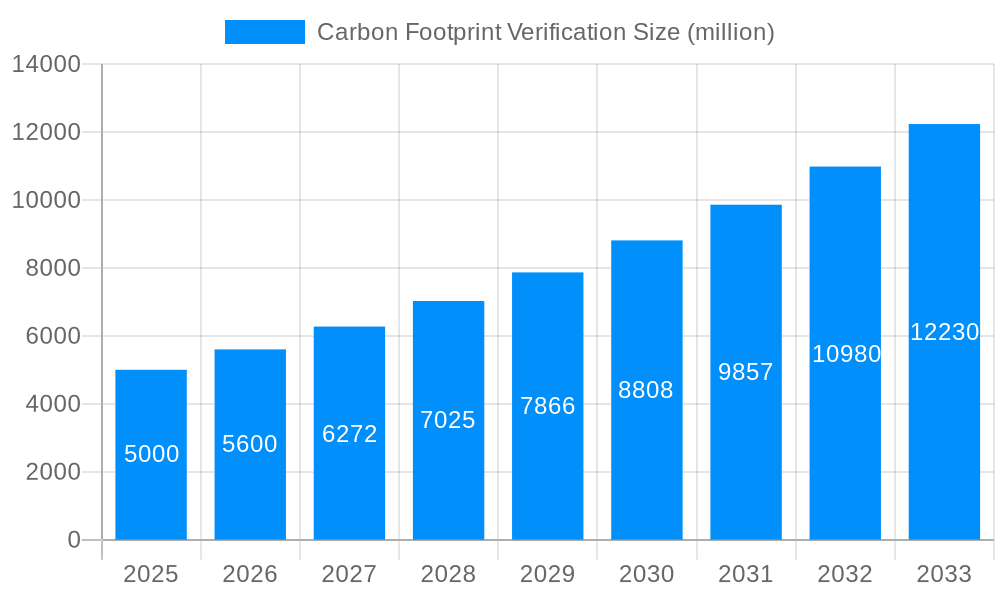

1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Footprint Verification?

The projected CAGR is approximately 8.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Carbon Footprint Verification

Carbon Footprint VerificationCarbon Footprint Verification by Type (Spend-based, Activity-based), by Application (Company Level, Product Level, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global carbon footprint verification market is poised for significant expansion, driven by escalating regulatory mandates, heightened public environmental consciousness, and a surge in corporate sustainability commitments. Demand for credible, independent verification of greenhouse gas emissions is a primary growth catalyst, empowering organizations to substantiate environmental stewardship and adhere to evolving compliance frameworks. The market is segmented by verification methodology (spend-based and activity-based) and by application scope (company-level and product-level). Leading entities such as TÜV SÜD, DEKRA, and BSI Group are capitalizing on their established expertise in testing and certification to secure substantial market positions. Innovations in carbon accounting frameworks and technological advancements further enhance the accuracy and efficiency of verification processes, contributing to market growth.

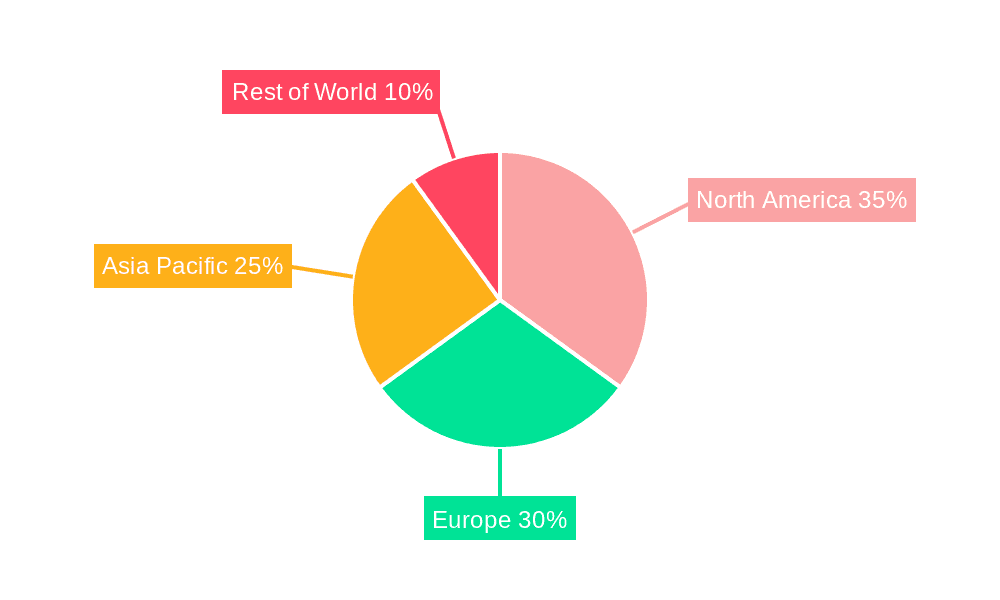

Projected market size is $11.11 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 8.1% through 2033. Geographically, North America and Europe exhibit strong market presence due to stringent environmental regulations and a high concentration of multinational corporations. Emerging economies in Asia-Pacific, particularly China and India, present considerable growth opportunities, fueled by their focus on sustainable development and increasing foreign investment. Key market restraints include the cost of verification services, data collection complexities, and regional methodological variations. Nevertheless, the growing importance of Environmental, Social, and Governance (ESG) criteria and investor interest in sustainable portfolios are expected to drive further market development. A diverse ecosystem of service providers, from global leaders to specialized consultants, fosters competition and innovation, benefiting organizations seeking robust and transparent carbon footprint verification.

The carbon footprint verification market is experiencing explosive growth, projected to reach USD XX million by 2033, from USD XX million in 2025. This represents a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The historical period (2019-2024) already showcased significant expansion, driven by increasing regulatory pressures, heightened consumer awareness of environmental issues, and corporate commitments to sustainability. The base year for our analysis is 2025, with estimations reflecting current market dynamics and future projections based on rigorous data analysis. Spend-based verification is currently the dominant type, representing a significant portion of the overall market, though activity-based methodologies are gaining traction, particularly within manufacturing and supply chain sectors. The demand for company-level verification is robust; however, the product-level segment is showing promising growth, indicating increasing focus on product lifecycle assessments and eco-labeling initiatives. The market shows geographical variations, with significant growth anticipated in regions enacting stringent environmental regulations and showing strong commitment to decarbonization efforts. Several emerging economies are exhibiting high growth potential due to increasing industrialization and the implementation of sustainability standards aligned with global best practices. The industry is also witnessing the emergence of new technological solutions and methodologies that improve accuracy, efficiency, and data transparency in carbon footprint verification processes. This includes the adoption of advanced data analytics, remote sensing technologies, and blockchain-based solutions for improved traceability and assurance. Looking ahead, the market will continue to evolve, shaped by technological advancements, regulatory developments, and shifts in consumer and corporate priorities.

Several key factors are driving the expansion of the carbon footprint verification market. Firstly, escalating governmental regulations and policies aimed at curbing greenhouse gas emissions are pushing businesses to demonstrate their environmental accountability. Mandatory carbon reporting and disclosure requirements are becoming increasingly common globally, making carbon footprint verification a necessity for compliance. Secondly, growing consumer demand for environmentally responsible products and services is compelling businesses to adopt sustainable practices and transparently showcase their environmental performance. Consumers are increasingly willing to pay a premium for products with verified low carbon footprints. Thirdly, corporate social responsibility (CSR) initiatives are boosting the adoption of carbon footprint verification as a means for organizations to demonstrate their commitment to sustainability and enhance their brand reputation. Investors and stakeholders are also increasingly factoring environmental performance into their decision-making processes, making accurate and reliable carbon footprint data crucial. Finally, the increasing availability of sophisticated software and methodologies are making carbon footprint verification more accessible and cost-effective for businesses of all sizes.

Despite its rapid growth, the carbon footprint verification market faces several challenges. Data accuracy and consistency remain significant hurdles. Gathering reliable data across complex supply chains, incorporating scope 3 emissions, and ensuring consistent methodologies are essential but challenging to implement. The complexity of carbon accounting standards and varying methodologies can lead to inconsistencies and difficulty in comparing results across different organizations. Moreover, the high cost of verification can act as a barrier to entry for smaller businesses, particularly in developing economies. The lack of standardized global reporting frameworks can impede comparability and transparency. Ensuring the integrity and credibility of verification bodies is also crucial, as the market is susceptible to the emergence of unqualified or less credible providers. The development and implementation of robust and widely accepted methodologies are therefore essential for overcoming these hurdles and ensuring the continued growth of the market.

The Company-Level application segment is poised to dominate the carbon footprint verification market over the forecast period. This segment encompasses a broad range of industries, and its significance stems from the increasing regulatory pressure on companies to disclose their carbon footprints and demonstrate their commitment to emission reduction.

North America and Europe are currently the leading regions due to stringent environmental regulations, robust sustainability initiatives, and high consumer awareness. However, rapid industrial growth and increasing regulatory scrutiny in Asia-Pacific, particularly in China and India, are driving significant growth in this region.

Spend-based methodologies currently hold the largest market share within the Type segment due to its relative simplicity and ease of implementation compared to activity-based approaches. However, the increasing focus on operational efficiency and the need for detailed emission data are propelling the growth of activity-based methodologies.

Company-level verification provides a holistic overview of an organization’s environmental footprint, making it crucial for compliance, investor relations, and corporate reporting. The Product-level segment showcases strong growth potential, as consumers increasingly demand detailed information on the environmental impact of individual products. This trend drives companies to verify the carbon footprint of their products to gain a competitive advantage and meet evolving consumer expectations.

The considerable growth in the market is attributed to the increasing adoption of sophisticated technologies such as remote sensing, advanced data analytics, and blockchain solutions for data transparency and traceability. The market also benefits from the rising demand for sustainability reporting, and the growing influence of environmental, social, and governance (ESG) investing.

The continued development and refinement of standardized methodologies, coupled with increasing affordability, will ensure broader adoption across all sectors and geographical regions. The projected dominance of company-level, spend-based verification reflects the immediate needs of many organizations to meet regulatory requirements and demonstrate their commitment to environmental responsibility. However, the future expansion of product-level and activity-based verifications is undeniable.

The carbon footprint verification industry is fueled by a confluence of factors. Stringent government regulations mandating carbon disclosures, coupled with heightened consumer awareness of environmental issues and corporate sustainability commitments, are driving substantial market expansion. Growing investor interest in ESG factors and the demand for transparent and credible environmental reporting further propel this growth. Moreover, advancements in data analytics and technological solutions are improving the efficiency and accuracy of carbon footprint verification, making it more accessible and cost-effective for businesses.

This report provides a detailed and comprehensive analysis of the carbon footprint verification market, offering invaluable insights into market trends, drivers, challenges, and future growth prospects. It includes in-depth profiles of leading players, regional market dynamics, and a thorough segmentation of the market based on type, application, and geography. The report's meticulous data analysis and forward-looking projections make it an indispensable resource for businesses, investors, and policymakers navigating the evolving landscape of carbon footprint verification.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.1%.

Key companies in the market include TÜV SÜD, DEKRA, BSI Group, SGS, Bureau Veritas, GEP Environmental, TÜV Nord, Intertek, Circular Ecology, DQS Holding, The Carbon Trust, Carbon Footprint Ltd, Det Norske Veritas, Applus+, SCS Global Services, CAS Testing, CTI, CIRS Group, Seatone Certification, LRQA, .

The market segments include Type, Application.

The market size is estimated to be USD 11.11 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Carbon Footprint Verification," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Carbon Footprint Verification, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.