1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Storage Crypto Wallets?

The projected CAGR is approximately 15.2%.

Cold Storage Crypto Wallets

Cold Storage Crypto WalletsCold Storage Crypto Wallets by Type (USB Connectivity Type, Bluetooth Connectivity Type, NFC Connectivity), by Application (Individual, Professionals/Business), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

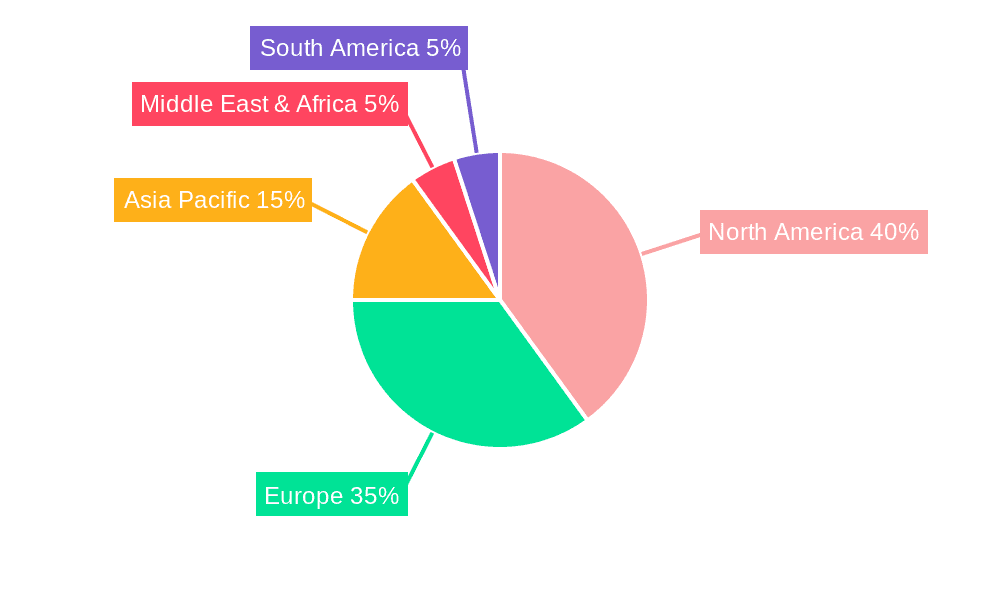

The global cold storage cryptocurrency wallet market is projected for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 15.2%. In the base year of 2024, the market was valued at approximately $3.5 billion. This expansion is primarily driven by the escalating adoption of cryptocurrencies and heightened concerns regarding the security vulnerabilities of exchange-based storage. Key factors propelling this market include the increasing sophistication of cyberattacks on cryptocurrency exchanges, prompting users to opt for the superior security of offline storage solutions. Furthermore, the growing institutional investment in digital assets necessitates secure and auditable storage, thereby increasing demand for cold storage wallets. The market is segmented by connectivity types, including USB, Bluetooth, and NFC, and by application, serving individual users and professional/business entities. While USB connectivity currently leads due to its established reliability, Bluetooth and NFC are gaining prominence for their user convenience, especially among individual users. Geographically, North America and Europe currently dominate, owing to high cryptocurrency ownership and advanced technological infrastructure. However, the Asia-Pacific region, particularly economies like India and China, presents significant future growth potential. The competitive landscape is dynamic, with established leaders like Ledger and Trezor facing competition from emerging players offering innovative features and competitive pricing. Future market development will be contingent on technological advancements, regulatory clarity, and enhanced consumer awareness of secure cryptocurrency storage importance.

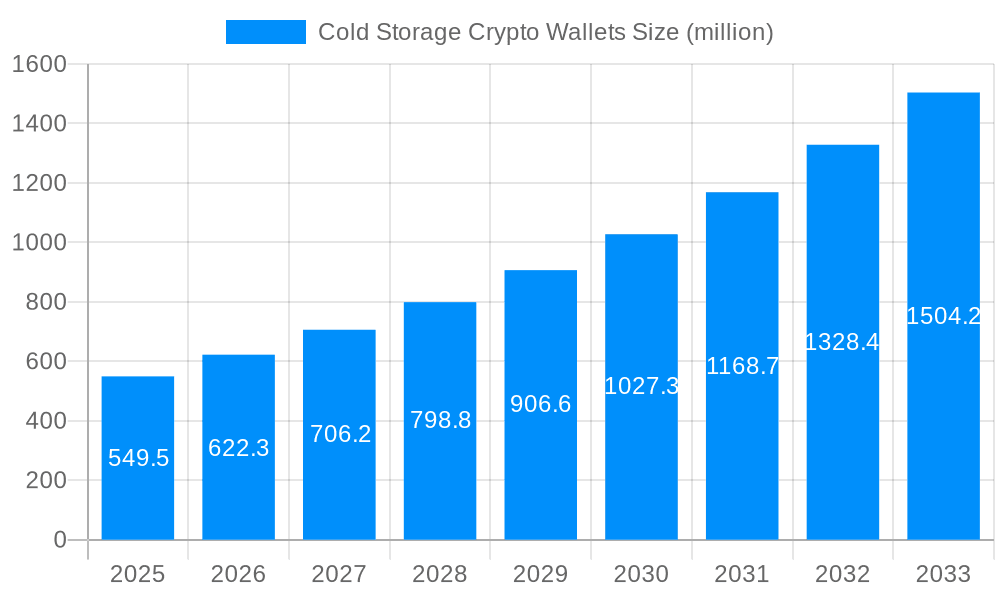

The forecast period, spanning from 2025 to 2033, anticipates sustained market expansion. This growth will be further fueled by increasing institutional investment in digital assets, the development of more intuitive user interfaces for cold storage wallets, and the integration of advanced security measures such as biometric authentication. Despite potential challenges, including the initial cost of some cold storage solutions and the risk of user error leading to key loss, the overall market trajectory indicates strong and consistent growth. Market consolidation is expected, with larger entities potentially acquiring smaller firms to broaden their market presence and product offerings. The advent of emerging technologies, such as quantum-resistant cryptography, will also play a pivotal role in shaping the future of the cold storage cryptocurrency wallet market.

The cold storage crypto wallet market, valued at USD 250 million in 2025, is poised for significant growth, projected to reach USD 1.2 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR). This surge is fueled by increasing cryptocurrency adoption, escalating concerns over security breaches affecting hot wallets, and the rising demand for robust security solutions among both individual investors and institutional players. The market demonstrates a clear preference for hardware wallets, driven by their superior security compared to software-based alternatives. This preference is translating into substantial investments in research and development, leading to innovative features like advanced encryption, multi-signature support, and biometric authentication. The market is witnessing a shift towards user-friendly interfaces and improved ease of use, particularly aimed at broadening accessibility for less tech-savvy individuals. Furthermore, the market is segmented by connectivity type (USB, Bluetooth, NFC), application (individual, professional/business), and geographical distribution. The increasing integration of cold storage wallets into decentralized finance (DeFi) applications and institutional-grade custody solutions is also a primary driver of market expansion. However, the market also faces challenges, including the relatively high initial cost of hardware wallets compared to software solutions and the potential for physical loss or damage. Despite these hurdles, the overall outlook for cold storage crypto wallets remains exceptionally positive, driven by the fundamental need for secure cryptocurrency storage in a constantly evolving digital landscape. The growing adoption of blockchain technology across multiple industries further contributes to the escalating demand for robust and secure wallet solutions.

Several factors are accelerating the growth of the cold storage crypto wallet market. The foremost is the rising frequency and severity of cryptocurrency hacks and thefts targeting hot wallets. The financial losses incurred through such breaches are significant, pushing both individuals and institutions to seek the enhanced security offered by offline storage. The increasing sophistication of cyberattacks further underscores the need for robust, offline security solutions. Secondly, the growing institutional adoption of cryptocurrencies is a crucial driver. As large financial institutions and corporations invest in digital assets, they prioritize security and regulatory compliance, making cold storage wallets a preferred choice for safekeeping large volumes of cryptocurrency. Simultaneously, the increasing complexity of cryptocurrency management, especially for users handling multiple digital assets, fuels demand for user-friendly yet secure hardware wallets. The development of advanced features such as biometric authentication and multi-signature functionality enhances the security and usability of these wallets, making them more appealing to a broader user base. Finally, the rising awareness of cryptocurrency scams and phishing attempts is contributing to the demand for secure storage solutions. Individuals are increasingly recognizing the importance of safeguarding their digital assets from potential threats, and cold storage wallets offer a reliable safeguard against these risks.

Despite the promising outlook, the cold storage crypto wallet market encounters several hurdles. The primary challenge is the relatively high cost of hardware wallets compared to software-based options. This price point can be a barrier to entry for less affluent individuals and smaller businesses. Another constraint is the inherent risk of physical loss or damage to the physical hardware wallet. If a device is lost, stolen, or destroyed, the user may lose access to their cryptocurrency unless appropriate backup measures are in place. Furthermore, the technical expertise required to set up and manage some advanced cold storage wallets can deter less tech-savvy users. The complexities of seed phrase management, firmware updates, and recovery processes can present a significant obstacle. Lastly, the evolving nature of cryptocurrency and blockchain technology demands constant adaptation and updates for hardware wallets, which necessitates ongoing development and maintenance costs. The need to stay abreast of emerging security threats and adapt to technological advancements is crucial for wallet manufacturers, adding to the overall complexity and cost of maintaining a competitive product.

The North American and European markets are expected to lead the cold storage crypto wallet market due to high cryptocurrency adoption rates and robust regulatory frameworks. Asia, particularly regions like China, South Korea, and Japan, demonstrate substantial growth potential given the increased awareness of cryptocurrencies and the significant interest in blockchain technology.

Dominant Segment: USB Connectivity Type: USB-based cold storage wallets currently represent the largest segment due to their simplicity, reliability, and wide compatibility. They provide a secure and straightforward method for storing and managing cryptocurrencies, without the added complexity of Bluetooth or NFC connectivity which could introduce security vulnerabilities. Their established technology, along with lower production costs, contributes to market dominance. The widespread availability of USB ports makes them accessible to a broad range of users. Users feel comfortable with this familiar technology, and the absence of external communication protocols minimizes the risk of hacking attempts. The established ecosystem of supporting software and resources for these devices enhances their usability and fosters market leadership.

Strong Growth Segment: Individual Application: The individual user segment continues to be the biggest driver, largely due to the increased number of individuals investing in cryptocurrencies. The ease of use and improving features of cold storage wallets are further contributing to the segment’s growth. As more individuals become aware of the risks associated with storing cryptocurrencies on exchanges or hot wallets, they seek better security, making individual adoption a cornerstone for the market's expansion. This segment showcases significant potential for continued growth, especially with educational initiatives and simplified user interfaces.

Several factors are catalyzing growth in the cold storage crypto wallet sector. The rising awareness of security risks associated with hot wallet storage is pushing users towards more secure alternatives. Moreover, the increasing institutional investment in cryptocurrencies and the growing demand for secure custody solutions are driving adoption within professional settings. Technological advancements, such as enhanced encryption methods and more user-friendly interfaces, are also playing a crucial role in broadening market appeal.

The cold storage crypto wallet market is experiencing robust expansion, driven by heightened security concerns, increased institutional adoption, and technological advancements. The market’s growth is further catalyzed by expanding awareness of cryptocurrency risks and improvements in user interface design. The comprehensive report provides a detailed analysis of market trends, drivers, challenges, key players, and future projections, offering invaluable insights for stakeholders in the cryptocurrency industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.2%.

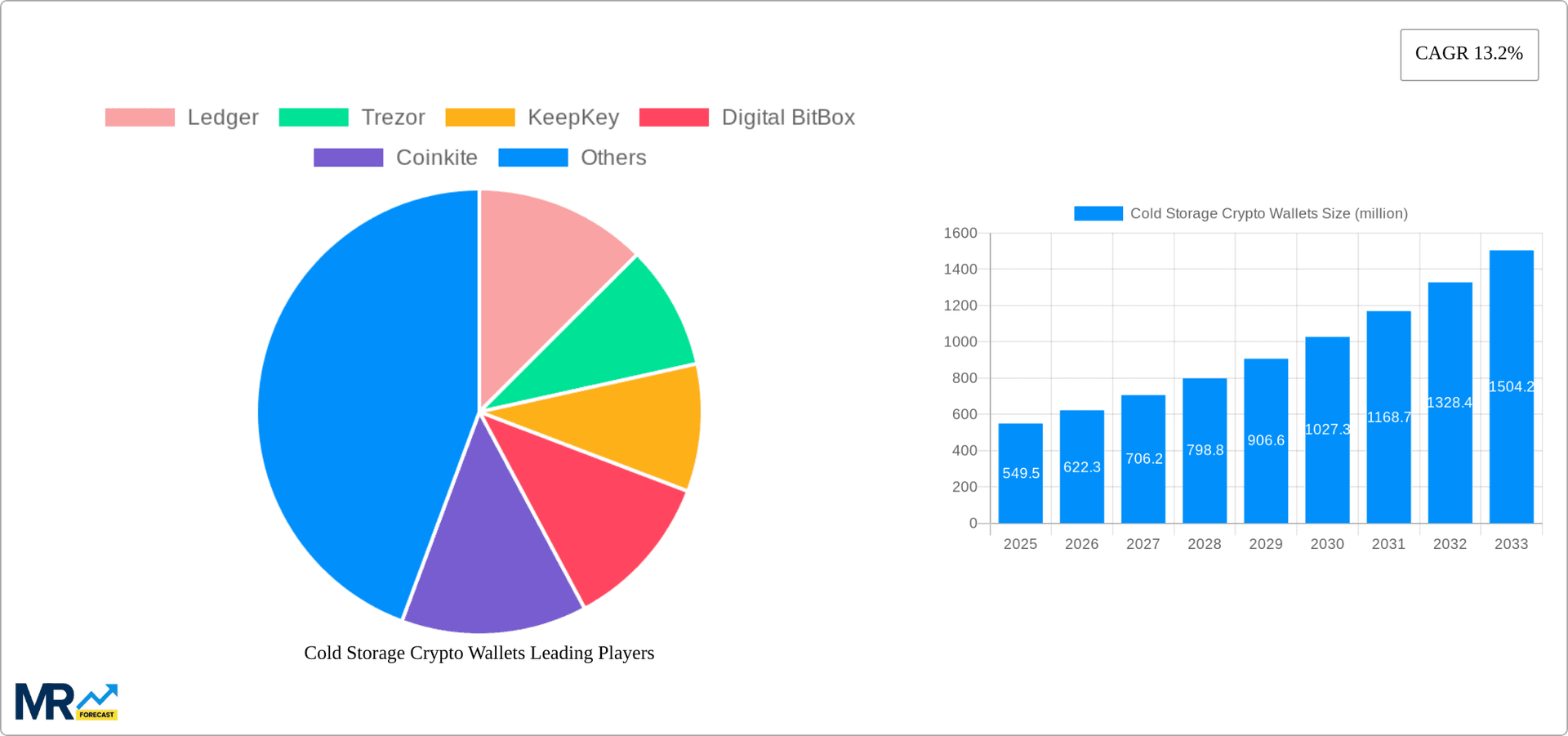

Key companies in the market include Ledger, Trezor, KeepKey, Digital BitBox, Coinkite, BitLox, CoolWallet, CryoBit, ELLIPAL, Keystone, OneKey, imkey, SafePal, .

The market segments include Type, Application.

The market size is estimated to be USD 3.5 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Cold Storage Crypto Wallets," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cold Storage Crypto Wallets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.