1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Insurance Market?

The projected CAGR is approximately 24.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cyber Insurance Market

Cyber Insurance MarketCyber Insurance Market by Insurance Type (Standalone, Tailored), by Coverage Type (First-party, Liability Coverage), by Enterprise Size (SMEs, Large Enterprise), by End-user (Healthcare, Retail, BFSI, IT & Telecom, Manufacturing, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

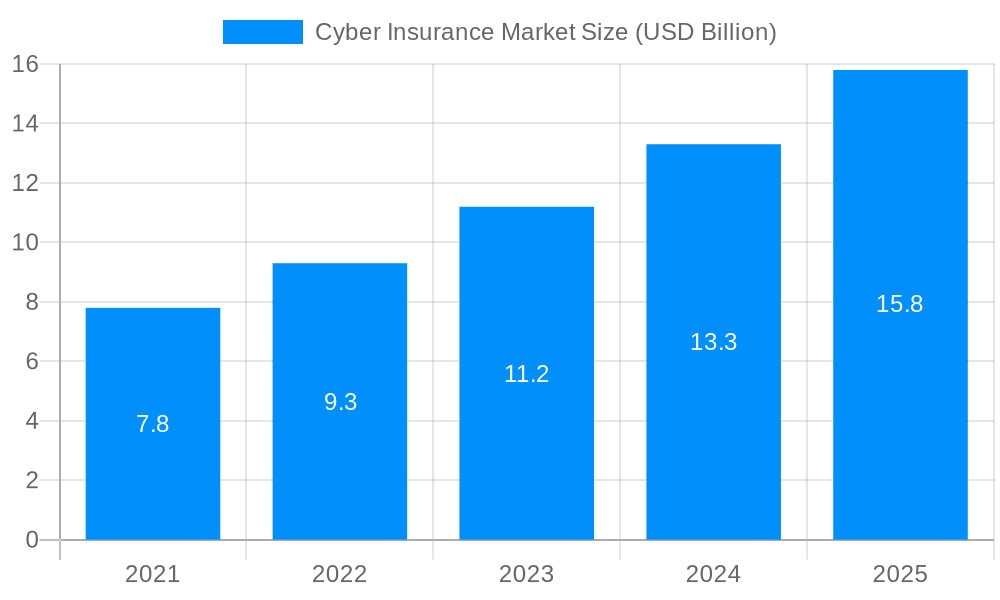

The size of the Cyber Insurance Market was valued at USD 16.66 USD Billion in 2023 and is projected to reach USD 77.24 USD Billion by 2032, with an expected CAGR of 24.5% during the forecast period. This remarkable surge is primarily attributed to the increasing prevalence of cyber threats and the growing awareness of cyber security risks among businesses. Hybrid seeds offer numerous advantages, including higher yields, improved disease resistance, better nutritional content, and adaptability to diverse climatic conditions, driving their adoption worldwide. Government initiatives and rising food security concerns further contribute to the market expansion. Technological advancements, such as precision agriculture and data analytics, enhance seed production and distribution, enabling farmers to optimize their operations and meet the growing global food demand. The Cyber Insurance Market finds significant applications in agricultural sectors, and major players like Bayer, Syngenta, and Corteva are actively involved in driving innovation and shaping the future of hybrid seed technology.

The Cyber Insurance Market is characterized by dynamic trends that are shaping its growth trajectory:

The Cyber Insurance Market is experiencing robust growth fueled by a confluence of factors. The escalating sophistication and frequency of cyberattacks are a primary driver, forcing businesses to seek robust protection against increasingly severe financial and reputational damage. This heightened awareness is further amplified by the rising costs associated with cyber incidents, including lost revenue, legal fees, regulatory fines, and the expense of remediation efforts. The expanding attack surface, driven by the widespread adoption of cloud technologies, IoT devices, and remote work models, significantly contributes to this growth. Furthermore, stringent government regulations mandating data protection and cybersecurity compliance are creating a significant demand for cyber insurance as a vital tool for regulatory adherence. Finally, a growing understanding among businesses of the inherent risks and the protective benefits of cyber insurance is fueling market expansion.

Despite the significant growth potential, the Cyber Insurance Market faces several challenges that impede its full potential. A lack of standardization across policies makes comparing and selecting appropriate coverage difficult for businesses. Policy exclusions and limitations often leave critical vulnerabilities uncovered, reducing the effectiveness of protection. Pricing remains a barrier, with premiums often considered prohibitively expensive for smaller enterprises with limited budgets. The industry also suffers from a shortage of skilled professionals adept at assessing and managing cyber risks, hindering accurate risk assessment and policy development. Finally, a persistent lack of awareness and understanding amongst certain business segments continues to suppress market adoption.

Dominant Region:

Dominant Segment:

Several factors are expected to act as growth catalysts for the Cyber Insurance Industry:

The Cyber Insurance Market can be segmented based on various criteria:

Insurance Type:

Coverage Type:

Enterprise Size:

End-user:

The Cyber Insurance Market is characterized by a competitive landscape with a mix of established and emerging players:

The Cyber Insurance Sector has witnessed several significant developments:

March 2023: Saiber Innovation Technologies partners with CYMAR Management Ltd. to address the cyber insurance needs of the maritime & logistics sector in the U.A.E.

February 2023: Cowbell partners with Millennial Shift Technologies to provide cyber insurance programs to Millennial Shift's e-trading broker platform, mFactor.

July 2022: SBI General introduces the SBI General Cyber VaultEdge insurance plan, offering protection against financial losses due to cyber risks and attacks.

October 2022: AXA XL establishes an incident response team in the Americas, reaffirming their commitment to supporting clients before, during, and after cyber-incidents.

July 2022: AXA XL announces cyber insurance role appointments and regional management in the U.S., focusing on growth strategies and addressing complex cyber & technology risks.

This comprehensive Cyber Insurance Market Report delivers an in-depth analysis of market trends, dynamics, and key performance indicators. It provides critical insights into the driving forces and challenges shaping the market, complemented by regional breakdowns and detailed profiles of key market players. The report offers valuable intelligence for businesses, investors, and industry stakeholders seeking a complete understanding of this rapidly evolving sector.

The Cyber Insurance Market is analyzed across key regions, including North America, Europe, Asia-Pacific, and the Middle East & Africa.

Major mergers and acquisitions in the Cyber Insurance sector include:

Regulatory landscapes for Cyber Insurance vary across regions:

Patent activity in the Cyber Insurance sector is growing, with companies investing in research and development to enhance their cybersecurity offerings.

Analysts forecast continued growth for the Cyber Insurance Market due to increasing cyber threats, regulatory compliance, and rising awareness of cyber security risks.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 24.5%.

Key companies in the market include Travelers Indemnity Company (US.), AXA XL (US.), Chubb (Switzerland), American International Group, Inc. (US.), Beazley Group (UK.), AXIS Capital Holdings Limited (Bermuda), CNA Financial Corporation (US.), BCS Financial Corporation (US.), The Hanover Insurance, Inc. (US.), Zurich Insurance (Switzerland), Travelers Indemnity Company (US.), AXA XL (US.), Chubb (Switzerland), American International Group, Inc. (US.), Beazley Group (UK.), AXIS Capital Holdings Limited (Bermuda), CNA Financial Corporation (US.), BCS Financial Corporation (US.), The Hanover Insurance, Inc. (US.), Zurich Insurance (Switzerland).

The market segments include Insurance Type, Coverage Type, Enterprise Size, End-user.

The market size is estimated to be USD 16.66 USD Billion as of 2022.

Increasing Cyberattacks and Data Breaches among Enterprises to Drive Market Growth.

Market Expansion to be Impelled by Rising Adoption of Crypto Insurance Services.

High Premium Cost to Hamper Market Growth.

March 2023: Saiber Innovation Technologies entered a partnership with CYMAR Management Ltd., a cyber-insurance specialist, to fulfill the cyber insurance needs of the maritime & logistics sector in the U.A.E. and help protect this sector from cyber-attacks.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4850, USD 5850, and USD 6850 respectively.

The market size is provided in terms of value, measured in USD Billion and volume, measured in K Units.

Yes, the market keyword associated with the report is "Cyber Insurance Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cyber Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.