1. What is the projected Compound Annual Growth Rate (CAGR) of the Console and Handheld Gaming Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Console and Handheld Gaming Software

Console and Handheld Gaming SoftwareConsole and Handheld Gaming Software by Type (/> Console Gaming, Handheld Gaming), by Application (/> Professional, Amateur), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

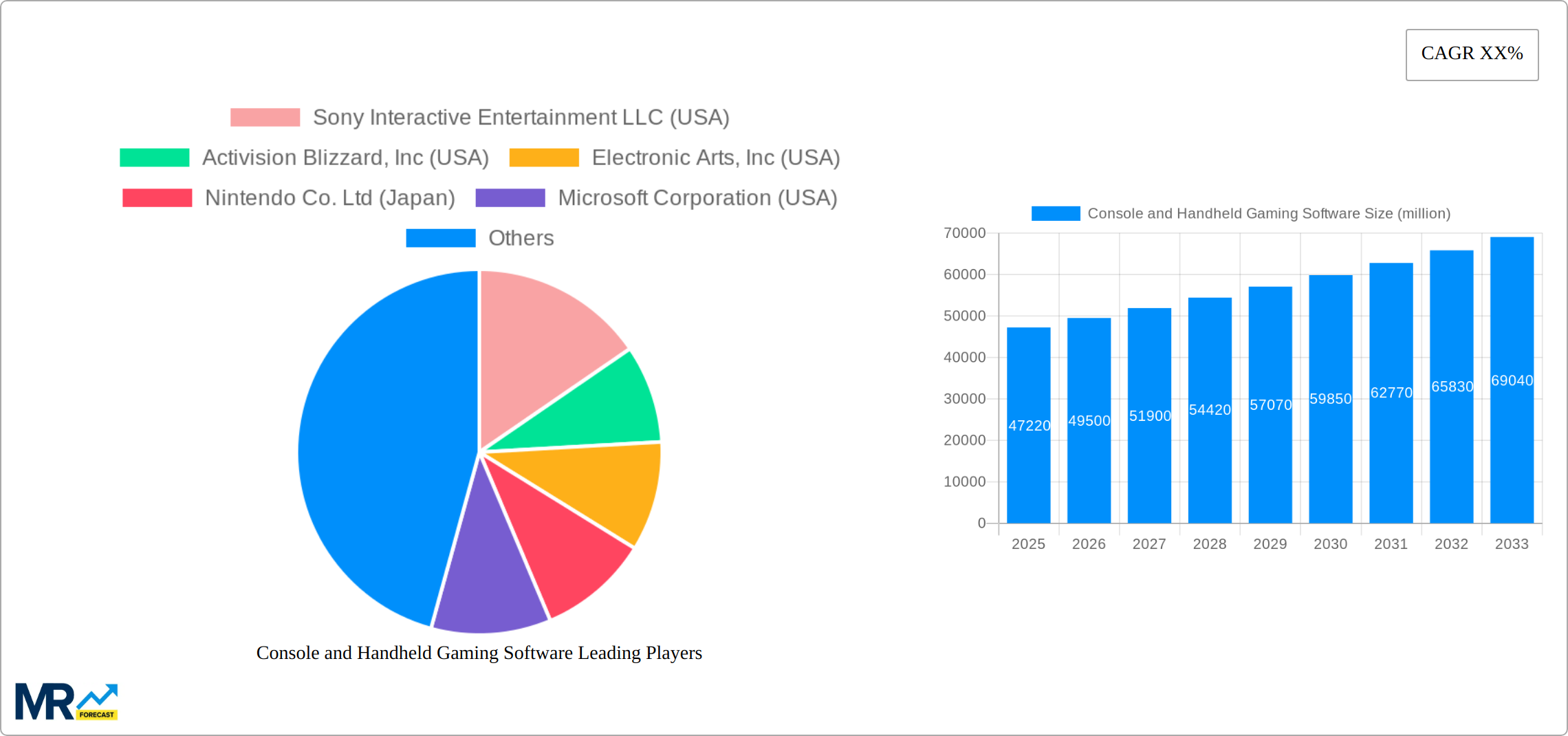

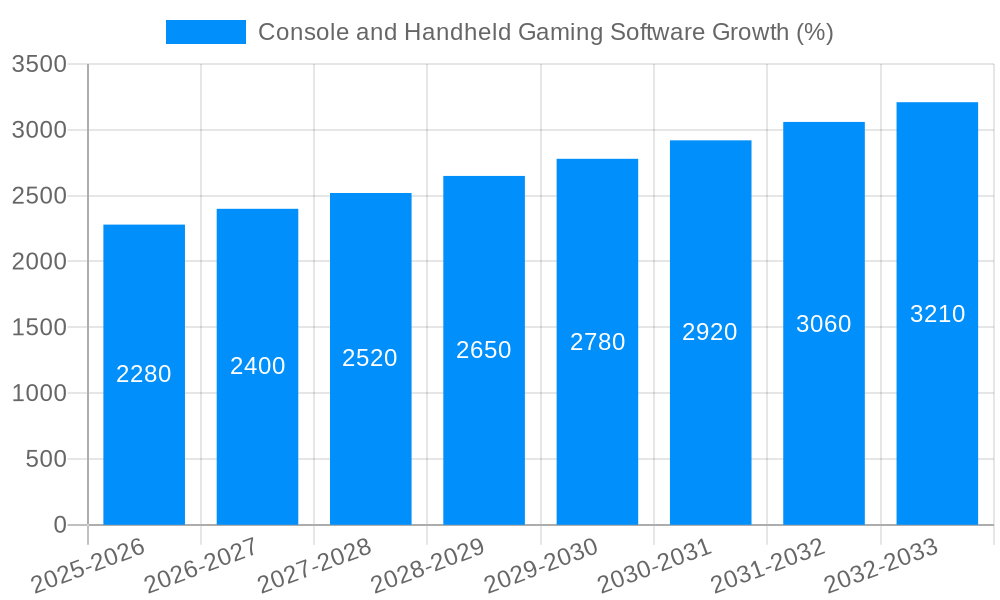

The console and handheld gaming software market, valued at $47.22 billion in 2025, is poised for substantial growth. Driven by factors such as the increasing affordability of high-performance consoles and handheld devices, the rise of esports, and the continuous innovation in game design and immersive technologies like VR and AR, this market is expected to experience significant expansion over the next decade. The increasing popularity of subscription-based gaming services and cloud gaming platforms further fuels this growth. Competition among major players like Sony, Microsoft, Nintendo, and Electronic Arts remains fierce, leading to a constant push for higher-quality graphics, engaging storylines, and innovative gameplay mechanics. This competitive landscape benefits consumers with a wider variety of games and platforms to choose from.

Despite the positive outlook, challenges exist. The market is susceptible to economic downturns, as discretionary spending on entertainment is often the first to be cut. Furthermore, the development of high-quality games is expensive and time-consuming, creating a barrier to entry for smaller developers and potentially leading to longer release cycles for major titles. However, the continued adoption of mobile gaming and the expansion into emerging markets are expected to mitigate some of these risks. The industry's reliance on technological advancements also poses a challenge; maintaining relevance requires constant adaptation and innovation to keep up with evolving consumer preferences and technological capabilities. The forecast indicates a promising future for the console and handheld gaming software market, with sustained growth fueled by technological advancements and evolving consumer demands. However, careful navigation of economic volatility and competitive pressures will be crucial for long-term success.

The console and handheld gaming software market experienced robust growth between 2019 and 2024, driven by technological advancements, the rise of esports, and an expanding global gaming community. The historical period (2019-2024) saw an average annual growth rate exceeding 10%, with sales exceeding 500 million units in 2024 alone. This upward trajectory is expected to continue, albeit at a slightly moderated pace, throughout the forecast period (2025-2033). The estimated market size for 2025 stands at approximately 650 million units, projecting to surpass 1 billion units by 2033. Key trends include the increasing popularity of subscription services like Xbox Game Pass and PlayStation Plus, a shift towards cloud gaming, and the continued evolution of game genres, with titles incorporating advanced graphics, immersive storytelling, and robust online multiplayer features. The rise of mobile gaming, while technically a separate segment, exerts significant influence, impacting the design and distribution strategies of console and handheld developers. Furthermore, the blurring lines between traditional gaming platforms and mobile devices present both opportunities and challenges for established players. The market is also witnessing the diversification of gaming content, with a rising demand for independent and AA titles alongside AAA blockbuster releases. This diversity is attracting a broader audience and driving further market expansion.

Several factors are fueling the expansion of the console and handheld gaming software market. Technological advancements, including enhanced processing power, improved graphics capabilities, and the proliferation of high-speed internet access, are significantly impacting game quality and accessibility. The rising popularity of esports and competitive gaming contributes to increased engagement and a wider appeal, driving both software sales and demand for high-performance hardware. The expansion of the global gaming community, particularly in emerging markets, presents significant growth opportunities. Furthermore, the continuous innovation in game design and storytelling captivates a broader audience, pushing beyond traditional demographics and fostering long-term player engagement. The affordability of consoles and handheld devices, combined with flexible subscription models, enhances market penetration, especially among younger demographics. Finally, the growing integration of mobile gaming elements into console and handheld titles caters to evolving player preferences and contributes to market diversification.

Despite significant growth potential, the console and handheld gaming software market faces several challenges. The high development costs associated with AAA titles create a barrier to entry for smaller studios, potentially stifling innovation and diversity. The cyclical nature of the gaming industry, with peak sales tied to major game releases, presents revenue volatility for developers and publishers. Increasing competition from mobile gaming and other forms of entertainment requires continuous innovation and adaptation to maintain market share. The digital distribution of games, while offering convenience, also presents challenges related to piracy and content protection. Furthermore, regulatory hurdles and regional differences in gaming preferences and legal frameworks can impact global market penetration. Lastly, evolving consumer preferences necessitate constant adaptation in game design and marketing strategies to remain relevant and attract new players.

Segments:

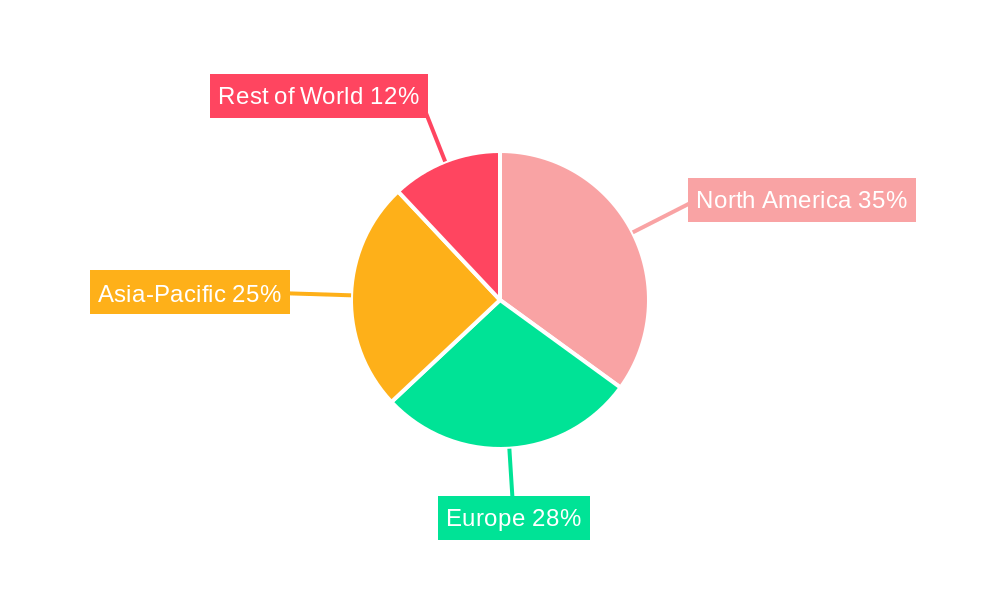

The combination of North America's established market strength and Asia's rapid expansion indicates a future where these regions will maintain dominance within the gaming software sector. The rising success of independent games, coupled with the transformative impact of subscription services, suggests a dynamic market poised for considerable future evolution.

The industry's growth is further fueled by the increasing affordability of hardware, the expansion of high-speed internet access globally enabling seamless online gameplay, and the continuous innovation in game mechanics and virtual reality (VR) technology, all contributing to a more immersive and engaging gaming experience.

This report provides a comprehensive overview of the console and handheld gaming software market, covering historical data, current trends, and future projections. It analyzes key market drivers and challenges, examines dominant regions and segments, identifies leading players, and highlights significant industry developments. The detailed analysis is geared toward informing strategic decisions for industry stakeholders, ranging from game developers and publishers to investors and technology providers. The forecast extends to 2033, providing a long-term perspective on market evolution and potential opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sony Interactive Entertainment LLC (USA), Activision Blizzard, Inc (USA), Electronic Arts, Inc (USA), Nintendo Co. Ltd (Japan), Microsoft Corporation (USA), Ubi Soft Entertainment S.A (France), Crystal Dynamics, Inc (USA), Giant Sparrow (USA), Kojima Productions Co., Ltd (Japan), Next Level Games Inc (Canada), Playground Games (UK), Respawn Entertainment, LLC (USA), Infinite Fall (USA), Bethesda Game Studios (USA), Guerrilla B.V (The Netherlands), Mercury Steam Entertainment (Spain).

The market segments include Type, Application.

The market size is estimated to be USD 47220 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Console and Handheld Gaming Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Console and Handheld Gaming Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.