1. What is the projected Compound Annual Growth Rate (CAGR) of the Clothing Store Inventory Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Clothing Store Inventory Software

Clothing Store Inventory SoftwareClothing Store Inventory Software by Application (/> Large Enterprises, SMEs), by Type (/> On-premise, Cloud-based), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

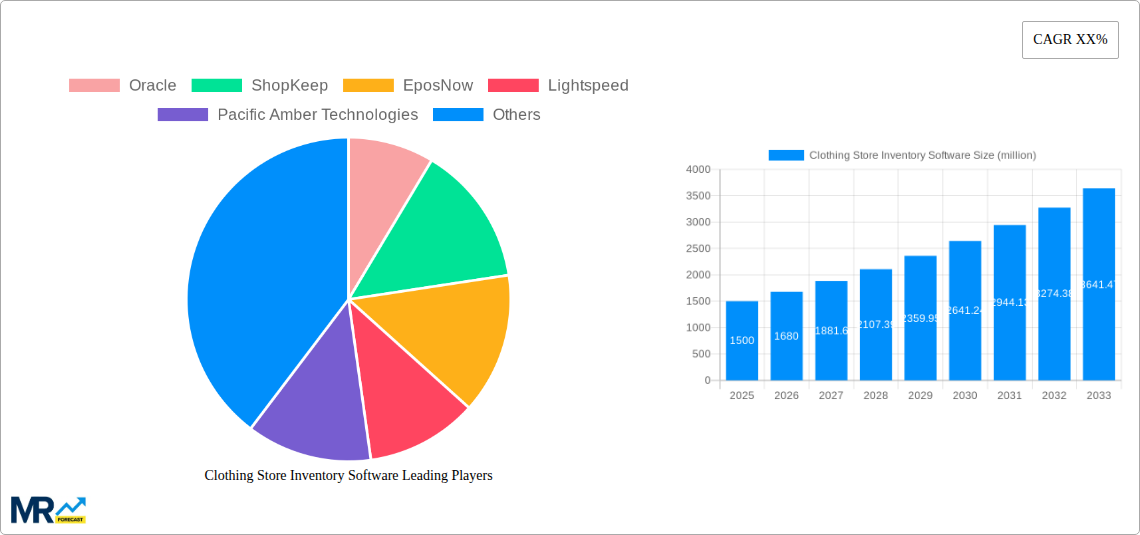

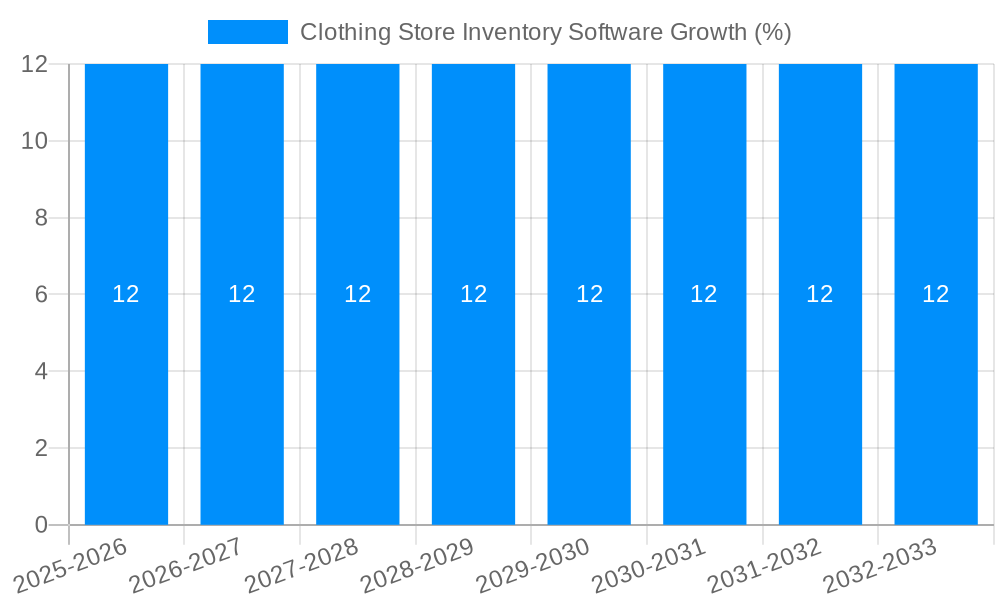

The global Clothing Store Inventory Software market is poised for substantial growth, projected to reach approximately $1.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 12% through 2033. This expansion is primarily fueled by the increasing need for efficient inventory management solutions to combat stockouts, reduce overstocking, and enhance overall operational efficiency in the dynamic retail fashion landscape. The burgeoning e-commerce sector and the growing adoption of omnichannel retail strategies by businesses of all sizes are significant drivers. Furthermore, the software's ability to provide real-time data, streamline sales processes, and offer valuable insights into customer purchasing patterns is compelling retailers to invest in these advanced solutions. The market encompasses a wide spectrum of applications, from large enterprises seeking sophisticated, integrated systems to Small and Medium-sized Enterprises (SMEs) looking for cost-effective and user-friendly cloud-based solutions.

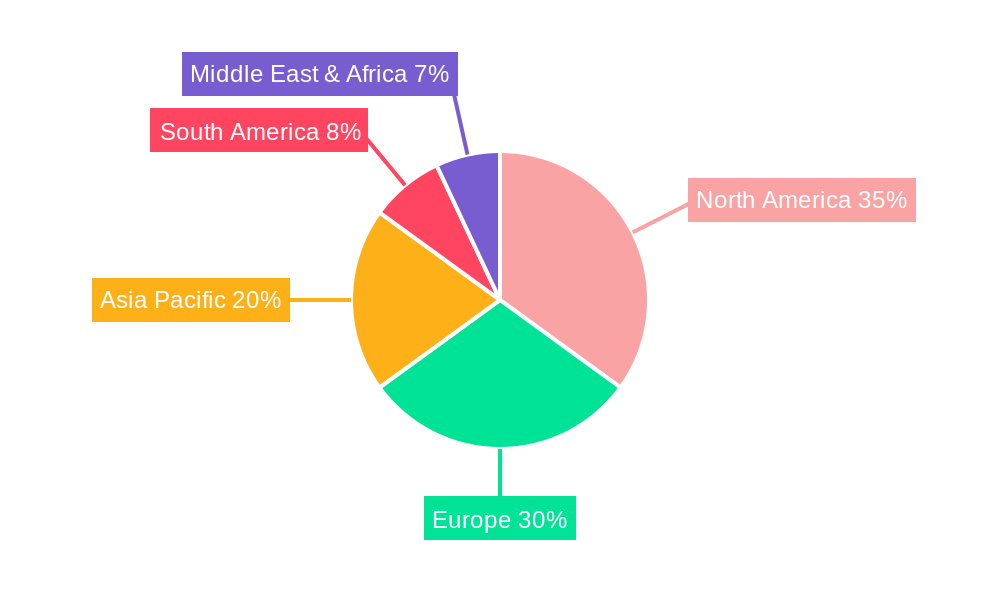

The market is characterized by continuous innovation, with a strong trend towards cloud-based solutions offering scalability, accessibility, and lower upfront costs. This shift is particularly beneficial for SMEs looking to compete with larger retailers. However, certain restraints exist, including the initial investment cost for advanced features, concerns about data security and privacy for some on-premise users, and the need for effective integration with existing retail infrastructure. Despite these challenges, the market is expected to witness robust growth driven by the ongoing digital transformation in retail. North America and Europe currently lead the market due to early adoption and the presence of a large retail base. However, the Asia Pacific region is emerging as a high-growth segment, driven by rapid e-commerce expansion and increasing digitalization efforts by retailers in countries like China and India. Key players are focusing on developing AI-powered features, mobile accessibility, and comprehensive analytics to cater to evolving retailer demands.

This comprehensive report delves into the dynamic evolution of the Clothing Store Inventory Software market, projecting a substantial valuation exceeding $500 million by the end of the Forecast Period (2025-2033). Spanning the Study Period (2019-2033), with a Base Year of 2025 and the Estimated Year also 2025, this analysis meticulously dissects trends, driving forces, challenges, and growth opportunities that are reshaping how fashion retailers manage their most critical asset – their inventory. The Historical Period (2019-2024) has witnessed a foundational shift, moving from rudimentary spreadsheet-based systems to sophisticated, integrated software solutions. This report will provide stakeholders with actionable insights to navigate this rapidly evolving landscape, offering a granular view of market segmentation by application (Large Enterprises, SMEs) and type (On-premise, Cloud-based), and identifying key players and technological advancements.

The global Clothing Store Inventory Software market is on a trajectory of unprecedented growth and innovation, with a projected market valuation poised to surpass $500 million by 2033. This surge is underpinned by a confluence of factors, chief among them being the escalating need for real-time inventory visibility across increasingly complex supply chains. Retailers are no longer content with static stock counts; they demand dynamic, data-driven insights to optimize stock levels, minimize markdowns, and prevent stockouts. The pervasive influence of e-commerce and omnichannel retail strategies has amplified this demand. As consumers seamlessly move between online and physical stores, the ability to offer consistent and accurate inventory information across all touchpoints becomes paramount. This necessitates sophisticated software capable of integrating with point-of-sale (POS) systems, e-commerce platforms, and even warehouse management systems, creating a unified view of stock. Furthermore, the rise of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing inventory management. Predictive analytics, powered by AI, are now enabling retailers to forecast demand with greater accuracy, optimize reordering points, and identify slow-moving items before they become obsolete. This proactive approach to inventory control is a significant departure from traditional reactive methods. The integration of RFID technology is also gaining traction, offering faster and more accurate inventory counts, reducing manual errors, and enhancing overall operational efficiency. As retailers grapple with the ever-increasing pace of fashion cycles and the demand for personalized customer experiences, the role of advanced inventory software is shifting from a back-office necessity to a strategic imperative for driving competitive advantage and profitability. The market is also witnessing a growing preference for cloud-based solutions due to their scalability, flexibility, and lower upfront investment, particularly for Small and Medium-sized Enterprises (SMEs). This trend ensures broader accessibility to advanced inventory management capabilities, democratizing sophisticated tools for a wider spectrum of fashion businesses. The focus is increasingly on software that not only tracks inventory but also provides actionable business intelligence, empowering retailers to make informed decisions that directly impact their bottom line.

The accelerated adoption and robust growth of clothing store inventory software are fueled by a compelling set of market forces, each contributing to its indispensable role in modern retail operations. Foremost among these is the relentless pursuit of operational efficiency and cost reduction. In an industry characterized by thin margins and high competition, businesses are constantly seeking ways to streamline processes, reduce waste, and optimize resource allocation. Sophisticated inventory management software automates manual tasks, minimizes human error, and provides real-time data, all of which contribute to significant cost savings. The burgeoning growth of e-commerce and the increasing prevalence of omnichannel retail strategies present another powerful driving force. With customers expecting seamless shopping experiences across online and offline channels, retailers must maintain accurate, synchronized inventory levels to avoid disappointing customers with out-of-stock items or inaccurate order fulfillment. This requires integrated systems that can provide a unified view of stock across all sales platforms. Furthermore, the desire to enhance customer satisfaction and loyalty is a key propeller. By ensuring product availability and enabling quicker order fulfillment, effective inventory management directly contributes to a positive customer experience, fostering repeat business and positive word-of-mouth. The rapidly evolving fashion industry, with its short product lifecycles and constant demand for new styles, necessitates agile inventory management. Businesses need to quickly identify trends, manage stock turnover, and minimize the risk of holding obsolete inventory. Inventory software plays a critical role in facilitating this agility. Finally, the increasing availability of advanced technological features, such as AI-powered demand forecasting and predictive analytics, is transforming inventory management from a purely transactional process into a strategic function that drives informed decision-making and competitive advantage.

Despite the significant growth and compelling drivers, the Clothing Store Inventory Software market is not without its hurdles and constraints, which can temper its pace of adoption and impact its overall expansion. A primary challenge lies in the initial investment and ongoing costs associated with implementing and maintaining advanced software solutions. For many Small and Medium-sized Enterprises (SMEs), the upfront cost of software licenses, hardware upgrades, and implementation services can be a considerable barrier, even with the increasing availability of subscription-based cloud models. This is compounded by the complexity of integration with existing legacy systems. Many established retailers operate with a patchwork of disparate software, and integrating new inventory management solutions can be a technically challenging and time-consuming process, requiring significant IT resources and expertise. The lack of skilled personnel to effectively utilize and manage sophisticated inventory software also poses a significant restraint. Proper implementation and ongoing optimization require employees with a solid understanding of inventory management principles and the software's capabilities, leading to training needs and potential operational bottlenecks if staff are not adequately equipped. Data security and privacy concerns, particularly with cloud-based solutions, can also be a deterrent for some businesses, especially those dealing with sensitive customer or sales data. Ensuring robust security protocols and compliance with data protection regulations is paramount, and any perceived vulnerability can lead to hesitation. Furthermore, the resistance to change within organizations can be a considerable obstacle. Employees accustomed to traditional, manual methods may be reluctant to adopt new technologies and workflows, leading to slower adoption rates and a failure to fully leverage the software's potential. Finally, the rapid pace of technological advancement itself can be a double-edged sword; while innovation drives growth, it also means that software can become outdated quickly, requiring continuous investment in upgrades and new solutions, which can be a strain on budgets.

The global Clothing Store Inventory Software market is poised for significant growth, with specific regions and market segments exhibiting a stronger propensity for adoption and innovation, ultimately leading to their dominance in the coming years.

Dominating Segments:

Application: SMEs (Small and Medium-sized Enterprises): While Large Enterprises have always been early adopters of sophisticated technology, the significant shift towards cloud-based, scalable, and more affordable inventory management solutions is empowering SMEs to leverage advanced capabilities. Historically, SMEs may have relied on manual methods or basic POS systems for inventory tracking. However, the increasing availability of feature-rich, subscription-based software from vendors like ShopKeep, EposNow, and Shopify, which are specifically designed for smaller businesses, is democratizing access to powerful inventory control. These solutions offer intuitive interfaces, streamlined workflows, and often integrate seamlessly with other essential business tools, making them highly attractive for businesses with limited IT budgets and personnel. The sheer volume of SMEs in the global retail landscape, coupled with their increasing need to compete with larger players and meet evolving consumer demands for efficiency and accuracy, positions them as a key growth engine for the inventory software market. Their ability to quickly adapt to new technologies also contributes to their dominance.

Type: Cloud-based: The transition from on-premise to cloud-based inventory management software is a defining trend that will continue to drive market dominance. Cloud solutions offer unparalleled flexibility, scalability, and accessibility, allowing businesses to access their inventory data from anywhere, at any time, on any device. This is particularly beneficial for the fashion industry, which often involves multiple store locations, warehouses, and remote teams. The lower upfront costs associated with cloud subscriptions, compared to hefty on-premise installations and ongoing maintenance, make them highly appealing to a broad spectrum of businesses, from startups to established retailers. Furthermore, cloud providers handle software updates, security patches, and data backups, relieving businesses of significant IT burdens. This inherent agility and cost-effectiveness ensure that cloud-based solutions will remain the preferred choice for the majority of clothing retailers seeking efficient and modern inventory management.

Dominating Regions:

North America (USA and Canada): This region is expected to maintain its leading position in the Clothing Store Inventory Software market, driven by a mature retail sector, a high concentration of technologically advanced businesses, and a strong consumer demand for efficient and personalized shopping experiences. The widespread adoption of e-commerce and omnichannel strategies, coupled with a proactive approach to technology adoption by both large enterprises and a burgeoning SME segment, fuels the demand for sophisticated inventory management solutions. Major players like Oracle, Lightspeed, and Shopify have a strong presence and a well-established customer base in North America. The region’s focus on data analytics and business intelligence further propels the adoption of software that can provide actionable insights from inventory data, optimizing stock levels and reducing operational costs.

Europe (United Kingdom, Germany, France): Europe represents a significant and growing market for clothing store inventory software. The region exhibits a diverse retail landscape, ranging from established department stores to numerous independent boutiques, all of whom are increasingly recognizing the necessity of efficient inventory management. Stringent regulations regarding data privacy (e.g., GDPR) also drive a demand for secure and compliant software solutions. The growing e-commerce penetration and the increasing emphasis on sustainability and ethical sourcing within the fashion industry necessitate better traceability and inventory control, further boosting software adoption. Key European markets like the UK, Germany, and France are characterized by a willingness to invest in technology that enhances operational efficiency and customer experience. The presence of both global software providers and emerging regional players catering to specific European market needs contributes to the region's robust growth.

The dominance of SMEs and cloud-based solutions, coupled with the strong market presence in North America and Europe, indicates a future where accessible, flexible, and intelligent inventory management software will be a standard operational requirement for virtually all clothing retailers, regardless of their size or geographical location.

Several key catalysts are poised to accelerate the growth of the Clothing Store Inventory Software industry. The relentless expansion of e-commerce and omnichannel retail strategies necessitates more sophisticated inventory synchronization across all sales channels, directly driving demand for integrated software solutions. Furthermore, the increasing adoption of AI and machine learning for predictive analytics in demand forecasting and stock optimization empowers retailers to reduce waste and improve profitability, making these advanced software features a significant growth driver. The growing focus on supply chain visibility and traceability, influenced by consumer demand for sustainable and ethically sourced products, also pushes retailers towards inventory software that offers end-to-end tracking capabilities. The democratization of technology, with more affordable and user-friendly cloud-based solutions becoming available, opens up the market to a wider array of Small and Medium-sized Enterprises (SMEs).

This report offers an exhaustive examination of the Clothing Store Inventory Software market, providing a holistic understanding of its trajectory and key influencing factors. It meticulously analyzes the historical performance during the Historical Period (2019-2024), details the current market landscape in the Base Year (2025), and presents robust projections for the Forecast Period (2025-2033), all within the broader Study Period (2019-2033). The report dissects the market into critical segments, including applications like Large Enterprises and SMEs, and types such as On-premise and Cloud-based solutions, to offer granular insights into their respective growth dynamics. Key industry developments, such as the integration of AI, the rise of omnichannel retail, and the increasing demand for sustainability, are thoroughly explored as significant growth catalysts. Furthermore, a detailed analysis of the driving forces and challenges provides a balanced perspective on the market's opportunities and impediments. The report culminates in a comprehensive overview of leading players and their strategic contributions, empowering stakeholders with the knowledge to navigate this dynamic and increasingly vital sector of the fashion retail industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Oracle, ShopKeep, EposNow, Lightspeed, Pacific Amber Technologies, Crimson Solutions, Gofrugal, CIN7, GiftLogic, Springboard Retail, Biztracker, Shoptiques, Hippos Software, Agiliron, Big Hairy Dog Information Systems, Alloy Software, Shopify, Zoho.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Clothing Store Inventory Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Clothing Store Inventory Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.