1. What is the projected Compound Annual Growth Rate (CAGR) of the Container Loading and Unloading Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Container Loading and Unloading Service

Container Loading and Unloading ServiceContainer Loading and Unloading Service by Type (Container Unloading, Container Loading), by Application (Loading Dock, Logistics Center), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

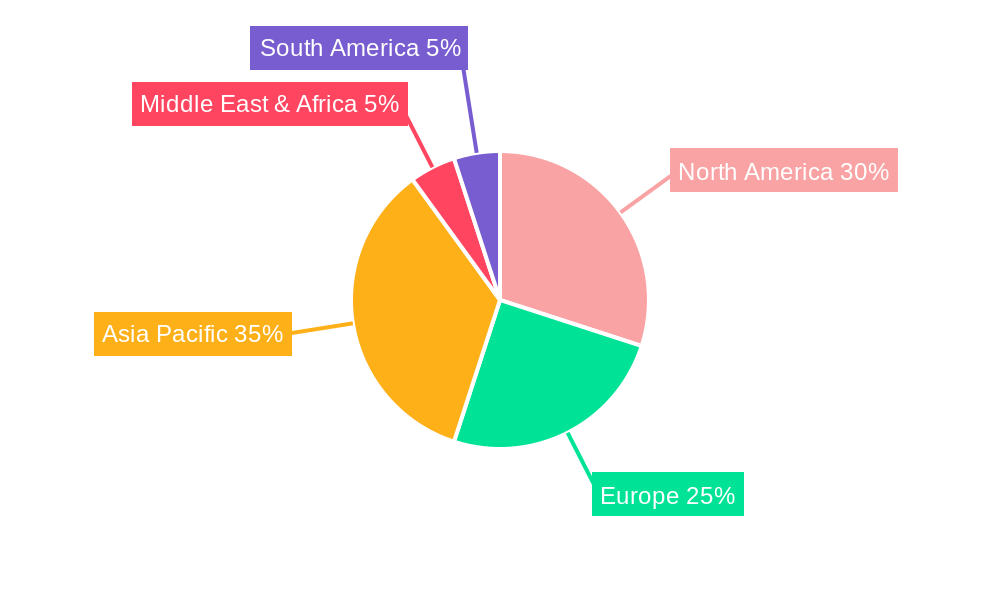

The global container loading and unloading service market, valued at approximately $7.04 billion in 2025, is experiencing robust growth fueled by the expansion of global trade and e-commerce. The increasing demand for efficient and reliable logistics solutions across various sectors, including manufacturing, retail, and distribution, is a primary driver. Technological advancements such as automated container handling systems and improved port infrastructure are further accelerating market expansion. Segmentation reveals a strong demand for services across both loading and unloading operations, with loading dock applications currently dominating, followed by logistics centers. This is likely due to the high volume of container handling within these locations and the need for specialized expertise to ensure efficient operations. The North American and Asia-Pacific regions are anticipated to hold significant market share owing to their established manufacturing hubs, bustling ports, and substantial e-commerce activities. However, fluctuating fuel prices, labor costs, and potential disruptions in global supply chains present challenges to consistent market growth. Nevertheless, the long-term outlook remains positive, driven by the sustained growth of global trade and continuous efforts toward supply chain optimization.

The competitive landscape features a mix of large multinational logistics providers and smaller regional companies catering to specific niches. Key players are focused on investing in innovative technologies, expanding their service offerings, and forging strategic partnerships to gain a competitive edge. Companies are emphasizing automation, data analytics, and optimized route planning to enhance efficiency and reduce operational costs. This focus on improved technology and process optimization is anticipated to continue, resulting in increased market consolidation and further growth in the sector. While specific regional growth rates are unavailable, it's reasonable to infer that regions experiencing high economic growth and robust import/export activities will witness faster expansion. Further market analysis would require a more granular understanding of the CAGR, which is missing from the provided data but is crucial for precise forecasting.

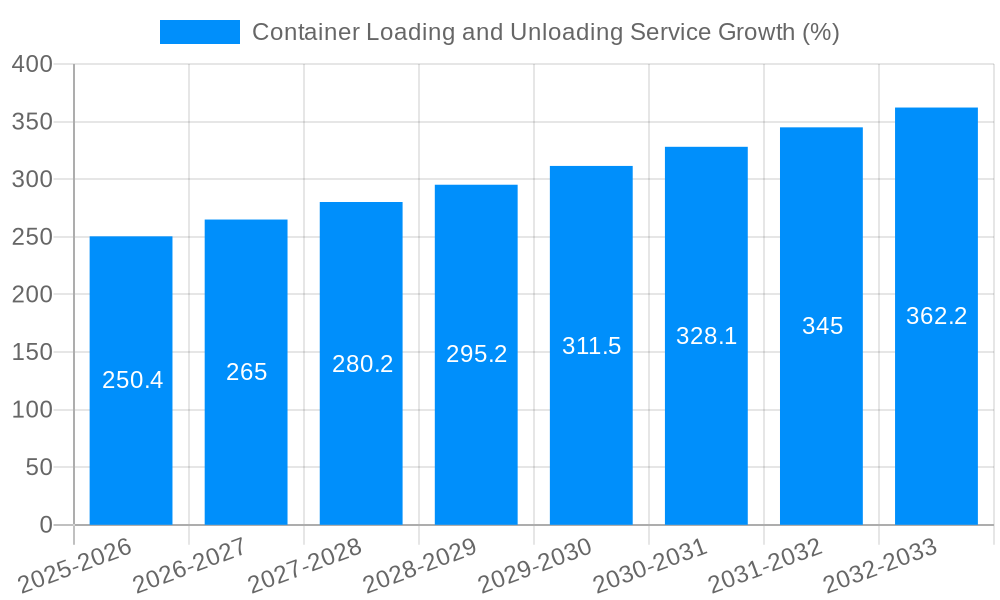

The global container loading and unloading service market exhibited robust growth during the historical period (2019-2024), exceeding USD 100 million in revenue by 2024. This expansion is projected to continue throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) exceeding 7% and reaching an estimated value surpassing USD 250 million by 2033. Several factors contribute to this growth trajectory. The increasing global trade volume necessitates efficient and reliable container handling solutions, driving demand for specialized services. The rise of e-commerce, with its associated surge in smaller shipments, creates a demand for flexible and scalable container loading and unloading services. Furthermore, technological advancements, such as automated guided vehicles (AGVs) and robotics, are streamlining operations and increasing efficiency, improving the overall cost-effectiveness and attractiveness of the market. The market is characterized by intense competition, with established players like Toll Group and newer entrants continually vying for market share. The fragmented nature of the market presents opportunities for consolidation and the emergence of larger, more integrated providers, offering complete supply chain management solutions. The preference for third-party logistics (3PL) providers is accelerating, as companies focus on core competencies while outsourcing non-core activities such as container handling. This trend is further bolstered by the increasing need for specialized handling of diverse cargo types, requiring expertise that many businesses lack in-house. Finally, regulations focusing on safety and environmental concerns are shaping the market by incentivizing the adoption of more sustainable practices and technologies in container handling.

The burgeoning global trade volume acts as a primary catalyst for the market's expansion. The continuous rise in international trade, driven by globalization and increased consumer demand, necessitates efficient and scalable container handling solutions. This demand is particularly pronounced in regions experiencing rapid economic growth, creating lucrative opportunities for service providers. The booming e-commerce sector significantly contributes to the market's growth, generating a high volume of smaller, time-sensitive shipments. E-commerce demands agile and responsive loading and unloading services to meet the speed and efficiency requirements of online retail. Technological advancements, including automated systems and data analytics, are revolutionizing the industry, enhancing productivity, optimizing workflows, and lowering operational costs. This automation allows for improved tracking, reduced errors, and faster turnaround times. Furthermore, the growing focus on supply chain optimization compels companies to outsource non-core functions like container handling to specialized providers. This trend leverages the expertise and economies of scale offered by 3PL providers, resulting in enhanced efficiency and cost savings for businesses. The increasing emphasis on efficient logistics and timely delivery further accentuates the demand for reliable and effective container handling services.

Despite the positive growth outlook, the container loading and unloading service market faces several challenges. Fluctuations in global trade volumes, influenced by geopolitical factors and economic downturns, pose a significant risk to market stability. Economic instability can lead to reduced shipping activity and subsequently affect demand for these services. Labor shortages and rising labor costs, particularly in key port cities, pose a significant operational constraint. Finding and retaining skilled workers to manage container handling is crucial, but labor costs can inflate overall service prices. Stringent regulations and compliance requirements, aimed at ensuring safety and environmental protection, add complexity and potentially increase operational expenses. Adherence to safety standards and environmental regulations can be costly and time-consuming. Intense competition from numerous established players and smaller independent operators contributes to price pressures and necessitates continuous innovation to maintain a competitive edge. The fragmented nature of the market can make it difficult for smaller players to compete with larger, more established companies. Finally, port congestion and infrastructure limitations, particularly in developing economies, can lead to delays and disrupt operations, affecting overall efficiency and customer satisfaction.

The Asia-Pacific region is projected to dominate the container loading and unloading service market during the forecast period. This dominance is primarily driven by the region's significant role in global manufacturing and trade, coupled with the rapid growth of e-commerce. China, in particular, is expected to remain a key market due to its massive port infrastructure and thriving manufacturing sector. North America and Europe are also expected to witness substantial growth, although at a slightly slower pace than the Asia-Pacific region. The growth in these regions is propelled by the continued expansion of e-commerce and the increasing demand for efficient logistics solutions.

Dominant Segment: The "Container Unloading" segment is anticipated to hold a larger market share compared to "Container Loading," driven by the greater complexity and potential for damage during unloading operations. This segment often necessitates specialized equipment and expertise for delicate or oversized cargo.

Dominant Application: Logistics centers are expected to dominate the application segment. These centers typically handle high volumes of containers requiring efficient loading and unloading processes, making them a crucial part of modern supply chains. Loading docks also play a significant role, but the centralized nature and scale of logistics centers drive higher demand.

The above factors make the combination of the Asia-Pacific region and the container unloading segment within logistics centers the most dominant sector of the market. The vast scale of operations, demand for specialized skills, and high volumes at logistics centers within this region will drive substantial growth.

Several factors are accelerating growth in this industry. The rising adoption of automation technologies, including robotics and AGVs, significantly improves efficiency and reduces labor costs. The increasing integration of data analytics and sophisticated software solutions optimizes supply chain operations, resulting in faster turnaround times and reduced errors. Furthermore, the ongoing trend towards outsourcing logistics functions to 3PL providers is boosting the market, as companies seek streamlined operations and cost savings. Finally, government initiatives to improve port infrastructure and streamline customs procedures facilitate faster container handling and overall smoother operations.

This report provides a detailed analysis of the container loading and unloading service market, encompassing market size, trends, growth drivers, challenges, and competitive landscape. It offers insights into key segments and regions, providing a comprehensive understanding of this dynamic sector. The report utilizes data from various sources, including industry reports, company filings, and government databases, to ensure accuracy and reliability. The report also includes forecasts for the future, helping businesses and investors make informed decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Wilkins Specialist Storage, Toll Group, Quick Cargo Service, Freight World, DGM, Apex Shipping Services, Labor Loop, Crating Unlimited, SDIC Yangpu Port Co., Ltd, Hero Moving Hawaii, Container Solutions, Mach Wings, West FBA, Equip Trucking, Tough Yakka, Lumper HQ, All Modes Transportation and Logistics, Bluebox Movers, .

The market segments include Type, Application.

The market size is estimated to be USD 7037 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Container Loading and Unloading Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Container Loading and Unloading Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.