1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Research Outsourcing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Contract Research Outsourcing

Contract Research OutsourcingContract Research Outsourcing by Type (/> Regulatory Service, Medical Writing, Pharmacovigilance, Site Management Protocol, Clinical Trial Service, Clinical Data Management & Biometrics, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

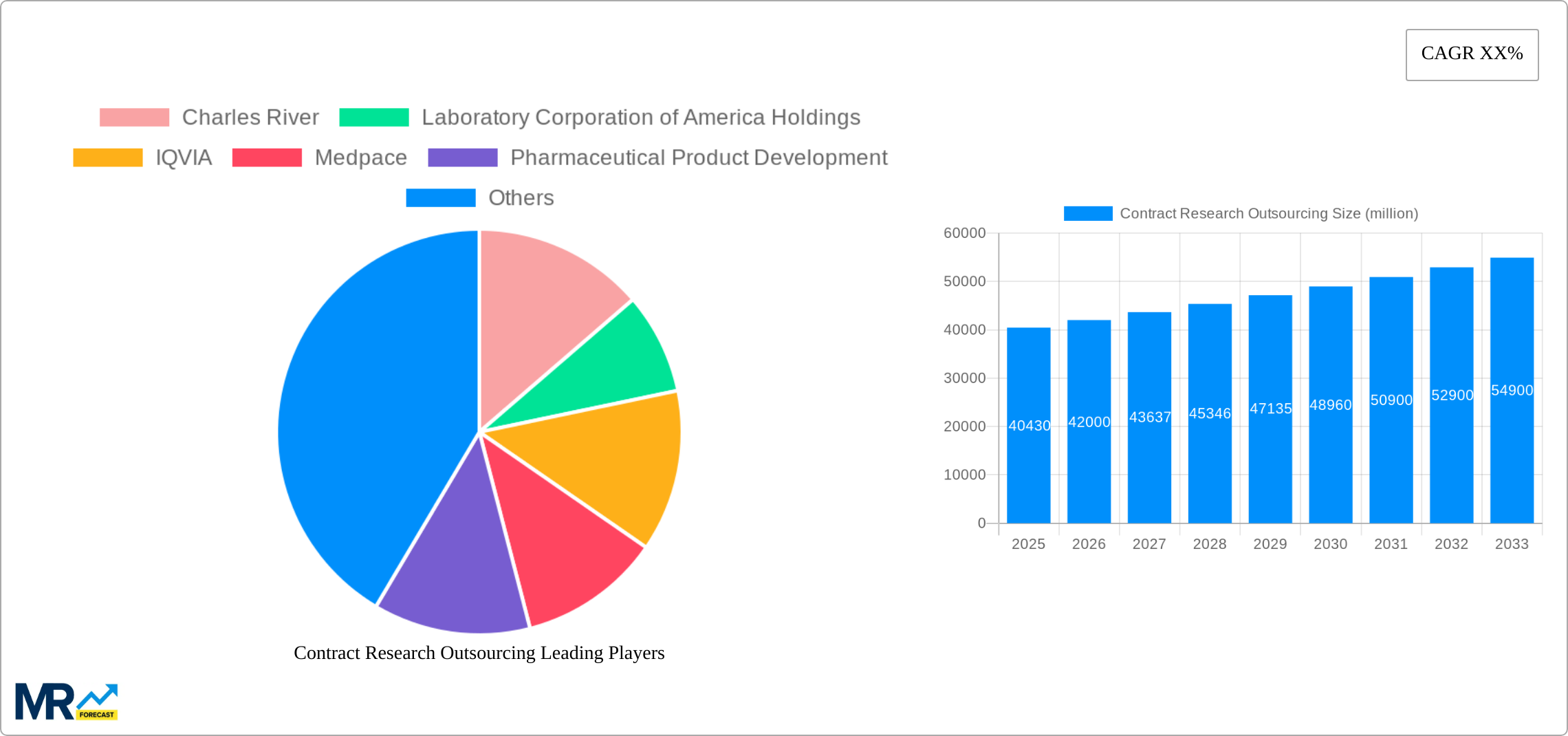

The Contract Research Organization (CRO) market, valued at $40.43 billion in 2025, is experiencing robust growth driven by several key factors. The increasing complexity of clinical trials, coupled with the rising demand for specialized services like medical writing and pharmacovigilance, fuels outsourcing to CROs. Pharmaceutical and biotechnology companies increasingly leverage CROs to streamline operations, reduce costs, and accelerate drug development timelines. This trend is amplified by the surge in innovative therapies, including biologics and cell therapies, which require specialized expertise and infrastructure. Furthermore, regulatory changes and evolving global healthcare landscapes are creating a more complex environment, driving the need for experienced CROs to navigate these challenges. Geographic expansion, particularly in emerging markets with growing healthcare expenditure and robust pharmaceutical industries, also contributes significantly to market growth. While some restraints might exist regarding data privacy concerns and maintaining consistent quality across globally dispersed operations, the overall market outlook remains positive.

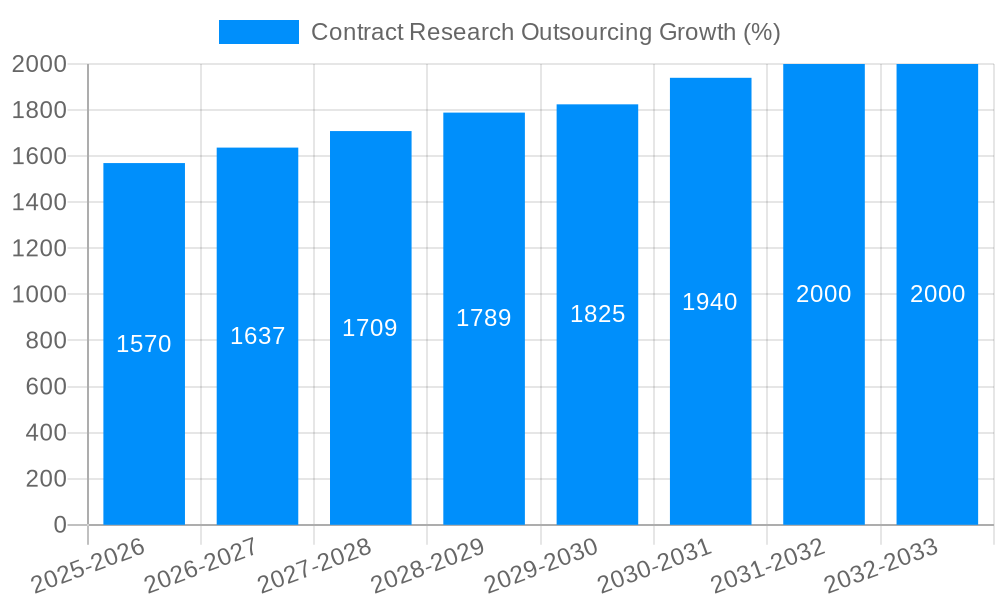

Growth is projected to continue based on market dynamics and established growth patterns within the industry. The diverse range of services offered by CROs, including clinical trial management, data management & biometrics, regulatory services and medical writing, ensures market resilience across various therapeutic areas. Major players like Charles River, IQVIA, and Syneos Health are actively investing in technological advancements like AI and machine learning to improve efficiency and data analysis, further propelling market expansion. Competition among established CROs and emerging players further drives innovation and enhances service offerings, benefiting pharmaceutical companies in their drug development endeavors. Regional growth is expected to vary, with North America and Europe maintaining significant market shares, while Asia-Pacific and other emerging markets demonstrate robust growth potential due to their burgeoning pharmaceutical sectors and increasing investment in healthcare infrastructure.

The Contract Research Outsourcing (CRO) market is experiencing robust growth, projected to reach several billion dollars by 2033. This expansion is driven by a confluence of factors, including the increasing complexity of drug development, the rising prevalence of chronic diseases fueling demand for new therapies, and a growing preference among pharmaceutical and biotechnology companies to outsource non-core functions. The historical period (2019-2024) witnessed a significant upswing, setting the stage for continued expansion during the forecast period (2025-2033). Key market insights reveal a strong preference for specialized services, with Clinical Trial Services and Clinical Data Management & Biometrics consistently holding significant market share. The estimated market value in 2025 is in the billions, indicating a healthy and mature market with substantial investment in technological advancements and infrastructure. This trend reflects the growing demand for efficiency, cost-effectiveness, and accelerated timelines in drug development. The market shows a strong preference for providers with global reach and proven expertise across various therapeutic areas, driving consolidation within the industry and the emergence of larger, more comprehensive CROs. Furthermore, the increasing adoption of technology, such as AI and machine learning in clinical trials, is streamlining processes and improving data analysis, further boosting market growth. Companies are actively seeking strategic partnerships and acquisitions to expand their service offerings and geographic reach, leading to a more competitive and dynamic market landscape.

Several key factors fuel the expansion of the CRO market. Firstly, the escalating cost of in-house drug development compels pharmaceutical and biotech firms to leverage external expertise, achieving cost optimization without compromising quality. This is especially true for smaller companies lacking the resources to establish comprehensive in-house capabilities. Secondly, the rising complexity of clinical trials, especially those involving advanced therapies and sophisticated data analysis, demands specialized skills and technological infrastructure often beyond the reach of individual companies. CROs provide access to a wide array of specialized services and experienced professionals, ensuring the successful execution of even the most challenging trials. Thirdly, the regulatory landscape continues to evolve, demanding rigorous compliance and expertise in navigating complex regulatory pathways. CROs offer invaluable support in navigating these complexities, ensuring adherence to international standards and minimizing the risk of delays or setbacks. Finally, the growing adoption of innovative technologies, such as AI and machine learning, are creating opportunities for CROs to offer enhanced data analysis, streamlined processes, and improved efficiency, further solidifying their crucial role in the drug development process.

Despite the significant growth, the CRO market faces challenges. Data security and privacy concerns remain paramount, particularly with the increasing reliance on electronic data capture and transmission. Maintaining data integrity and protecting sensitive patient information necessitates robust security measures and adherence to stringent regulations. Another significant challenge is ensuring consistent quality and standardization across geographically dispersed clinical trial sites, requiring effective communication, rigorous quality control, and meticulous project management. Competition among CROs is fierce, creating price pressures and necessitating continuous innovation and improvement to maintain a competitive edge. The regulatory landscape itself can present challenges, with constantly evolving guidelines and compliance requirements. Furthermore, managing global clinical trials involving diverse cultures and regulatory environments adds complexity to project management and necessitates cultural sensitivity and adaptive strategies. Finally, the availability of skilled professionals, especially in specialized areas like biostatistics and data management, can be a constraint, requiring CROs to invest heavily in recruitment and training programs.

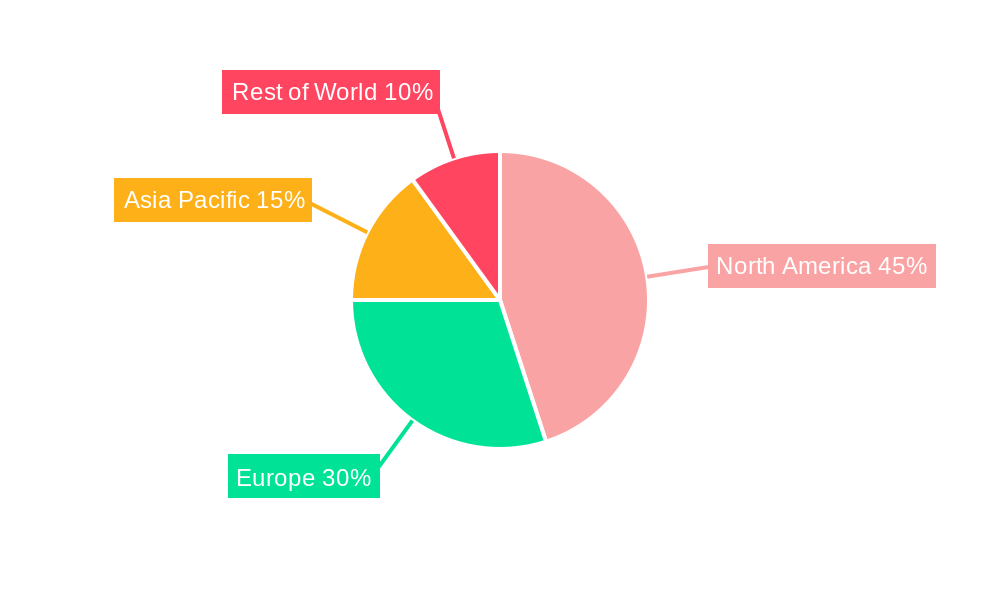

North America: This region is projected to maintain a dominant position due to the high concentration of pharmaceutical and biotechnology companies, well-established regulatory frameworks, and advanced healthcare infrastructure. The large number of clinical trials conducted in this region fuels demand for CRO services.

Europe: Europe represents a significant market, driven by a strong pharmaceutical industry and substantial investment in R&D. Stringent regulatory standards in Europe push for quality and expertise, further driving demand for CRO services.

Asia-Pacific: This region is expected to exhibit rapid growth, primarily fueled by increasing healthcare spending, a growing number of clinical trials, and a rise in outsourcing activities by pharmaceutical companies.

Clinical Trial Services: This segment is expected to retain a leading position, representing a substantial share of the market. The complexity and critical nature of clinical trials drive companies to seek expert assistance.

Clinical Data Management & Biometrics: This is a rapidly growing segment, benefiting from the increasing volume and complexity of data generated in clinical trials. The need for advanced analytical capabilities drives demand for specialized CRO services.

The dominance of North America and Europe is linked to established healthcare systems, regulatory frameworks, and the concentration of large pharmaceutical and biotechnology players. The Asia-Pacific region, while currently smaller, is projected to experience the fastest growth rate due to expanding healthcare infrastructure and a surge in clinical trials. Within segments, Clinical Trial Services and Clinical Data Management & Biometrics are leading the way due to their critical roles in the drug development process and the increasing complexity of data management and analysis. The other segments (Regulatory Services, Medical Writing, Pharmacovigilance, Site Management Protocol, and Other) also contribute significantly, but at a comparatively slower rate of growth compared to the aforementioned leading segments. The overall trend points to a continuation of these dominant regions and segments well into the forecast period.

The CRO market is experiencing significant growth due to the increasing outsourcing of research and development activities by pharmaceutical and biotechnology companies. This is driven by several factors, including cost savings, improved efficiency, and access to specialized expertise and technologies. The rising prevalence of chronic diseases is fueling demand for new therapies, creating further opportunities for CROs. Moreover, technological advancements, such as AI and machine learning, are improving the efficiency and effectiveness of clinical trials, creating new avenues for growth.

This report provides a detailed analysis of the Contract Research Outsourcing market, covering market size, growth drivers, challenges, key players, and future outlook. It offers valuable insights into emerging trends, such as the increasing use of technology and decentralized clinical trials, helping stakeholders make informed decisions. The report includes detailed segmentation by service type and geographic region, providing a comprehensive understanding of the market dynamics and competitive landscape. In addition, the report incorporates extensive data analysis to forecast market growth accurately over the forecast period and provide valuable insights for business planning and strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Charles River, Laboratory Corporation of America Holdings, IQVIA, Medpace, Pharmaceutical Product Development, Syneos Health, PAREXEL International Corporation, ICON plc, PRA Health Sciences, Envigo.

The market segments include Type.

The market size is estimated to be USD 40430 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Contract Research Outsourcing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Contract Research Outsourcing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.