1. What is the projected Compound Annual Growth Rate (CAGR) of the Cash Flow Forecast Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cash Flow Forecast Service

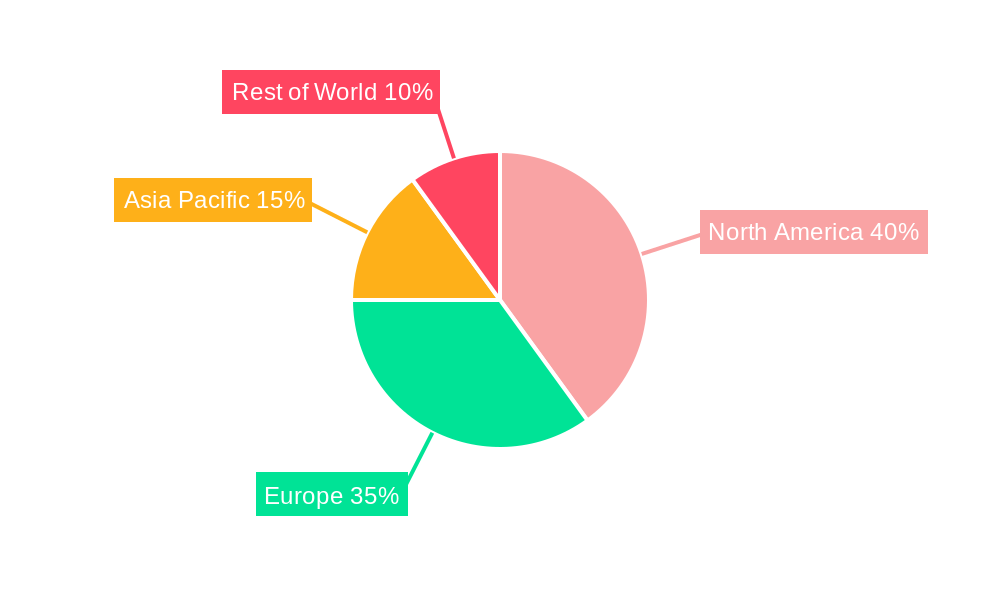

Cash Flow Forecast ServiceCash Flow Forecast Service by Application (Contractors, Sole Traders, Small Businesses, Others), by Type (Predicting Income, Estimating Outgoings), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

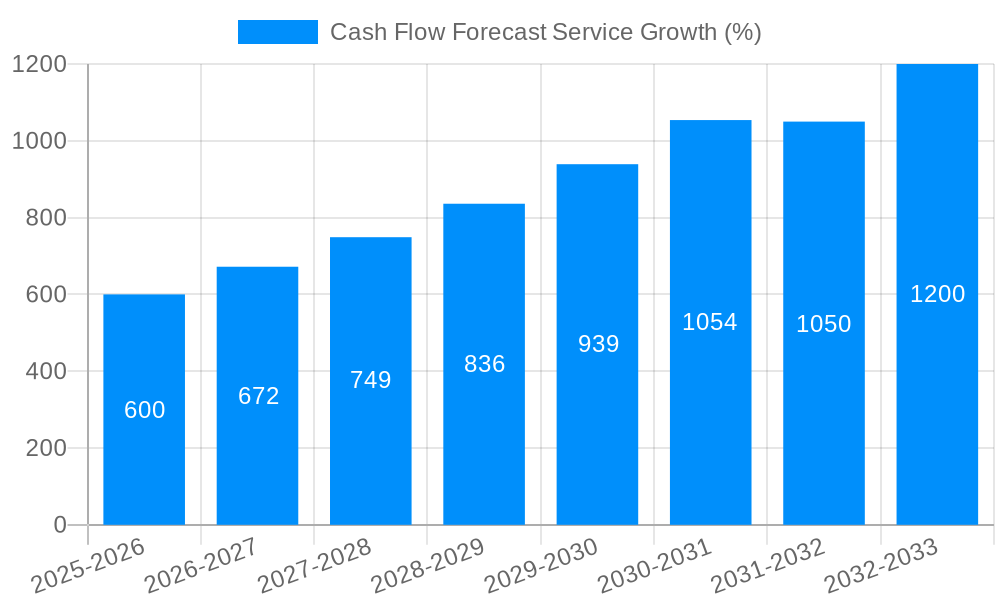

The Cash Flow Forecast Service market is experiencing robust growth, driven by increasing demand from contractors, small businesses, and sole traders seeking improved financial planning and management. The market's expansion is fueled by several key factors. Firstly, the rising complexity of business operations and the need for accurate financial projections are compelling businesses to invest in professional cash flow forecasting services. Secondly, the availability of sophisticated software and analytical tools has simplified the process and made it more accessible to a wider range of businesses. Thirdly, increased regulatory scrutiny and stricter lending requirements are pushing businesses to demonstrate robust financial health, making cash flow forecasting a critical necessity. The market is segmented by application (contractors, sole traders, small businesses, others) and by service type (predicting income, estimating outgoings). While the precise market size in 2025 is unavailable, a reasonable estimate, considering the presence of numerous established and emerging players, along with the overall growth of the accounting and finance technology sectors, suggests a market value exceeding $500 million. This value is expected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 15% throughout the forecast period of 2025-2033. Geographic segments are widely distributed, with North America and Europe leading in market share, but Asia-Pacific demonstrates significant potential for future expansion based on increasing digital adoption and entrepreneurial activities within the region. Key restraints to growth include a possible reliance on manual processes for smaller firms and a potential lack of awareness about the benefits of professional cash flow forecasting services in certain markets.

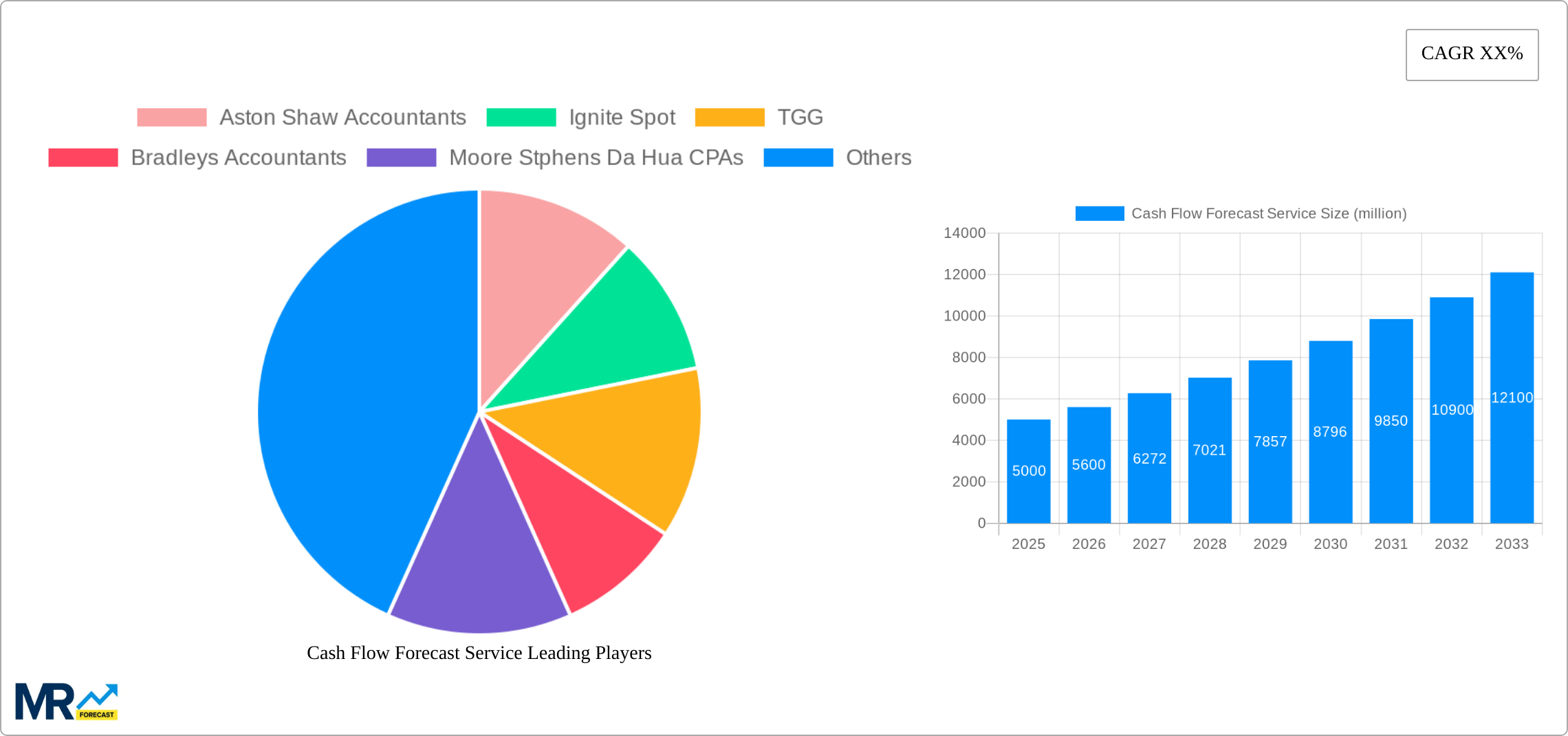

The competitive landscape features a mixture of large accounting firms (like Aston Shaw Accountants and Moore Stephens Da Hua CPAs) offering comprehensive financial services, alongside specialized technology-focused providers and smaller, boutique firms. This diversity fosters innovation and ensures the availability of services catering to varied business needs and budgets. The continued growth of the market hinges on factors such as technological advancements, improved data analytics capabilities, and effective marketing strategies raising awareness among target customer segments. The market is predicted to witness consolidation in the coming years as larger firms acquire smaller players or specialize in niche areas within the broader cash flow forecasting market. The ability to integrate cash flow forecasting with other financial management tools and platforms will become increasingly vital in shaping future market trends and driving growth.

The global cash flow forecast service market is experiencing robust growth, projected to reach USD XX million by 2033, exhibiting a CAGR of X% during the forecast period (2025-2033). The base year for this analysis is 2025, with historical data spanning from 2019 to 2024. This growth is fueled by a confluence of factors, including the increasing adoption of cloud-based accounting software, the rising need for improved financial planning and management among small and medium-sized enterprises (SMEs), and the growing awareness of the importance of proactive financial management for business sustainability. The market is witnessing a shift towards sophisticated forecasting models incorporating AI and machine learning, allowing for more accurate predictions and improved decision-making. Furthermore, the expanding availability of readily accessible and affordable cash flow forecasting services tailored to specific business needs, such as those designed for sole traders or contractors, is further stimulating market expansion. The increasing complexity of financial regulations across various industries also necessitates more robust cash flow forecasting to ensure compliance and mitigate potential risks. This trend is evident across all key market segments, including predicting income, estimating outgoings, and adapting to industry developments. The competitive landscape is dynamic, with established players focusing on innovation and expansion, while new entrants leverage technology to offer tailored and cost-effective solutions. The market's growth trajectory indicates a sustained demand for sophisticated financial forecasting tools that empower businesses to navigate the complexities of modern economic environments. This is further supported by increasing investment in fintech solutions that enhance the efficiency and accuracy of cash flow prediction methodologies.

Several key factors are propelling the growth of the cash flow forecast service market. Firstly, the increasing complexity of business operations and economic uncertainty necessitate more accurate and proactive financial planning. Businesses are relying heavily on precise cash flow forecasting to secure funding, optimize resource allocation, and make informed investment decisions. Secondly, the rise of cloud-based accounting software has streamlined data integration and analysis, making cash flow forecasting more accessible and efficient. This technological advancement has drastically reduced the time and cost associated with the process, thereby increasing its adoption among SMEs. Thirdly, the growing awareness of the importance of proactive financial management is driving demand for these services. Businesses are recognizing that accurate cash flow projections are crucial for identifying potential financial bottlenecks, managing risks effectively, and achieving long-term financial stability. Lastly, government initiatives and financial regulations supporting improved financial planning and reporting also contribute to the market's growth. This regulatory push creates a compelling incentive for businesses to implement robust cash flow forecasting systems.

Despite the considerable growth potential, the cash flow forecast service market faces certain challenges. One major hurdle is the lack of awareness and understanding among some businesses, particularly smaller enterprises, of the benefits of professional cash flow forecasting services. Over-reliance on rudimentary forecasting methods can lead to inaccurate predictions and poor financial decision-making. Another significant constraint is the cost factor, as comprehensive cash flow forecasting services can be expensive for smaller businesses with limited budgets. Furthermore, the accuracy of cash flow forecasts is heavily reliant on the quality and completeness of the input data. Inaccurate or incomplete data can lead to unreliable predictions, undermining the effectiveness of the service. Competition in the market is also intense, with numerous established players and emerging fintech companies vying for market share. Maintaining a competitive edge requires ongoing innovation, technological upgrades, and effective marketing strategies. Lastly, ensuring data security and privacy is paramount, particularly when dealing with sensitive financial information, demanding robust security measures and compliance with relevant regulations.

The Small Business segment is poised to dominate the cash flow forecast service market. The increasing number of small businesses globally, coupled with their heightened need for improved financial management, fuels substantial demand for these services. Small businesses, unlike larger corporations with dedicated finance departments, often lack the expertise and resources to manage cash flow effectively. This segment's demand for accessible, affordable, and user-friendly cash flow forecasting tools is driving significant market growth. This is particularly true for service-based small businesses, which often experience unpredictable income streams, making accurate forecasting crucial for managing expenses and maintaining financial stability. Further driving this segment’s dominance is the growing availability of software and services specifically tailored to the needs of small businesses, providing easy-to-use interfaces and affordable pricing models. Furthermore, educational initiatives and government programs promoting financial literacy among small business owners are also contributing to increased adoption.

The "Predicting Income" type of service is also experiencing high demand. Accurate income forecasting is paramount for business planning and resource allocation, facilitating improved decision-making related to investment, expansion, and staffing. The ability to accurately predict future income allows businesses to proactively manage their finances, ensuring sufficient funds to meet operational costs and invest in growth opportunities. This is especially critical in volatile economic climates, where accurate income prediction becomes even more crucial for survival and long-term success.

Several factors are catalyzing the growth of the cash flow forecast service industry. Increased technological advancements, especially the integration of AI and machine learning, are leading to improved accuracy and efficiency in forecasting. Rising awareness among businesses regarding the importance of proactive financial management and improved accessibility and affordability of these services, particularly through cloud-based solutions, are also significant drivers. Government initiatives and regulatory measures promoting financial transparency and better financial planning among small and medium-sized businesses are also fostering market expansion.

This report provides a detailed analysis of the global cash flow forecast service market, covering market trends, driving forces, challenges, key players, and significant developments. It offers in-depth insights into various market segments and geographical regions, providing valuable data for businesses and investors seeking to understand this dynamic market. The report's comprehensive coverage ensures a complete understanding of the industry landscape, informing strategic decision-making and facilitating future growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Aston Shaw Accountants, Ignite Spot, TGG, Bradleys Accountants, Moore Stphens Da Hua CPAs, Grant Considine Chartered Accountants, Crest Accountants, LCW Certified Public Accountants, Fintelligent, David Owen, Hurkans, Royston Parkin, Satellite CPA Services, Kingston Burrowes, Laurenson Chartered Accountants, Pasaban Accounting Solutions, Thomas Westcott, Wolters Kluwer, Morris Crocker, Maisey Harris, Accurox, CFO On-Call, Flatworld Solutions, Cashfac, IAW Accountancy Services, Cutter & Co, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cash Flow Forecast Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cash Flow Forecast Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.