1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Banking Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Consumer Banking Service

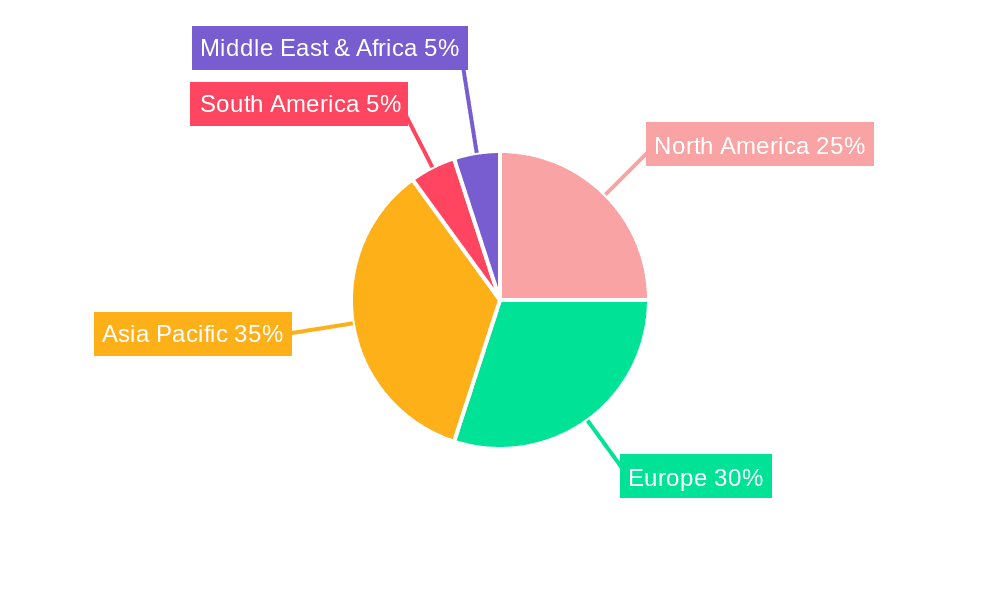

Consumer Banking ServiceConsumer Banking Service by Type (Traditional, Digital Led), by Application (Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

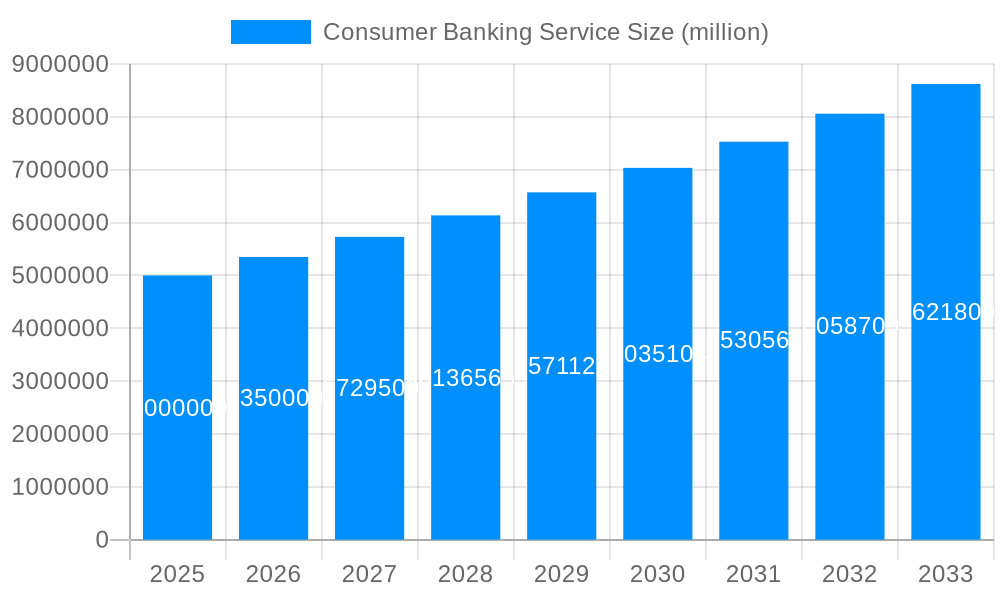

The global consumer banking services market is experiencing robust growth, driven by increasing digital adoption, expanding financial inclusion, and the rising demand for personalized financial solutions. The market, currently valued at approximately $5 trillion (estimated based on typical market sizes for related financial services), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7% between 2025 and 2033. This growth is fueled by several key factors, including the proliferation of mobile banking applications, the rise of fintech companies offering innovative banking products, and the increasing reliance on digital payment methods. Traditional banking services are being challenged by these disruptive forces, necessitating a strategic shift towards digitalization and enhanced customer experience. The segment showing the most significant growth is digital-led services, particularly in transactional accounts and mobile-first banking solutions. Geographically, North America and Europe currently dominate the market, but rapid growth is expected in Asia-Pacific regions driven by increasing smartphone penetration and burgeoning middle classes. However, challenges remain, including stringent regulatory requirements, cybersecurity threats, and the need to manage operational efficiency in the face of intense competition. The market’s future success hinges on the ability of banks to adapt to evolving customer needs and technological advancements.

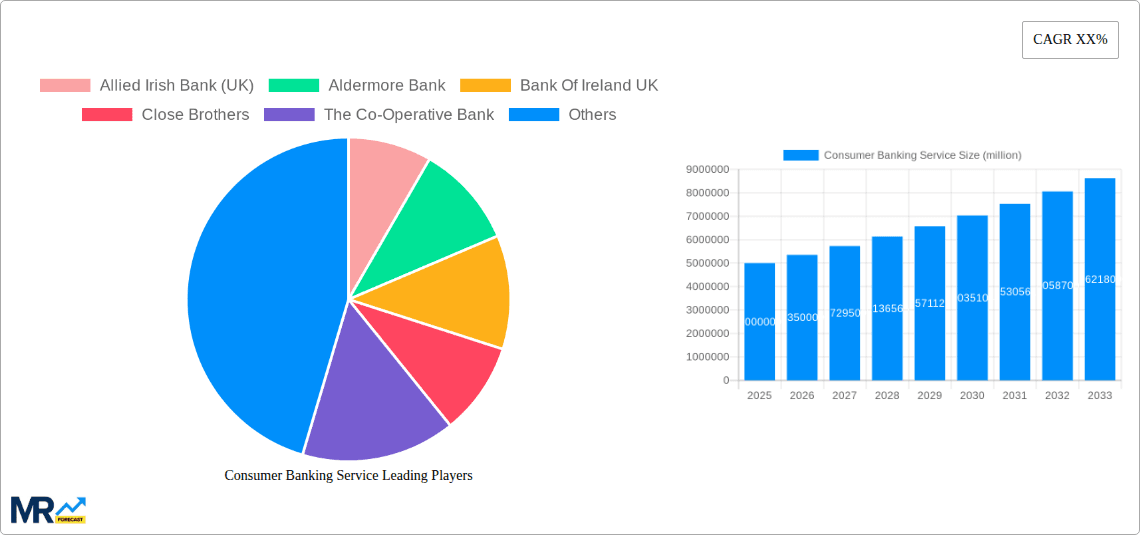

The competitive landscape is fiercely contested, with established players like Allied Irish Bank, Bank of Ireland UK, and TSB vying for market share alongside innovative fintech companies and challenger banks. To maintain a competitive edge, banks are investing heavily in technological infrastructure, enhancing data analytics capabilities, and implementing robust cybersecurity measures. Further segmentation reveals that transactional accounts and credit cards represent substantial revenue streams, while the growth of loans and other financial products is driven by consumer demand for personal finance management tools and access to credit. Successful players will be those that successfully integrate traditional banking services with innovative digital offerings, creating seamless and personalized customer experiences across all segments, from basic transactional accounts to sophisticated investment products. A crucial aspect will be the development of sophisticated fraud detection and risk management systems to ensure the security and stability of the digital banking ecosystem.

The UK consumer banking service market, valued at £XXX million in 2024, is poised for significant transformation over the forecast period (2025-2033). The historical period (2019-2024) witnessed a complex interplay of factors influencing growth, including shifting consumer preferences towards digital banking, increased regulatory scrutiny, and the emergence of fintech disruptors. The base year of 2025 provides a crucial benchmark for understanding future trends. This report projects robust growth, driven primarily by the increasing adoption of digital banking services across all demographics and the expansion of financial inclusion initiatives. However, challenges remain, including maintaining cybersecurity, managing customer data privacy, and adapting to evolving regulatory landscapes. The market is increasingly competitive, with established banks facing pressure from agile fintech companies offering specialized and personalized services. This competition is fostering innovation, leading to the development of more sophisticated and user-friendly banking applications and services. The rise of open banking is also reshaping the landscape, creating new opportunities for data-driven personalized offerings and collaborative partnerships. While traditional banking models continue to hold significant market share, the shift towards digital-led solutions is undeniable, leading to a hybrid model where both physical and digital channels coexist and complement each other. The demand for diverse financial products, encompassing transactional accounts, savings accounts, loans, and credit cards, will continue to fuel market expansion. Further, the growing adoption of mobile banking and contactless payments significantly impacts the transaction volumes and necessitates continuous technological advancements to enhance security and efficiency. Finally, the need for sustainable and ethical banking practices is gaining momentum, with consumers increasingly prioritizing banks demonstrating responsible lending and environmental commitment.

Several key factors are driving growth in the UK consumer banking service market. The rapid adoption of digital technologies is a major catalyst, with consumers increasingly favoring online and mobile banking for its convenience and accessibility. This digital shift is pushing banks to invest heavily in innovative technologies to enhance user experience, improve security, and offer personalized financial solutions. Furthermore, the expanding reach of financial inclusion programs aims to bring underserved populations into the formal banking system, adding a significant new segment to the market. Regulatory changes, while posing challenges, also indirectly drive innovation by encouraging banks to improve their services and enhance customer protection. The rising demand for specialized financial products, catering to diverse customer needs and preferences, is another significant driver. This includes tailored solutions for specific life stages, income levels, and risk profiles, leading to product diversification and market segmentation. Finally, the increasing awareness of personal finance management and the need for tailored financial advice creates opportunities for banks to expand their product offerings and provide value-added services to customers, enhancing customer loyalty and driving revenue growth.

Despite the growth potential, several challenges and restraints hinder the UK consumer banking service market. Maintaining robust cybersecurity measures in the face of increasingly sophisticated cyber threats is paramount. Data breaches and security vulnerabilities can severely damage a bank's reputation and erode customer trust, necessitating continuous investment in advanced security infrastructure and protocols. Meeting stringent regulatory requirements, including those related to data privacy (GDPR) and anti-money laundering (AML), presents significant operational and financial burdens for banks. Compliance costs can impact profitability, requiring strategic planning and resource allocation. Intense competition from both established banks and innovative fintech companies puts pressure on pricing and profitability margins. Banks must differentiate themselves through superior customer service, personalized offerings, and competitive pricing strategies to maintain market share. Economic downturns and fluctuations in interest rates can significantly impact lending activity and consumer spending patterns, influencing demand for various banking services. Finally, managing customer expectations in a rapidly evolving technological environment necessitates continuous innovation and adaptation, demanding significant investment in technology and human capital.

The UK consumer banking market is characterized by a diverse geographical spread of activity, with London and other major cities naturally showing higher concentration due to greater population density and financial hubs. However, the digital nature of many banking services reduces the significance of geographical limitations. The segment projected to dominate the market in the forecast period (2025-2033) is Digital-Led banking. This segment’s growth is fuelled by several key factors:

Within the Digital-Led segment, the application areas showing the strongest growth include Transactional Accounts and Savings Accounts. The shift towards digital platforms for everyday banking transactions is pronounced, with consumers embracing digital payment methods and online account management. The convenience and ease of managing savings digitally, along with the potential for higher interest rates offered by online-only banks, will continue to drive growth in digital savings accounts. While traditional banking models remain vital, especially for older demographics, the long-term trend clearly favors digital-led solutions, particularly among younger and tech-savvy consumers. The future of consumer banking in the UK points towards a hybrid model where both traditional and digital channels co-exist to cater to the diverse needs of a wider population.

Several factors are poised to catalyze growth within the UK consumer banking services sector. Firstly, continued investment in digital infrastructure and technological innovation will enhance the efficiency and accessibility of banking services. Secondly, the expanding adoption of open banking APIs fosters collaboration and innovation, leading to the development of personalized financial products and services. Finally, increasing financial literacy and awareness will empower consumers to make informed decisions regarding their financial well-being, leading to a growth in demand for a wider range of banking products.

This report provides a comprehensive overview of the UK consumer banking service market, incorporating historical data, current market trends, and future projections. It offers detailed insights into market segments, key players, driving forces, challenges, and growth catalysts. This in-depth analysis equips stakeholders with the information needed to make informed decisions and strategize for success in this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allied Irish Bank (UK), Aldermore Bank, Bank Of Ireland UK, Close Brothers, The Co-Operative Bank, Cybg (Clydesdale And Yorkshire Banks), First Direct, Handelsbanken, Masthaven Bank, Metro Bank, Onesavings Bank, Paragon Bank, Secure Trust Bank, Shawbrook Bank, TSB, Virgin Money, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Consumer Banking Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Consumer Banking Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.