1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Infrastructure as a Service Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cloud Infrastructure as a Service Software

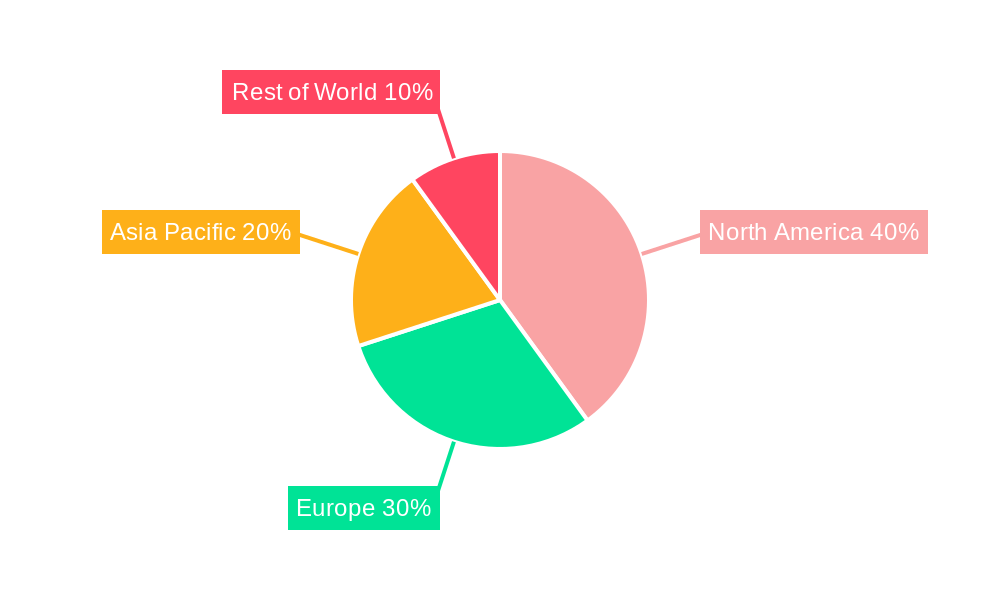

Cloud Infrastructure as a Service SoftwareCloud Infrastructure as a Service Software by Type (Cloud-Based, On-Premises), by Application (Large Enterprises(1000+ Users), Medium-Sized Enterprise(499-1000 Users), Small Enterprises(1-499 Users)), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

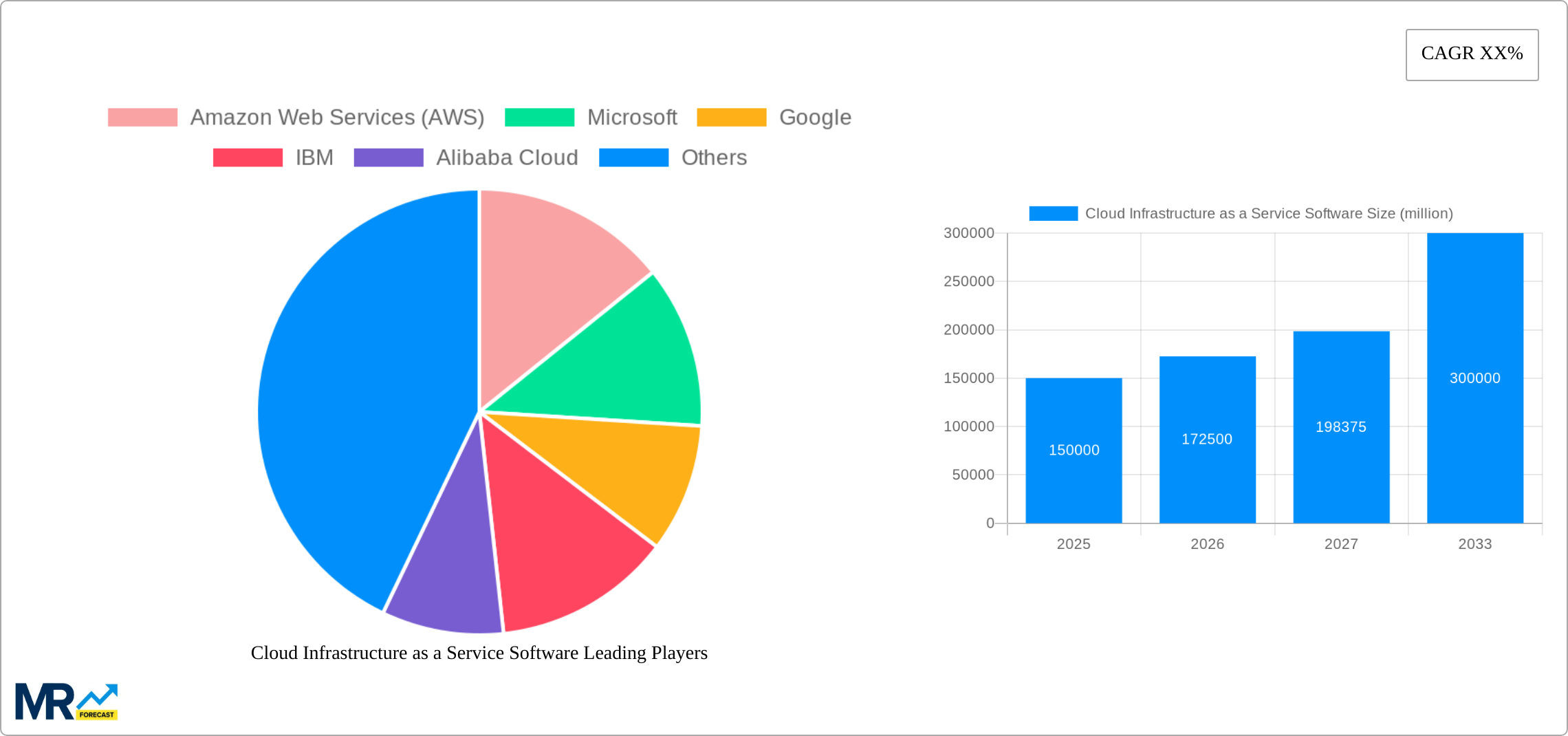

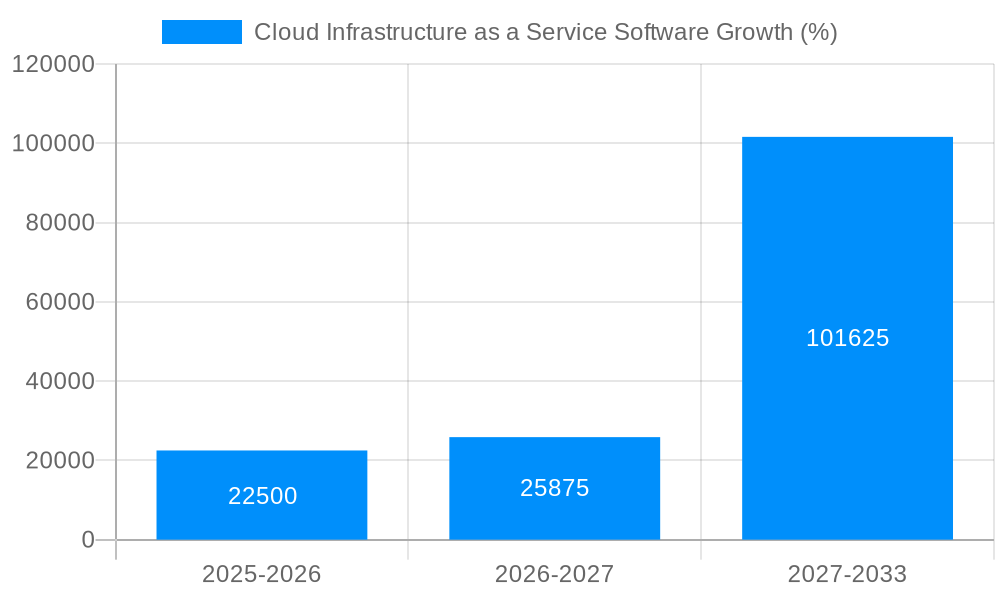

The global Cloud Infrastructure as a Service (IaaS) Software market is poised for substantial growth, projected to reach approximately $160 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 18% expected between 2025 and 2033. This robust expansion is primarily fueled by the increasing adoption of hybrid and multi-cloud strategies across enterprises of all sizes, driven by the persistent need for scalability, cost-efficiency, and enhanced data management capabilities. Organizations are increasingly migrating their critical workloads to IaaS platforms to leverage the agility and innovation offered by cloud providers, thereby reducing upfront capital expenditures and operational overhead. The growing demand for advanced computing power, robust data storage solutions, and seamless network integration further propels market momentum. Key trends include the rise of edge computing, the integration of AI and machine learning within IaaS offerings, and a heightened focus on security and compliance, particularly as regulatory landscapes evolve globally.

The IaaS Software market is characterized by significant diversification across enterprise segments and deployment types. Large enterprises, with their extensive IT infrastructure and complex operational needs, currently represent the largest share of the market, driven by their capacity for significant cloud investment and their reliance on scalable solutions. However, medium-sized and small enterprises are rapidly increasing their IaaS adoption, spurred by more accessible and cost-effective cloud solutions, democratizing access to enterprise-grade IT capabilities. The market is also witnessing a sustained preference for cloud-based IaaS solutions due to their inherent flexibility and lower total cost of ownership compared to on-premises deployments. Restraints such as data security concerns, vendor lock-in fears, and the complexity of migrating legacy systems remain factors that cloud providers are actively addressing through enhanced security protocols, interoperability features, and simplified migration tools, further solidifying the positive market outlook.

XXX, a comprehensive market analysis, delves into the dynamic landscape of Cloud Infrastructure as a Service (IaaS) Software, meticulously dissecting its evolution and future trajectory. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year, and the forecast period extending from 2025 to 2033, building upon the historical data from 2019 to 2024. A significant trend observed is the accelerating adoption of cloud-native architectures, fueled by the increasing demand for agility, scalability, and cost-efficiency. Enterprises are progressively migrating their workloads from traditional on-premises data centers to IaaS environments, driven by the realization of reduced capital expenditure and operational overhead. The market is witnessing a strong surge in hybrid cloud strategies, where organizations leverage a combination of public and private IaaS solutions to optimize performance, security, and compliance. This approach allows businesses to maintain sensitive data on-premises while utilizing the flexibility and scalability of public cloud for less critical applications. Furthermore, the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) within IaaS platforms is becoming a pivotal trend. These integrations enable sophisticated automation of resource management, predictive analytics for performance optimization, and enhanced security measures. The report highlights the growing importance of specialized IaaS solutions catering to specific industry needs, such as healthcare, finance, and manufacturing, offering tailored services and compliance features. The increasing adoption of serverless computing and containerization technologies is also reshaping the IaaS market, abstracting away infrastructure management and empowering developers to focus on application development. The evolving regulatory landscape and the growing emphasis on data sovereignty are prompting providers to offer more localized IaaS solutions and robust data protection mechanisms. The market is characterized by intense competition and continuous innovation, with providers constantly introducing new services and enhancing existing ones to meet the ever-changing demands of businesses. The global IaaS market is projected to reach several hundred million dollars in the coming years, with substantial growth anticipated across various segments.

The exponential growth of the Cloud Infrastructure as a Service (IaaS) Software market is propelled by a confluence of compelling factors, fundamentally altering how businesses operate and innovate. The primary driver is the unyielding pursuit of digital transformation, where organizations across all sectors are embracing cloud technologies to enhance agility, accelerate innovation cycles, and improve customer experiences. The inherent scalability and elasticity of IaaS solutions enable businesses to seamlessly adapt to fluctuating demands, provision resources on-the-fly, and rapidly deploy new applications and services without the constraints of traditional IT infrastructure. This flexibility is particularly crucial in today's fast-paced market. Cost optimization remains a significant impetus, as IaaS empowers companies to shift from a capital expenditure (CapEx) model to an operational expenditure (OpEx) model. By paying only for the resources they consume, businesses can significantly reduce upfront investments in hardware, software, and data center maintenance, leading to substantial cost savings and improved financial predictability. The increasing complexity of IT environments and the growing scarcity of skilled IT professionals are also driving IaaS adoption. Cloud providers manage the underlying infrastructure, freeing up internal IT teams to focus on strategic initiatives rather than routine maintenance and troubleshooting. Furthermore, the proliferation of data and the growing need for advanced analytics and AI/ML capabilities are finding fertile ground in IaaS environments. These platforms offer the computational power and storage necessary to process vast datasets and train sophisticated models, thereby unlocking new insights and driving data-informed decision-making.

Despite the undeniable momentum of the Cloud Infrastructure as a Service (IaaS) Software market, several challenges and restraints can potentially impede its unhindered growth. A primary concern for many organizations is the perceived complexity of cloud migration and management. While IaaS promises simplicity, the actual process of migrating existing workloads, re-architecting applications, and managing multi-cloud environments can be intricate and demanding, requiring specialized expertise. Security and data privacy remain paramount concerns for businesses, particularly in highly regulated industries. Although cloud providers invest heavily in security, the shared responsibility model can create confusion and anxiety regarding data protection, compliance, and the potential for data breaches. The fear of vendor lock-in is another significant restraint. Organizations may worry about becoming overly dependent on a single IaaS provider, making it difficult and costly to switch to another provider in the future. This concern is amplified by the proprietary nature of some cloud services and APIs. Interoperability and integration issues between different cloud platforms and existing on-premises systems can also pose challenges. Achieving seamless integration can be complex and require significant development effort. Furthermore, the cost management of cloud resources, while offering potential savings, can become a burden if not properly monitored and optimized. Unforeseen usage spikes or inefficient resource allocation can lead to escalating costs, negating the anticipated benefits. Finally, the evolving regulatory landscape and the increasing emphasis on data sovereignty in different geographies can create compliance hurdles for global IaaS deployments, demanding careful consideration of data residency and legal frameworks.

The Cloud Infrastructure as a Service (IaaS) Software market is characterized by dominant regions and segments that are shaping its overall growth trajectory.

Dominant Regions:

Dominant Segments:

The Cloud Infrastructure as a Service (IaaS) Software industry is experiencing robust growth, significantly propelled by several key catalysts. The accelerating digital transformation initiatives across all industries are a primary driver, pushing organizations to adopt agile and scalable IT solutions. The increasing demand for advanced analytics, AI, and machine learning capabilities, which require substantial computational power and storage, is finding a natural home in IaaS environments. Furthermore, the economic imperative of cost optimization, with businesses seeking to shift from capital expenditure to operational expenditure, makes IaaS an attractive proposition. The ongoing evolution of hybrid and multi-cloud strategies, enabling greater flexibility and resilience, also fuels adoption.

This comprehensive report provides an in-depth analysis of the Cloud Infrastructure as a Service (IaaS) Software market, meticulously covering its past, present, and future. The study delves into the intricate details of market trends, identifying key shifts in adoption and technological advancements. It thoroughly examines the driving forces that are propelling the market forward, including digital transformation and the pursuit of cost efficiencies. Crucially, the report also addresses the inherent challenges and restraints, offering insights into potential obstacles to growth. A significant portion of the analysis is dedicated to identifying dominant regions and segments, providing a clear picture of where the market is most vibrant and which categories are experiencing the strongest demand. Furthermore, the report highlights crucial growth catalysts and provides an exhaustive list of leading players. Significant developments, including recent and projected trends, are detailed, offering a forward-looking perspective. The report's overarching aim is to equip stakeholders with the knowledge necessary to navigate this dynamic and rapidly evolving market, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amazon Web Services (AWS), Microsoft, Google, IBM, Alibaba Cloud, VMware, OVH, Oracle, Tencent Cloud, CenturyLink, Virtustream, Dimension Data (NTT Communications), Skytap, NTT Communications, GTT (Interoute), Joyent, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cloud Infrastructure as a Service Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cloud Infrastructure as a Service Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.