1. What is the projected Compound Annual Growth Rate (CAGR) of the Credit Card Reward App?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Credit Card Reward App

Credit Card Reward AppCredit Card Reward App by Type (Android, iOS), by Application (Personal, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

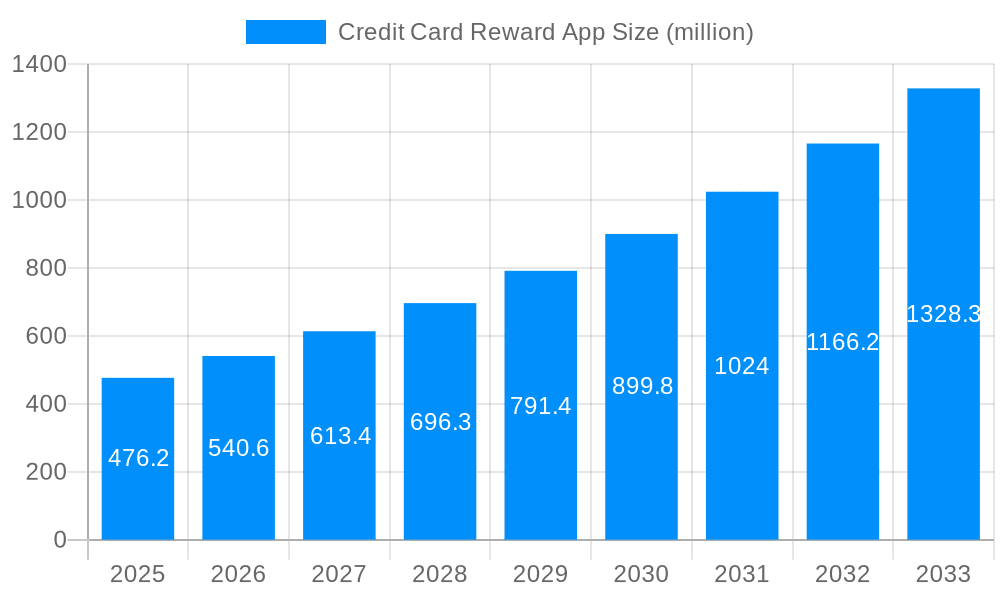

The global credit card reward app market, valued at $1182.6 million in 2025, is poised for significant growth. This burgeoning sector is driven by several key factors. The increasing adoption of smartphones and mobile banking, coupled with the rising popularity of rewards programs offered by credit card companies, creates a fertile ground for these applications. Consumers are increasingly seeking ways to maximize their rewards and track their spending effectively, making user-friendly reward management apps highly desirable. Furthermore, the competitive landscape, with established players like Mint and newer entrants like AwardWallet and Birch Finance constantly innovating with features like personalized recommendations and automated reward redemption, fuels market expansion. The integration of AI and machine learning capabilities within these apps enhances user experience by providing proactive insights and optimized reward strategies, further driving market growth. Segmentation by operating system (Android and iOS) and user type (personal and enterprise) allows for targeted market penetration and app customization, catering to diverse user needs. Geographic expansion, particularly in developing markets with growing credit card penetration, presents significant future opportunities.

The market's growth trajectory is projected to be robust, with a considerable Compound Annual Growth Rate (CAGR) influencing the forecast period (2025-2033). While precise CAGR figures are not provided, a conservative estimate considering market dynamics and technological advancements would place the CAGR in the high single digits to low double digits. Regional variations exist, with North America and Europe currently holding significant market share due to higher credit card usage and technological adoption. However, the Asia-Pacific region is expected to witness substantial growth over the forecast period driven by rising disposable incomes and increasing smartphone penetration. The market faces some restraints, including security concerns regarding user data and the complexity of some reward programs, necessitating continuous improvements in app security and user interface design. Nevertheless, the overall market outlook remains extremely positive, driven by ongoing technological innovation and expanding consumer demand for efficient reward management solutions.

The credit card reward app market experienced explosive growth during the historical period (2019-2024), driven by increasing credit card ownership, a surge in digital adoption, and a heightened consumer focus on maximizing rewards. The market value exceeded $XXX million in 2024, demonstrating significant traction. The estimated market value for 2025 sits at $YYY million, reflecting continued growth. This upward trajectory is expected to continue throughout the forecast period (2025-2033), fueled by innovative app features, improved user interfaces, and the expansion of reward programs offered by financial institutions. Consumers are increasingly seeking streamlined ways to manage their multiple credit cards and optimize their rewards potential, contributing to the market's expanding user base. Furthermore, the increasing integration of AI-powered features, such as personalized reward recommendations and fraud detection capabilities, is enhancing user experience and attracting a wider range of consumers. The market is witnessing a shift toward sophisticated reward management platforms capable of aggregating data from various sources, which simplifies the process of tracking and redeeming rewards. This comprehensive approach is creating a competitive landscape that drives innovation and improvement in the services offered. The increasing adoption of mobile-first strategies by financial institutions and other players further contributes to the growth of the market, facilitating seamless integration and engagement with customers. The predicted market value for 2033 surpasses $ZZZ million, showcasing the immense potential of this evolving sector.

Several key factors are propelling the growth of the credit card reward app market. The rising popularity of credit cards, particularly amongst millennials and Gen Z, is creating a substantial user base for these apps. Consumers are actively seeking ways to maximize the value derived from their credit card spending, and reward apps provide a convenient and effective tool to achieve this. The increasing number of reward programs offered by banks, retailers, and airlines further fuels the market's expansion. The complexity of managing multiple reward programs can be overwhelming, and these apps offer a centralized platform for tracking and managing all rewards in one place. Technological advancements, such as improved user interfaces, enhanced data security features, and integration with other financial applications, significantly enhance user experience and contribute to increased adoption rates. The development of personalized reward recommendations based on spending habits further elevates the value proposition for users, encouraging greater engagement and loyalty. Furthermore, strategic partnerships between financial institutions and app developers are expanding the reach and capabilities of these apps, leading to a more comprehensive and user-friendly experience.

Despite the impressive growth trajectory, the credit card reward app market faces several challenges. Data security and privacy concerns are paramount, and maintaining user trust through robust security measures is crucial. Competition within the market is intense, with numerous players vying for market share. Differentiation and providing unique value propositions are essential to stand out. Ensuring the accuracy and reliability of reward information is critical, as inaccuracies can lead to user dissatisfaction and loss of trust. Maintaining compatibility with various credit card programs and reward structures can be complex and requires ongoing updates and maintenance. Regulation and compliance with data privacy laws vary across different jurisdictions, requiring app developers to navigate a complex legal landscape. Furthermore, user adoption rates may vary depending on technological literacy and familiarity with mobile apps. Overcoming these challenges requires strategic planning, ongoing investment in technology, and a focus on providing exceptional user experiences.

The Personal Application segment within the iOS and Android platforms is projected to dominate the credit card reward app market throughout the forecast period.

iOS Dominance: The iOS ecosystem’s strong user base and reputation for user-friendliness contribute to its leading position. Higher average spending among iOS users also fuels demand for sophisticated reward management tools. The intuitive design and ease of integration with other Apple services further enhance its appeal.

Android Growth: While Android maintains a larger market share globally, the iOS segment enjoys higher average revenue per user (ARPU) in this niche. However, Android's broad reach and growing adoption of premium features are facilitating significant growth.

Personal Application Focus: The vast majority of users utilize these apps for personal financial management, maximizing their rewards on everyday spending. The convenience and simplicity offered by personal applications are pivotal to their mass adoption and will continue driving this segment's growth.

The North American market is expected to be a key region of growth. The high credit card penetration rate, coupled with the advanced technological infrastructure and high disposable incomes in countries like the US and Canada, fosters a favourable environment for the proliferation of these apps. The strong focus on customer loyalty programs among major financial institutions in these regions further reinforces market expansion. European and Asian markets are showing increasing interest, although at a comparatively slower pace due to variations in credit card adoption rates and regulatory frameworks. However, robust growth is predicted for these regions as credit card usage expands and digital financial services mature. The expanding middle class and rising disposable incomes in many Asian markets are particularly promising for future growth.

The increasing sophistication of reward programs, offering a wider array of options beyond simple cashback, is a major catalyst for growth. The integration of artificial intelligence (AI) to provide personalized reward recommendations and optimize spending habits is enhancing user engagement. The development of partnerships between app developers and financial institutions leads to seamless integration and a wider range of supported reward programs. The increasing trend towards mobile-first banking and financial management further fuels the adoption of these apps as consumers seek centralized solutions for managing their finances. Moreover, improvements in user interface/user experience (UI/UX) design enhance the overall user experience, thereby boosting adoption and retention.

This report provides a comprehensive analysis of the credit card reward app market, encompassing historical data, current market trends, and future projections. The report delves into the key drivers and challenges shaping the market, identifies leading players and their strategies, and offers detailed segment analysis. This insightful report is valuable for businesses involved in the fintech sector, investors seeking investment opportunities, and consumers interested in understanding the evolving landscape of reward management.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AwardWallet, MaxRewards, Mint, CardPointers, Uthrive, point.me, The Points Guy, CardWiz, Birch Finance, Avion Rewards, Stocard, Chase Ultimate Rewards, Bank of America, Bilt Rewards, Kwik Rewards, Kroger Rewards, .

The market segments include Type, Application.

The market size is estimated to be USD 1182.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Credit Card Reward App," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Credit Card Reward App, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.