1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell and Gene Supply Chain Solutions?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cell and Gene Supply Chain Solutions

Cell and Gene Supply Chain SolutionsCell and Gene Supply Chain Solutions by Type (Cloud-Based, On-Premises), by Application (Biobank/ Cell-bank, Hospitals, Research Institutes, Cell Therapy Labs, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

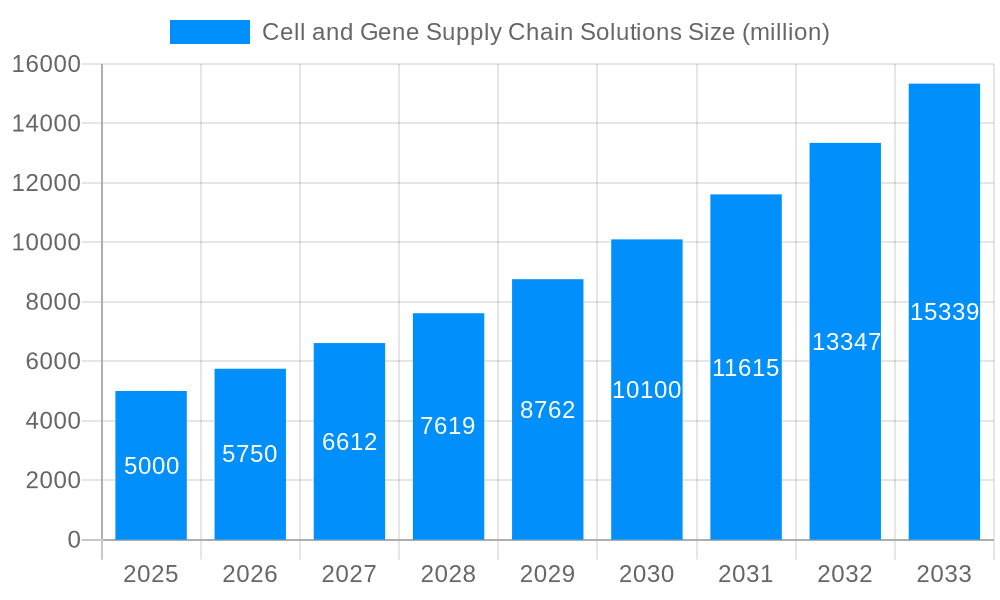

The cell and gene therapy supply chain solutions market is experiencing rapid growth, driven by the increasing number of clinical trials and approvals for innovative cell and gene therapies. The market's value is substantial, with projections indicating a significant expansion over the forecast period (2025-2033). Assuming a conservative CAGR of 15% (a reasonable estimate given the rapid advancements in the field), and a 2025 market size of $5 billion (a plausible figure based on industry reports of similar markets), the market is expected to reach approximately $15 billion by 2033. Key drivers include the rising prevalence of chronic diseases necessitating advanced therapies, increasing investments in R&D by pharmaceutical and biotech companies, and favorable regulatory environments in key markets. Technological advancements, such as improved cryopreservation techniques and advanced tracking systems, further propel market growth. However, challenges remain, including the high cost of manufacturing and logistical complexities associated with the sensitive nature of cell and gene therapies, along with the need for rigorous regulatory compliance. The market is segmented by service type (logistics, storage, manufacturing support), technology (cryopreservation, transportation), and end-user (pharmaceutical companies, CROs, academic institutions).

The competitive landscape is dynamic, with numerous companies offering specialized solutions across the supply chain. Major players such as Catalent, Thermo Fisher Scientific, and Cryoport are establishing themselves as leaders, offering a range of integrated solutions. However, smaller, specialized companies are also making significant contributions by focusing on niche areas within the supply chain. Future market growth will depend on several factors, including technological innovations improving efficiency and reducing costs, expansion into emerging markets, and the successful commercialization of new cell and gene therapies. Strategic partnerships and mergers & acquisitions are expected to shape the competitive landscape, further consolidating the market. The continuous evolution of regulatory frameworks will also significantly influence the industry's trajectory.

The cell and gene therapy market is experiencing explosive growth, projected to reach several hundred billion dollars by 2033. This surge necessitates robust and efficient supply chain solutions capable of handling the unique challenges posed by these highly specialized therapies. The market is shifting from a predominantly research-focused landscape to one increasingly driven by commercialization, demanding scalable and compliant supply chains. This transition is reflected in increased investments in automation, advanced technologies like AI and blockchain for tracking, and a growing emphasis on data analytics to optimize logistics and ensure product integrity. The demand for specialized cold chain solutions, including cryopreservation and temperature-controlled transportation, is particularly strong, as is the need for compliant manufacturing and distribution facilities. The market also shows a growing interest in integrated solutions that encompass the entire supply chain, from cell collection and processing to final delivery to the patient. This holistic approach minimizes risks, improves efficiency, and ensures the timely delivery of life-saving therapies. The market witnessed significant consolidation in the historical period (2019-2024), with several companies acquiring smaller players to enhance their capabilities and market share. This trend is expected to continue in the forecast period (2025-2033), leading to further industry consolidation and the emergence of a few dominant players offering comprehensive end-to-end supply chain solutions. Current estimates place the market value in the tens of billions of dollars in 2025, projected to reach hundreds of billions by 2033, signifying an exceptional Compound Annual Growth Rate (CAGR). This growth is not just numerical; it represents a fundamental shift in healthcare, driving innovation and demanding sophisticated logistical support.

Several key factors are propelling the growth of the cell and gene supply chain solutions market. The increasing approval and commercialization of cell and gene therapies are primary drivers. As more therapies gain regulatory approval, the demand for efficient and reliable supply chains to support their distribution and delivery exponentially increases. Technological advancements in areas like cryopreservation, automated processing, and real-time tracking systems are significantly enhancing the efficiency and safety of cell and gene product handling. These innovations minimize the risk of product degradation and loss, ensuring the quality and efficacy of these highly sensitive therapies. Furthermore, the growing adoption of regulatory frameworks and guidelines aimed at ensuring the quality and safety of cell and gene therapies is driving the demand for compliant supply chain solutions. Companies are investing heavily in systems that guarantee full traceability and compliance with evolving regulations, including Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP). Finally, the rise of personalized medicine, where therapies are tailored to individual patients, further adds complexity and necessitates customized supply chain solutions capable of handling the unique requirements of each patient’s treatment. This individualized approach significantly increases the demand for flexible and agile supply chains that can adapt to rapidly changing needs.

Despite the immense growth potential, the cell and gene supply chain sector faces significant challenges. The high cost associated with developing and maintaining specialized infrastructure for handling cell and gene products presents a major barrier to entry for many players. This includes investments in advanced equipment, cold chain logistics, and compliant manufacturing facilities. Maintaining the integrity of these highly sensitive therapies throughout the supply chain is also crucial and extremely difficult. The stringent temperature requirements, potential for contamination, and short shelf life of many cell and gene products necessitate sophisticated monitoring and control systems. Regulatory compliance presents another hurdle, with evolving guidelines and standards demanding significant investments in quality control and documentation. The global nature of the cell and gene therapy market adds to the complexity, requiring seamless coordination across multiple jurisdictions and regulatory bodies. Finally, a shortage of skilled professionals capable of managing the complex technical and logistical aspects of this industry creates a bottleneck limiting growth.

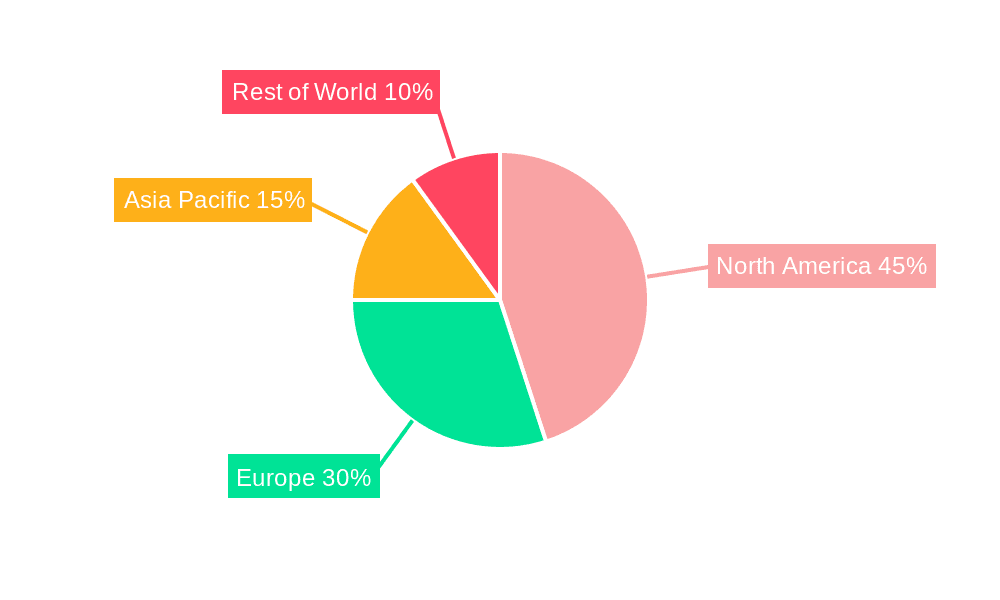

The North American market, particularly the United States, is currently leading the cell and gene supply chain solutions market due to its strong presence of biotech and pharmaceutical companies, significant investments in research and development, and a supportive regulatory environment. However, other regions, including Europe and Asia-Pacific, are experiencing rapid growth and are expected to witness significant market expansion.

Segments: The cold chain logistics segment is expected to dominate due to the critical need for maintaining the viability and potency of cell and gene therapies throughout the supply chain. This includes specialized cryogenic shipping containers, temperature-controlled warehouses, and advanced monitoring systems. The software and IT solutions segment will also experience significant growth as companies seek advanced solutions for supply chain management, tracking, and regulatory compliance. This segment includes software for inventory management, batch tracking, and analytics.

In terms of individual therapeutic areas, oncology and hematology are projected to hold the largest market share due to the large number of cell and gene therapies in development and clinical trials within these areas. However, the market is likely to diversify over the forecast period with growth observed in rare diseases and other therapeutic segments. This diversification will impact the supply chain, demanding even greater flexibility and customization capabilities. The market will witness continued growth driven by the expanding portfolio of approved therapies and an increased focus on personalized medicine. This will necessitate highly adaptive supply chain solutions capable of handling individualized product specifications and patient-specific logistics.

Several factors are accelerating growth in this sector. Increased funding for research and development is spurring innovation in cell and gene therapies and creating a greater demand for robust supply chain capabilities. Regulatory approvals for new therapies directly translate into increased production and distribution needs, driving market expansion. Technological advancements, particularly in automation, cryopreservation, and data analytics, are improving efficiency and reducing risks within the supply chain. The increasing adoption of advanced analytical tools for predictive modeling and optimization further enhances supply chain agility and cost-effectiveness.

This report provides a comprehensive overview of the cell and gene supply chain solutions market, covering market size and projections, key trends, driving forces, challenges, and competitive landscape. It also offers detailed insights into key segments, regions, and leading players, enabling stakeholders to make informed business decisions and navigate this rapidly evolving market. The report’s detailed analysis and forecasts will empower businesses to understand future market dynamics and optimize their strategies for success within this promising industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Arvato, Biocair, CSafe Global, LLC, Catalent, BioLife Solutions, BioTherapies, Azenta US, Inc., Clarkston Consulting, Cryoport, Haemonetics, Hypertrust Patient Data Care, Lykan Bioscience, MAK-SYSTEM International Group, MasterControl, Inc., SAP, SAVSU Technologies, Inc., sedApta Group, Stafa Cellular Therapy, Title21 Health Solutions, TraceLink, Inc., TrakCel Limited, Vineti, Inc.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cell and Gene Supply Chain Solutions," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cell and Gene Supply Chain Solutions, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.