1. What is the projected Compound Annual Growth Rate (CAGR) of the Commodity Index Funds?

The projected CAGR is approximately XX%.

Commodity Index Funds

Commodity Index FundsCommodity Index Funds by Application (Personal Finance, Corporate Investment, Risk Management), by Type (Precious Metal Index Fund, Agricultural Index Fund, Base Metal Index Fund, Energy Index Fund), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

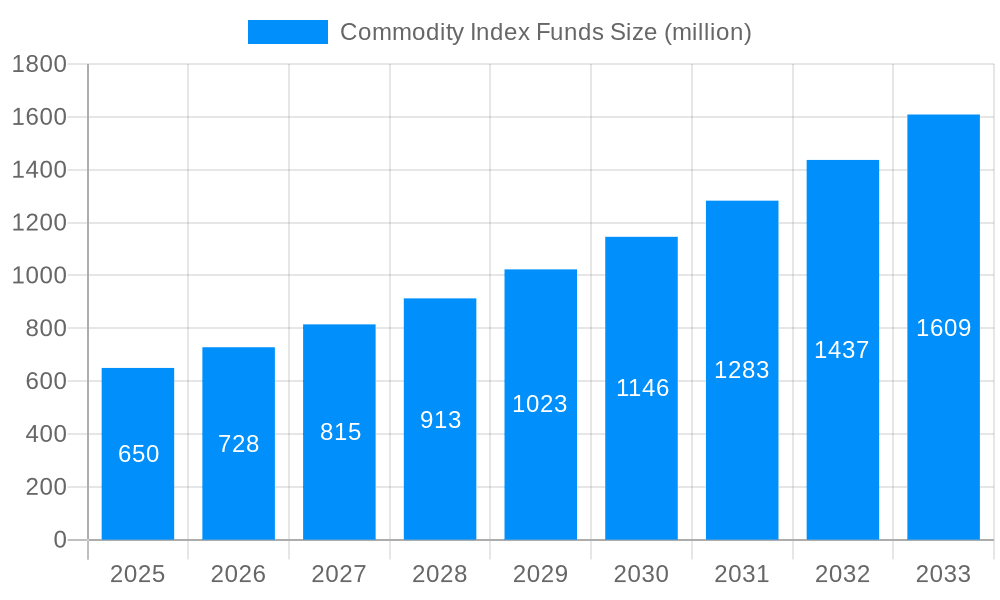

The global Commodity Index Funds market is poised for significant expansion, projected to reach an estimated market size of approximately $650 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 12% anticipated throughout the forecast period extending to 2033. This growth is primarily fueled by increasing investor demand for diversified portfolios and a hedge against inflation, particularly in volatile economic climates. The persistent pursuit of stable returns and the inherent appeal of commodities as a tangible asset class are driving this upward trajectory. Key drivers include heightened institutional investor participation, the growing adoption of passive investment strategies, and the increasing complexity of global financial markets that necessitate broad-based exposure. Applications such as corporate investment and risk management are seeing substantial uptake, as businesses and financial institutions leverage these funds to mitigate exposure to fluctuations in raw material prices and geopolitical uncertainties. The Precious Metal Index Fund segment, in particular, is expected to witness strong performance due to its traditional role as a safe-haven asset.

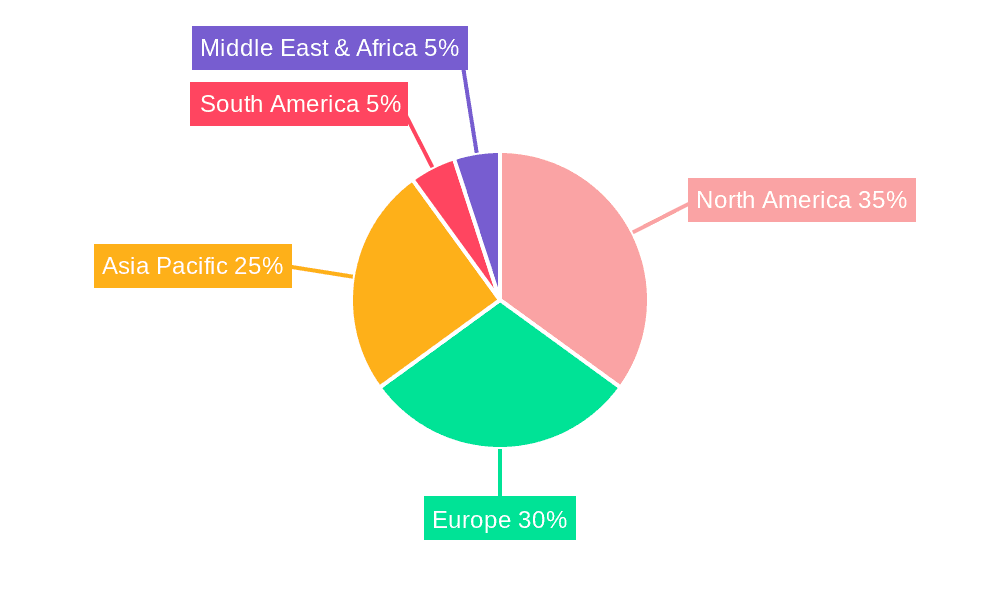

The market's expansion is further propelled by ongoing innovation in product offerings, with a greater variety of index fund types emerging to cater to specific investor needs and risk appetites. While the market presents a promising outlook, certain restraints could temper its growth. These include regulatory complexities in different jurisdictions, potential volatility in commodity prices themselves, and a lack of widespread investor education regarding the intricacies of commodity index investing. However, the overarching trend towards portfolio diversification and the need for inflation-hedging solutions are expected to outweigh these challenges. Asia Pacific, led by China and India, is emerging as a significant growth engine, mirroring the rapid economic development and increasing investment sophistication in the region. North America and Europe continue to be mature markets with substantial investor bases, while emerging markets in the Middle East and Africa present untapped potential.

The global commodity index funds market is poised for substantial expansion, projected to witness a compound annual growth rate (CAGR) of approximately 7.5% from 2019 to 2033, reaching an estimated value of over $850 million by 2025. This growth is fueled by increasing investor appetite for diversification and a hedge against inflation, particularly as we transition through the forecast period from 2025 to 2033. The historical period of 2019-2024 laid the groundwork for this upward trajectory, demonstrating a steady, albeit sometimes volatile, interest in commodity-linked investments. As the market matures, we anticipate a heightened focus on specialized index funds, catering to specific investor needs within precious metals, agricultural products, base metals, and energy commodities. The estimated market size for 2025 hovers around $700 million, with a projected climb to over $1 billion by 2033. This trend is indicative of a broader shift in investment strategies, where investors are increasingly recognizing the intrinsic value and portfolio-enhancing capabilities of commodities beyond traditional equities and bonds. The inherent diversification benefits offered by commodity index funds are becoming more pronounced, especially during periods of economic uncertainty and geopolitical instability, which have been recurring themes throughout the historical period. The convenience and accessibility of index funds, particularly through providers like BlackRock and Invesco, further contribute to their growing popularity among both institutional and retail investors. The ability to gain broad exposure to a basket of commodities with a single investment vehicle simplifies portfolio management and reduces the complexity associated with direct commodity trading. Furthermore, the development of innovative financial instruments and improved regulatory frameworks are expected to foster a more robust and transparent market for commodity index funds. The increasing adoption of technology in financial services is also playing a crucial role in democratizing access to these investment products, making them available to a wider range of investors.

XXX - Key market insights reveal a growing demand for commodity index funds as a strategic asset allocation tool. The historical period (2019-2024) has seen a heightened awareness of inflation's impact on purchasing power, driving investors towards commodities as a potential inflation hedge. This trend is expected to intensify in the forecast period (2025-2033). The estimated market size for 2025 is approximately $700 million, with projections indicating a significant increase to over $850 million by 2033. This growth is underpinned by the increasing sophistication of investment strategies, particularly within the corporate investment and risk management segments. The convenience of diversified exposure offered by index funds, compared to direct commodity investment, is a significant draw. For instance, the popularity of iShares and Invesco's offerings highlights the demand for easily accessible commodity exposure. We foresee a continued trend towards thematic commodity index funds, focusing on areas like energy transition metals or sustainable agriculture, reflecting evolving global economic priorities. The base year of 2025 is crucial as it represents a point of significant inflection where the market is expected to accelerate its expansion. The interplay between macroeconomic factors, such as interest rate movements and geopolitical events, and commodity price volatility will continue to shape investor sentiment and investment flows into these funds. The report will delve into the specific drivers and challenges influencing this market, providing a nuanced understanding of its future trajectory.

Several powerful forces are propelling the growth of the commodity index funds market. A primary driver is the persistent global inflation concerns. As economies grapple with rising prices, investors increasingly turn to commodities as a potential hedge against the erosion of purchasing power. This trend is amplified by the diversification benefits that commodity index funds offer. By providing exposure to a broad spectrum of commodities such as precious metals, agricultural products, base metals, and energy, these funds help investors mitigate portfolio risk by reducing correlation with traditional asset classes like stocks and bonds. This is particularly relevant for corporate investment strategies aiming to protect capital and for personal finance portfolios seeking long-term stability. Furthermore, the growing accessibility and liquidity of commodity index funds, facilitated by major players like BlackRock and Invesco, have made them more attractive to a wider investor base. The ease of investment through exchange-traded funds (ETFs) and similar vehicles democratizes access to commodity markets, which were historically more challenging for individual investors to navigate. The increasing sophistication of risk management strategies within financial institutions also contributes to this growth, as commodity exposure can serve as a vital component in hedging against unforeseen economic shocks and supply chain disruptions. The demand for specific commodity segments, such as those supporting the energy transition (e.g., copper, lithium), is also a significant propellant, driving innovation in index fund creation.

Despite the optimistic outlook, the commodity index funds market faces several challenges and restraints. Volatility inherent in commodity markets is a significant concern for many investors. Fluctuations in prices, often driven by geopolitical events, weather patterns, and supply-demand dynamics, can lead to substantial short-term losses, deterring risk-averse investors. The complexity of some commodity markets and the potential for contango and backwardation in futures contracts can also be difficult for retail investors to understand, necessitating thorough research and potentially professional guidance. Regulatory scrutiny and evolving compliance requirements across different jurisdictions can also pose hurdles, impacting the ease of offering and investing in these funds globally. The operational costs associated with managing commodity index funds, particularly those involving physical commodities or complex futures strategies, can also affect their overall returns. Moreover, the increasing correlation between commodity prices and broader market movements during certain periods can diminish their diversification benefits, leading investors to question their efficacy as pure inflation hedges. Competition from other alternative investment vehicles and the emergence of more direct investment opportunities in specific commodities could also fragment the market. The potential for market manipulation, though less prevalent in diversified index funds, remains a background concern for some asset classes within the commodity space.

The North America region, particularly the United States, is poised to dominate the commodity index funds market. This dominance stems from several factors, including a highly developed financial infrastructure, a large pool of institutional and retail investors with a keen interest in diversification, and a robust regulatory framework that supports the growth of exchange-traded products. The presence of leading financial institutions and asset managers like BlackRock, Invesco, and ProShares, headquartered in this region, further solidifies its leadership.

Within the broader market, the Energy Index Fund segment is expected to exhibit significant dominance, driven by the global reliance on energy resources and the ongoing transition towards new energy technologies. This segment includes exposure to crude oil, natural gas, and other energy derivatives. The inherent volatility and significant price swings in energy markets often attract investors seeking potential high returns, albeit with commensurate risks. The sheer scale of the global energy market and its pivotal role in industrial production and daily life ensure consistent investor interest.

Another segment poised for significant growth and potential dominance, particularly in the medium to long term, is the Precious Metal Index Fund. These funds, typically tracking indices for gold, silver, and platinum, are highly sought after during periods of economic uncertainty and inflation. Their perceived status as a safe-haven asset makes them a perpetual favorite for risk-averse investors and those looking to preserve capital. The growing awareness of wealth preservation strategies in personal finance, coupled with their use in corporate investment portfolios as a hedge against currency depreciation, bolsters their market share.

In terms of application, Corporate Investment is anticipated to be a key driver of market growth. Large corporations often utilize commodity index funds as part of their hedging strategies to manage price risks associated with raw material procurement or to diversify their treasury operations. The need to manage exposure to volatile commodity prices, especially for companies in manufacturing, agriculture, and energy sectors, makes these funds an indispensable tool. The estimated market size for corporate investment-driven commodity index fund allocations is substantial, often measured in hundreds of millions of dollars annually.

Furthermore, Risk Management as an application is intrinsically linked to the growth of commodity index funds. Sophisticated risk management frameworks within financial institutions increasingly incorporate commodity exposure to mitigate systemic risks and hedge against inflation. This strategic allocation allows businesses to better navigate unpredictable economic landscapes. The demand for instruments that can offer a predictable correlation to inflation or specific asset classes makes commodity index funds a vital component of robust risk management protocols.

The Base Metal Index Fund segment is also expected to see substantial growth, driven by industrial demand and the increasing focus on metals crucial for technological advancements and the green energy transition. Metals like copper, aluminum, and nickel are fundamental to infrastructure development, manufacturing, and renewable energy technologies, making these funds attractive for long-term growth-oriented investment strategies.

Several catalysts are accelerating the growth of the commodity index funds industry. The persistent global inflation and concerns over currency devaluation are making commodities an attractive inflation hedge. The ongoing energy transition is spurring demand for specific metals like copper and lithium, creating opportunities for specialized index funds. Furthermore, the increasing demand for diversification among investors, seeking to reduce portfolio risk and enhance returns, is a significant growth driver. Technological advancements in financial services are also enhancing accessibility and transparency, making these funds more appealing to a broader investor base.

This report offers a comprehensive analysis of the commodity index funds market, providing in-depth insights into its current state and future trajectory. It covers a detailed study period from 2019 to 2033, with a base year of 2025, and includes historical analysis from 2019 to 2024. The report delves into the key drivers, such as inflation hedging and portfolio diversification, as well as the challenges, including market volatility and regulatory complexities. It identifies the dominant regions and segments, highlighting the significant role of North America and the Energy and Precious Metal Index Funds. Furthermore, the report profiles leading players like BlackRock and Invesco and outlines significant industry developments, offering a holistic view of this dynamic market for corporate investment, personal finance, and risk management applications.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

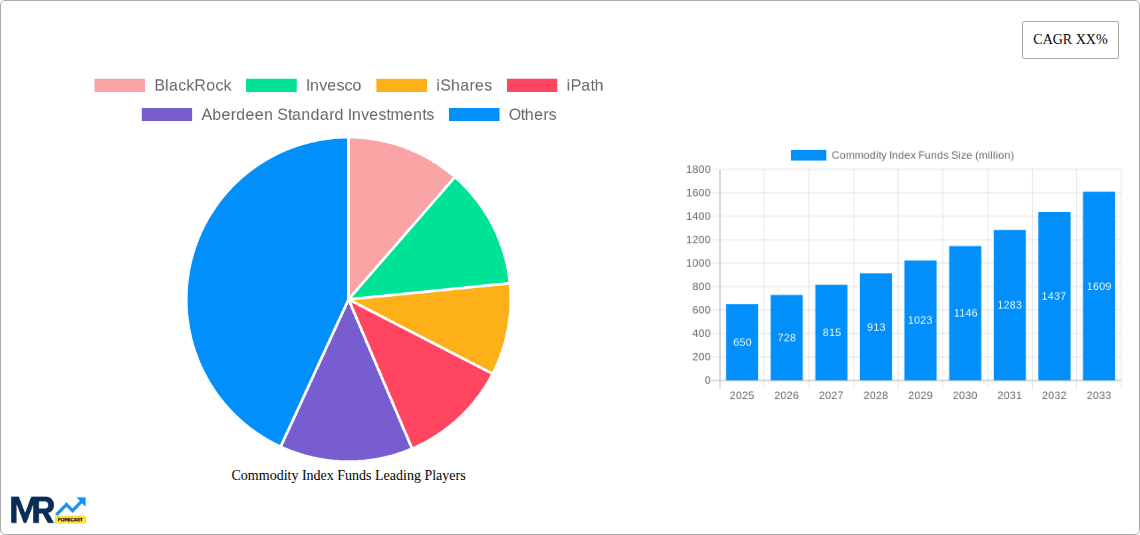

Key companies in the market include BlackRock, Invesco, iShares, iPath, Aberdeen Standard Investments, First Trust, WisdomTree Investments, GraniteShares, China Merchants Fund, UBS ETRACS, ProShares, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Commodity Index Funds," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commodity Index Funds, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.