1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Credit Trading Platform?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Carbon Credit Trading Platform

Carbon Credit Trading PlatformCarbon Credit Trading Platform by Type (Voluntary Type, Regulated Type), by Application (Industrial, Utilities, Energy, Petrochemical, Aviation, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

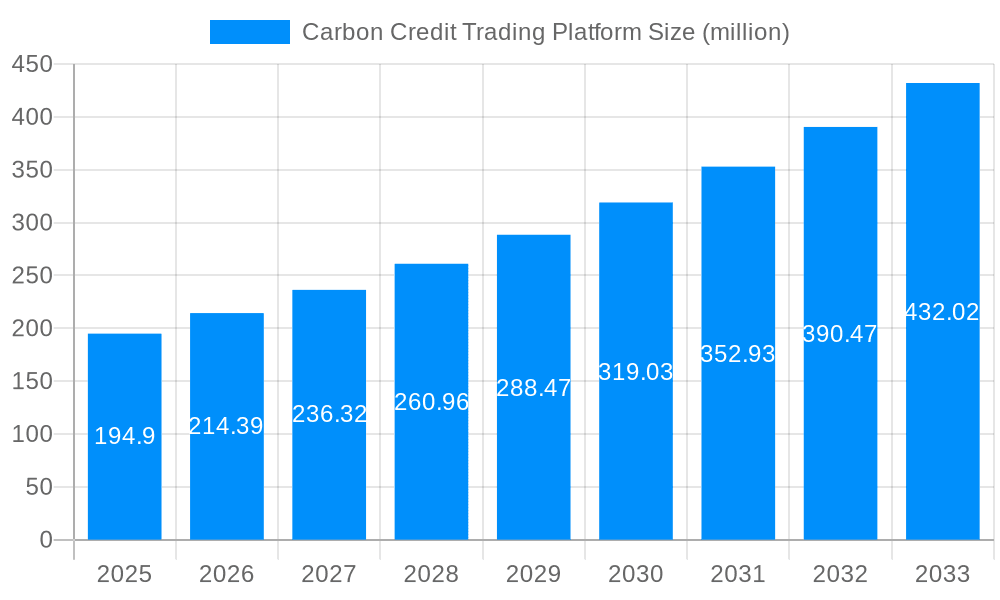

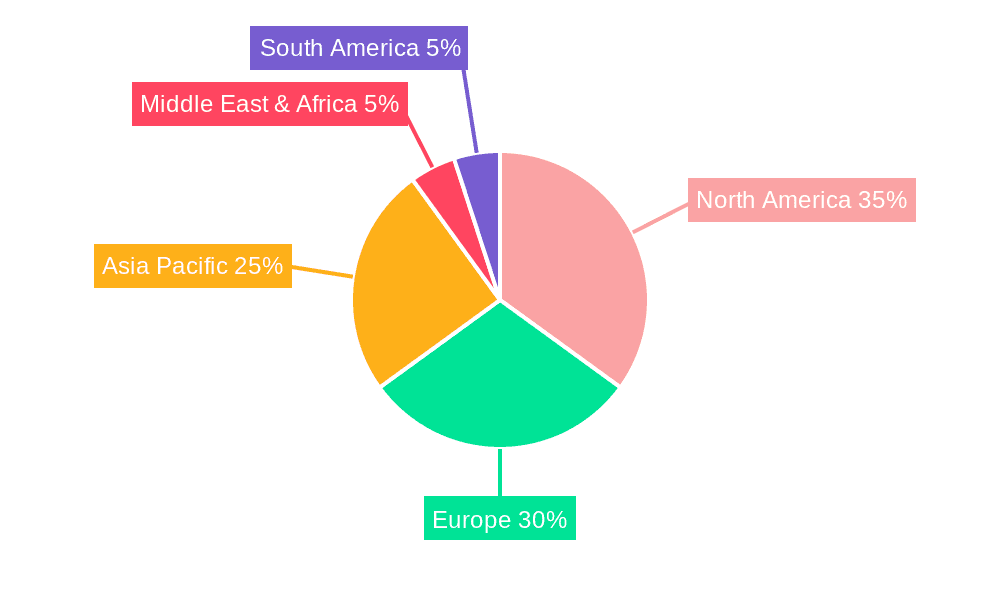

The global carbon credit trading platform market, valued at $194.9 million in 2025, is poised for substantial growth. Driven by increasing regulatory pressure to reduce carbon emissions, growing corporate sustainability initiatives, and the rising awareness of climate change among consumers and investors, the market is experiencing a surge in demand. The voluntary carbon market, while currently larger, is expected to witness significant expansion alongside the regulated market, fueled by the implementation of stricter emissions trading schemes (ETS) globally. Key application segments, including industrial processes, utilities, energy, and petrochemicals, are major contributors to market growth, as these sectors face the most stringent emission regulations and actively seek ways to offset their carbon footprint. Technological advancements within the platforms, such as blockchain integration for enhanced transparency and traceability, further accelerate market expansion. Competition is intensifying with established players like Nasdaq and CME Group alongside newer entrants like AirCarbon Exchange and Climate Impact X vying for market share. Geographical growth is expected across all regions, with North America and Europe leading initially, but Asia-Pacific showing promising growth potential driven by China and India's commitment to carbon neutrality goals.

The market's future growth trajectory will be shaped by several factors. Government policies and regulations regarding carbon pricing mechanisms will be crucial in determining market volume. The development of standardized methodologies for carbon credit verification and validation is also important to maintain market integrity and confidence. Furthermore, technological improvements in platform efficiency, accessibility, and security will enhance market liquidity and attract a wider range of participants. The ongoing debate around the effectiveness and potential for greenwashing within the voluntary market presents a challenge that needs to be addressed to sustain long-term growth. Successful strategies for market players will focus on addressing these challenges, enhancing transparency, and building robust and scalable platforms to accommodate growing market demand.

The carbon credit trading platform market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by increasing global awareness of climate change and the urgent need for carbon emission reduction, the market is witnessing a surge in demand for efficient and transparent trading mechanisms. The historical period (2019-2024) saw significant foundational development, with the establishment of several key platforms and a growing understanding of carbon credit verification and standardization. The estimated year 2025 marks a pivotal point, with the market poised for significant expansion fueled by regulatory pressures and corporate sustainability initiatives. The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) in the high single digits or low double digits, driven by both voluntary and regulated markets. This growth is further fueled by technological advancements enhancing transparency and efficiency within the trading process. We project a market size exceeding $XXX billion by 2033, reflecting the increasing integration of carbon credits into broader sustainability strategies across diverse industries. The evolution from nascent, fragmented markets to increasingly sophisticated, interconnected ecosystems is a defining characteristic of this period. This trend is particularly evident in the growing integration of blockchain technology for enhanced security and traceability of carbon credits. The diverse range of players, from established exchanges to innovative fintech startups, highlights the dynamic and competitive nature of the market. The increasing sophistication of methodologies for carbon offsetting and the development of robust standards are crucial factors influencing the growth trajectory. Finally, the evolving regulatory landscape, both at the national and international levels, presents both opportunities and challenges for market participants.

Several key factors are accelerating the growth of the carbon credit trading platform market. Firstly, the escalating urgency of climate change mitigation is forcing governments and corporations to adopt more stringent emission reduction targets. This, in turn, creates a strong demand for effective carbon offsetting mechanisms. Secondly, the increasing sophistication and acceptance of carbon credit methodologies are boosting market confidence and attracting a wider range of participants. Thirdly, technological innovations, such as blockchain technology, are enhancing the transparency, efficiency, and security of carbon credit transactions, thereby improving market liquidity. Moreover, the rising awareness of environmental, social, and governance (ESG) factors among investors and consumers is driving corporate demand for credible carbon offsetting solutions. The growing number of international collaborations and agreements focused on climate action further solidify the market’s upward trajectory. These initiatives are promoting the standardization and harmonization of carbon credit frameworks, fostering greater market confidence and facilitating cross-border trading. Finally, the increasing availability of high-quality, verified carbon offset projects is providing a robust supply of carbon credits, essential for meeting the growing demand.

Despite the significant growth potential, the carbon credit trading platform market faces several challenges. One major obstacle is the lack of standardization and harmonization across different carbon credit certification schemes, which can lead to market fragmentation and confusion. The verification and validation of carbon credits also pose a significant challenge, with concerns about the accuracy and reliability of offsetting projects. Moreover, the relatively nascent stage of the market means that there is a need for increased transparency and disclosure requirements to build investor confidence. The complexity involved in navigating the various regulations and compliance requirements can also hinder participation. Price volatility within the carbon credit market is another concern, influenced by supply and demand factors, as well as evolving market sentiment. Additionally, concerns about the potential for greenwashing and the need for robust mechanisms to prevent fraudulent activities require careful attention. Finally, the ongoing debate surrounding the effectiveness of carbon offsetting as a climate change mitigation strategy needs to be addressed to ensure continued market development.

The European Union (EU) is poised to be a dominant player, primarily due to its ambitious climate change policies and stringent emission reduction targets. The EU Emissions Trading System (ETS) provides a robust regulatory framework for carbon trading and drives significant demand for carbon credits within the region.

Regulated Type: The regulated carbon credit market, primarily driven by compliance with government regulations, is projected to show substantial growth. The EU ETS is a prime example of this segment’s potential. Stringent emission reduction targets mandated by governmental agencies propel growth.

Industrial Segment: The industrial sector, with its high carbon footprint, is a key driver of demand for carbon credits, especially within energy-intensive industries. The need to comply with emission reduction regulations and enhance their ESG profiles are major drivers.

United States: While currently less developed than the EU market, the US is projected to experience rapid growth driven by increasing state-level regulations and corporate sustainability initiatives. The voluntary carbon market is expected to play a significant role in this growth.

Asia-Pacific Region: This region, despite already having a significant presence, will witness substantial growth as developing nations implement more stringent environmental policies and large corporations strive to improve their environmental performance. The presence of large economies with high emission levels makes this region critical for market expansion.

In summary, while the voluntary market will continue to grow, the regulated market, specifically in the EU and increasingly in other regions, will show stronger growth in the forecast period due to mandatory emission reduction requirements. The industrial segment presents significant opportunities due to its high carbon emissions, but substantial potential also exists within the utilities, energy, and petrochemical sectors. The growth in these segments will be closely tied to the implementation and enforcement of national and international environmental policies.

The carbon credit trading platform industry is experiencing remarkable growth fueled by a confluence of factors. Stringent government regulations compelling emission reductions, coupled with the increasing corporate focus on ESG initiatives and investor demand for sustainability, are key drivers. Technological advancements, particularly the implementation of blockchain technology for improved transparency and traceability, are further accelerating market expansion. The growing awareness among consumers of environmental issues and their preference for sustainable products are also contributing to market growth.

This report offers a comprehensive analysis of the carbon credit trading platform market, encompassing historical data, current trends, and future projections. The report covers key market segments, drivers, challenges, and leading industry players. It provides valuable insights into the evolving regulatory landscape and technological advancements shaping the market's trajectory, enabling businesses to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

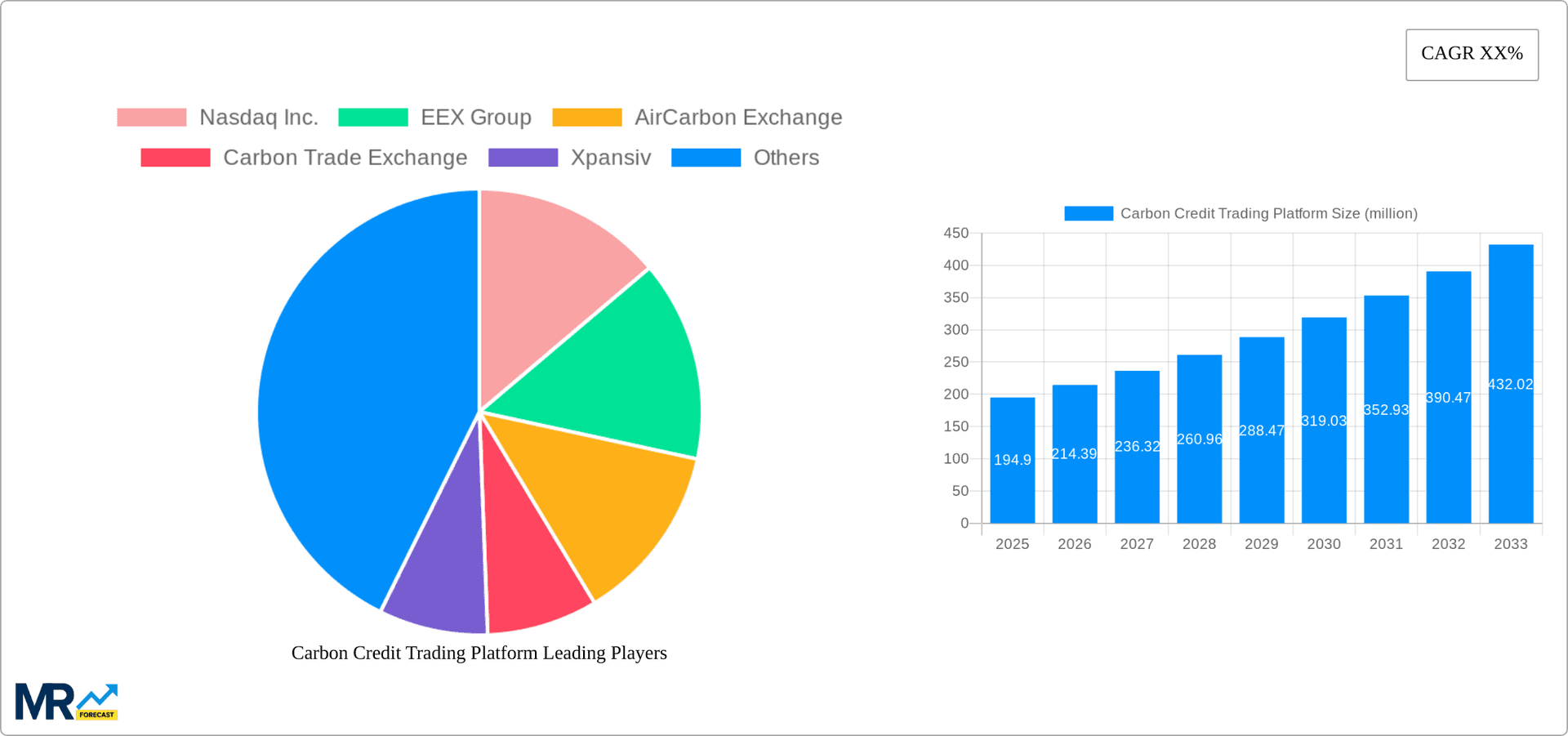

Key companies in the market include Nasdaq Inc., EEX Group, AirCarbon Exchange, Carbon Trade Exchange, Xpansiv, CME Group, Climate Impact X, Carbonplace, Planetly, Likvidi, Toucan, BetaCarbon, MOSS.Earth, ClimateTrade, Carbon Credit Capital, Flowcarbon, Carbonex, PathZero, South Pole, Public Investment Fund, .

The market segments include Type, Application.

The market size is estimated to be USD 194.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Carbon Credit Trading Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Carbon Credit Trading Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.