1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Security Online Training?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cyber Security Online Training

Cyber Security Online TrainingCyber Security Online Training by Type (Network Security, Cloud Security, Endpoint Security, Mobile Security, IoT Security, Others), by Application (SMEs, Large Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

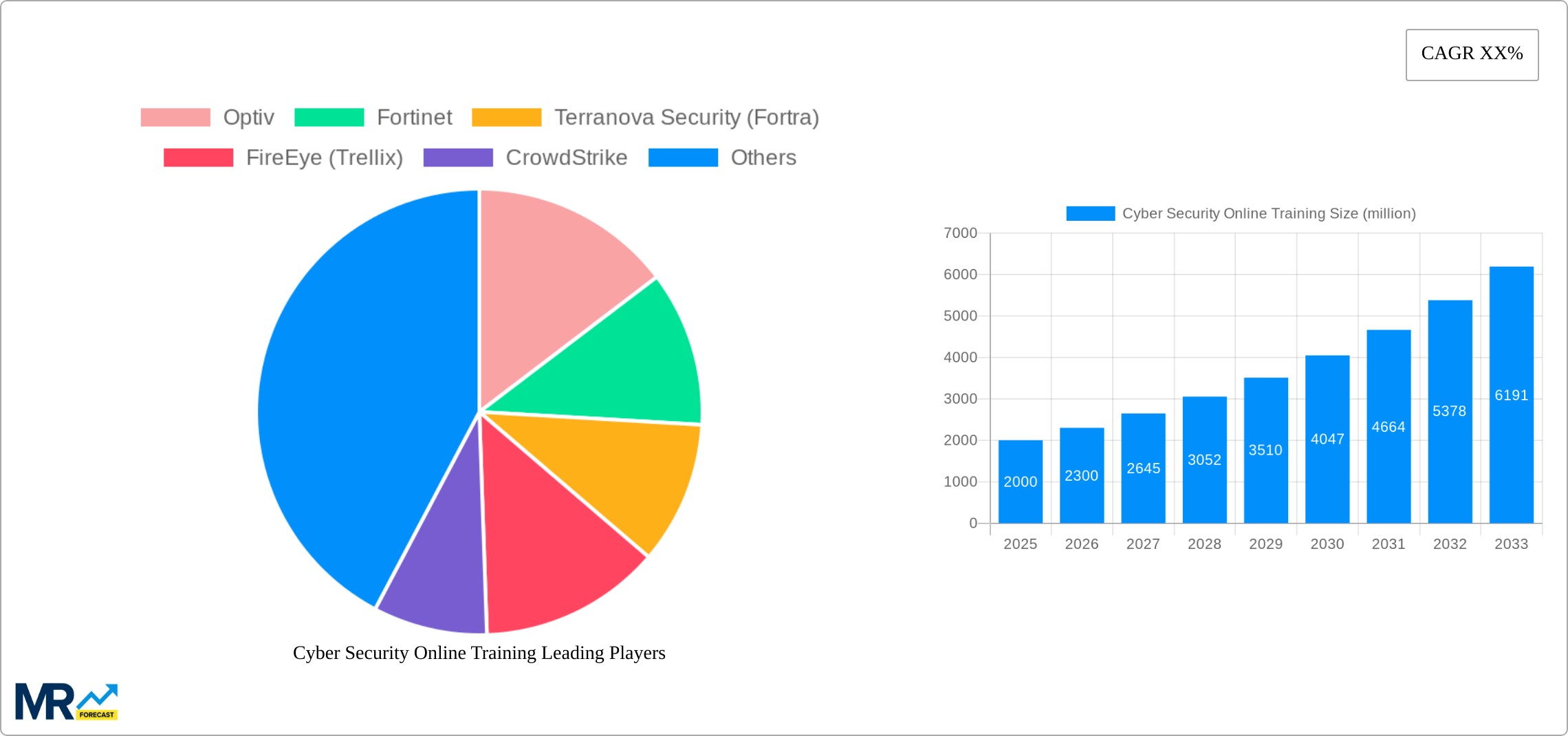

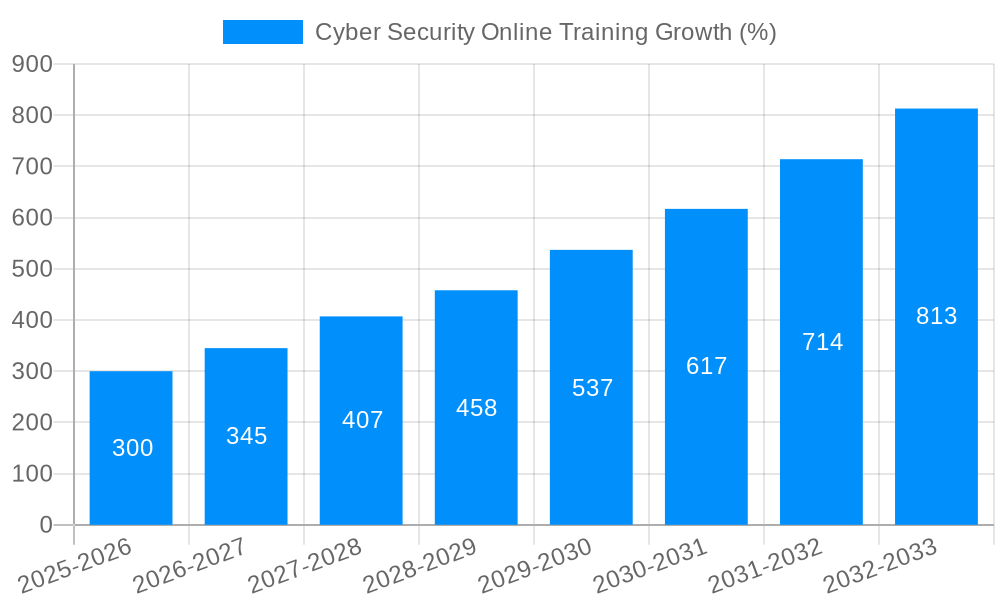

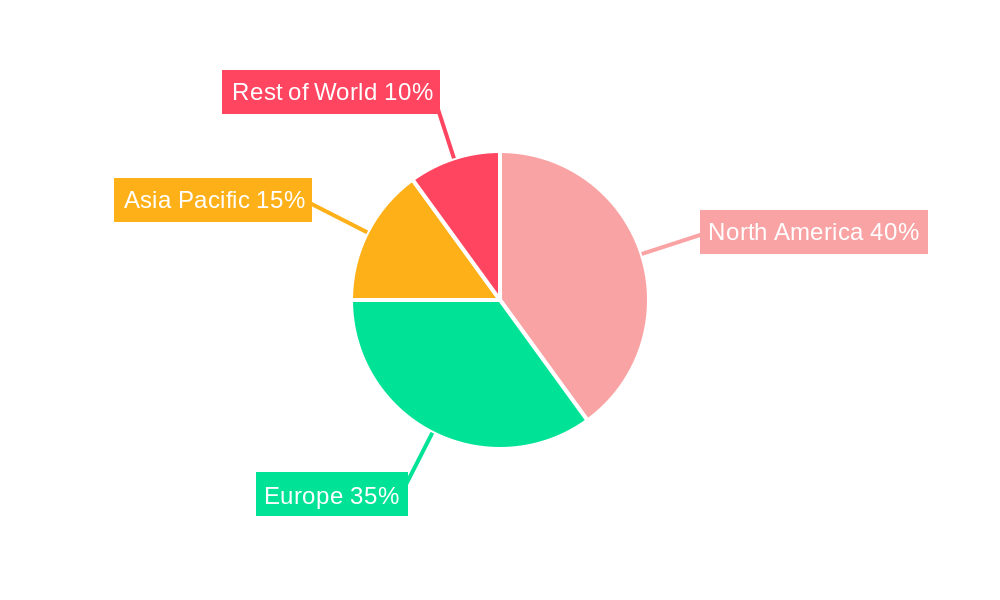

The global cybersecurity online training market is experiencing robust growth, driven by the escalating demand for skilled cybersecurity professionals and the increasing adoption of online learning platforms. The market, estimated at $2 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $6 billion by 2033. This surge is fueled by several key factors: the rising frequency and severity of cyberattacks targeting businesses of all sizes, the growing complexity of cybersecurity threats requiring specialized expertise, and the cost-effectiveness and flexibility of online training compared to traditional classroom-based programs. The market is segmented by training type (network, cloud, endpoint, mobile, IoT security, and others) and target audience (SMEs and large enterprises). Large enterprises currently dominate the market share due to their greater investment capacity in cybersecurity training, but the SME segment is anticipated to witness significant growth in the coming years driven by increasing cyber threats and awareness. Geographically, North America and Europe currently hold the largest market share, reflecting advanced digital infrastructure and a higher awareness of cybersecurity risks. However, regions like Asia-Pacific are projected to exhibit faster growth rates due to rapid technological advancement and increasing internet penetration.

The competitive landscape is characterized by a mix of established players offering comprehensive cybersecurity training programs and emerging specialized training providers catering to niche areas. Key players include well-known cybersecurity firms offering training as part of their broader portfolio (like Fortinet and CrowdStrike) alongside dedicated online learning platforms (such as Cybrary and Udemy). The market’s growth will depend on several factors, including the continuous evolution of cybersecurity threats, government regulations mandating cybersecurity training, and the development of innovative online learning methodologies such as gamification and immersive simulations. The ongoing skills gap in the cybersecurity industry will remain a significant driver, ensuring continued demand for effective and accessible online training solutions.

The global cybersecurity online training market is experiencing explosive growth, projected to reach multi-million dollar valuations by 2033. Analyzing data from 2019-2024 (historical period) and projecting to 2033 (forecast period), with 2025 as the base and estimated year, reveals a compelling narrative. The market's expansion is fueled by the ever-increasing sophistication of cyber threats, coupled with a persistent shortage of skilled cybersecurity professionals. This skills gap drives demand for accessible and flexible online training solutions, catering to both small and medium-sized enterprises (SMEs) and large enterprises alike. The trend towards cloud adoption, the proliferation of IoT devices, and the increasing reliance on mobile technologies further intensify the need for robust cybersecurity training. We're seeing a shift from traditional classroom-based learning towards online platforms offering self-paced courses, live webinars, and interactive simulations. This transition allows individuals and organizations to upskill or reskill at their convenience, optimizing learning outcomes and reducing costs associated with travel and instructor fees. Key market insights indicate a preference for specialized training in areas like cloud security, endpoint security, and mobile security, reflecting the evolving threat landscape. Furthermore, the integration of gamification and virtual reality technologies into online training programs is enhancing engagement and knowledge retention, contributing significantly to market growth. The competitive landscape is highly dynamic, with established players alongside emerging providers vying for market share. This competition fosters innovation and drives down costs, making quality cybersecurity training more accessible to a wider audience. The market is witnessing a substantial increase in the adoption of subscription-based models, providing ongoing access to updated content and resources, thereby securing recurring revenue streams for training providers.

Several key factors are propelling the remarkable growth of the cybersecurity online training market. The escalating frequency and severity of cyberattacks across all industries, from finance to healthcare, are creating an urgent need for skilled professionals capable of preventing, detecting, and responding to these threats. This demand is significantly outpacing the supply of qualified cybersecurity personnel, creating a widening skills gap. The cost-effectiveness and accessibility of online training platforms offer a solution. These platforms bypass geographical limitations, allowing individuals and organizations to access training resources regardless of location. Furthermore, the flexibility of online learning caters to diverse schedules and learning styles, unlike traditional classroom settings. The increasing adoption of cloud-based technologies and the expanding Internet of Things (IoT) ecosystem have broadened the attack surface, demanding a wider skillset in cybersecurity. Online training programs are readily adaptable to cover the evolving threat landscape, providing updated curricula to address the latest vulnerabilities and techniques. Government regulations and industry standards also play a significant role, mandating cybersecurity certifications and training for employees in specific sectors. This regulatory pressure further boosts the demand for online training programs that comply with these standards.

Despite the substantial growth potential, the cybersecurity online training market faces several challenges. Maintaining the relevance and accuracy of training materials in the rapidly evolving cybersecurity landscape is a constant struggle. Keeping up with the latest threats, vulnerabilities, and attack vectors requires continuous updates and revisions to course content. Another hurdle is ensuring the quality and effectiveness of online training. The lack of face-to-face interaction can potentially hinder learning, particularly for complex topics requiring hands-on practice. Moreover, the market is fragmented, with a wide array of providers offering varying levels of quality and expertise. This makes it challenging for learners to identify reputable and effective training programs. Ensuring the security of the online training platforms themselves is also paramount. Protecting sensitive information and preventing unauthorized access to learning materials is critical to maintaining the integrity of the training process. Finally, the digital divide, particularly in regions with limited internet access or digital literacy, can limit the reach and impact of online training initiatives. Bridging this gap requires targeted efforts to improve digital infrastructure and provide accessible training resources.

The North American region is projected to dominate the cybersecurity online training market throughout the forecast period (2025-2033). This dominance stems from several factors:

In terms of market segments, cloud security training is expected to dominate throughout the forecast period. The widespread adoption of cloud computing across businesses of all sizes makes it a primary target for cyberattacks. This necessitates a specialized skill set to manage and secure cloud-based systems, driving the demand for focused cloud security training programs.

Additionally, the large enterprise segment is expected to exhibit significant growth within the market. Large organizations manage extensive and complex IT infrastructure, making them vulnerable to sophisticated cyberattacks. They are also more likely to have the budget and resources to invest in comprehensive cybersecurity training programs for their employees.

The cybersecurity online training industry is experiencing significant growth driven by several key factors. The increasing sophistication of cyberattacks, the growing skills gap in cybersecurity, and the cost-effectiveness and accessibility of online training are all major drivers. Government regulations and industry standards, along with a shift towards subscription-based models, are further fueling this expansion. The incorporation of innovative technologies like gamification and virtual reality enhances engagement and knowledge retention, contributing to improved learning outcomes.

This report offers a comprehensive analysis of the cybersecurity online training market, providing valuable insights into current trends, growth drivers, challenges, and key players. The report includes detailed market projections for the forecast period, enabling informed strategic decision-making. Specific focus is given to key regions and segments, allowing businesses to tailor their strategies effectively. The information provided facilitates a deeper understanding of the competitive landscape, technological advancements, and emerging opportunities within this rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Optiv, Fortinet, Terranova Security (Fortra), FireEye (Trellix), CrowdStrike, Kaspersky, SGS, CyberSecOp, SANS Institute, Infosec, iSystems Security Limited (iSystems), Vinsys, Cofense, Cybrary, Udemy, Coursera, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cyber Security Online Training," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cyber Security Online Training, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.