1. What is the projected Compound Annual Growth Rate (CAGR) of the Convertible Bond?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Convertible Bond

Convertible BondConvertible Bond by Type (Vanilla Convertible Bond, Mandatory Convertible Bond, Reversible Convertible Bond), by Application (Energy Industry, Financial Sector, Manufacturing, Real Estate, Traffic and Transportation, Accommodation and Meals, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global convertible bond market is experiencing robust growth, driven by increasing demand for flexible financing solutions across diverse sectors. While precise market size figures for 2019-2024 are not provided, leveraging publicly available financial data and industry reports suggests a substantial market value in the billions, with a Compound Annual Growth Rate (CAGR) that's likely in the range of 5-8% during that period. This growth is fueled by several key factors. First, convertible bonds offer a compelling alternative to traditional debt and equity financing, providing companies with access to capital while offering investors the potential for equity upside. Second, low interest rate environments in recent years have made convertible bonds an attractive option for both issuers and investors seeking relatively higher returns compared to traditional fixed-income instruments. Third, the increasing complexity of global financial markets pushes companies to explore more sophisticated funding avenues, while investors actively seek diversified portfolios. Finally, the diverse range of applications across industries, from energy and finance to real estate and technology, contributes significantly to market expansion. The segments within the market, categorized by bond type (Vanilla, Mandatory, Reversible) and industry application, present diverse opportunities for specialized investment strategies.

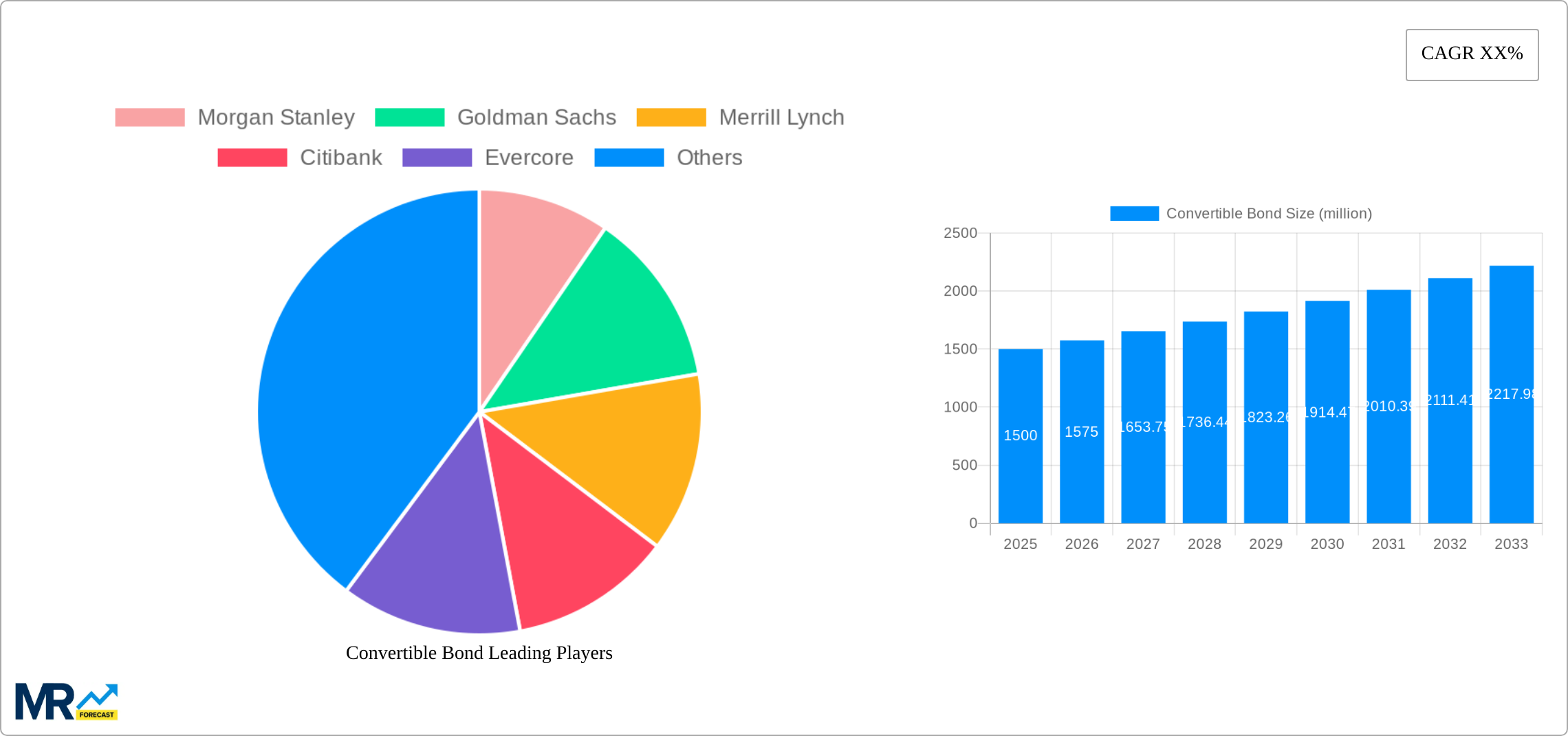

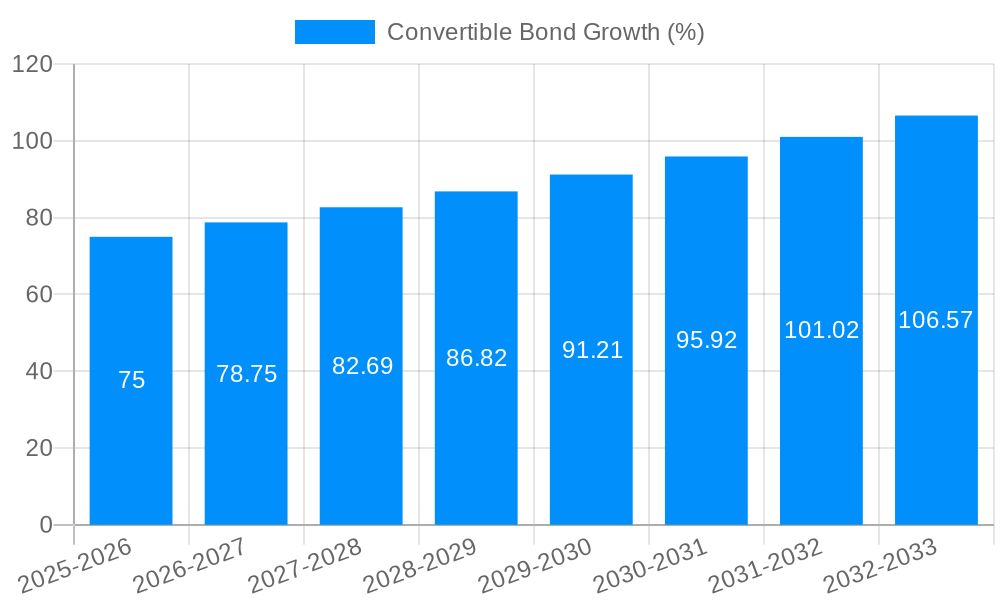

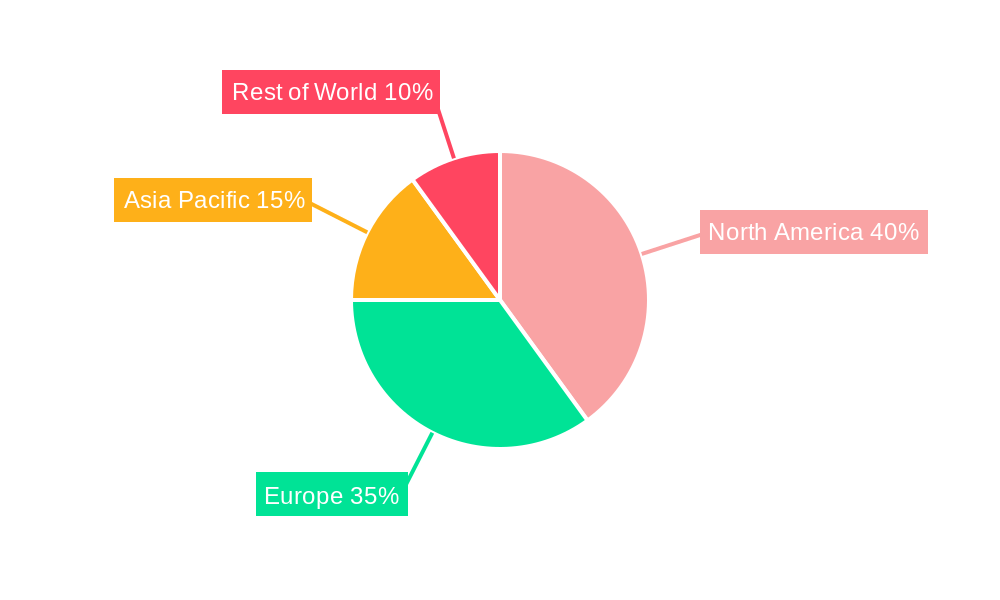

Looking ahead to 2025-2033, the market is poised for continued expansion, albeit potentially at a slightly moderated CAGR, possibly between 4-7%, reflecting a more normalized post-pandemic market environment and a possible rise in interest rates. However, several factors could influence the pace of growth. Regulatory changes, fluctuations in interest rates, economic uncertainties, and shifts in investor sentiment all contribute to the inherent volatility within the convertible bond market. Despite these challenges, the long-term outlook remains positive, particularly as companies across various sectors continue seeking flexible and efficient capital-raising mechanisms. The significant participation of major global investment banks suggests a level of confidence in the future trajectory of the market. Regional variations are expected, with North America and Europe remaining dominant markets, though the Asia-Pacific region, driven by growth in China and India, is anticipated to show significant growth potential.

The global convertible bond market exhibited dynamic trends between 2019 and 2024, experiencing fluctuating growth influenced by macroeconomic factors, interest rate movements, and investor sentiment. The historical period (2019-2024) saw a period of moderate expansion, with issuance volumes peaking in 2021 at approximately $350 billion, driven by low interest rates and a search for yield among investors. However, rising interest rates in 2022 led to a contraction in the market, with issuance dropping to around $280 billion. The base year of 2025 reflects a cautious recovery, estimated at $300 billion, as investors assess the evolving economic landscape. Looking ahead, the forecast period (2025-2033) projects a compound annual growth rate (CAGR) of approximately 6%, reaching an estimated market size of $550 billion by 2033. This growth is anticipated to be fueled by increased corporate activity, particularly in sectors experiencing significant technological advancements and expansion opportunities. The market's performance will remain sensitive to shifts in interest rates, economic growth, and overall investor risk appetite. Furthermore, regulatory changes and evolving investor preferences concerning Environmental, Social, and Governance (ESG) factors will continue to influence the market's trajectory. Key market players, such as Morgan Stanley, Goldman Sachs, and others listed, are expected to play a crucial role in shaping market trends through their advisory, underwriting, and trading activities. The market is also witnessing increasing issuance of innovative convertible bond structures, beyond traditional vanilla bonds, to meet the diverse financing needs of companies across various sectors.

Several key factors are propelling the growth of the convertible bond market. Firstly, the hybrid nature of convertible bonds offers a compelling proposition for both issuers and investors. For issuers, they provide access to capital at potentially lower interest rates compared to straight debt, while offering the potential for equity dilution to be deferred or avoided entirely. For investors, convertible bonds offer a blend of fixed income security with the potential for equity upside if the issuer's stock price appreciates. Secondly, the increasing prevalence of private equity and venture capital investments fuels growth as these firms frequently use convertible bonds as a financing instrument during expansion phases. The need for flexible financing options in uncertain economic conditions adds to their popularity. Thirdly, low interest rates in recent years have pushed investors to seek higher-yielding investments, making convertible bonds an attractive option. Finally, the increasing sophistication of structured products and derivative markets is allowing for customized convertible bonds to cater to specific risk profiles and investment objectives of various investor groups, thereby expanding the market's reach and appeal. These factors collectively contribute to the sustained growth of the convertible bond market, particularly in specific sectors like technology and healthcare, where high-growth companies require flexible financing.

Despite the positive outlook, the convertible bond market faces several challenges. Interest rate volatility poses a significant risk. Rising interest rates can make straight debt more attractive compared to convertible bonds, leading to reduced demand. Moreover, changes in equity valuations can significantly impact the value of convertible bonds. A decline in the issuer's stock price could decrease the conversion value, potentially leading to losses for investors. Another significant constraint is the complexity of convertible bonds, which require sophisticated understanding and analysis from both issuers and investors. This complexity can deter smaller investors and potentially limit market participation. Further, regulatory changes and increased scrutiny from regulatory bodies concerning disclosure and compliance could add further complexity and compliance costs. Furthermore, macroeconomic uncertainty and economic downturns can lead to reduced investor confidence and lower demand for convertible bonds. Finally, the potential for credit risk remains a factor, particularly if the underlying issuer faces financial difficulties. Effectively managing these challenges and uncertainties is key for maintaining sustainable growth within the convertible bond market.

The North American market (specifically the United States) is expected to hold a significant share of the global convertible bond market throughout the forecast period. This dominance stems from the large number of publicly listed companies, a robust and liquid capital market, and the presence of major investment banks specializing in convertible bond transactions. Within the segments, the Vanilla Convertible Bond type is projected to retain its largest market share due to its simplicity and established market familiarity. However, the Mandatory Convertible Bond segment is anticipated to see strong growth, driven by demand from companies seeking certainty in funding and a defined conversion path.

The Financial Sector will likely experience robust demand for convertible bonds, given the sector's need for flexible capital solutions. The Energy Industry, driven by substantial investment in renewable energy projects, represents another significant segment. Manufacturing, particularly in high-growth technology manufacturing, will also show substantial demand. However, it's important to note that market share distribution across various application segments will fluctuate, reflecting the dynamic nature of economic conditions and investment trends within each sector.

Several factors will catalyze the convertible bond industry's growth. Continued low-interest rate environments, while less prevalent than in recent years, can still stimulate demand for hybrid instruments offering higher potential returns than traditional debt. Furthermore, increasing innovation in structuring convertible bonds, providing tailored products to suit specific needs, will fuel greater market penetration. The growing expertise and availability of specialist financial institutions focused on these securities will help to streamline processes and increase market liquidity. Finally, the global expansion of capital markets, including the development of more sophisticated markets in emerging economies, will provide more opportunities for issuances.

This report provides a comprehensive overview of the convertible bond market, analyzing historical trends, identifying key driving forces and challenges, and projecting future growth. It offers detailed insights into key market segments, geographic regions, and leading players, providing valuable information for investors, issuers, and industry professionals seeking a thorough understanding of this dynamic and evolving financial instrument. The report's in-depth analysis aids in making well-informed strategic decisions within the convertible bond market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Morgan Stanley, Goldman Sachs, Merrill Lynch, Citibank, Evercore, Guggenheim Investments, Bank of America, Lazard, Moelis & Company, Deutsche Bank, Barclays, Credit Suisse Group, UBS Group, HSBC, BNP Paribas, Societe Generale, OAO Sberbank, Nomura Holdings, Daewoo Securities, CITIC Securities, CICC, China Securities, Huatai Securities, State Bank of India, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Convertible Bond," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Convertible Bond, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.