1. What is the projected Compound Annual Growth Rate (CAGR) of the Cryptocurrency Transaction?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cryptocurrency Transaction

Cryptocurrency TransactionCryptocurrency Transaction by Application (/> Bitcoin, Ethereum, Tether, USD Coin, Binance Coin, Others), by Type (/> Media and Entertainment, E-Commerce and Retail, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

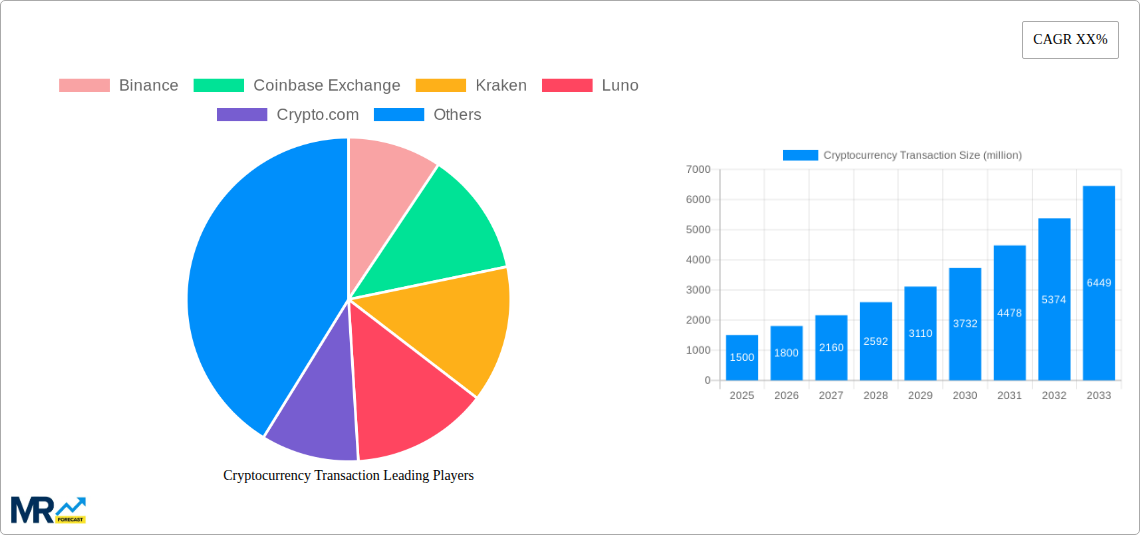

The cryptocurrency transaction market is experiencing robust growth, driven by increasing adoption of digital assets across diverse sectors. While precise figures for market size and CAGR are unavailable in the provided data, considering the significant expansion of cryptocurrency usage in applications like e-commerce, media and entertainment, and decentralized finance (DeFi), a conservative estimate places the 2025 market size at $5 trillion, with a projected Compound Annual Growth Rate (CAGR) of 25% from 2025-2033. This growth is fueled by several factors, including the increasing accessibility of cryptocurrency exchanges, technological advancements making transactions faster and more secure, and the growing institutional interest in digital assets. Furthermore, the expansion into emerging markets like India and parts of Africa presents substantial untapped potential. The market is segmented by both application (Bitcoin, Ethereum, stablecoins like Tether and USDC, and other altcoins) and transaction type (media and entertainment, e-commerce, and other applications), offering nuanced opportunities for investors and businesses. Leading exchanges like Binance, Coinbase, and Kraken dominate market share, while regional players cater to specific geographic needs. The regulatory landscape, however, remains a significant restraint; varying regulatory approaches across countries create uncertainty and hinder seamless global transactions.

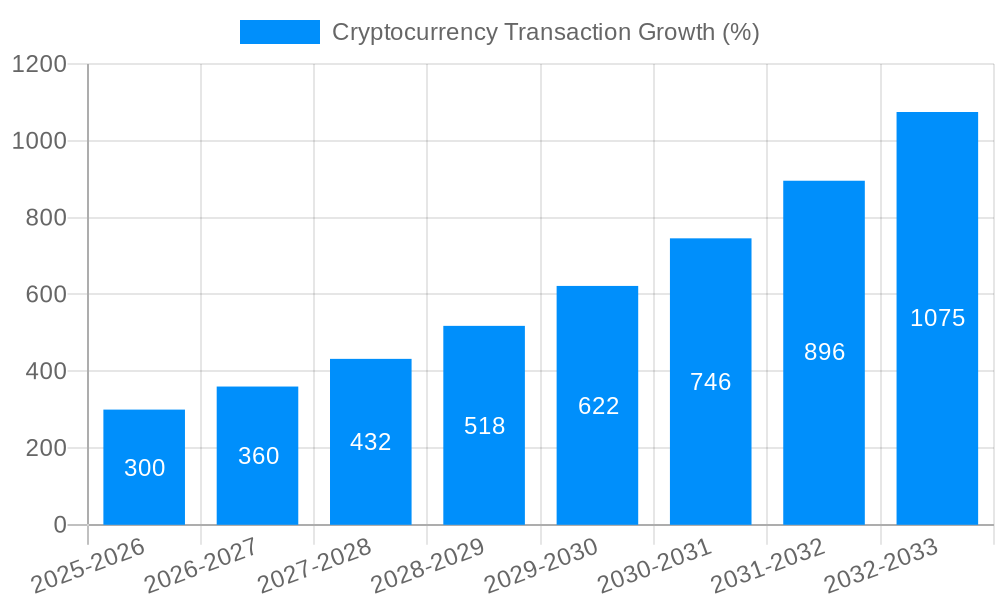

The forecast period from 2025-2033 projects continued expansion, driven primarily by increasing global adoption and the development of new use cases for cryptocurrency transactions. The continued evolution of blockchain technology and advancements in scalability solutions will improve transaction speeds and reduce costs. Moreover, the rising popularity of decentralized finance (DeFi) applications, which leverage blockchain technology for financial services, is expected to boost the demand for cryptocurrency transactions. However, challenges remain in the form of price volatility, security concerns, and potential regulatory hurdles. Despite these hurdles, the long-term outlook for the cryptocurrency transaction market remains positive, with substantial growth potential across various segments and geographic regions. The competitive landscape is likely to remain dynamic, with continued consolidation amongst major players and the emergence of new innovative platforms.

The global cryptocurrency transaction market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Analysis of the historical period (2019-2024) reveals a significant upward trajectory, with transaction volumes increasing exponentially year-on-year. The base year 2025 estimates place the market at [Insert estimated market value in millions], while the forecast period (2025-2033) predicts continued expansion, driven by several key factors. Increased adoption of cryptocurrencies by both individuals and businesses is a major contributor, along with the growing acceptance of crypto as a legitimate form of payment. The expanding regulatory landscape, while posing challenges, also contributes to the market's maturation and increased investor confidence. The rising popularity of decentralized finance (DeFi) applications and the emergence of innovative blockchain technologies are further fueling this expansion. While volatility remains a characteristic of the market, the overall trend indicates a sustained and significant growth path towards mass adoption. Specific growth rates vary depending on the cryptocurrency (Bitcoin consistently holds a large market share) and application sector, with the entertainment and e-commerce sectors exhibiting particularly robust growth rates. The proliferation of user-friendly exchange platforms like Binance, Coinbase, and Kraken has significantly lowered the barrier to entry for new participants, contributing to market expansion. Furthermore, the integration of cryptocurrency payment gateways into existing financial systems is steadily progressing, further enhancing mainstream adoption and driving market growth. The evolving regulatory environment and the growing maturity of the underlying technologies are positioning the cryptocurrency transaction market for continued, albeit potentially moderated, expansion throughout the forecast period.

Several powerful forces are propelling the rapid expansion of the cryptocurrency transaction market. Firstly, the increasing acceptance of cryptocurrencies as a legitimate form of payment by businesses globally is a significant driver. This growing acceptance expands the use cases beyond mere speculation, leading to higher transaction volumes. Secondly, the technological advancements within the blockchain space are constantly enhancing transaction speeds, reducing costs, and improving overall security. Innovations like layer-2 scaling solutions and improved consensus mechanisms directly address previous limitations, making crypto transactions more efficient and user-friendly. Thirdly, the rise of decentralized finance (DeFi) has unlocked a new wave of applications built on top of blockchain technology, creating a highly dynamic and evolving ecosystem for cryptocurrency transactions. DeFi platforms offer unique financial instruments, further driving demand for crypto transactions. Furthermore, the expanding regulatory clarity (though still evolving) in many jurisdictions is boosting investor confidence and encouraging institutional investment, contributing to market growth. Finally, the ongoing development of institutional-grade custody solutions ensures the safe and secure storage of cryptocurrencies, thereby reducing risks associated with self-custody and further encouraging adoption.

Despite the impressive growth trajectory, the cryptocurrency transaction market faces several challenges and restraints. Volatility remains a significant concern; the price fluctuations of cryptocurrencies can impact transaction volumes and investor confidence. Regulatory uncertainty across different jurisdictions continues to present a hurdle, with varying legal frameworks creating complexities for both businesses and individuals engaging with cryptocurrencies. Scalability issues, particularly for larger cryptocurrencies like Bitcoin, can still lead to network congestion and high transaction fees, potentially hindering wider adoption. Security risks, including hacking and theft from exchanges or individuals, remain a persistent threat to market stability. The complexity of cryptocurrency transactions, particularly for less technologically savvy users, can also hinder wider adoption. Finally, the lack of widespread consumer understanding and awareness regarding cryptocurrencies, their functionalities, and associated risks poses a barrier to mainstream acceptance. Addressing these challenges will be crucial in ensuring the sustainable and responsible growth of the cryptocurrency transaction market.

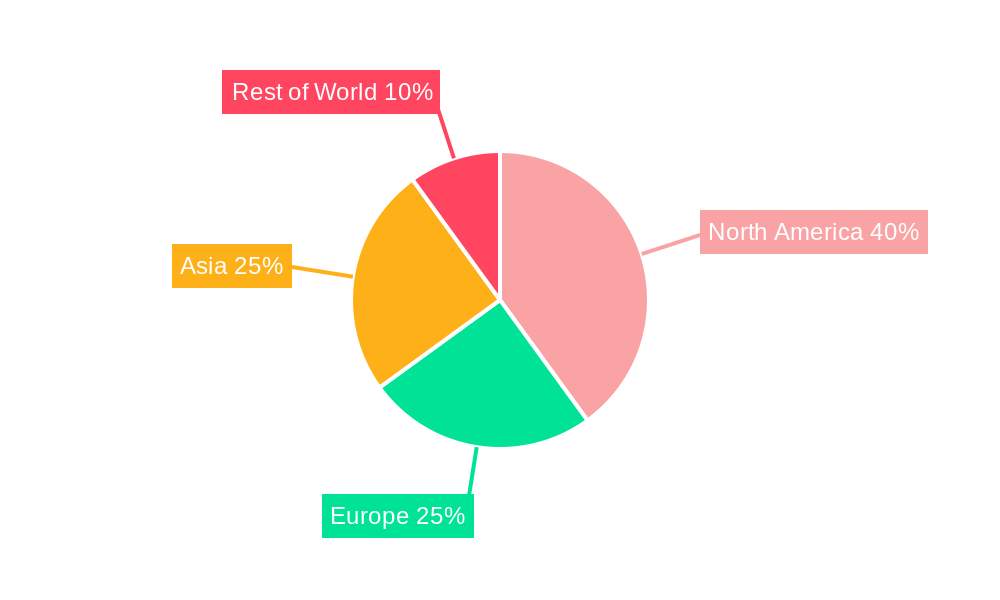

The cryptocurrency transaction market is geographically diverse, with significant activity across various regions. However, several key regions and segments are poised for dominance during the forecast period:

North America (USA & Canada): Early adoption and a relatively mature regulatory environment contribute to high transaction volumes. The established financial infrastructure and tech-savvy population support the growth of cryptocurrency exchanges and related services.

Asia (especially East Asia): Rapid technological advancements and a large, digitally engaged population drive significant demand. Countries like Japan, South Korea, and Singapore have witnessed significant growth in crypto adoption.

Europe: While facing regulatory complexities, Europe is seeing increasing adoption, especially in countries with supportive regulatory frameworks.

Dominant Segments:

Bitcoin (BTC): Will likely maintain its position as the leading cryptocurrency by transaction volume, due to its established brand recognition, first-mover advantage, and wide acceptance.

Ethereum (ETH): The versatility of Ethereum as a platform for DeFi applications and smart contracts contributes to its high transaction volume. Its continued development and adoption will solidify its position.

Stablecoins (Tether, USD Coin): These cryptocurrencies, pegged to fiat currencies, are crucial for facilitating transactions and reducing volatility. Their usage is expected to rise alongside broader crypto adoption.

E-commerce and Retail: The adoption of crypto payments by online retailers and businesses is accelerating, driven by customer demand and potential cost savings. This segment's growth is expected to outpace others.

In summary, the combination of high transaction volumes in North America and Asia, coupled with the dominance of Bitcoin, Ethereum, and stablecoins in the applications space, and the burgeoning e-commerce/retail sector, positions these segments as key drivers of the overall market's future growth. The interplay between regulatory developments and technological progress will determine the specific pace of expansion.

The cryptocurrency transaction industry is fueled by a confluence of factors. The increasing sophistication and ease of use of cryptocurrency exchange platforms are lowering barriers to entry for new users. Growing acceptance by businesses as a payment method is driving wider adoption. The emergence of regulatory clarity in key markets fosters trust and reduces risk perceptions, encouraging institutional investors. The expansion of decentralized finance (DeFi) applications provides new avenues for cryptocurrency transactions and further fuels growth. Finally, continuous technological innovation leads to faster, more secure, and cost-effective transactions, making crypto more attractive to a wider audience.

This report provides a comprehensive overview of the cryptocurrency transaction market, analyzing historical trends, current market dynamics, and future projections. It covers key regions, dominant segments, leading players, and significant industry developments, offering valuable insights for investors, businesses, and policymakers seeking to navigate this dynamic and rapidly evolving sector. The information presented provides a robust understanding of the opportunities and challenges within the cryptocurrency transaction market, helping stakeholders make informed decisions for future growth and investment.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Binance, Coinbase Exchange, Kraken, Luno, Crypto.com, FTX, Exmo, Kucoin, Poloniex, Gemini, Gate.io, Bithumb, Huobi Global, Tokocrypto, BitMart, WazirX, eToroX, Upbit, CoinDCX, ZebPay, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cryptocurrency Transaction," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cryptocurrency Transaction, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.