, Telecom & Utility, Mortgage & Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

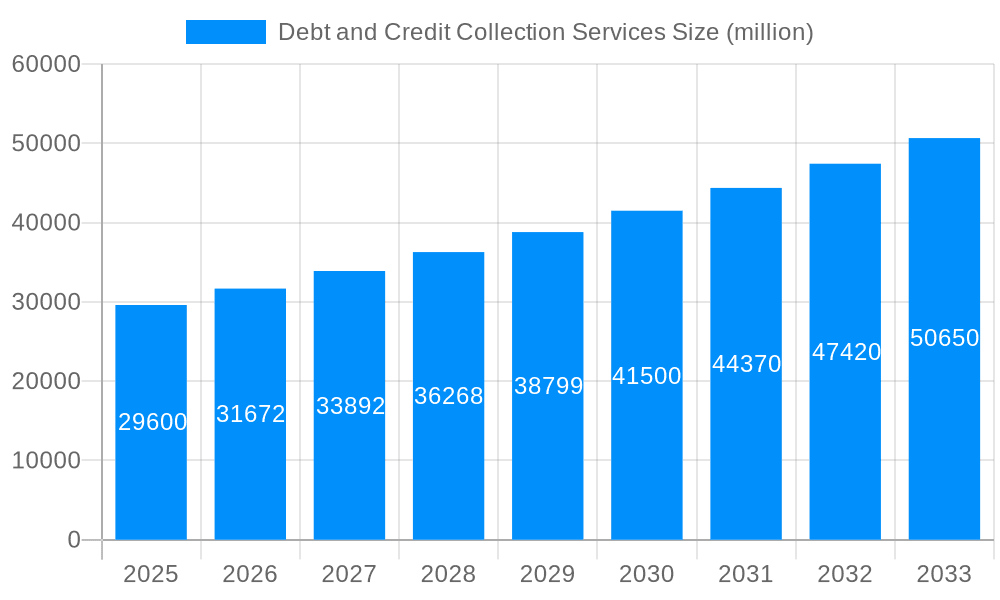

The debt and credit collection services market, valued at $27.11 billion in 2025, is projected to experience steady growth, driven by several key factors. Rising consumer debt levels across various segments – healthcare, student loans, and mortgages – are fueling demand for efficient collection solutions. The increasing adoption of technology, particularly AI-powered analytics and automation tools, is streamlining collection processes, improving efficiency, and reducing operational costs. This technological advancement also enables more targeted and effective debt recovery strategies, further stimulating market expansion. Regulatory changes impacting debt collection practices in various regions are creating both challenges and opportunities. While stricter regulations aim to protect consumers, they also incentivize the development of more compliant and sophisticated collection techniques, leading to innovation within the industry. The market's segmentation reflects diverse debt types and applications, with healthcare and student loan debt recovery likely experiencing significant growth due to their respective market dynamics.

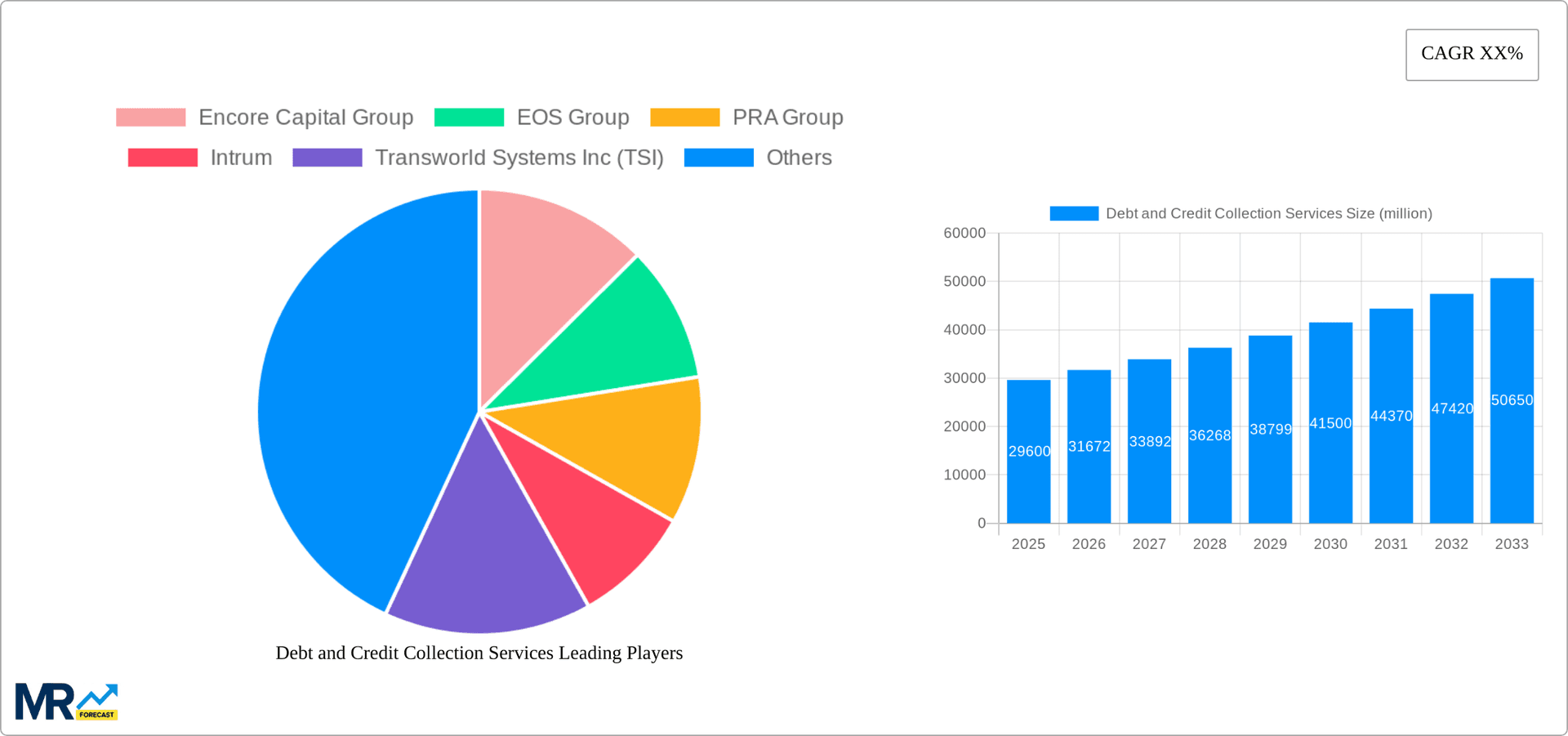

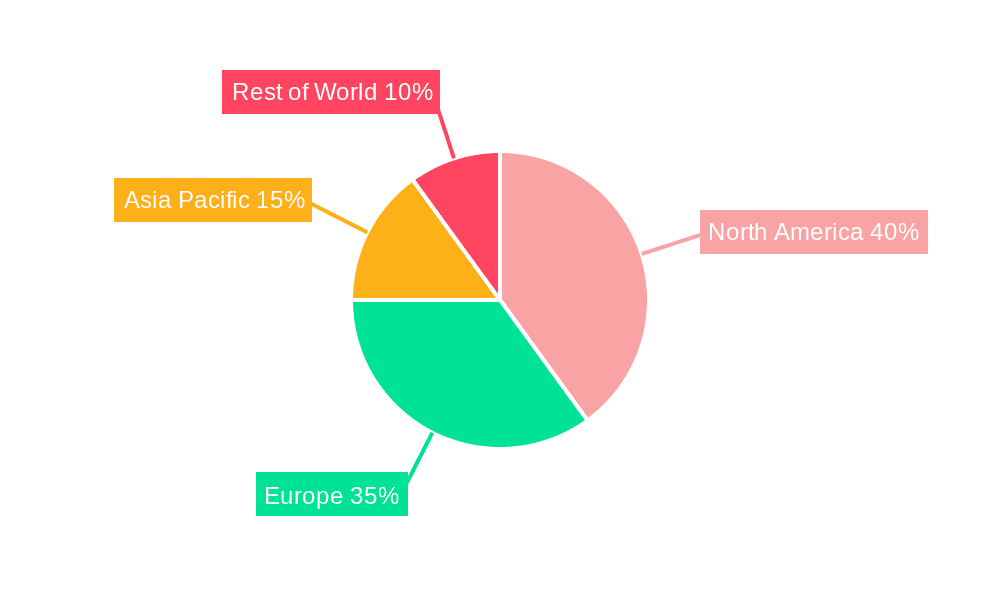

Competition within the debt and credit collection services market is intense, with a mix of large multinational corporations and specialized regional players. The presence of established players like Encore Capital Group and EOS Group alongside emerging firms demonstrates a dynamic landscape. Geographic variations in regulatory environments, consumer debt profiles, and technological adoption rates influence regional market growth. North America and Europe are currently major market contributors, but developing economies in Asia-Pacific are also showcasing promising growth potential. The forecast period (2025-2033) suggests a continued, albeit moderate, expansion of the market, primarily influenced by technological advancements, evolving regulatory frameworks, and the persistent challenge of managing high consumer debt levels globally. Further market diversification, potentially including the increased use of alternative dispute resolution methods, could shape future growth trajectories.

The global debt and credit collection services market is experiencing significant growth, driven by rising consumer debt levels and increasingly stringent regulatory frameworks. Over the study period (2019-2033), the market is projected to witness substantial expansion, with the estimated market value in 2025 exceeding several billion dollars. This growth is fueled by several factors, including the increasing prevalence of non-performing assets (NPAs) across various sectors, the rise in technological advancements that streamline collection processes, and a growing demand for outsourcing solutions by financial institutions and other businesses. The market is characterized by the presence of both large multinational corporations and smaller specialized firms, each catering to a specific segment of the debt recovery landscape. While traditional methods like phone calls and letters still play a role, the industry is rapidly embracing digital technologies such as AI-powered analytics, automation, and data-driven strategies to improve efficiency and recovery rates. This shift towards digitalization is not only increasing the efficiency of collection but also improving the customer experience and reducing the overall cost of operations. The competitive landscape is dynamic, with mergers and acquisitions playing a crucial role in shaping the market structure. Companies are continuously investing in technology and developing innovative strategies to gain a competitive edge and cater to the evolving needs of their clients. The forecast period (2025-2033) projects continued robust growth, driven by the persistent need for efficient debt management solutions and the ongoing penetration of digital technologies. The historical period (2019-2024) has already shown impressive growth setting the stage for a more expansive future.

Several key factors contribute to the robust growth of the debt and credit collection services market. The escalating levels of consumer and commercial debt across the globe are a primary driver, creating a significant demand for efficient and effective debt recovery solutions. This is particularly pronounced in sectors like healthcare, student loans, and financial services, where high-value debts necessitate specialized collection strategies. Further accelerating this trend is the increasing outsourcing of debt collection activities by financial institutions and other businesses. This is largely due to the cost-effectiveness and expertise offered by specialized debt collection agencies. Technological advancements, particularly the application of artificial intelligence (AI) and machine learning (ML) in debt recovery processes, are dramatically improving efficiency and recovery rates. AI-powered tools can analyze vast datasets to identify high-potential debtors and personalize collection strategies, ultimately boosting revenue recovery. Lastly, stricter regulatory compliance requirements necessitate the engagement of expert collection agencies equipped to navigate the complexities of legal and ethical considerations. This increases the reliance on specialized services and further propels market expansion.

Despite the promising growth prospects, the debt and credit collection services industry faces several challenges. Stringent regulations and evolving consumer protection laws are creating a complex regulatory landscape, increasing the compliance costs for debt collection agencies. Maintaining ethical standards and avoiding aggressive collection practices are crucial to avoid legal penalties and maintain a positive brand image. The industry also encounters difficulties in collecting debts from financially distressed individuals, necessitating flexible and empathetic strategies. The increasing use of mobile technologies and evolving communication preferences pose challenges in reaching debtors effectively. Furthermore, the rising popularity of debt consolidation programs and bankruptcy filings can negatively impact collection rates. Data security and privacy concerns are also critical issues, necessitating robust security measures to protect sensitive customer information. Finally, fluctuating economic conditions can impact overall debt levels and the effectiveness of collection efforts, adding another layer of complexity for industry players.

The North American and European markets are currently leading the debt and credit collection services market, owing to high consumer debt levels and established regulatory frameworks. However, growth in emerging markets is substantial.

Dominant Segments: The financial services segment consistently demonstrates high demand for debt collection services due to the substantial volume of credit card debt, personal loans, and other financial products. The healthcare sector is also a significant segment because of the increasing costs of medical treatments and the resulting high amounts of medical debt. The student loan segment is rapidly expanding, driven by the rising costs of higher education and the resulting increase in student loan defaults. Within debt types, bad debt collection represents a significant portion of the market, given the challenges associated with recovering severely delinquent debts.

Geographic Dominance: The United States continues to be a major market due to its large and diverse financial landscape. European countries like the UK and Germany also represent significant markets with robust debt recovery systems. However, the Asia-Pacific region is predicted to experience the highest growth rate over the coming years as developing economies witness a rise in consumer borrowing and economic activity.

The high volume of non-performing loans within the financial services sector fuels demand for sophisticated collection strategies, and the rising cost of healthcare and education further contributes to the segment's dominance. The bad debt segment requires specialized skills and techniques to maximize recovery, contributing significantly to the market's size and complexity. The predicted growth in the Asia-Pacific region underscores the global nature of the debt collection industry.

Several factors are catalyzing growth in the debt and credit collection services industry. The increasing prevalence of digital technologies, including AI-powered analytics, is significantly improving efficiency and reducing costs. Furthermore, outsourcing trends are driving market expansion, as businesses seek cost-effective and expert solutions. The rising volume of non-performing assets (NPAs) across various sectors is also creating greater demand for debt recovery services. Finally, evolving regulatory requirements necessitate specialized agencies capable of navigating complex compliance issues.

This report provides a comprehensive analysis of the debt and credit collection services market, covering market size, segmentation, key players, growth drivers, and future trends. The report offers valuable insights for industry participants, investors, and researchers, facilitating informed decision-making in this dynamic and expanding sector. The detailed analysis spans the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), providing a long-term perspective on market evolution.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 1.3%.

Key companies in the market include Encore Capital Group, EOS Group, PRA Group, Intrum, Transworld Systems Inc (TSI), Midland Credit Management, TCM Group, GC Services, Hoist Finance, Arrow Global, Creditreform, Axactor, B2Holding, KRUK Group, Lowell, Arvato (Bertelsmann Group), Alorica, Cerved, iQera, iQor, IC System, coeo Inkasso GmbH, Altus GTS Inc., Weltman, Weinberg & Reis, Atradius Collections, Bierens Debt Recovery Lawyers, Link Financial, UNIVERSUM Group, Prestige Services Inc (PSI), Asta Funding, .

The market segments include Type, Application.

The market size is estimated to be USD 27110 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Debt and Credit Collection Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Debt and Credit Collection Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.