1. What is the projected Compound Annual Growth Rate (CAGR) of the Death Care Service?

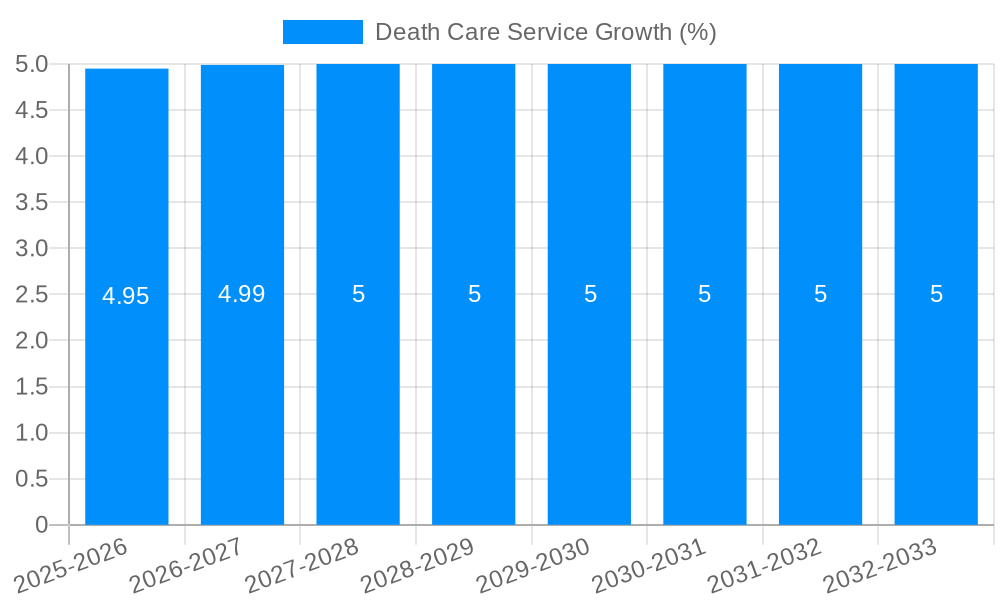

The projected CAGR is approximately 4.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Death Care Service

Death Care ServiceDeath Care Service by Type (Funeral homes, Cemeteries, Manufacturers, Other), by Application (Online, Offline), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

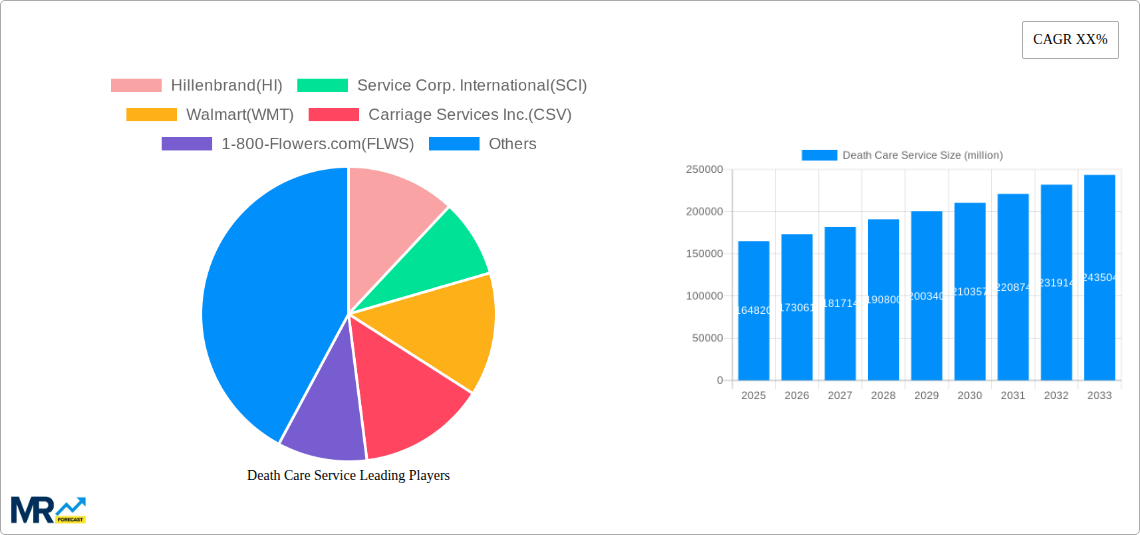

The global death care services market, valued at $125.09 billion in 2025, is projected to experience steady growth, driven by a combination of factors. The aging global population, coupled with rising life expectancy in several regions, is significantly increasing the demand for funeral homes, cemeteries, and related products and services. Technological advancements, such as online memorial services and virtual grief counseling, are also transforming the industry, providing new avenues for service delivery and potentially attracting younger demographics. However, economic downturns can impact consumer spending on non-essential death care services, potentially slowing market growth. Furthermore, regulatory changes and evolving societal attitudes towards death and bereavement can influence market dynamics. Competition is intense, with established players like Service Corporation International and Hillenbrand facing challenges from emerging online platforms and niche providers.

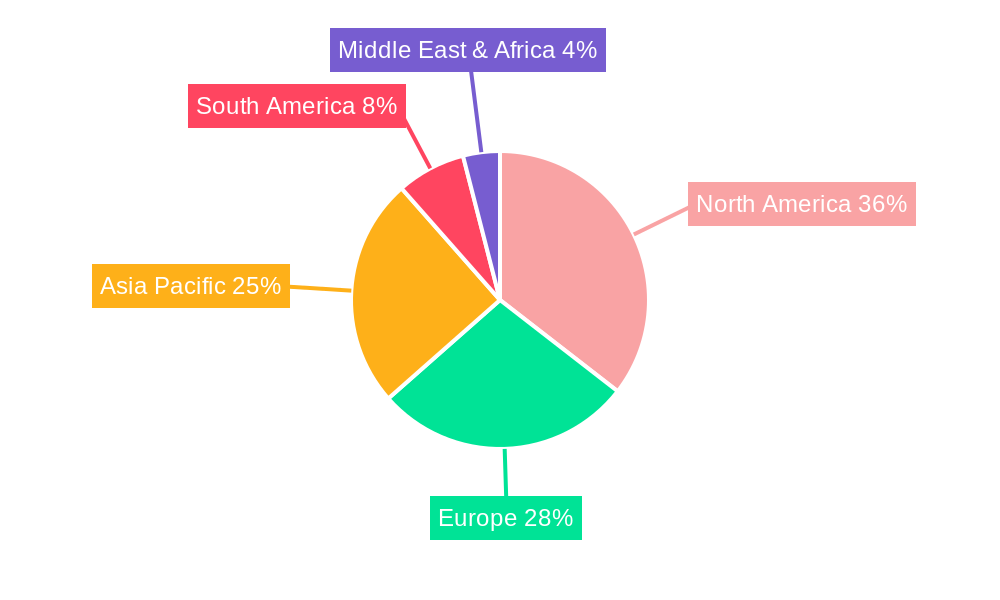

Segment analysis reveals that funeral homes and cemeteries currently constitute the largest market shares, with a projected continued dominance throughout the forecast period. The "Other" segment, encompassing ancillary services like grief counseling, memorial products, and pre-need arrangements, is also expected to see significant growth driven by the increasing demand for comprehensive end-of-life solutions. The online segment shows strong potential for expansion, offering convenience and accessibility to a wider audience, while the offline segment continues to hold significant market share due to the personal and emotional nature of death care services. Regional variations exist, with North America and Europe holding the largest market shares, reflecting higher life expectancies and established infrastructure in these regions. However, Asia-Pacific is poised for considerable growth, fuelled by rapid economic development and urbanization.

The death care service industry, valued at [Insert Market Value in Millions] in 2025, is experiencing a complex interplay of trends. Aging populations globally are driving a surge in demand for funeral services, cremation options, and cemetery plots. This demographic shift is the most significant factor influencing market growth throughout the forecast period (2025-2033). However, evolving consumer preferences are also reshaping the industry landscape. Traditional funeral services are gradually giving way to more personalized, cost-effective, and sometimes less formal arrangements. The rise of cremation, for example, is significantly impacting the demand for traditional burial services and associated products. Simultaneously, the increasing adoption of online platforms for planning and purchasing death care services reflects a broader shift towards digitalization across various sectors. This online penetration, while still relatively nascent compared to offline channels, is steadily gaining traction, particularly amongst younger demographics who are comfortable with digital transactions and prefer convenience. Further impacting the market are fluctuating material costs for caskets, urns, and cemetery infrastructure, as well as economic conditions that can affect consumer spending on these often-expensive services. The industry is adapting to these pressures through innovation in service offerings, cost-optimization strategies, and the integration of technology to enhance customer experience and operational efficiency. The competitive landscape is also dynamic, with both established players and new entrants vying for market share through strategic acquisitions, service diversification, and technological advancements. The historical period (2019-2024) showed a steady growth trajectory, and the estimated year (2025) reveals a significant market expansion, setting the stage for robust growth during the forecast period.

Several key factors are driving growth within the death care service industry. Firstly, the global aging population is a fundamental driver. Longer lifespans in developed and developing countries inevitably lead to a higher number of deaths, directly increasing the demand for funeral services, cemetery plots, and related products. This demographic trend is projected to continue for several decades, ensuring a sustained market expansion. Secondly, evolving consumer preferences are significantly shaping the industry. The growing acceptance of cremation, compared to traditional burial, creates new avenues for market players to cater to these changing needs. Further, increasing demand for personalized funeral arrangements and memorialization services—reflecting a desire for unique and meaningful tributes— fuels market diversification and innovation. Technological advancements are also a key driver, as online platforms are improving the ease and convenience of planning funeral arrangements and purchasing products. These platforms also increase accessibility and allow for greater price transparency, empowering consumers with choices. Finally, consolidation within the industry, through mergers and acquisitions, leads to larger, more efficient providers, which in turn can offer a wider range of services and potentially drive down costs in some segments.

Despite the positive growth trajectory, the death care service industry faces several challenges. Firstly, economic downturns can significantly impact consumer spending on funeral services and related products, given their often substantial cost. This economic sensitivity makes the market vulnerable to periods of recession or economic uncertainty. Secondly, the industry's reliance on traditional practices and business models is gradually being challenged by changing consumer preferences and the rise of digital platforms. Adapting to these changes requires substantial investment in technology and the development of new service offerings to meet evolving customer expectations. Thirdly, regulatory hurdles and varying legal requirements across different regions can add complexity and cost to operations. Navigating these varying regulations, especially concerning cemetery operations and the handling of remains, poses significant challenges for industry players. Lastly, maintaining ethical standards and ensuring transparent pricing practices are vital for preserving consumer trust. Any perceived lack of transparency or ethical misconduct can severely damage a company's reputation and deter potential customers.

The North American market, particularly the United States, is expected to continue its dominance in the death care services sector throughout the forecast period. This is primarily attributed to a relatively high aging population compared to many other global regions and high per-capita expenditure on funeral services.

Dominant Segment: Funeral Homes

Funeral homes remain the core of the death care service industry, providing a wide range of services from arranging viewings and funerals to handling cremation and memorial services. Their multifaceted offerings and central role in the bereavement process solidify their dominance. The increasing demand for personalized and bespoke funeral arrangements also drives innovation within this segment, leading to specialized services catering to various cultural and religious needs. The shift towards pre-need planning, where funeral arrangements are made in advance, is further strengthening the importance of funeral homes and their long-term customer relationships. Their established network and trusted reputation ensure that funeral homes maintain their leading role in the overall market. The shift towards more modern and accommodating funeral home facilities, including more flexible spaces for celebrations of life, further enhances their market position.

Several key factors are accelerating growth in the death care services industry. The aging global population is the primary catalyst, driving a substantial increase in demand for all death care services. Evolving consumer preferences, such as the growing acceptance of cremation and demand for personalization, are also significant catalysts, diversifying services and promoting market expansion. Technological advancements, including online platforms for planning and purchasing services, are increasing accessibility and convenience, stimulating growth in the industry. Finally, strategic mergers and acquisitions among industry players create larger, more efficient operations, leading to economies of scale and further market expansion.

This report provides a comprehensive analysis of the death care service industry, covering market size, trends, drivers, restraints, and key players. It offers detailed segmentation by type (funeral homes, cemeteries, manufacturers, other) and application (online, offline), providing a granular understanding of market dynamics. The report also includes detailed regional analyses, highlighting key growth areas and future opportunities. Furthermore, it incorporates an in-depth examination of the competitive landscape and profiles leading players in the industry. This report is a valuable resource for anyone seeking to understand this evolving market and its future growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.0%.

Key companies in the market include Hillenbrand(HI), Service Corp. International(SCI), Walmart(WMT), Carriage Services Inc.(CSV), 1-800-Flowers.com(FLWS), Rock of Ages Corp.(ROAC), Stewart Enterprises Inc.(STEI), Matthews International(MATW), Amazon.com(AMZN), .

The market segments include Type, Application.

The market size is estimated to be USD 125090 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Death Care Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Death Care Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.