1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Footprint Verification?

The projected CAGR is approximately 8.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Carbon Footprint Verification

Carbon Footprint VerificationCarbon Footprint Verification by Type (Spend-based, Activity-based), by Application (Company Level, Product Level, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

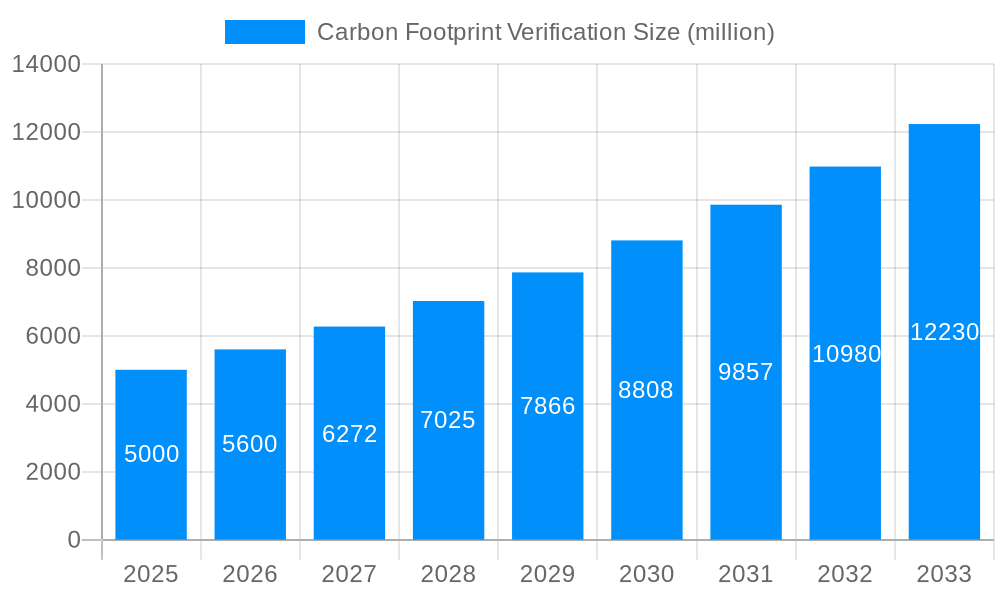

The global carbon footprint verification market is poised for significant expansion, driven by escalating regulatory mandates, heightened environmental consciousness, and a growing commitment to corporate sustainability. The market, valued at $11.11 billion in the base year of 2025, is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 8.1%, reaching an estimated $11.11 billion by 2033. This upward trajectory is underpinned by several critical drivers. Firstly, governments globally are enacting stringent environmental regulations that mandate carbon footprint reporting and verification across numerous sectors, thereby stimulating demand for these essential services. Secondly, consumers are increasingly prioritizing environmentally responsible products and services, favoring businesses that demonstrate verifiable low carbon footprints. This consumer influence compels organizations to seek verification to bolster their brand reputation and gain a competitive advantage. Thirdly, corporate social responsibility (CSR) is becoming a cornerstone of strategic business planning, encouraging companies to proactively measure, reduce, and transparently report their carbon emissions through third-party verification.

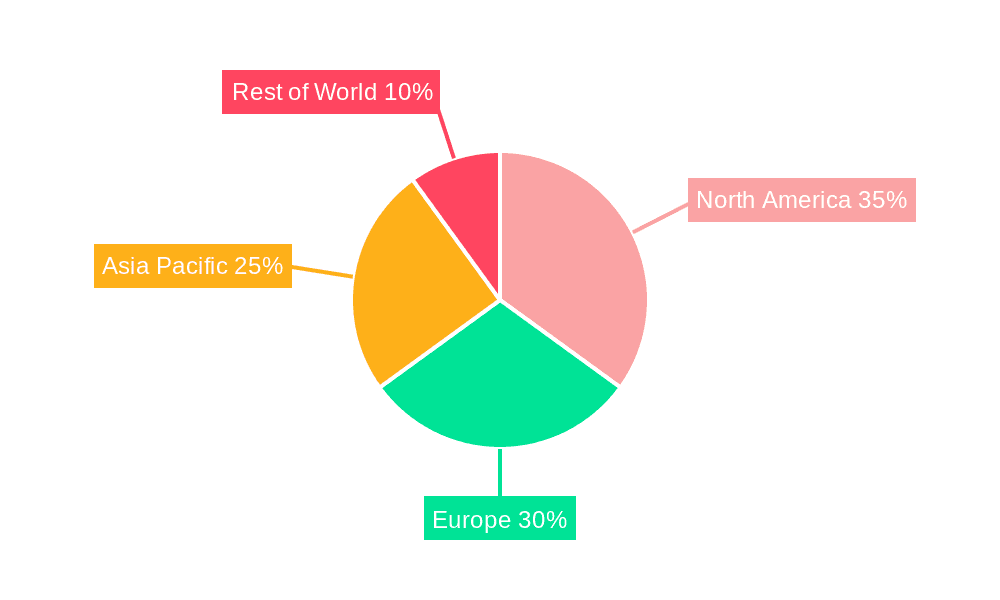

The market is strategically segmented by verification type (spend-based, activity-based), application (company-level, product-level, others), and geographic region. While spend-based verification currently commands a larger market share, activity-based verification is exhibiting accelerated growth due to its capacity for more precise data collection and analysis of emission sources. North America and Europe are leading market regions, attributed to robust environmental regulations and a high concentration of sustainability-focused enterprises. However, the Asia-Pacific region is emerging as a high-growth market, propelled by rapid industrialization and escalating environmental awareness. Despite this promising outlook, challenges persist, including the significant cost associated with verification services and the inherent complexity of accurately quantifying and validating carbon footprints across intricate supply chains. Nevertheless, the long-term forecast for the carbon footprint verification market remains exceptionally positive, fueled by the persistent urgency of climate change concerns and the escalating significance of sustainability across all industries.

The global carbon footprint verification market is experiencing explosive growth, projected to reach tens of billions of USD by 2033. This surge is fueled by increasing regulatory pressure, heightened consumer awareness of environmental issues, and a growing corporate commitment to sustainability. The historical period (2019-2024) saw a steady climb in demand for verification services, laying the foundation for the dramatic expansion anticipated in the forecast period (2025-2033). The base year of 2025 marks a significant inflection point, with numerous companies adopting ambitious carbon reduction targets and seeking third-party validation of their efforts. This trend is evident across various sectors, from manufacturing and energy to agriculture and transportation. The market is diversifying beyond simple emissions accounting, with a growing emphasis on lifecycle assessments, supply chain transparency, and the verification of carbon offset projects. The shift towards more stringent methodologies and the increasing complexity of verification processes are also key market insights. We are observing a consolidation among verification bodies, with larger firms acquiring smaller players to expand their geographic reach and service offerings. Simultaneously, innovative technology solutions are streamlining verification processes, leading to greater efficiency and reduced costs. The market is also witnessing the emergence of specialized verification services catering to niche industries and specific emission sources. The estimated market value in 2025 already indicates a substantial increase from previous years, with millions of dollars invested in verification and validation globally. This signifies a growing confidence in the market and the increasing importance of carbon footprint transparency.

Several key factors are driving the rapid expansion of the carbon footprint verification market. Firstly, stringent government regulations and carbon pricing mechanisms are making carbon footprint verification mandatory or highly incentivized for numerous industries. Companies are facing increasing pressure from stakeholders, including investors, customers, and regulators, to demonstrate their commitment to sustainability and transparency regarding their environmental impact. Secondly, growing consumer awareness of environmental issues and a preference for sustainable products are pushing companies to invest in carbon footprint verification to enhance their brand reputation and gain a competitive edge. This consumer demand is translating into market pressure, encouraging transparency and accountability. Thirdly, the increasing availability of sophisticated technologies and methodologies for carbon footprint assessment and verification is making the process more efficient and cost-effective. This technological advancement is reducing barriers to entry for smaller companies and expanding the reach of verification services. Finally, the growing corporate social responsibility (CSR) initiatives and the commitment of companies towards achieving net-zero emissions are significantly contributing to the demand for robust carbon footprint verification. Many large corporations are setting ambitious emission reduction targets and requiring third-party verification to validate their progress, further bolstering the market's growth.

Despite the significant growth, the carbon footprint verification market faces several challenges. One key challenge is the lack of standardization and harmonization across different verification methodologies and standards, leading to inconsistencies in reported emissions data and creating confusion among stakeholders. Achieving global uniformity in standards is crucial for trust and comparability. The high cost associated with comprehensive carbon footprint verification can also be a significant barrier for small and medium-sized enterprises (SMEs), limiting their participation in the market. The complexity of supply chains and the difficulty in accurately accounting for emissions across the entire value chain are further challenges that require sophisticated methodologies and transparent collaboration. Data collection and accuracy remain critical issues, as incomplete or unreliable data can undermine the credibility of verification results. Furthermore, the shortage of skilled professionals capable of conducting accurate and reliable carbon footprint verification is another limitation. Addressing these challenges requires greater collaboration between stakeholders, including governments, standardization bodies, and verification companies, to foster greater harmonization and develop more accessible and affordable solutions.

The Product Level application segment is poised for significant growth in the carbon footprint verification market. This segment focuses on verifying the emissions associated with the entire lifecycle of a specific product, from raw material extraction to end-of-life disposal.

Increased Consumer Demand: Consumers are increasingly demanding transparency about the environmental impact of the products they buy, creating a strong incentive for manufacturers to invest in product-level carbon footprint verification.

Supply Chain Transparency: Product-level verification necessitates a detailed understanding of the entire supply chain, driving improvements in traceability and sustainability throughout the production process.

Regulatory Scrutiny: Regulations are increasingly targeting product-level emissions, pushing companies to verify their impact and meet compliance requirements.

Competitive Advantage: Companies that can demonstrate the low carbon footprint of their products gain a competitive edge in the market, attracting environmentally conscious consumers.

Market Segmentation: The product-level verification market can be further segmented by industry (e.g., food and beverage, automotive, electronics) and product type, enabling targeted marketing and service offerings.

Geographical Distribution: While developed regions like North America and Europe are currently driving the product-level market, developing economies are expected to witness rapid growth, particularly in sectors like manufacturing and consumer goods.

The leading regions for product level carbon footprint verification are expected to be North America and Europe, driven by stringent environmental regulations and consumer demand for sustainable products. Asia-Pacific is expected to show robust growth due to rising industrialization and increasing regulatory pressure.

The carbon footprint verification industry is experiencing significant growth driven by factors such as increasing regulatory pressure, heightened consumer awareness of environmental issues, and a growing corporate commitment to sustainability. These forces are pushing companies to demonstrate environmental responsibility and invest in third-party verification to enhance credibility and competitiveness. The development of standardized methodologies and technological advancements are further streamlining verification processes and driving down costs, making these services accessible to a broader range of businesses.

This report provides a comprehensive overview of the carbon footprint verification market, covering key trends, drivers, challenges, and leading players. It offers valuable insights for businesses, investors, and policymakers seeking to understand the dynamics of this rapidly expanding market and its role in achieving global sustainability goals. The detailed analysis of market segments and regional growth forecasts enables strategic decision-making and informed investment strategies within the carbon footprint verification landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.1%.

Key companies in the market include TÜV SÜD, DEKRA, BSI Group, SGS, Bureau Veritas, GEP Environmental, TÜV Nord, Intertek, Circular Ecology, DQS Holding, The Carbon Trust, Carbon Footprint Ltd, Det Norske Veritas, Applus+, SCS Global Services, CAS Testing, CTI, CIRS Group, Seatone Certification, LRQA, .

The market segments include Type, Application.

The market size is estimated to be USD 11.11 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Carbon Footprint Verification," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Carbon Footprint Verification, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.