1. What is the projected Compound Annual Growth Rate (CAGR) of the Cargo Charter Service?

The projected CAGR is approximately 9.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cargo Charter Service

Cargo Charter ServiceCargo Charter Service by Type (Small Cargo Plane, Large Cargo Plane), by Application (Valuable Goods, Dangerous Goods, Large Cargo, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

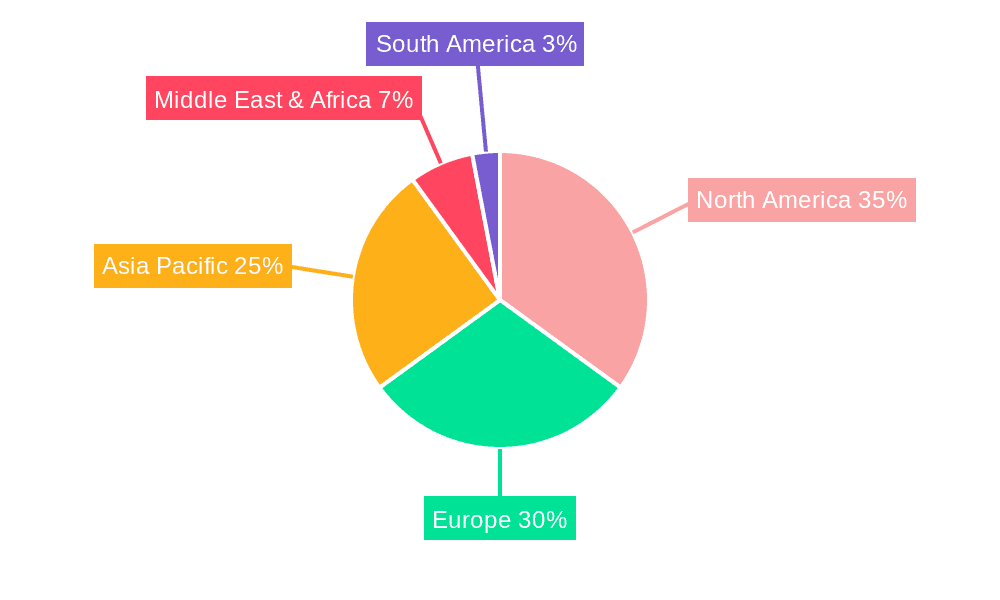

The global cargo charter service market is projected to expand significantly, driven by escalating demand for expedited and specialized cargo logistics. The burgeoning e-commerce sector, especially cross-border transactions, necessitates agile and efficient charter solutions. Market segmentation includes aircraft size (small and large cargo aircraft) and cargo type (high-value, hazardous, oversized, and general cargo). Large cargo aircraft currently lead the market due to their superior capacity for bulk shipments, while specialized transport for high-value and hazardous goods fuels growth in niche areas. North America and Europe represent key markets due to advanced logistics infrastructure and robust economic activity. Emerging economies in Asia-Pacific and the Middle East & Africa present substantial growth prospects. The competitive landscape features a mix of global and regional providers offering diverse services and fleets. Technological innovations, including advanced flight tracking and cargo management systems, are enhancing operational efficiency and transparency. Future market expansion will be shaped by global trade trends, infrastructure investment, and the integration of sustainable aviation practices.

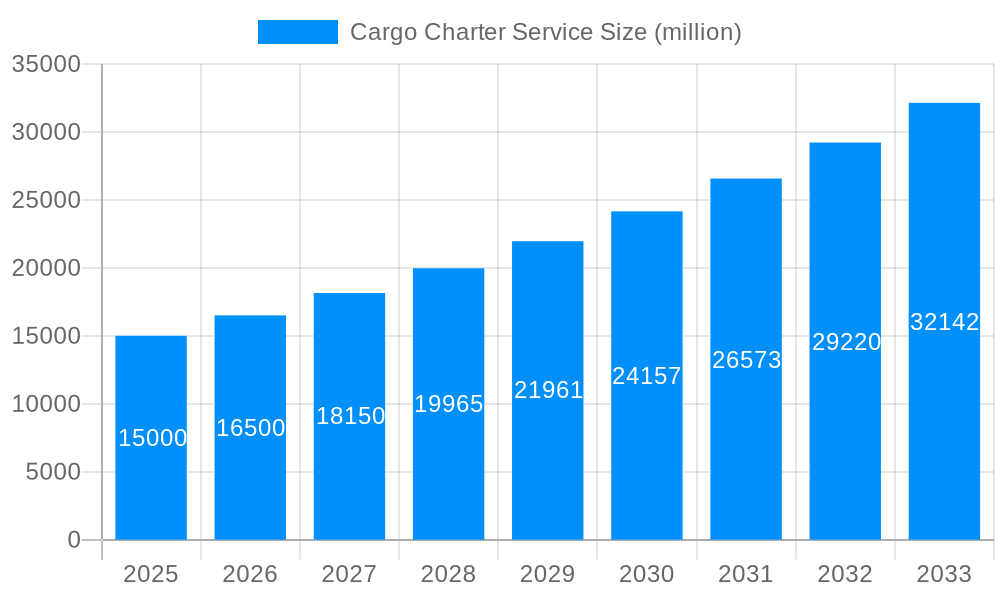

Industry consolidation through mergers and acquisitions is a prominent trend, with larger operators acquiring smaller entities to broaden service portfolios and geographic reach. Regulatory shifts and volatile fuel prices may present market constraints. Nevertheless, the cargo charter service market outlook remains optimistic, with a projected compound annual growth rate (CAGR) of 9.2%. This sustained growth will be propelled by consistent expansion in global trade and the evolving logistics requirements of diverse industries. Increased technology adoption for enhanced operational efficiency, safety, and sustainability is anticipated, fostering further market consolidation and the development of novel service models. The market size is estimated at $10.89 billion in the base year of 2025, with units in billion.

The global cargo charter service market exhibited robust growth throughout the historical period (2019-2024), exceeding $XXX million in 2024. This surge was primarily driven by the e-commerce boom, necessitating faster and more flexible delivery solutions than traditional scheduled air freight could provide. The market's expansion was further fueled by increasing globalization and the consequent rise in cross-border trade. The COVID-19 pandemic, while initially disruptive, paradoxically accelerated this growth as supply chains were stressed, highlighting the value of charter services' agility and reliability in navigating unforeseen circumstances. The demand for specialized charter solutions, such as those handling valuable goods, dangerous goods, and oversized cargo, also significantly contributed to market expansion. Looking ahead to the forecast period (2025-2033), the market is projected to maintain a healthy growth trajectory, potentially reaching $YYY million by 2033, driven by continuing e-commerce expansion, technological advancements in logistics, and a growing emphasis on just-in-time inventory management across various industries. The base year for this analysis is 2025, with estimations made for the same year and projections extending to 2033. While the market faces challenges (discussed later), its overall outlook remains positive, underpinned by consistent demand and ongoing innovation within the sector. The study period spans 2019-2033, providing a comprehensive view of market evolution and future projections.

Several key factors are driving the expansion of the cargo charter service market. Firstly, the unrelenting growth of e-commerce continues to fuel demand for rapid and reliable delivery of goods worldwide. Businesses increasingly rely on air charter services to meet the stringent delivery timelines expected by online shoppers. Secondly, the globalized nature of modern supply chains necessitates flexible and adaptable transportation solutions. Charter services offer the customized options needed to manage unpredictable demands and navigate logistical complexities, including handling oversized or specialized cargo. Thirdly, the rise of time-sensitive industries, such as pharmaceuticals and high-value electronics, has created a niche market for charter operators who can guarantee fast and secure transportation. Finally, technological advancements, including sophisticated tracking and management systems, are improving efficiency and transparency within the charter service industry, further driving its appeal to businesses seeking reliable and cost-effective logistics solutions. These factors, combined with the increasing need for just-in-time inventory management across various sectors, ensure that the demand for cargo charter services will remain strong in the coming years.

Despite the positive outlook, the cargo charter service market faces several challenges. Fuel price volatility significantly impacts operational costs, making pricing unpredictable and potentially reducing profitability. Regulatory complexities and varying aviation regulations across different countries can create administrative hurdles and increase operational expenses for charter operators. Competition from other modes of transportation, such as sea freight and rail, remains a persistent challenge, especially for less time-sensitive goods. Furthermore, finding skilled pilots and ground crew is becoming increasingly difficult, adding to labor costs and potentially impacting operational efficiency. The susceptibility to external factors such as geopolitical instability, pandemics, and unforeseen weather events further contributes to the inherent risk and operational challenges within the industry. Successfully navigating these challenges requires effective risk management strategies, technological innovation, and efficient operational planning.

The Large Cargo Plane segment is poised to dominate the cargo charter service market in the forecast period. This is due to the increasing demand for the transportation of bulky and heavy goods across various industries, including manufacturing, construction, and energy.

Large Cargo Plane Segment Dominance: The demand for efficient transportation of large and heavy goods is a key driver. The ability to consolidate shipments and reduce the number of flights required makes large cargo planes a cost-effective solution for businesses transporting bulk items. The growing demand for industrial goods, raw materials, and machinery across various industries significantly boosts this segment. Moreover, advancements in aircraft technology are leading to the development of larger and more efficient cargo planes, further strengthening the segment's position.

The cargo charter service industry's growth is fueled by several key factors: the continued expansion of e-commerce and its demand for rapid delivery; the globalization of supply chains, necessitating flexible logistics solutions; the rise of time-sensitive industries like pharmaceuticals, demanding secure and swift transportation; and the ongoing technological advancements in logistics, streamlining operations and boosting efficiency. These catalysts are synergistically driving consistent market growth and expanding opportunities for players within the industry.

This report provides a comprehensive analysis of the cargo charter service market, covering historical data, current market trends, and future projections. It delves into the key driving forces, challenges, and growth catalysts impacting the industry. The report also identifies the leading players in the market and provides a detailed segment analysis, focusing on the dominant large cargo plane segment and key regions. This in-depth analysis equips stakeholders with the insights needed to make informed decisions within this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.2%.

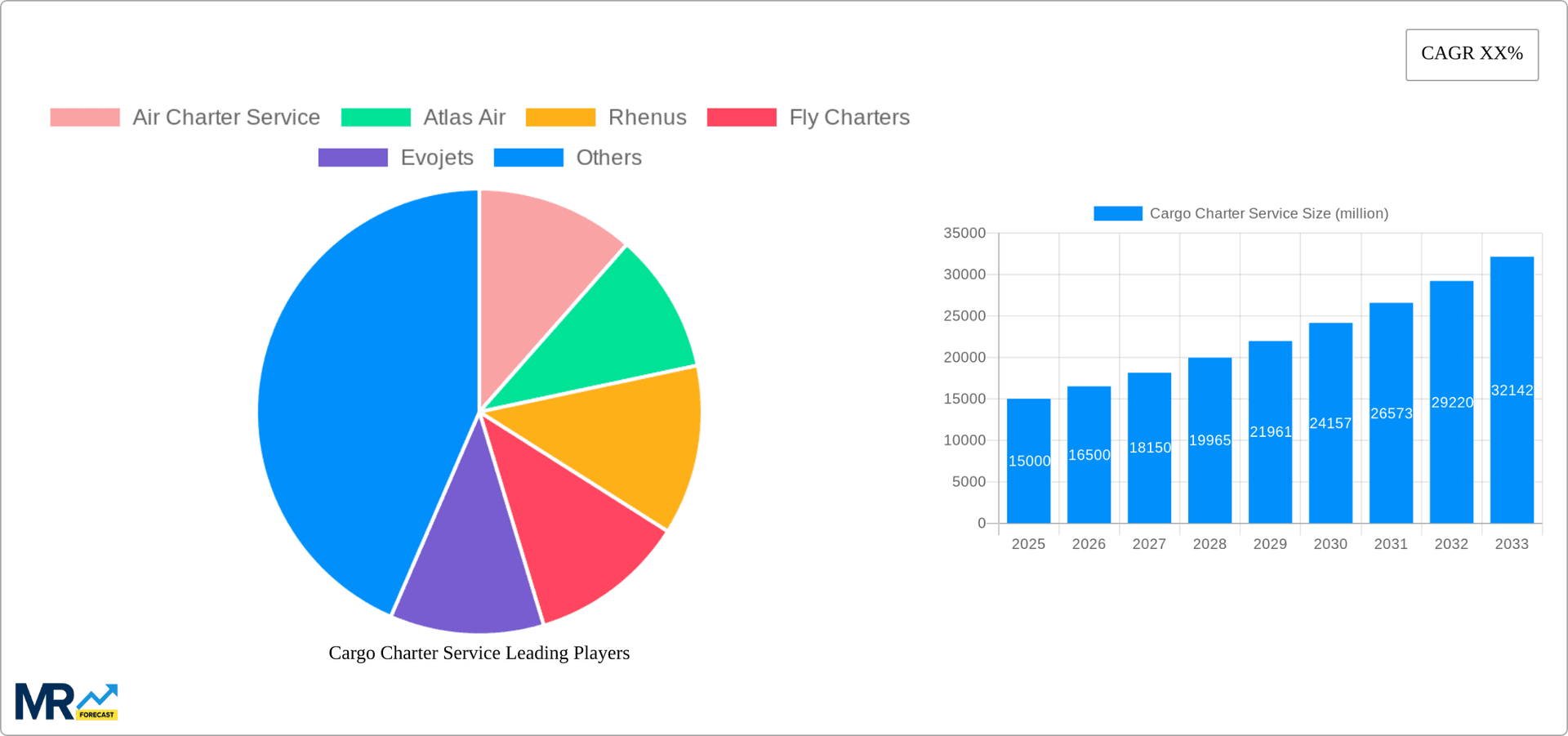

Key companies in the market include Air Charter Service, Atlas Air, Rhenus, Fly Charters, Evojets, Menkor Aviation, CharterSync, Cargo-Partner, LunaJets, IAG Cargo, Air Partner, Chapman Freeborn, QR Charter, ACC Charter, BITLUX, Turkish Cargo, CargoLogicAir, CSI Aviation, Korean Air, CX Cargo, Singapore Airlines, Zela Aviation, Thai Airways International, Saudia Cargo, Cargolux, .

The market segments include Type, Application.

The market size is estimated to be USD 10.89 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Cargo Charter Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cargo Charter Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.