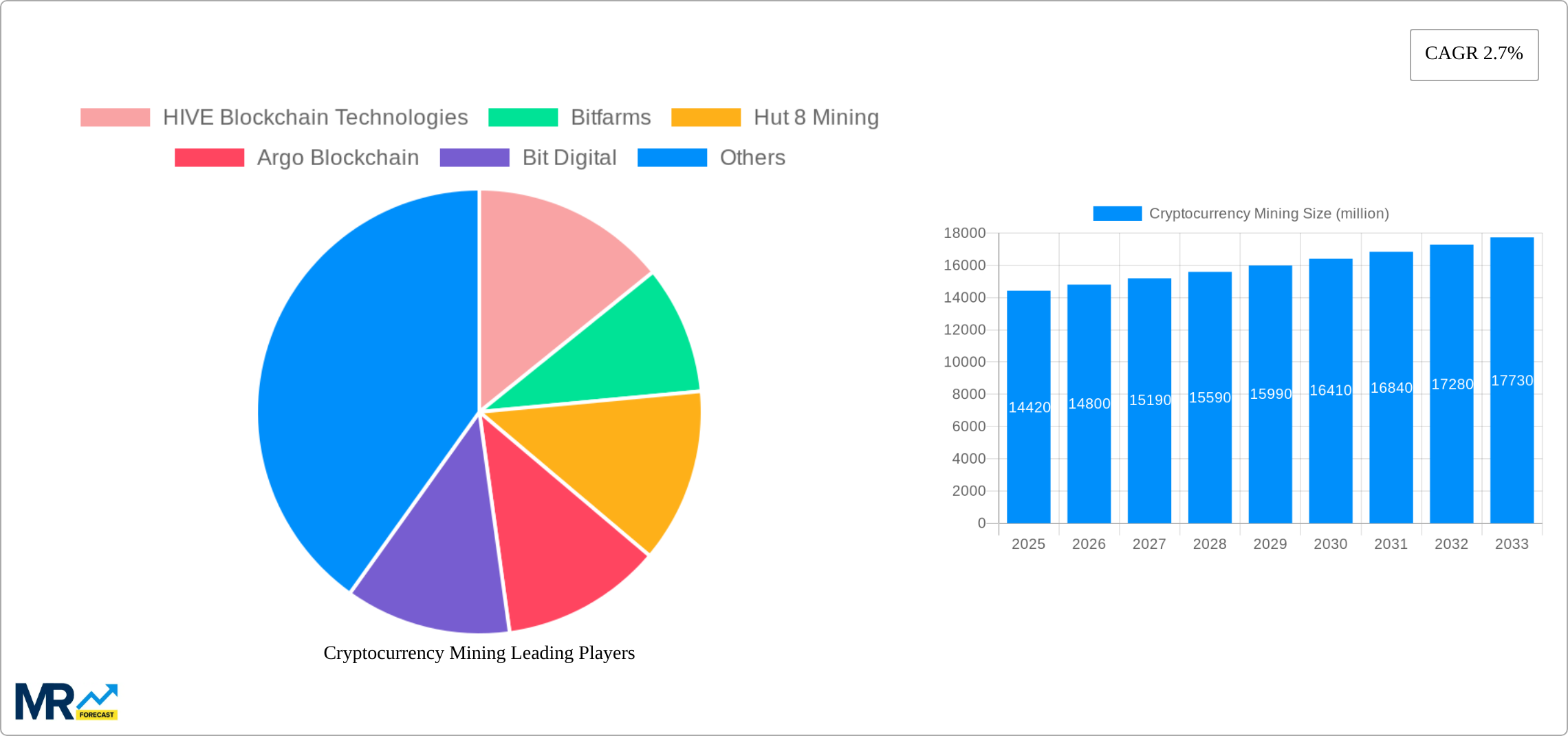

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cryptocurrency Mining?

The projected CAGR is approximately 2.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cryptocurrency Mining

Cryptocurrency MiningCryptocurrency Mining by Type (ASICs, GPUs, FPGAs), by Application (Remote Hosting Services, Cloud Mining, Self-mining), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

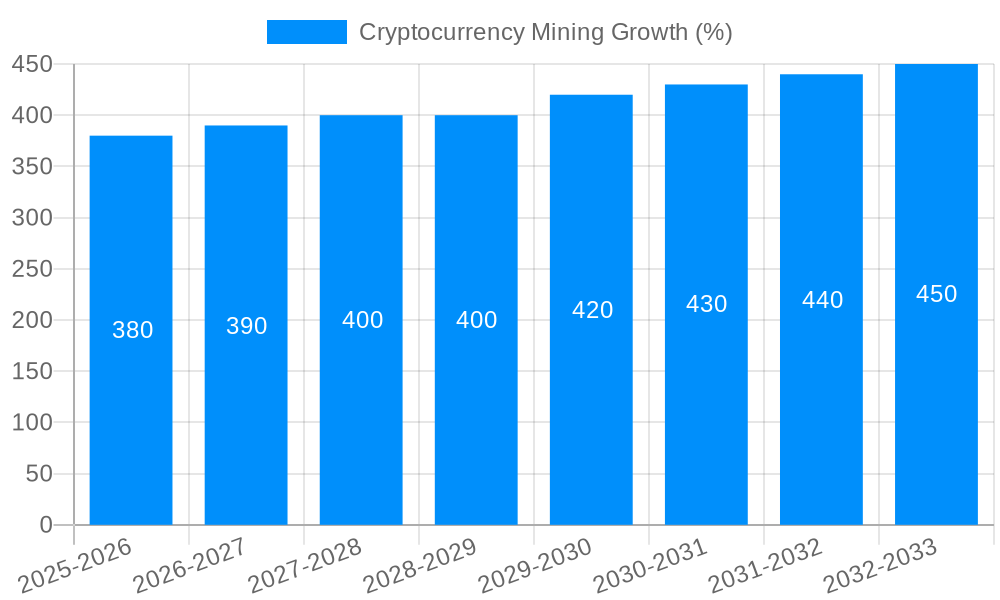

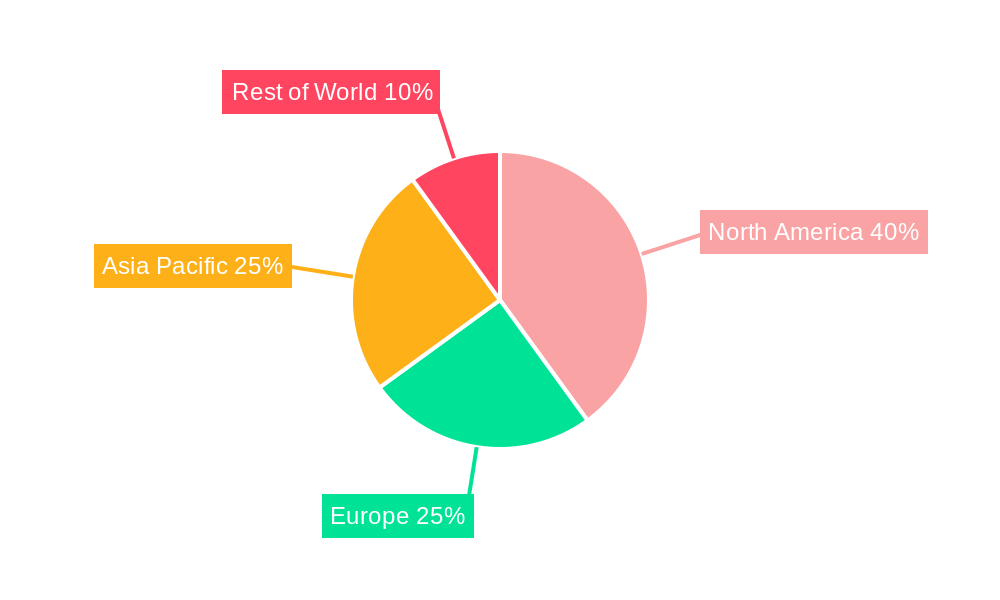

The cryptocurrency mining market, valued at $14,420 million in 2025, is projected to experience steady growth, driven by increasing adoption of cryptocurrencies, advancements in mining hardware (ASICs, GPUs, FPGAs), and the expansion of cloud mining services. The Compound Annual Growth Rate (CAGR) of 2.7% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. This growth is fueled by the ongoing evolution of blockchain technology and the diversification of cryptocurrency applications beyond simple trading, including decentralized finance (DeFi) and non-fungible tokens (NFTs). However, regulatory uncertainty across various jurisdictions, fluctuating cryptocurrency prices, and the significant energy consumption associated with mining pose considerable challenges to market expansion. The market is segmented by mining hardware type (ASICs leading the market due to their specialized efficiency, followed by GPUs and FPGAs catering to different needs and price points) and application (remote hosting services gaining traction due to ease of access and scalability, followed by cloud mining and self-mining, each with specific advantages and disadvantages regarding cost, control, and technical expertise). North America and Asia Pacific are expected to be major contributors to market revenue, given the concentration of mining operations and technological advancements in these regions.

The competitive landscape is characterized by a mix of large-scale publicly traded companies like Riot Blockchain and Marathon Digital Holdings, alongside smaller, more specialized players. These companies are constantly innovating to improve efficiency, reduce energy consumption, and adapt to changing regulatory environments. The long-term outlook hinges on the continued maturation of the cryptocurrency industry, the development of more energy-efficient mining technologies, and a clearer regulatory framework that fosters sustainable growth while addressing environmental concerns. The market's success is intrinsically linked to the wider adoption and stability of cryptocurrencies; any major shift in cryptocurrency prices or regulatory crackdown could significantly impact future market projections. A crucial factor is the balance between profitability, energy consumption, and environmental sustainability, driving the market toward more responsible and efficient practices.

The cryptocurrency mining market witnessed explosive growth during the historical period (2019-2024), driven primarily by the surging popularity of cryptocurrencies like Bitcoin and Ethereum. This period saw significant investments in mining hardware and infrastructure, leading to a substantial increase in mining capacity. The market value fluctuated considerably, reflecting the volatile nature of cryptocurrency prices and the energy-intensive nature of the mining process. While the estimated year (2025) shows some consolidation after a period of intense expansion, the forecast period (2025-2033) anticipates continued growth, albeit at a more moderated pace. This is largely attributed to technological advancements, the increasing institutional adoption of cryptocurrencies, and the ongoing development of more energy-efficient mining solutions. However, regulatory scrutiny and environmental concerns remain key factors that will influence the market trajectory. Several key players, including HIVE Blockchain Technologies, Bitfarms, and Riot Blockchain, emerged as prominent forces, expanding their operations and consolidating market share. The total market value in 2024 reached an estimated $XX billion, with projections indicating growth to $YY billion by 2033. This represents a Compound Annual Growth Rate (CAGR) of XX%. The shift toward more sustainable mining practices, driven by increased environmental awareness and regulatory pressure, will be a defining characteristic of the market's future evolution. Technological innovations aimed at improving efficiency and reducing energy consumption will continue to be central to the growth and long-term sustainability of the industry. Millions of dollars are being invested in research and development to optimize mining processes and address the environmental concerns associated with the industry's high energy demands. This commitment to innovation is expected to drive market growth and adoption despite the inherent challenges.

Several factors contribute to the ongoing expansion of the cryptocurrency mining industry. The increasing acceptance and adoption of cryptocurrencies by institutional investors and retail users fuel demand, creating a larger market for mined coins. Technological advancements in mining hardware, particularly the development of more efficient ASICs (Application-Specific Integrated Circuits), allow miners to process transactions faster and more profitably, driving further participation. The emergence of innovative mining strategies, including cloud mining and remote hosting services, lowers the barrier to entry for smaller players, fostering wider participation and expanding the mining landscape. Furthermore, the ongoing development of new cryptocurrencies, each requiring mining to create new tokens, adds to the overall demand for mining power. The decentralized nature of cryptocurrency mining, unlike traditional finance which is tightly controlled by institutions, also acts as a powerful incentive, attracting individuals and businesses seeking financial independence and opportunity. Government regulations, while potentially posing challenges, can also indirectly drive growth by creating a more transparent and structured environment, which encourages investment and participation. The continuous evolution of the underlying blockchain technologies further fuels the need for miners to secure and maintain the integrity of these networks.

The cryptocurrency mining industry faces significant headwinds. The high volatility of cryptocurrency prices presents a major challenge, directly impacting the profitability of mining operations. Significant initial investments in hardware and infrastructure create substantial barriers to entry for potential participants. The energy-intensive nature of mining is a significant environmental concern, attracting regulatory scrutiny and leading to increased operational costs in regions with stricter environmental regulations. The increasing competition among mining firms, particularly among larger players, puts pressure on profit margins. Regulatory uncertainty in different jurisdictions poses a significant risk, with varying laws and regulations impacting the legal and operational aspects of mining operations. Furthermore, the risk of obsolescence due to rapid technological advancements requires constant investment in upgrading equipment, potentially incurring significant financial losses. The difficulty of mining, which adjusts dynamically to maintain a consistent block creation rate, presents ongoing challenges in maintaining profitability. The security risks associated with large-scale mining operations, including the possibility of theft or hacking, also necessitate substantial investment in security measures. Finally, the dependence on electricity prices significantly impacts operating costs and profitability.

ASICs Dominance:

ASICs (Application-Specific Integrated Circuits) are currently the dominant technology for Bitcoin mining due to their superior hashing power and energy efficiency compared to GPUs and FPGAs. This dominance is likely to persist throughout the forecast period.

The market share of ASICs in 2024 was approximately 85%, valued at millions of dollars, and is projected to increase to 90% by 2033, exceeding hundreds of millions of dollars in value. This growth is fueled by continuous innovation and development of more powerful and energy-efficient ASICs tailored for specific cryptocurrencies.

Major players in the ASIC manufacturing and supply chain hold significant influence over the mining landscape, shaping market trends and influencing profitability. This concentrated control, however, may present challenges for smaller miners and potential entrants.

Self-Mining's Continued Growth:

Self-mining, where individuals or companies directly operate their mining hardware, remains a significant segment. This is driven by a desire for greater control over the mining process and the potential for higher profits by avoiding fees associated with other options.

While requiring a larger initial investment, self-mining offers flexibility and control which attract significant investment. The segment is projected to retain a substantial market share throughout the forecast period, despite the emergence of cloud mining and remote hosting services.

The ability to scale mining operations and adapt to changing market conditions is a key advantage that drives the appeal of self-mining, ensuring its continued significance.

North America and Asia as Leading Regions:

North America, particularly the United States and Canada, is a leading region for cryptocurrency mining due to its relatively supportive regulatory environment, access to affordable energy, and established infrastructure.

China, despite recent regulatory changes that limited domestic mining operations, remains an influential player in the global landscape through its strong manufacturing base for mining hardware and its significant involvement in the broader cryptocurrency ecosystem.

Asia, beyond China, continues to be a significant region for cryptocurrency mining, contributing a significant portion of the global mining hash rate. Countries in this region are witnessing growing interest in cryptocurrency mining, particularly in areas with affordable energy costs.

The continued dominance of ASICs as the primary mining hardware, the enduring popularity of self-mining, and the strong presence of North America and Asia as key regions underscore the dynamic and multifaceted nature of the cryptocurrency mining market.

The cryptocurrency mining industry’s growth is fueled by several key factors: the increasing institutional adoption of cryptocurrencies, leading to greater market demand and stability; advancements in hardware and software efficiency; the emergence of new and innovative mining techniques like cloud mining, expanding accessibility; and the ongoing development of new cryptocurrencies, each requiring its own dedicated mining infrastructure. These factors combined create a positive feedback loop, further driving market growth and innovation.

This report provides a detailed analysis of the cryptocurrency mining market, covering historical trends, current market dynamics, and future growth projections. The report incorporates market sizing, segmentation, and a comprehensive competitive landscape, providing invaluable insights for investors, industry stakeholders, and anyone seeking to understand this rapidly evolving sector. The comprehensive analysis, detailed forecasts, and insightful perspectives on key trends deliver a complete understanding of this complex market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.7%.

Key companies in the market include HIVE Blockchain Technologies, Bitfarms, Hut 8 Mining, Argo Blockchain, Bit Digital, GMO Internet, Riot Blockchain, Core Scientific, Marathon Digital Holdings, MGT Capital Investments, Ault Global Holdings, .

The market segments include Type, Application.

The market size is estimated to be USD 14420 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cryptocurrency Mining," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cryptocurrency Mining, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.