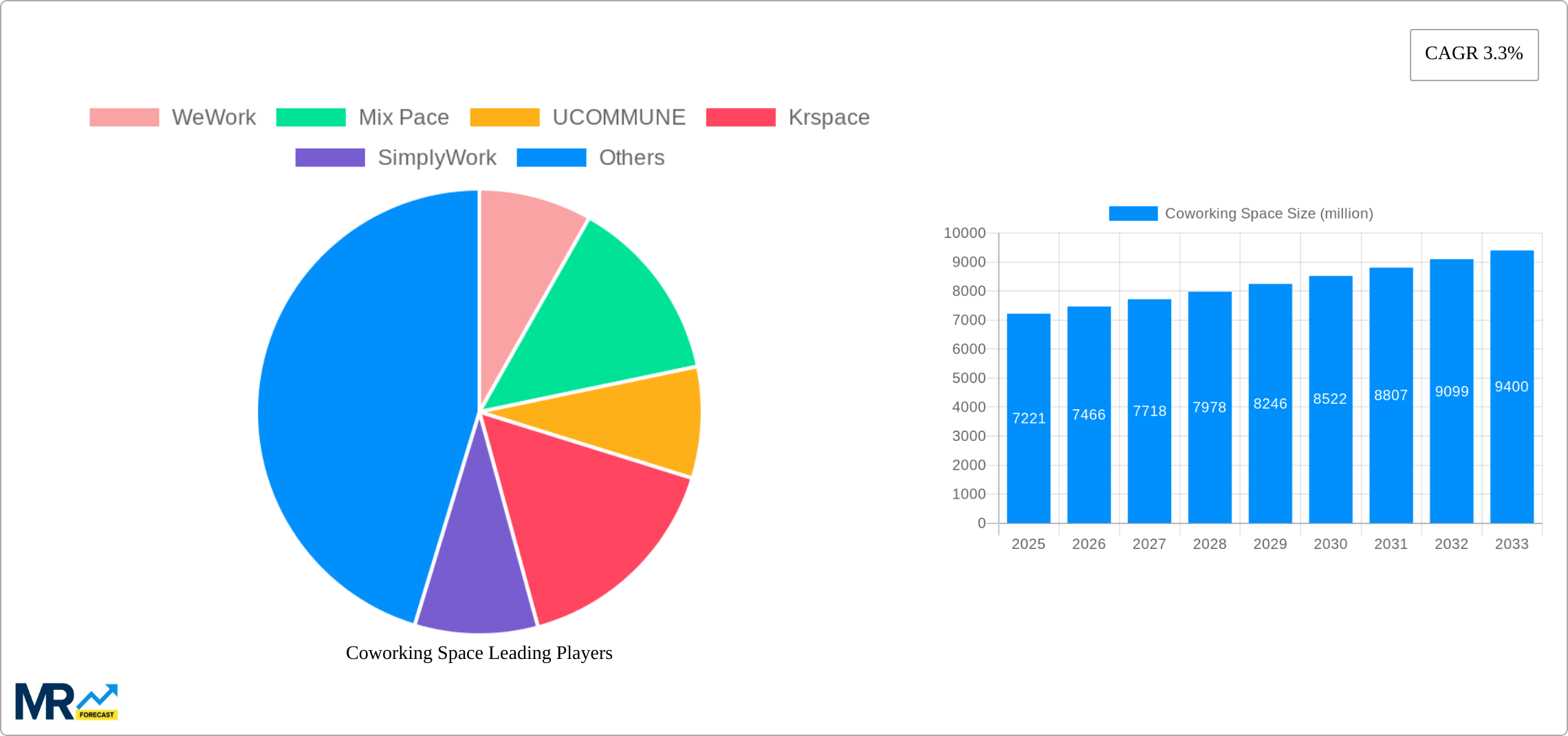

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coworking Space?

The projected CAGR is approximately 3.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Coworking Space

Coworking SpaceCoworking Space by Application (Personal User, Small Scale Company, Large Scale Company, Others), by Type (Flexible Managed Office, Serviced Office), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

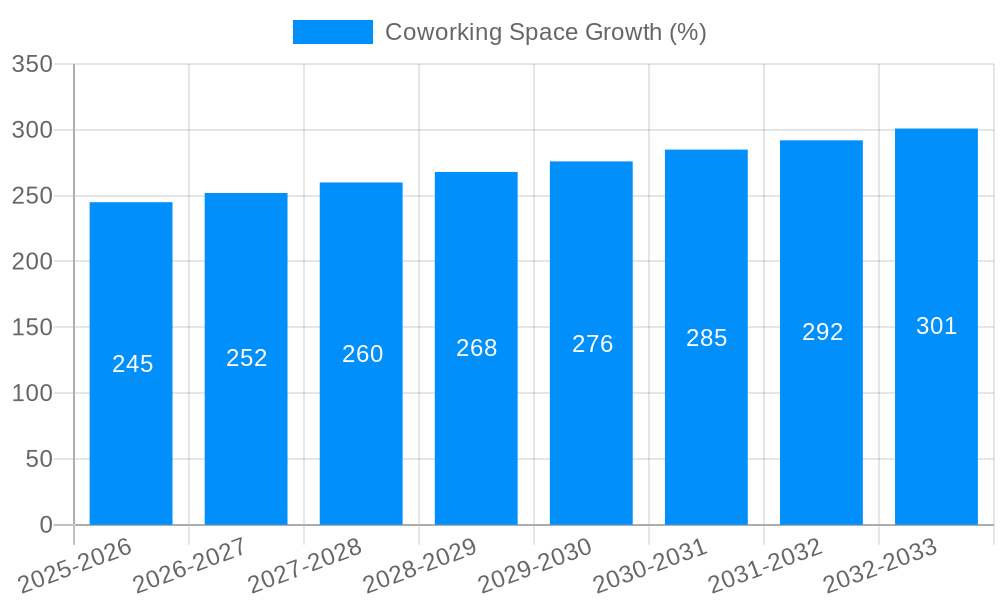

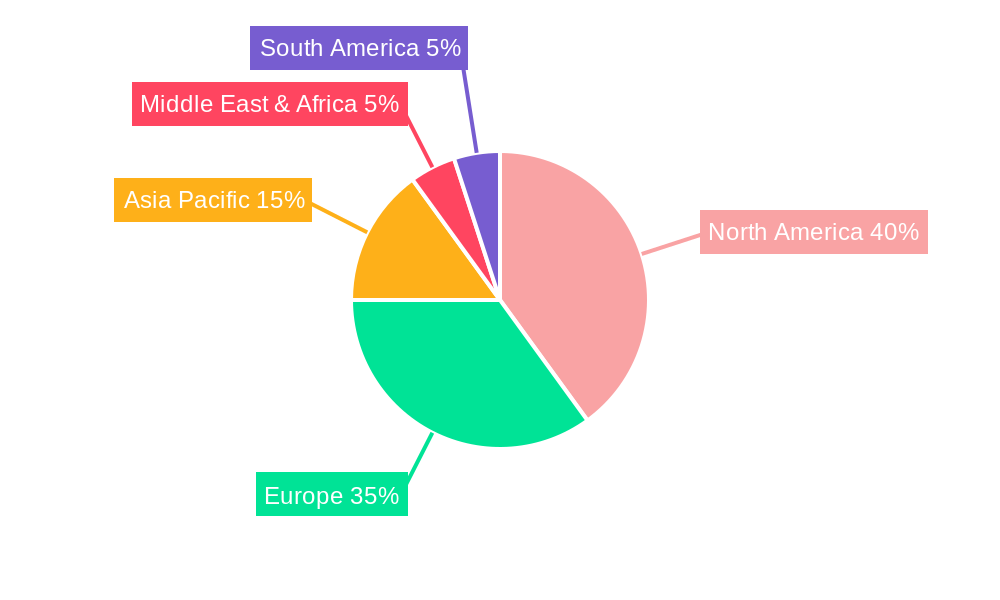

The global coworking space market, valued at $7221 million in 2025, is projected to experience steady growth, driven by a rising preference for flexible work arrangements among freelancers, startups, and established companies. The 3.3% CAGR indicates a consistent expansion, fueled by several key factors. Increased urbanization and the growth of the gig economy contribute significantly to the demand for shared workspaces. Furthermore, the cost-effectiveness of coworking spaces compared to traditional office leases, along with the provision of amenities such as high-speed internet, meeting rooms, and networking opportunities, make them an attractive option for businesses of all sizes. The market segmentation reveals a strong demand across various application types, including personal users, small and large-scale companies. Flexible managed offices and serviced offices are the dominant types within the market, reflecting the diverse needs and preferences of the user base. Technological advancements facilitating remote work and virtual collaboration are also indirectly contributing to the growth of this sector. While factors like economic downturns and the potential for oversaturation in certain markets could act as restraints, the overall market outlook remains positive, indicating sustained growth in the forecast period (2025-2033). The geographic distribution of the market shows a strong presence across North America and Europe, with Asia-Pacific also demonstrating significant growth potential.

The competitive landscape is characterized by a mix of established global players like WeWork and Regus and smaller, localized operators. This competition fosters innovation and drives the development of diverse offerings catering to specific needs. The success of individual operators depends heavily on their ability to offer attractive pricing, convenient locations, and high-quality amenities while adapting to evolving market trends and technological advancements. The continued focus on sustainability and community building within coworking spaces is likely to further enhance the attractiveness of this sector to environmentally conscious businesses and individuals. The market's future hinges on the continued adoption of flexible work models and the ability of coworking spaces to adapt to evolving demands and maintain a competitive edge.

The global coworking space market is experiencing a dynamic evolution, marked by significant growth and transformation throughout the study period (2019-2033). While the historical period (2019-2024) saw substantial expansion, fueled by the increasing preference for flexible work arrangements and the rise of the gig economy, the estimated year (2025) and forecast period (2025-2033) project even more impressive figures. We project a global coworking space consumption value exceeding several billion dollars by 2033, representing a considerable compound annual growth rate (CAGR). This growth isn't uniform; shifts in the market are driven by technological advancements, evolving user demographics, and changing business needs. The increasing demand from small and large-scale companies seeking cost-effective and adaptable workspaces is a major contributor to this expansion. Simultaneously, the rise of hybrid work models, where employees blend remote and office work, is significantly bolstering the industry’s demand. Furthermore, the integration of technology within coworking spaces – from high-speed internet and collaborative software to advanced booking systems and smart building technologies – is enhancing the overall user experience and driving adoption. The market is also witnessing a diversification of offerings, with specialized coworking spaces catering to specific industries and professional needs. This trend reflects a movement beyond the basic provision of desks and internet access towards the creation of vibrant and supportive communities that foster innovation and collaboration. Competition is fierce, with established players and new entrants vying for market share, leading to continuous innovation in space design, service offerings, and pricing strategies. The increasing focus on sustainability and the incorporation of environmentally friendly practices within coworking spaces is also gaining momentum. Ultimately, the future of coworking spaces lies in their ability to adapt to the ever-changing needs of the modern workforce and deliver value-added services that enhance productivity and foster a sense of community. The market is expected to witness continued consolidation, with larger players acquiring smaller operators to achieve economies of scale and expand their geographic footprint.

Several key factors are driving the phenomenal growth of the coworking space industry. The increasing prevalence of remote work and the gig economy has created a surge in demand for flexible and accessible workspaces. Coworking spaces offer an attractive alternative to traditional office leases, providing cost-effective solutions for businesses of all sizes. The ability to scale up or down workspace as needed, avoiding long-term commitments, is particularly appealing to startups and small businesses experiencing rapid growth or fluctuating needs. Furthermore, coworking spaces often foster a vibrant and collaborative environment, facilitating networking and knowledge sharing among diverse professionals. This is highly beneficial for entrepreneurs and freelancers seeking mentorship and business opportunities. The rise of hybrid work models, blending remote and in-office work, is another major driver. Coworking spaces provide a professional and productive alternative to working from home, offering a dedicated workspace with essential amenities and a sense of community. Lastly, technological advancements, such as sophisticated booking systems, high-speed internet, and collaborative tools, are enhancing the overall coworking experience, making it more efficient and attractive to users. These factors combine to make coworking spaces an increasingly essential element of the modern work landscape.

Despite the impressive growth, the coworking space industry faces several challenges. Competition is intense, with numerous providers vying for market share, leading to price wars and the need for constant innovation to maintain a competitive edge. Securing prime locations in desirable urban areas can be expensive and challenging, impacting profitability. Maintaining a consistent occupancy rate is crucial for financial viability, and fluctuations in the economy or changes in work patterns can significantly affect demand. Managing the diverse needs of a wide range of users, from freelancers to large corporations, requires significant operational expertise and adaptability. Ensuring a safe and secure environment for all users is paramount, necessitating robust security measures and potentially impacting operational costs. The pandemic highlighted the vulnerability of the industry to external shocks, underlining the importance of resilience and adaptability to unforeseen circumstances. Finally, maintaining a vibrant community atmosphere and fostering a sense of belonging within a constantly shifting population of users requires ongoing effort and investment.

The North American market, particularly the United States, is expected to remain a dominant force in the coworking space industry throughout the forecast period (2025-2033). This is driven by high demand from various segments, including small-scale companies and large-scale corporations, as well as individual users, seeking flexible and efficient workspaces. The large and diverse business landscape, combined with a strong preference for flexible work arrangements, fuels this market leadership.

Within the segments, small-scale companies are projected to be a significant driver of growth. Their need for flexible, cost-effective workspace solutions perfectly aligns with the coworking model. Large-scale companies are also increasingly adopting coworking spaces for satellite offices or project-based teams, further contributing to market expansion.

The Flexible Managed Office type, which offers a blend of services and amenities, is likely to dominate the market as it caters to the broadest range of users and their varied needs.

The continued growth of the coworking space industry is fueled by several key catalysts. The ongoing shift towards hybrid and remote work models necessitates adaptable and professional workspaces outside of traditional office environments. The increasing demand for cost-effective and flexible solutions, particularly amongst small and medium-sized businesses (SMBs), further propels this growth. The emphasis on fostering collaboration and community within coworking spaces also contributes to their popularity. Furthermore, technological advancements continue to enhance the user experience, making coworking spaces increasingly efficient and attractive.

This report offers a comprehensive analysis of the coworking space market, covering historical trends, current market dynamics, and future projections. It provides valuable insights into market drivers, challenges, key players, and significant developments, enabling informed decision-making for businesses and investors in this dynamic sector. The report segments the market by application (personal, small-scale companies, large-scale companies, others) and type (flexible managed office, serviced office), providing a detailed understanding of growth patterns across different segments. The geographic scope of the report includes major markets worldwide, offering a global perspective on the industry's evolution and future prospects. The detailed forecasting presented offers a clear view of the market's potential for the coming years.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.3%.

Key companies in the market include WeWork, Mix Pace, UCOMMUNE, Krspace, SimplyWork, Regus, Impact Hub, Your Alley, Knotel, District Cowork, Techspace, Serendipity Labs, .

The market segments include Application, Type.

The market size is estimated to be USD 7221 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Coworking Space," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Coworking Space, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.