1. What is the projected Compound Annual Growth Rate (CAGR) of the Cargo Charter and Freight Service?

The projected CAGR is approximately 12.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cargo Charter and Freight Service

Cargo Charter and Freight ServiceCargo Charter and Freight Service by Application (Private Use, Commercial Use), by Type (Heavy And Outsize Cargo, Dangerous Cargo, Animal Transportation, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

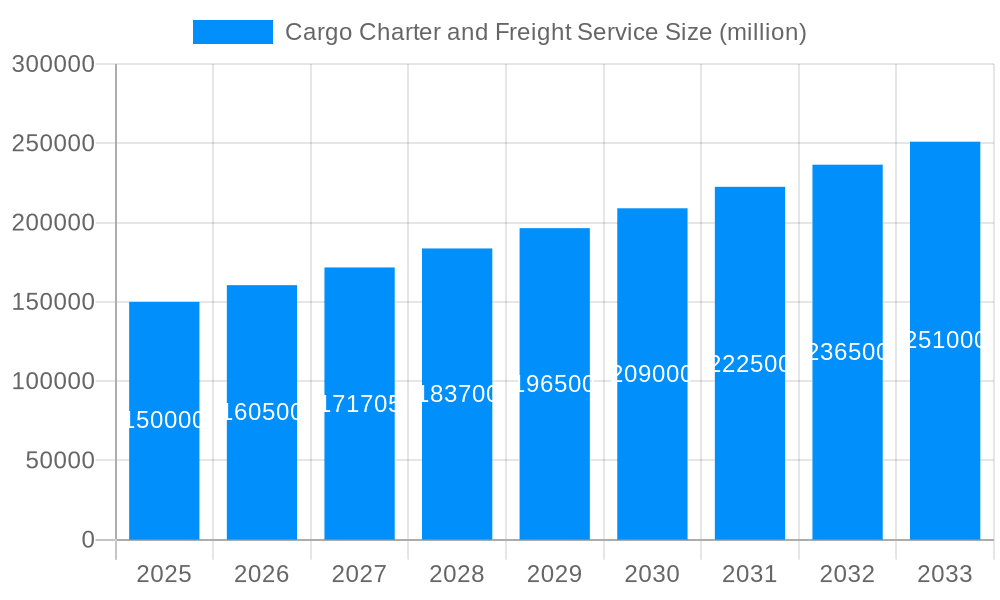

The global cargo charter and freight service market is experiencing robust growth, driven by the expansion of e-commerce, increasing global trade, and the need for efficient and specialized transportation solutions. The market, estimated at $150 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033, reaching approximately $250 billion by 2033. This growth is fueled by several key factors. The rise of e-commerce necessitates faster and more reliable delivery systems, boosting demand for air cargo charter services. Furthermore, the increasing globalization of businesses leads to a higher volume of goods needing international transportation, creating opportunities for specialized freight services catering to various cargo types, including heavy and outsize cargo, dangerous goods, and live animals. Technological advancements, such as improved tracking systems and optimized logistics software, further enhance efficiency and transparency within the industry.

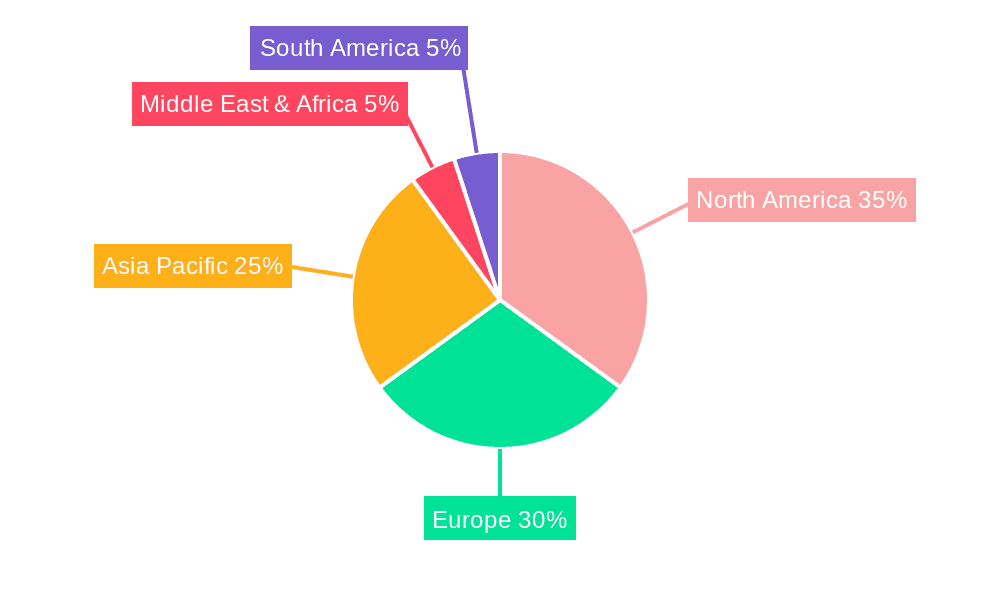

However, the market faces certain restraints. Fluctuating fuel prices significantly impact operational costs, while geopolitical instability and regulatory changes can disrupt supply chains and increase operational complexity. Competition among established players and the emergence of new entrants also present challenges. Despite these obstacles, the market's long-term outlook remains positive, particularly with the growth of niche segments such as temperature-controlled transportation for pharmaceuticals and perishable goods. The market is segmented by application (private and commercial use) and cargo type (heavy and outsize, dangerous goods, live animals, and other). Key players, including FedEx, UPS, and various specialized charter operators, are strategically expanding their global reach and service offerings to capture market share. Regional growth will vary, with North America and Asia-Pacific expected to lead the way due to robust economic activity and expanding infrastructure.

The global cargo charter and freight service market exhibited robust growth throughout the historical period (2019-2024), exceeding $XXX million in 2024. This expansion is projected to continue, reaching an estimated $XXX million in 2025 and further surging to $XXX million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025-2033). This growth is driven by a confluence of factors, including the burgeoning e-commerce sector, increasing globalization of trade, and the rising demand for faster and more reliable delivery solutions across various industries. The market is characterized by a diverse range of service providers, from large multinational corporations like FedEx and UPS to smaller, specialized charter operators catering to niche segments like heavy-lift cargo or animal transportation. Significant technological advancements, such as the implementation of advanced tracking systems and the optimization of logistics networks using AI and machine learning, are further enhancing efficiency and transparency within the industry. However, the market is also subject to cyclical fluctuations influenced by global economic conditions, geopolitical events, and unforeseen disruptions to supply chains, as exemplified by the recent pandemic. The increasing complexity of regulations surrounding dangerous goods transportation and environmental concerns are also shaping the market landscape, pushing companies towards more sustainable and compliant practices. Finally, the ongoing competition for skilled labor and the need to invest in modernizing fleets and infrastructure are significant factors influencing overall market dynamics and profitability.

Several key factors are propelling the growth of the cargo charter and freight service market. The explosive growth of e-commerce has created an unprecedented demand for efficient and reliable delivery solutions, driving significant investment in logistics infrastructure and technological advancements. The increasing globalization of trade necessitates the seamless movement of goods across continents, fostering a greater reliance on specialized cargo charter and freight services. Furthermore, the rise of just-in-time manufacturing methodologies, where companies receive parts and components only when needed, necessitates timely and precise delivery, creating opportunities for specialized freight providers to offer tailored solutions. The expansion of industries such as pharmaceuticals, requiring temperature-controlled transportation for sensitive goods, also contributes to market growth. The increasing need for efficient supply chain management, especially in response to disruptions such as natural disasters or geopolitical instability, has put emphasis on reliable and flexible cargo charter and freight services. Finally, advancements in technology like blockchain, AI, and the Internet of Things (IoT) enhance supply chain transparency, efficiency, and security, further fueling market expansion.

Despite the positive growth outlook, the cargo charter and freight service market faces several challenges. Fluctuations in global fuel prices significantly impact operating costs, impacting profitability and potentially affecting pricing strategies. Stringent government regulations regarding safety, security, and environmental compliance pose significant hurdles for operators, necessitating continuous investment in compliance measures. Competition within the market is intense, with both established multinational corporations and smaller specialized operators vying for market share, placing pressure on pricing and margins. The global economic climate also plays a significant role; recessions or periods of reduced economic activity can negatively impact demand for freight services. Furthermore, labor shortages, particularly for skilled personnel, and disruptions to supply chains caused by unforeseen events (pandemics, natural disasters) can significantly impede operations and profitability. Finally, the increasing complexity of global trade regulations and customs procedures adds another layer of operational complexity and potential delays, making efficient and compliant operations crucial.

The Commercial Use segment is projected to dominate the cargo charter and freight service market during the forecast period. This dominance stems from the robust growth of various industries, including manufacturing, retail, and e-commerce, all heavily reliant on efficient cargo transportation.

North America and Europe are anticipated to remain key regional markets due to their well-established logistics infrastructure, robust economies, and high demand for efficient cargo transportation. However, the Asia-Pacific region is poised for significant growth, fuelled by the rapid expansion of e-commerce and manufacturing in countries like China and India.

Commercial Use: This segment’s continued growth is underpinned by several factors:

Within the Commercial Use segment, sub-segments like the transportation of Heavy and Outsize Cargo are also expected to experience significant growth due to the growing infrastructure development projects worldwide and the increasing need to move large-scale industrial components.

Conversely, while Private Use will contribute to the market, its growth will be less significant compared to the commercial sector. This is due to the nature of private usage; it often lacks the consistent volume and predictability that characterize the commercial side of the industry. Similarly, although other segments exist such as Dangerous Cargo and Animal Transportation, the commercial segment will dominate due to larger volumes and more predictable revenue streams.

The industry's growth is further fueled by the increasing adoption of advanced technologies like blockchain for enhanced supply chain transparency and security, the implementation of artificial intelligence and machine learning for optimized route planning and resource allocation, and the rise of big data analytics for predictive maintenance and risk management. These technological advancements contribute significantly to improved efficiency, reduced costs, and enhanced customer satisfaction.

This report provides a comprehensive overview of the cargo charter and freight service market, analyzing key trends, growth drivers, challenges, and opportunities. It offers detailed insights into market segmentation, regional performance, and competitive dynamics, while also examining the impact of technological advancements and regulatory changes. The report includes detailed forecasts for the next decade, enabling stakeholders to make informed strategic decisions. The in-depth analysis facilitates a thorough understanding of the industry's current state and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 12.4%.

Key companies in the market include Atlas Air Worldwide Holdings, Cathay Pacific Airways Ltd., Air Transport Services Group Inc., Air Charter Service, Garuda Indonesia, CEVA Logistics, Geodis Freight & Logistics Services, RATP Dev, Transdev Group, Haulystic Ltd, Expeditors, Alinnza Trading London Ltd, Barrington Freight Ltd, Kite Freight Services, RWorld Express, Cool Cargo UK, United Aircraft Corporation (UAC), FedEx Corporation, United Parcel Service, Air Transport Services Group Inc, A.P. Moller – Mærsk A/S, Stratos Jet Charters Inc, Cainiao Smart Logistics Network Limited, Air Cargo Charter Company, Bu Shames FZE, Iraq Gate Company, MATEEN Express, Atlas Air, Fridenson Logistic Services Ltd, Challenge Airlines (IL) Ltd, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Cargo Charter and Freight Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cargo Charter and Freight Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.