1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Weapons Technologies?

The projected CAGR is approximately 17.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cyber Weapons Technologies

Cyber Weapons TechnologiesCyber Weapons Technologies by Type (Defensive Cyber Weapons, Offensive Cyber Weapons), by Application (Military and National Defense, Enterprises and Consumers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

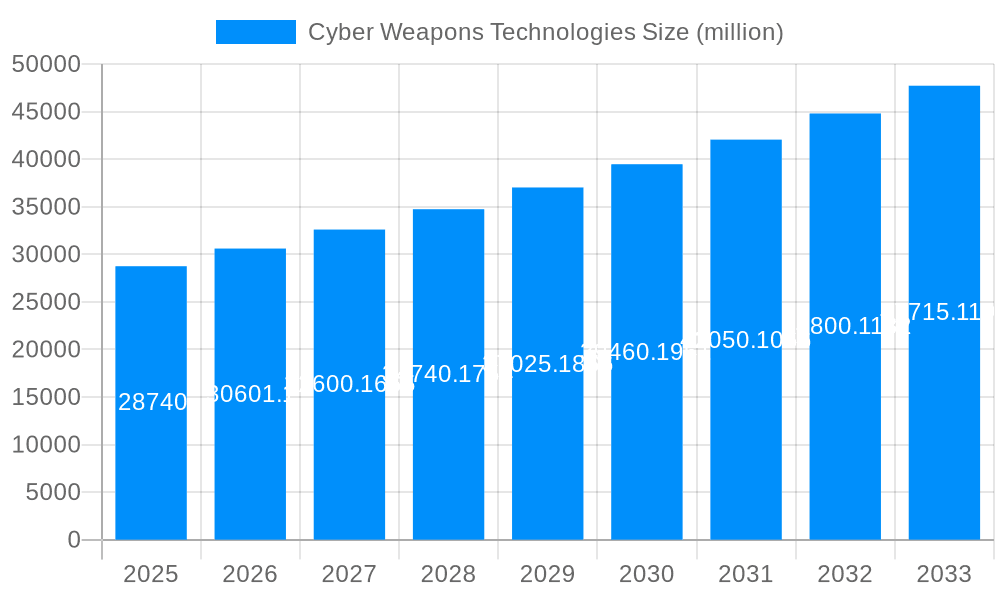

The global cyber weapons technologies market, valued at $28.74 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, increasing cyber threats from state-sponsored actors and non-state actors, and the rising adoption of advanced persistent threats (APTs). The market's Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033 indicates a substantial expansion, exceeding $45 billion by 2033. This growth is fueled by continuous technological advancements in offensive and defensive cyber weaponry, including artificial intelligence (AI)-powered threat detection systems, sophisticated malware, and advanced encryption techniques. The market is segmented by weapon type (offensive and defensive) and application (military & national defense, enterprises & consumers). The military and national defense segment currently dominates, driven by significant government investments in cybersecurity infrastructure and national defense initiatives. However, the enterprise and consumer segments are witnessing accelerated growth due to increasing reliance on digital infrastructure and the rising frequency of cyberattacks targeting businesses and individuals. Key players, including Lockheed Martin, Raytheon, and BAE Systems, are strategically investing in research and development to maintain their competitive edge, driving further market expansion. Geographic distribution reveals North America as the leading region, followed by Europe and Asia Pacific, reflecting the concentration of technologically advanced nations and significant cybersecurity spending in these areas.

The competitive landscape is characterized by both large established defense contractors and specialized cybersecurity firms. Strategic partnerships and mergers and acquisitions are becoming increasingly prevalent as companies seek to expand their capabilities and market reach. Despite the significant growth potential, market restraints include the ethical concerns surrounding the use of cyber weapons, stringent regulations governing their development and deployment, and the constant arms race between offensive and defensive capabilities. Furthermore, the high cost of developing and maintaining advanced cyber weapons systems presents a barrier to entry for smaller players. Future market trends point towards increased focus on AI and machine learning in cyber defense, the proliferation of cyber warfare in the digital space, and a heightened emphasis on international cooperation to mitigate the risks of widespread cyber conflict. The continuous evolution of cyber threats necessitates constant innovation and adaptation within the cyber weapons technologies market, ensuring a dynamic and evolving landscape in the coming years.

The global cyber weapons technologies market is experiencing explosive growth, projected to reach hundreds of billions of dollars by 2033. The study period of 2019-2033 reveals a consistently upward trajectory, driven by escalating cyber threats, increasing reliance on digital infrastructure, and heightened geopolitical tensions. The base year of 2025 serves as a pivotal point, marking a significant surge in investment and innovation across both defensive and offensive capabilities. The estimated market value for 2025 already signals a substantial market size in the tens of billions of dollars, with the forecast period (2025-2033) promising even more dramatic expansion. Analysis of the historical period (2019-2024) highlights a clear trend: the market's growth is not merely incremental; it's a rapid acceleration fueled by the need for sophisticated protection against increasingly complex and damaging cyberattacks. This necessitates continuous development of both defensive measures to mitigate threats and offensive capabilities to deter and respond effectively. This market is segmented based on the type of cyber weapon (defensive and offensive) and the application (military and national defense, enterprises and consumers). The escalating sophistication of cyberattacks, coupled with the interconnected nature of modern infrastructure, fuels demand for advanced technologies across all segments. Furthermore, government regulations and initiatives aimed at enhancing cybersecurity are further bolstering market growth. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) in cyber weapons technologies is adding another layer of complexity and effectiveness, which directly impacts both the development and the cost of the technologies. This market is characterized by intense competition among major players, each striving to develop cutting-edge solutions and secure lucrative government contracts.

Several key factors are driving the expansion of the cyber weapons technologies market. First, the rising frequency and severity of cyberattacks targeting governments, businesses, and individuals are creating an urgent need for robust defensive and offensive capabilities. The financial losses associated with successful cyberattacks, including data breaches, ransomware attacks, and disruptions to critical infrastructure, run into the billions annually, incentivizing substantial investments in prevention and response. Second, the increasing reliance on interconnected digital systems across all sectors of society leaves a vast attack surface vulnerable to exploitation. From critical national infrastructure to private sector enterprises, nearly all essential functions rely on digital networks, making cyber defense a matter of national and economic security. Third, the geopolitical landscape is marked by increasing cyber warfare, with nations and non-state actors using cyber weapons as a tool for espionage, sabotage, and influence operations. This fuels competition in developing advanced technologies to maintain a cyber advantage and enhance national security. Lastly, the continuous innovation in cyberattack techniques necessitates a parallel evolution in defensive and offensive cyber weapons technologies. Hackers are constantly developing new methods of attack, demanding ongoing research and development to counter these threats. This arms race drives market expansion as organizations seek cutting-edge solutions.

Despite the substantial growth potential, the cyber weapons technologies market faces several challenges. Ethical concerns surrounding the development and use of offensive cyber weapons are a significant constraint. The potential for misuse and escalation of cyber conflicts raises serious ethical and legal questions. Furthermore, the high cost of research, development, and deployment of advanced cyber weapons technologies can limit market accessibility for smaller companies or developing nations. This technological barrier to entry contributes to market concentration amongst a few major players. The rapid pace of technological change in the cybersecurity domain demands ongoing adaptation and upgrades, adding to the financial burden for organizations. Another major challenge is the shortage of skilled cybersecurity professionals capable of developing, deploying, and maintaining complex cyber weapons systems. This talent gap can hinder the effectiveness of both defensive and offensive cyber capabilities. Finally, the inherent difficulty in attributing cyberattacks to specific perpetrators, particularly in complex scenarios involving state-sponsored actors or sophisticated hacking groups, makes responding and deterring attacks more challenging. International cooperation is crucial to establish norms of behavior and address attribution issues effectively.

The North American market, particularly the United States, is expected to dominate the cyber weapons technologies market throughout the forecast period. This dominance stems from several factors:

The Military and National Defense segment will be the largest application area, contributing significantly to the overall market value.

The Defensive Cyber Weapons segment will witness substantial growth, driven by increasing concerns about cyber threats.

In summary, the convergence of high government spending, technological innovation, and the critical need for cybersecurity will cement North America, specifically the U.S., as the dominant market, with the Military and National Defense, and Defensive Cyber Weapons segments driving the majority of market growth, with overall market values projected in the hundreds of billions of dollars by 2033.

The cyber weapons technologies industry is experiencing significant growth due to several key factors. Increased government investments in national security and cybersecurity initiatives are a major driver, along with rising cyber threats against both governmental and private entities. The escalating sophistication of cyberattacks necessitates continuous innovation and development of more robust defensive and offensive technologies. The growing reliance on interconnected digital infrastructure across all sectors further fuels this demand, as does the expansion of cloud computing and the Internet of Things (IoT), which increases the attack surface and the potential for devastating breaches.

This report provides a comprehensive analysis of the cyber weapons technologies market, covering market trends, driving forces, challenges, key players, and significant developments. The report offers detailed insights into market segmentation by weapon type (offensive and defensive) and application (military & national defense, enterprises & consumers). It also includes forecasts for market growth, highlighting key regions and countries that are expected to dominate the market. The report serves as a valuable resource for industry stakeholders, government agencies, and researchers interested in understanding the dynamics and future of the cyber weapons technologies market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 17.3%.

Key companies in the market include Lockheed Martin, Gen Digital, BAE Systems, Raytheon, Thales, Northrop Grumman Corporation, Booz Allen Hamilton, General Dynamics, Trend Micro, ManTech, Cisco Systems, Jacobs (KeyW), Boeing, Mandiant, Kaspersky Lab, Airbus, WithSecure, GovCIO, Israel Aerospace Industries (IAI).

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Cyber Weapons Technologies," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cyber Weapons Technologies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.