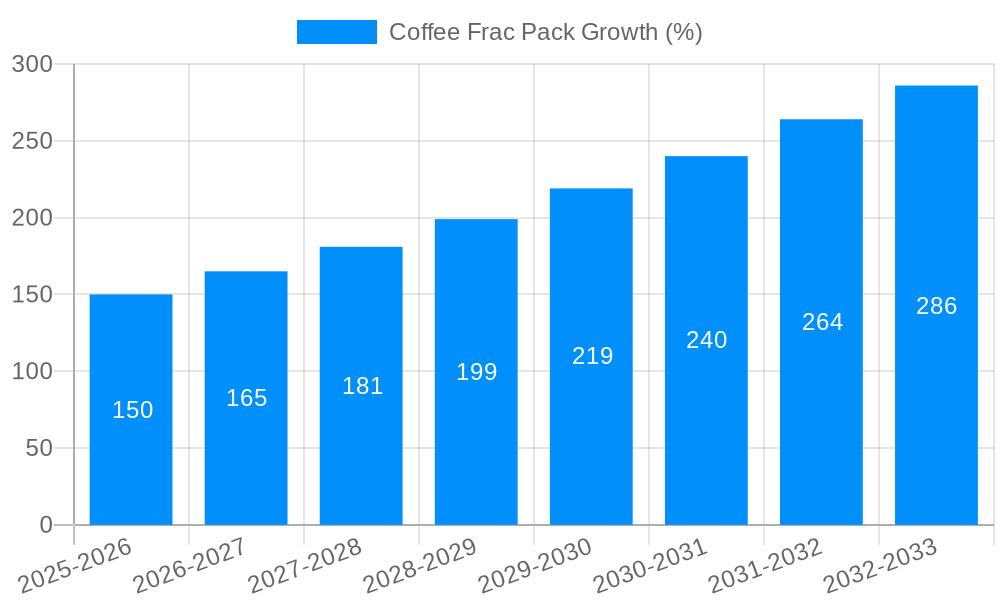

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coffee Frac Pack?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Coffee Frac Pack

Coffee Frac PackCoffee Frac Pack by Type (Below 1.5 oz, 5 oz to 2 oz, 2 oz to 5 oz, World Coffee Frac Pack Production ), by Application (Grocery and Retail, Restaurants, Coffee shops, Others, World Coffee Frac Pack Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global coffee frac pack market is poised for steady growth, projected to reach approximately $681.8 million by 2025. This expansion is driven by an anticipated Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033. The increasing demand for convenient, single-serve coffee solutions continues to be a primary catalyst, catering to the busy lifestyles of consumers who seek quality coffee experiences on the go. The market is segmented by type, with "Below 1.5 oz" and "5 oz to 2 oz" likely dominating due to their widespread use in single-serve coffee machines and for individual consumption. Applications span across grocery and retail, where consumers purchase these packs for home use, as well as restaurants and coffee shops, which increasingly offer personalized coffee options. The "Others" category, encompassing office pantries and travel needs, also contributes to overall market volume.

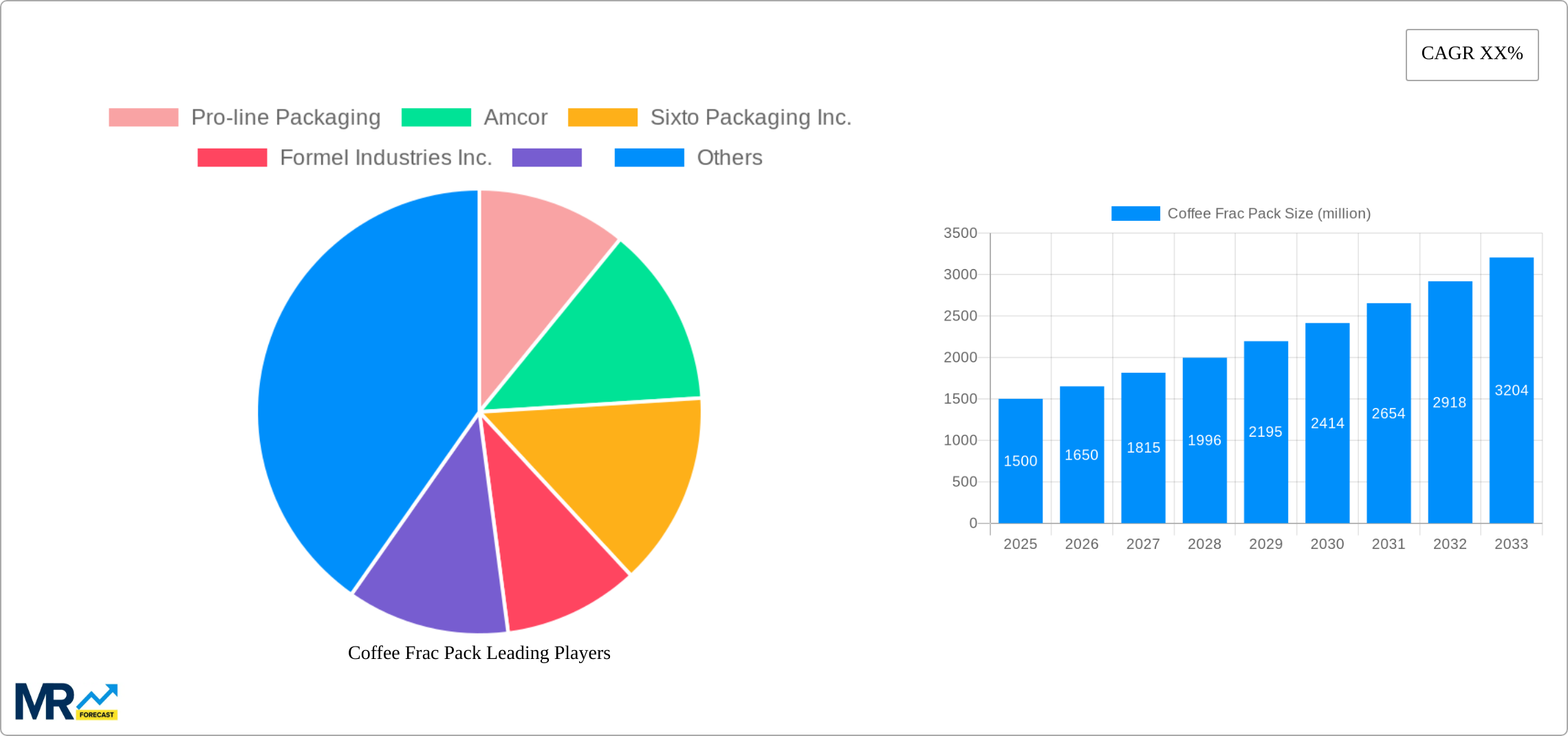

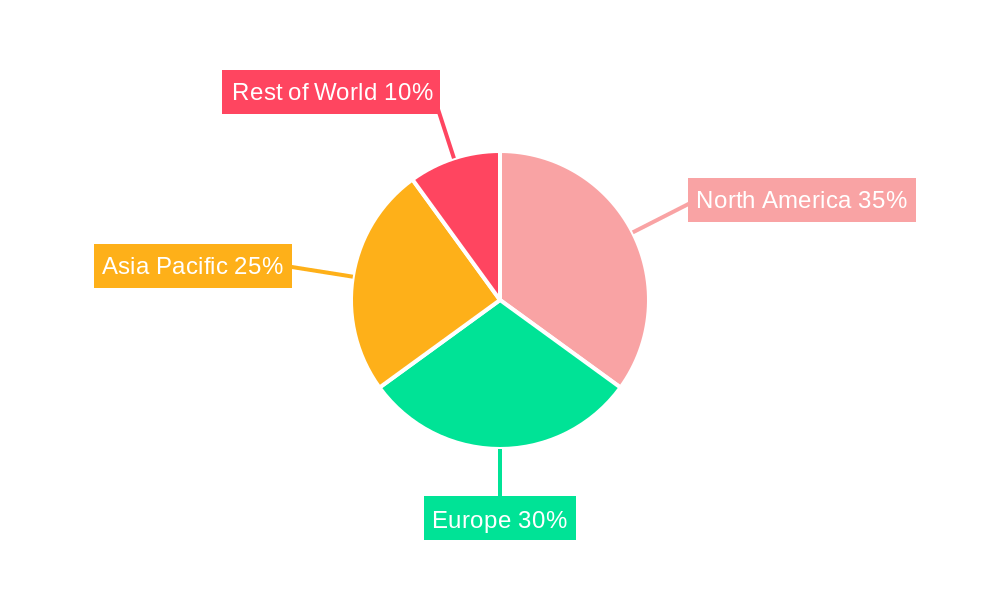

Emerging trends in sustainable packaging and innovative flavor profiles are expected to shape the market landscape. Manufacturers are exploring eco-friendly materials and designs to appeal to environmentally conscious consumers, while the introduction of specialty blends and premium coffee options will further entice a discerning customer base. However, the market may encounter restraints such as fluctuations in raw material prices, particularly for coffee beans, and the increasing competition from alternative single-serve formats like pods and soluble coffee. Geographically, North America and Europe are expected to remain dominant markets, driven by high coffee consumption and established retail infrastructure. Asia Pacific, with its rapidly growing middle class and increasing adoption of Western coffee culture, presents a significant opportunity for future expansion. Key players like Pro-line Packaging, Amcor, and Sixto Packaging Inc. are strategically positioned to capitalize on these dynamics through product innovation and market penetration.

This report delves into the intricate landscape of the global Coffee Frac Pack market, offering a comprehensive analysis of its trends, driving forces, challenges, and future outlook. From 2019 to 2033, the market has witnessed significant evolution, with the base year of 2025 serving as a critical benchmark for projections. Our extensive research, encompassing the historical period of 2019-2024 and an estimated forecast period of 2025-2033, provides invaluable insights for stakeholders seeking to navigate this dynamic sector. The report meticulously examines various segments, including pack types categorized by size (Below 1.5 oz, 2 oz to 5 oz) and applications across diverse channels such as Grocery and Retail, Restaurants, Coffee Shops, and Others. Furthermore, it highlights key industry developments and identifies leading players, presenting a holistic view of the market's trajectory.

The global Coffee Frac Pack market is undergoing a significant transformation, driven by evolving consumer preferences and advancements in packaging technology. From 2019 to 2033, the market is projected to witness substantial growth, with the base year of 2025 acting as a pivotal point for estimating future trends. Consumers are increasingly seeking convenience and portability, leading to a surge in demand for smaller, single-serve coffee portions. This trend is particularly evident in the "Below 1.5 oz" segment, which is expected to outpace other size categories due to its appeal to on-the-go consumers and those seeking to minimize waste. The "2 oz to 5 oz" segment also holds considerable promise, catering to individuals who desire a slightly larger, but still convenient, coffee experience.

The application landscape is equally dynamic. The "Grocery and Retail" segment is expected to remain a dominant force, driven by the growing number of households that prefer brewing coffee at home with pre-portioned options. As retail environments adapt to changing consumer behaviors, the availability and visibility of frac packs are expected to increase, further stimulating demand. Simultaneously, the "Coffee Shops" segment, while already a mature market for single-serve solutions, will continue to innovate with premium offerings and unique blends packaged in frac formats. The "Restaurants" sector is also showing a steady upward trajectory, particularly in casual dining and QSR environments, where offering a quick, quality coffee option is becoming increasingly important. The "Others" application, encompassing travel, hospitality, and office environments, presents a nascent but rapidly expanding opportunity for coffee frac packs.

Technological advancements in packaging materials and design are playing a crucial role in shaping market trends. The demand for sustainable and eco-friendly packaging solutions is on the rise, prompting manufacturers to explore recyclable, biodegradable, and compostable materials. This shift is not only driven by consumer awareness but also by regulatory pressures and corporate sustainability initiatives. Furthermore, innovations in barrier properties are crucial for maintaining coffee freshness and flavor, ensuring that the quality of the coffee within the frac pack matches consumer expectations. The market is also observing a trend towards personalized and premium offerings, with brands increasingly using frac packs to introduce new blends, limited editions, and specialty coffees, thereby enhancing consumer engagement and brand loyalty. The overall market is projected to experience robust growth, fueled by these multifaceted trends and a continuous drive for innovation.

The global Coffee Frac Pack market is experiencing a robust surge, propelled by a confluence of compelling driving forces that are reshaping consumer behavior and industry practices. The paramount driver is the escalating demand for convenience and portability, a trend amplified by increasingly busy lifestyles. Consumers, across demographics, are actively seeking products that seamlessly integrate into their daily routines, and single-serve, pre-portioned coffee frac packs offer an unparalleled solution for quick and easy coffee preparation, whether at home, in the office, or on the go. This convenience factor directly translates into increased sales within the "Grocery and Retail" and "Restaurants" segments, where accessibility and speed are critical.

Furthermore, a growing emphasis on portion control and waste reduction is significantly contributing to the market's expansion. As consumers become more conscious of their environmental impact and personal health, the ability to use precisely the amount of coffee needed for a single cup minimizes wastage of both product and resources. This resonates particularly well with the "Below 1.5 oz" and "2 oz to 5 oz" pack types, appealing to both budget-conscious and environmentally aware individuals. The proliferation of specialty and premium coffee brands has also played a pivotal role. Frac packs provide an ideal format for these brands to introduce new or limited-edition blends to a wider audience, allowing consumers to explore diverse flavor profiles without committing to larger quantities. This strategy is particularly effective in engaging consumers within the "Coffee Shops" segment and driving trial purchases through retail channels.

Technological advancements in packaging materials and manufacturing processes are also acting as significant catalysts. The development of innovative, high-barrier packaging solutions ensures the freshness and quality of the coffee, extending shelf life and maintaining optimal flavor. This technological prowess enables manufacturers to meet the stringent demands of premium coffee brands and cater to a discerning consumer base. The increasing accessibility of these packaging solutions, coupled with economies of scale achieved through evolving production techniques, further contributes to the affordability and widespread availability of coffee frac packs, solidifying their position in the global market.

Despite the robust growth trajectory, the global Coffee Frac Pack market is not without its set of challenges and restraints that could potentially impede its progress. A primary concern revolves around the environmental impact of single-use packaging. While offering convenience, the vast majority of existing frac packs are not readily recyclable or biodegradable, leading to a significant accumulation of waste. This is a growing point of contention for environmentally conscious consumers and regulatory bodies, creating pressure on manufacturers to develop more sustainable packaging alternatives. The cost associated with developing and implementing such eco-friendly solutions can be substantial, posing a financial hurdle for many companies.

Another significant challenge lies in maintaining coffee freshness and flavor over extended periods. Coffee is a delicate product that is susceptible to oxidation and degradation when exposed to air, light, and moisture. Achieving optimal barrier properties in smaller frac pack formats, especially for premium coffee varieties, requires advanced and often costly packaging technologies. Failure to adequately preserve freshness can lead to consumer dissatisfaction and damage brand reputation. The "Below 1.5 oz" segment, being the smallest, faces particular challenges in maintaining aroma and taste integrity.

Furthermore, the competitive landscape is intensely crowded, with a multitude of players vying for market share. This intense competition can lead to price wars, eroding profit margins for manufacturers. The cost of raw materials, particularly high-quality coffee beans and advanced packaging components, can also be volatile, impacting production costs and ultimately influencing the retail price of frac packs. While the "Grocery and Retail" segment benefits from volume, the margins can be thinner due to competitive pricing pressures. Additionally, consumer perception and acceptance of the value proposition offered by frac packs can be a restraint. Some consumers may perceive them as being less economical than larger packaging formats, particularly in price-sensitive markets, limiting adoption in certain demographics or application areas like "Restaurants" if perceived as overly expensive for the portion size.

The global Coffee Frac Pack market is projected to witness a significant dominance in specific regions and segments over the study period of 2019-2033, with the base year of 2025 serving as a critical juncture for these estimations.

Dominant Region/Country:

Dominant Segment (by Type):

Dominant Segment (by Application):

The synergy between these dominant regions and segments is expected to shape the overall trajectory of the global coffee frac pack market, with North America leading the charge driven by consumer demand for convenience, innovation, and premium coffee experiences, particularly through the "Below 1.5 oz" pack type and widespread availability in "Grocery and Retail" channels.

The global Coffee Frac Pack industry is poised for accelerated growth, fueled by several key catalysts. The relentless pursuit of convenience by consumers, driven by increasingly hectic lifestyles, remains a paramount growth driver. The demand for pre-portioned, easy-to-prepare coffee solutions that fit seamlessly into daily routines is a constant. Furthermore, a growing environmental consciousness among consumers is pushing innovation towards sustainable packaging materials and designs, creating opportunities for manufacturers who can offer eco-friendly frac packs without compromising on quality or freshness. The expansion of specialty and premium coffee markets also acts as a significant catalyst, as frac packs provide an accessible and low-risk entry point for consumers to explore diverse flavor profiles and higher-end offerings. Technological advancements in packaging, such as improved barrier properties and biodegradable materials, are enhancing product quality and consumer appeal.

This report provides an in-depth analysis of the global Coffee Frac Pack market, offering a holistic perspective for stakeholders. It meticulously covers the market's evolution from 2019 to 2033, with a foundational understanding rooted in the base year of 2025. The report dissects the market across critical segments, including pack types (Below 1.5 oz, 2 oz to 5 oz) and applications spanning Grocery and Retail, Restaurants, Coffee Shops, and Others. It further explores the underlying driving forces, potential challenges, and growth catalysts shaping the industry's future. A comprehensive list of leading players and significant industry developments, contextualized with specific years, ensures readers are equipped with actionable intelligence. The report's detailed examination of regional dominance and segment performance, coupled with its forward-looking projections, makes it an indispensable resource for strategic decision-making in the dynamic coffee frac pack sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Pro-line Packaging, Amcor, Sixto Packaging Inc., Formel Industries Inc., .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Coffee Frac Pack," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Coffee Frac Pack, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.