1. What is the projected Compound Annual Growth Rate (CAGR) of the Cash Payment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cash Payment

Cash PaymentCash Payment by Type (/> Business, Personal), by Application (/> Electricity Bill Payments, Hotel Bill Payments, Shopping, Travel Bookings, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

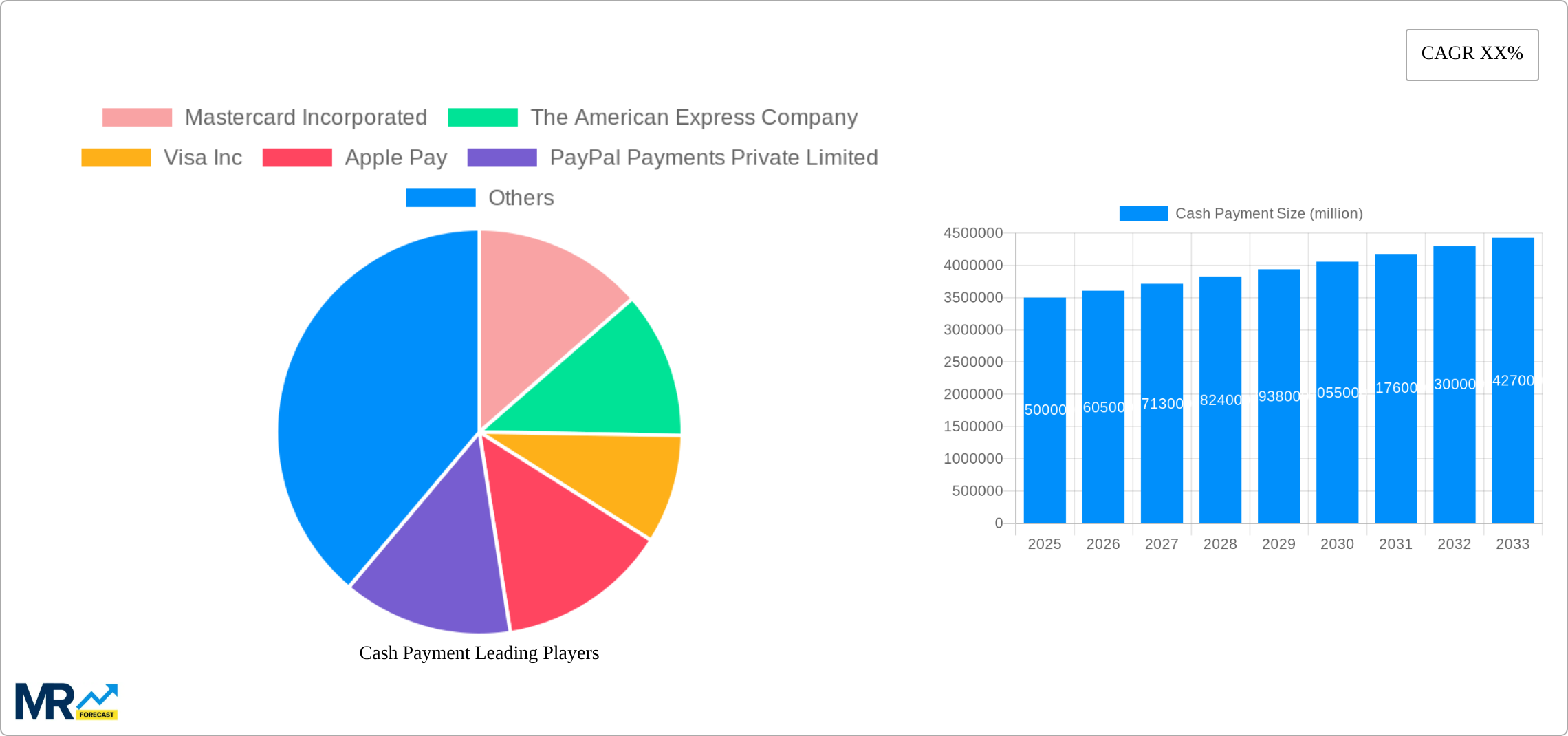

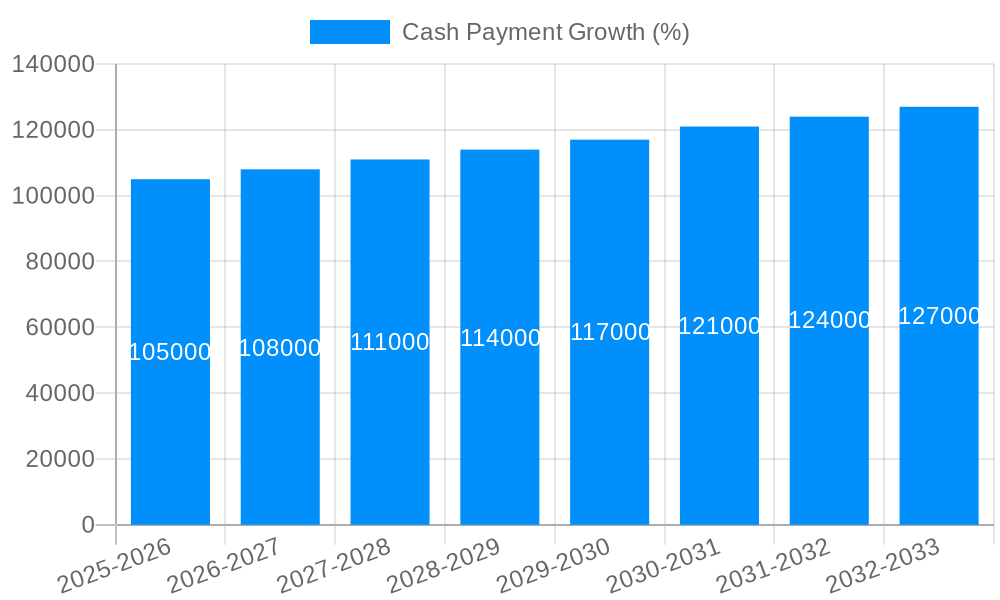

The global cash payment market, while facing significant pressure from digital alternatives, continues to hold substantial value, particularly in developing economies and for specific transaction types. While precise figures are unavailable, a reasonable estimation based on global payment trends suggests a 2025 market size in the range of $3-4 trillion USD, with a Compound Annual Growth Rate (CAGR) of approximately 2-3% over the forecast period (2025-2033). This relatively low CAGR reflects the ongoing shift toward digital payments; however, factors like persistent underbanked populations, preference for cash in certain sectors (e.g., informal markets), and security concerns around digital transactions are contributing to cash's continued relevance. Growth will likely be concentrated in regions with high cash dependency, such as parts of Asia and Africa, though even in developed markets, cash remains a significant player for smaller, everyday transactions.

The market is segmented by user type (business and personal) and application (electricity bill payments, hotel bill payments, shopping, travel bookings, and others). While business-to-business (B2B) cash transactions are gradually declining, personal use of cash for smaller purchases and in contexts with limited digital infrastructure is expected to persist. Key players in the cash processing and handling industry include companies that provide cash management solutions, ATMs, armored transportation services, and point-of-sale systems. Regulatory changes related to anti-money laundering (AML) and know-your-customer (KYC) compliance also influence market dynamics, driving the need for more robust cash handling infrastructure and processes within the financial services sector. Therefore, although the long-term outlook projects reduced market share compared to digital payments, cash payments retain a significant presence and will remain a critical component of the global financial system for the foreseeable future.

The global cash payment market, while facing significant headwinds from the rise of digital transactions, retains a substantial presence, particularly in certain regions and sectors. The study period from 2019 to 2033 reveals a complex picture. While the historical period (2019-2024) showed a gradual decline in cash usage in developed economies driven by increased digital financial inclusion and the proliferation of digital payment platforms like PayPal, Visa, and Mastercard, the base year (2025) and the projected forecast period (2025-2033) suggest a more nuanced trend. The estimated value of cash payments in 2025 sits at a significant figure in the millions, showcasing its enduring relevance, especially in developing nations with lower rates of financial inclusion and underdeveloped digital infrastructure. The continuing reliance on cash transactions in informal economies and among certain demographics contributes significantly to the overall market size. This report delves into the multifaceted dynamics influencing cash usage, examining both its persistent strengths and vulnerabilities in the face of technological advancements. Factors such as security concerns surrounding digital payments, the lack of access to technology in underserved communities, and the inherent simplicity and familiarity of cash transactions contribute to its continued usage. While the market's growth trajectory is negative compared to digital transactions, the absolute value of cash payments remains substantial and warrants careful analysis. Understanding regional variations, socioeconomic disparities, and industry-specific preferences will be crucial to accurately predicting future trends within the cash payment market. The report will shed light on the specific segments, geographical regions and drivers that contribute to the continued relevance of cash payments despite the growth of digital payment systems.

Several factors sustain the relevance of cash payments despite the surge in digital alternatives. First, the lack of financial inclusion in many parts of the world remains a crucial driver. Millions lack access to bank accounts or smartphones, making cash the only viable transaction method. Second, security concerns surrounding digital payments persist. Many consumers, especially older generations, still harbor concerns about online fraud, data breaches, and the loss of personal financial information. The perceived simplicity and anonymity of cash transactions are appealing to those seeking to avoid digital footprints. Third, cash offers a tangible sense of control and immediate gratification; there are no transaction fees, processing delays, or reliance on unreliable technology. This is particularly important for low-value transactions and in situations with weak internet connectivity. Finally, specific sectors, such as certain segments of the informal economy, continue to rely heavily on cash due to regulatory challenges, tax avoidance, or a simple lack of integration with digital systems. These aspects combine to ensure that the cash payment market will likely remain substantial for the foreseeable future, though its dominance is undeniably eroding in developed economies.

The dominance of cash payments is facing significant headwinds. The ongoing global push for digital financial inclusion and the increasing ease of access to digital payment systems pose major threats. Governments and financial institutions worldwide are actively promoting the adoption of digital alternatives, offering incentives and creating more accessible digital infrastructure. Furthermore, the increasing security of digital payment platforms is addressing past consumer concerns, reducing a key advantage of cash. The growth of mobile money and e-wallets is rapidly expanding access to digital transactions, especially in developing economies, steadily eroding cash's market share. Another significant challenge is the cost and logistical complexities of handling physical currency. The cost of printing, transporting, storing, and securing cash remains significant for businesses and governments. The risk of theft, loss, and counterfeiting further adds to the overall challenges associated with cash transactions. These factors cumulatively push towards a reduction in cash usage, though this transition remains uneven across different regions and demographics.

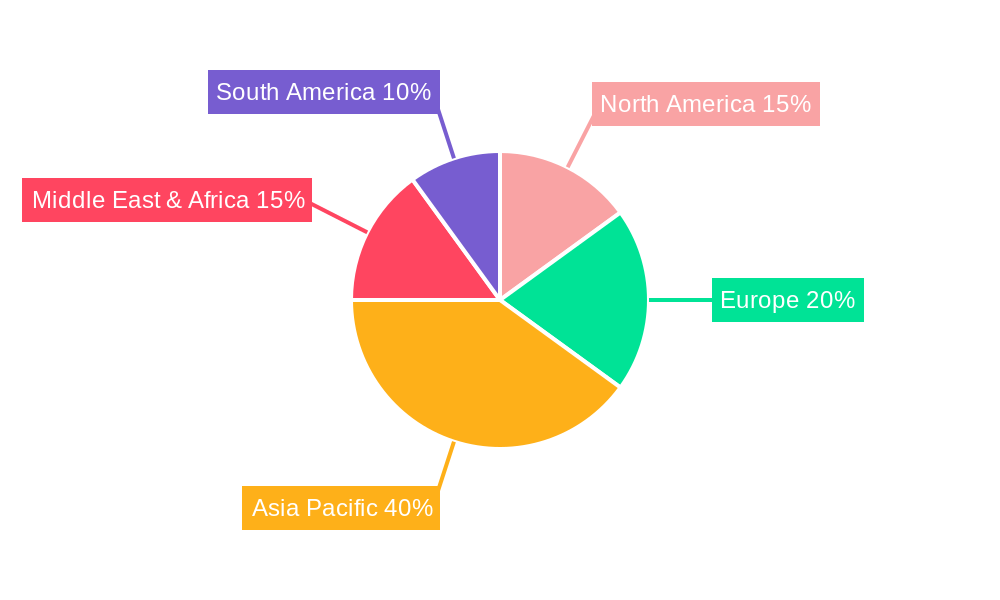

The cash payment market displays significant regional disparities. Developing economies in Asia, Africa, and parts of Latin America are projected to retain higher cash usage compared to developed nations in North America and Europe where digital payments are increasingly prevalent. This is primarily due to a lower rate of financial inclusion, limited access to digital infrastructure, and a greater reliance on the informal economy.

Developing Economies (Asia, Africa, Latin America): These regions exhibit a high proportion of cash transactions due to several factors including limited access to banking services, low smartphone penetration, and a large informal economy. Cash remains a crucial driver of economic activity in these regions.

Personal Segment: While the business segment shows a gradual shift towards digital payments, the personal segment, particularly in less developed regions, shows a strong continued reliance on cash for day-to-day transactions, small purchases, and social transfers.

Specific Applications: While the transition is happening in all applications, cash transactions still dominate in sectors such as street vending, informal markets, and smaller businesses where digital infrastructure may be less accessible or transaction costs are a significant consideration.

The forecast period (2025-2033) anticipates a sustained, though slowing, cash transaction volume in these key regions and segments. While the overall trend favors a decline in the global cash market share, the sheer volume of transactions in these areas ensures that the absolute value of cash payments remains significantly high. Significant governmental initiatives to promote digital financial inclusion could, however, accelerate the decline in the long term.

Despite the overall decline, niche growth catalysts exist. These include the continued preference for cash among certain demographics who prioritize privacy and security, and the enduring reliance on cash in sectors with limited digital penetration. Continued expansion of the informal economy in certain developing regions can also temporarily sustain cash usage.

This report provides a comprehensive overview of the global cash payment market, examining its current state, future projections, and underlying factors. The report goes beyond simple market size estimations to delve into the intricate interplay of technology, regulation, and consumer behavior, giving a detailed understanding of both the challenges and opportunities within the cash payment landscape. The report's analysis will be invaluable to businesses, investors, and policymakers seeking to navigate the evolving world of financial transactions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Mastercard Incorporated, The American Express Company, Visa Inc, Apple Pay, PayPal Payments Private Limited, Capital One Financial Corporation, The Bank of America Corporation, Payoneer Inc, Stripe, Due Inc..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cash Payment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cash Payment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.