1. What is the projected Compound Annual Growth Rate (CAGR) of the Casino and Gaming?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Casino and Gaming

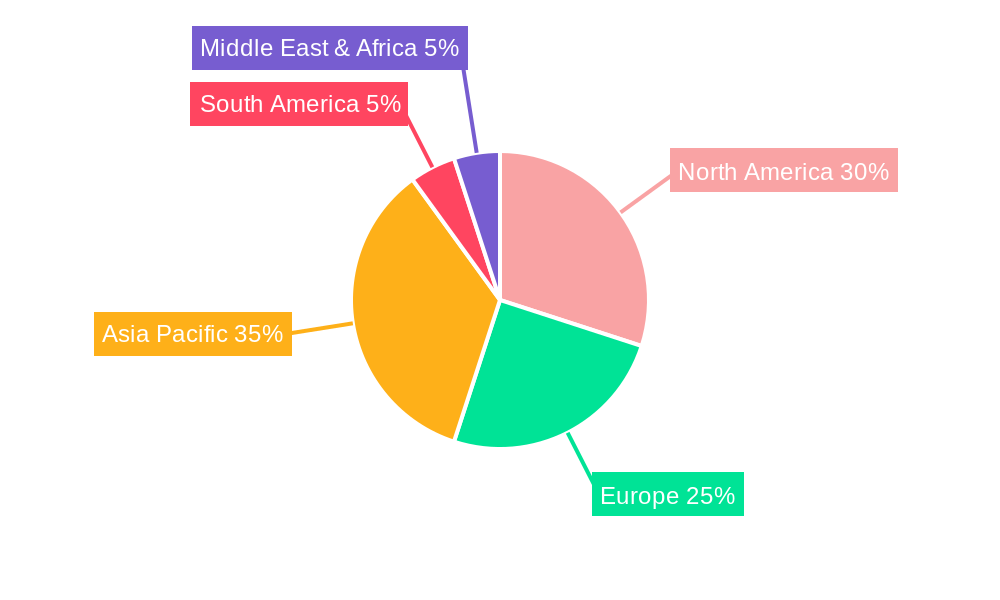

Casino and GamingCasino and Gaming by Type (/> Online Gaming Casino, Card Room Gaming, Lotteries, Race & Sports Wagering, Bingo, Others), by Application (/> 18-30 Years Old, 31-40 Years Old, 41-50 Years Old, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

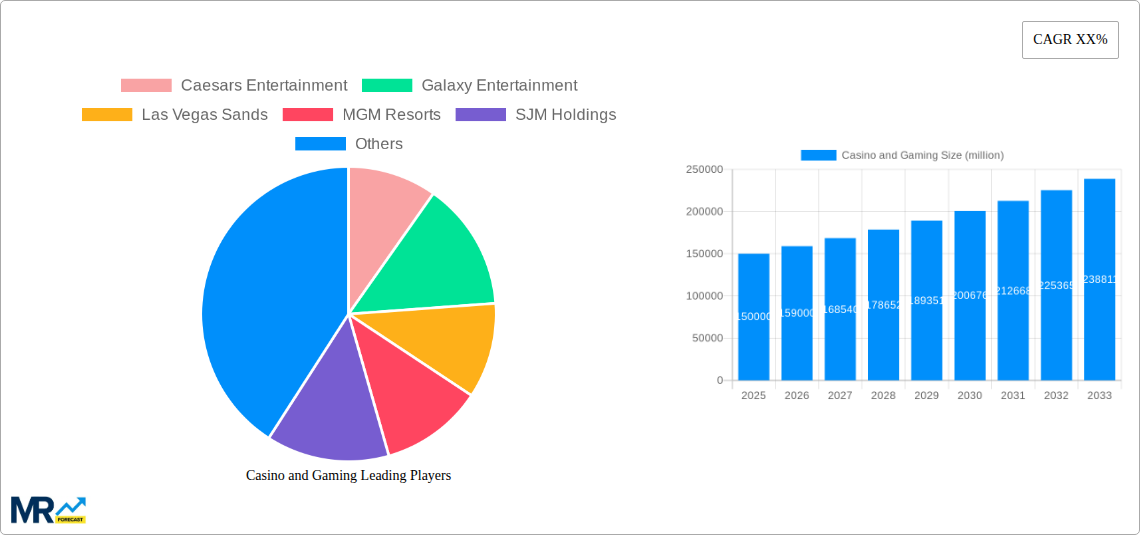

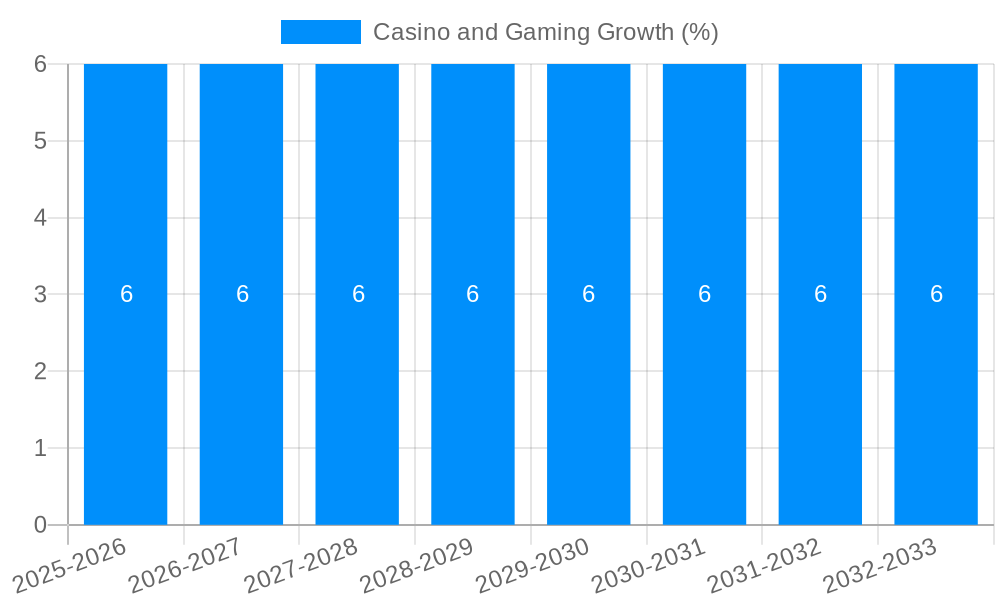

The global casino and gaming market is poised for robust expansion, projected to reach an impressive $XXX million in 2025, fueled by a Compound Annual Growth Rate (CAGR) of XX% throughout the forecast period of 2025-2033. This substantial growth is underpinned by several powerful drivers, most notably the increasing disposable incomes and a growing appetite for entertainment among a digitally connected global population. The proliferation of online gaming, encompassing online casino games, card rooms, and lotteries, is a significant catalyst, breaking down geographical barriers and offering unparalleled accessibility. Furthermore, the legalization and expansion of race and sports wagering in numerous regions are attracting a new demographic of enthusiasts. Technological advancements, including the integration of mobile gaming, augmented reality (AR), and virtual reality (VR), are continuously enhancing player engagement and creating novel gaming experiences. The appeal extends across various age demographics, with a pronounced interest observed in the 18-30 and 31-40 year old segments, who are early adopters of digital entertainment.

Despite the promising outlook, the market faces certain restraints that could temper its growth trajectory. Regulatory hurdles and evolving legal frameworks in different jurisdictions present a complex landscape for operators. Concerns surrounding problem gambling and the ethical implications of intensified marketing efforts necessitate careful consideration and responsible gaming initiatives. The competitive intensity among established players and emerging online platforms also creates a dynamic market where innovation and customer retention are paramount. Key market segments such as Online Gaming Casino and Card Room Gaming are expected to exhibit the highest growth rates due to their accessibility and convenience. Geographically, Asia Pacific, with its burgeoning economies and large young population, is anticipated to be a major growth engine, alongside established markets in North America and Europe. Major players like Caesars Entertainment, Galaxy Entertainment, and Las Vegas Sands are actively investing in digital transformation and expanding their global footprints to capitalize on these evolving trends.

This comprehensive market research report offers an in-depth analysis of the global casino and gaming industry, spanning a detailed study period from 2019 to 2033, with the base and estimated year set as 2025. The report meticulously examines the historical trajectory (2019-2024) and forecasts significant growth and evolving dynamics across the forecast period (2025-2033). Leveraging a robust methodology, this report provides actionable insights for stakeholders seeking to navigate this dynamic and rapidly expanding sector. It delves into key market trends, scrutinizes the driving forces behind industry expansion, identifies critical challenges and restraints, and highlights dominant segments and geographical regions. Furthermore, the report pinpoints crucial growth catalysts and profiles leading players, offering a holistic understanding of the casino and gaming landscape. The insights presented are invaluable for strategic decision-making, investment planning, and identifying emerging opportunities within this multi-billion dollar industry.

XXX The global casino and gaming market is undergoing a profound transformation, driven by technological advancements, shifting consumer preferences, and evolving regulatory landscapes. A paramount trend is the relentless surge of online gaming, which has transcended its niche status to become a dominant force. This growth is fueled by increased accessibility through mobile devices, enhanced user interfaces, and the introduction of innovative game formats, including live dealer experiences that mimic the thrill of a physical casino. The integration of artificial intelligence (AI) and machine learning is also revolutionizing player engagement, enabling personalized recommendations, fraud detection, and more sophisticated game development. Furthermore, the rise of esports betting and the convergence of gaming and social media platforms are creating new avenues for revenue generation and audience reach. While traditional brick-and-mortar casinos are adapting by enhancing their entertainment offerings, incorporating immersive technologies like virtual reality (VR) and augmented reality (AR), and focusing on experiential gaming, the digital realm continues to capture a significant share of consumer spending. Lotteries, though often perceived as a more traditional form of gaming, are also experiencing innovation through online platforms and innovative prize structures, widening their appeal. Race and sports wagering are experiencing a renaissance, particularly with the legalization and expansion of sports betting in numerous jurisdictions, providing a significant boost to this segment. The demographic landscape of gamers is also diversifying, with a growing participation from younger age groups who are digital natives and more inclined towards online and mobile gaming experiences. The industry is also witnessing an increasing focus on responsible gaming initiatives, driven by regulatory pressures and a growing societal awareness of potential risks associated with gambling. This multifaceted evolution promises a dynamic and competitive market in the coming years.

The casino and gaming industry's remarkable expansion is propelled by a confluence of powerful forces. Foremost among these is the pervasive digitalization of consumer lifestyles, which has seamlessly integrated online gaming into daily routines. The proliferation of smartphones and high-speed internet access has democratized gaming, making it accessible to a broader demographic than ever before. This ease of access is complemented by significant advancements in technology, particularly in areas like mobile gaming optimization, immersive graphics, and the development of sophisticated online platforms. The increasing adoption of cryptocurrencies as a payment method is also a noteworthy driving force, offering enhanced security and anonymity for online transactions, further enticing a tech-savvy user base. Furthermore, favorable regulatory changes in various countries, including the legalization of sports betting and online casinos, have opened up vast untapped markets and created a more robust and legitimate operating environment for businesses. The growing demand for entertainment and leisure activities, especially in a post-pandemic world where consumers are seeking novel and engaging experiences, also plays a crucial role. Companies are also actively investing in marketing and customer acquisition strategies, employing data analytics to understand player behavior and tailor offerings, thereby fostering loyalty and increasing overall spending.

Despite its robust growth, the casino and gaming industry faces several significant challenges and restraints that can impede its progress. One of the most prominent is the ever-evolving and often complex regulatory landscape across different jurisdictions. The fragmented nature of these regulations can create compliance hurdles and limit market entry for businesses, particularly for global operators. Stringent licensing requirements and varying taxation policies can also impact profitability and investment decisions. Another critical challenge is the increasing scrutiny and demand for responsible gaming practices. Growing concerns about problem gambling and addiction necessitate significant investments in player protection measures, which can add to operational costs and potentially limit certain marketing activities. The cybersecurity threat landscape is also a constant concern, with the risk of data breaches and online fraud posing a significant threat to both operators and players, requiring continuous investment in robust security infrastructure. Furthermore, intense competition within the industry, both from established players and emerging disruptors, can lead to price wars and pressure on profit margins. Maintaining player engagement and loyalty in a crowded market also requires constant innovation and adaptation to changing consumer preferences. Public perception and societal attitudes towards gambling can also act as a restraint, with some segments of the population viewing the industry negatively, potentially leading to public backlash and restrictive policies.

The global casino and gaming market is characterized by dynamic regional dominance and segment leadership, with Asia-Pacific, particularly Macau and Singapore, emerging as a powerhouse in traditional casino gaming, while North America, especially the United States, is witnessing exponential growth in Race & Sports Wagering and Online Gaming Casino.

Key Dominating Segments:

Online Gaming Casino: This segment is poised for sustained dominance across multiple regions, driven by its accessibility, convenience, and continuous innovation.

Race & Sports Wagering: This segment is experiencing a renaissance, particularly in North America, due to widespread legalization and a surge in interest.

Key Dominating Regions:

Asia-Pacific (specifically Macau and Singapore): These regions continue to be dominant in the high-stakes traditional casino and integrated resort sector.

North America (specifically the United States): This region is a multi-faceted leader, dominating in both online expansion and traditional casino operations, with a particular surge in sports betting.

The casino and gaming industry's growth trajectory is significantly bolstered by several key catalysts. The relentless advancement of digital technologies, particularly mobile integration and AI, enhances user experience and accessibility, drawing in a wider audience. The increasing legalization and regulation of online gambling and sports betting in various global markets are unlocking substantial new revenue streams and legitimizing the industry. Furthermore, the growing demand for personalized and immersive entertainment experiences drives innovation in game design and platform development, encouraging higher player engagement. The expansion of emerging markets and the increasing disposable income in developing economies also present new opportunities for growth.

This report offers a holistic and granular perspective on the global casino and gaming market, providing an unparalleled depth of analysis. It moves beyond surface-level statistics to dissect the intricate interplay of trends, drivers, and challenges shaping the industry's future. The report's comprehensive nature is underscored by its detailed segmentation by type (Online Gaming Casino, Card Room Gaming, Lotteries, Race & Sports Wagering, Bingo, Others) and application (demographic segments like 18-30 Years Old, 31-40 Years Old, 41-50 Years Old, Others), offering targeted insights for specific market niches. With a robust historical analysis from 2019-2024 and a forward-looking forecast period of 2025-2033, it equips stakeholders with the strategic foresight necessary to capitalize on emerging opportunities and mitigate potential risks within this multi-billion dollar sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Caesars Entertainment, Galaxy Entertainment, Las Vegas Sands, MGM Resorts, SJM Holdings, 888 Holdings, Betfair Online Casino Games, Boyd Gaming, Melco Resorts & Entertainment, Delaware Park.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Casino and Gaming," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Casino and Gaming, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.