1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Owner Information Service?

The projected CAGR is approximately 23.39%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Car Owner Information Service

Car Owner Information ServiceCar Owner Information Service by Application (Telecom Operators, Insurance Client, Others), by Type (ETC Promotion and Service, Vehicle Condition Inspection Service), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

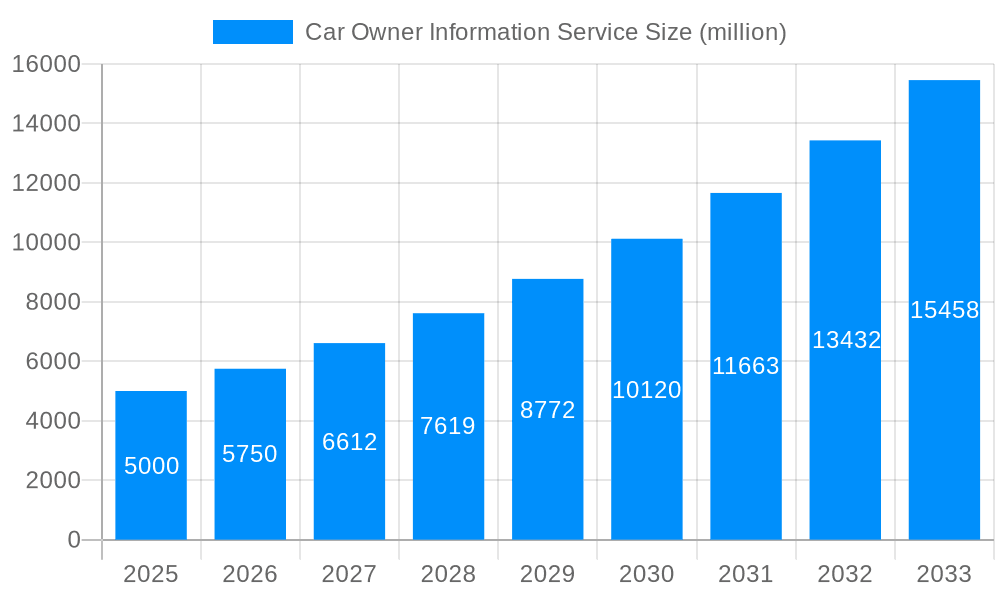

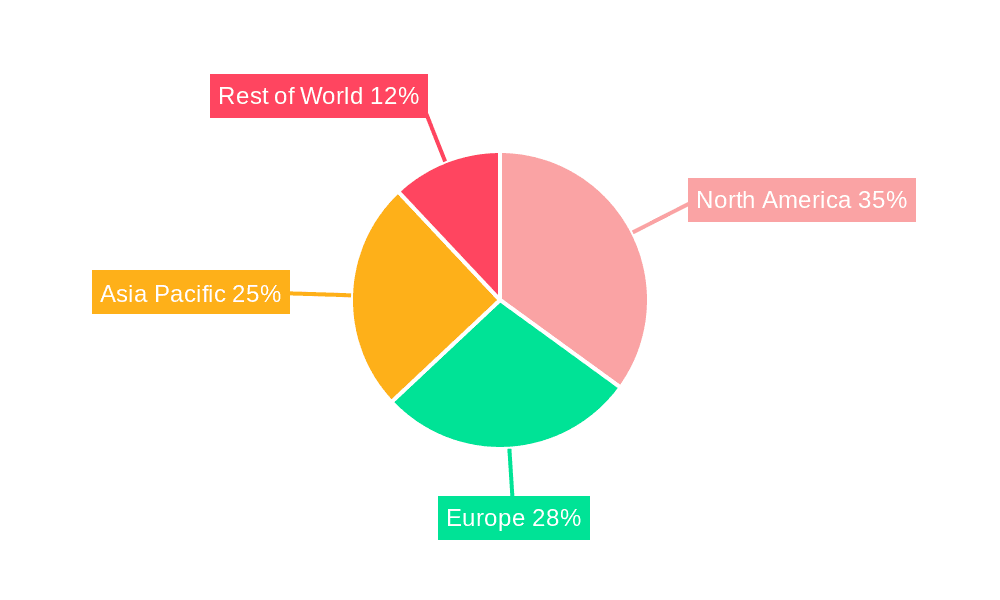

The global Car Owner Information Service market is poised for significant expansion, propelled by the widespread adoption of connected car technologies, escalating demand for vehicle maintenance and repair services, and the increasing utilization of telematics data for insurance risk assessment. The market is segmented by application, including Telecom Operators, Insurance Clients, and Others, and by service type, such as ETC Promotion and Service, and Vehicle Condition Inspection Service. Projected market size for 2025 is estimated at $4.96 billion, with a robust Compound Annual Growth Rate (CAGR) of 23.39% for the forecast period of 2025-2033. Growth is anticipated across all regions, with North America and Europe maintaining substantial market share due to high vehicle ownership and technological adoption. Emerging economies, particularly in Asia-Pacific, are expected to exhibit rapid growth driven by increasing disposable incomes and expanding automotive sectors.

Key market restraints involve data privacy concerns related to the collection and use of sensitive vehicle and owner information. Effective data security measures and transparent data usage policies are essential for sustained market expansion. Successful integration of diverse data sources and the development of intuitive interfaces for accessing car owner information will be critical for market penetration. The competitive landscape is dynamic, featuring established companies and innovative technology providers, where strategic partnerships and continuous innovation will shape future success. The growing adoption of subscription-based models for car owner information services is expected to be a primary driver of revenue generation and market stability. Differentiation through specialized services, predictive maintenance, and personalized recommendations will be crucial for achieving market leadership in this evolving sector.

The global car owner information service market is experiencing significant growth, projected to reach several million units by 2033. The period between 2019 and 2024 (historical period) laid the groundwork for this expansion, with advancements in telematics, increasing vehicle connectivity, and a rising demand for proactive vehicle maintenance contributing to market expansion. The estimated market value in 2025 (base year and estimated year) reflects a substantial increase from previous years, driven by factors such as the increasing adoption of connected car technologies and the growing awareness among car owners regarding the importance of vehicle maintenance and safety. The forecast period (2025-2033) anticipates continued robust growth, fueled by several key trends. These include the proliferation of smartphone apps offering integrated vehicle diagnostics and maintenance scheduling, the expansion of insurance telematics programs that incentivize safe driving and preventative maintenance, and the rising popularity of subscription-based services providing comprehensive vehicle information and support. The integration of AI and machine learning into vehicle diagnostic systems is also enhancing the accuracy and efficiency of car owner information services, leading to increased demand. Furthermore, the increasing prevalence of electric vehicles (EVs) is creating new opportunities for specialized car owner information services tailored to the unique needs of EV owners. The market's growth isn't uniform; regional variations are driven by factors like infrastructure development, regulatory frameworks, and consumer behavior. For instance, regions with advanced digital infrastructure and strong consumer adoption of mobile technologies exhibit faster growth. This trend underscores the critical role of technological advancements and consumer behavior in shaping the future of the car owner information service market.

Several factors are driving the growth of the car owner information service market. The increasing penetration of connected car technology is a significant contributor. Modern vehicles are equipped with advanced telematics systems, allowing for real-time data collection on vehicle performance, maintenance needs, and even driving behavior. This data is then leveraged by car owner information services to provide personalized recommendations and alerts, improving vehicle maintenance and safety. Moreover, the rising demand for proactive vehicle maintenance is a key driver. Car owners are increasingly seeking convenient and efficient ways to maintain their vehicles, and information services provide valuable tools for scheduling maintenance, tracking repairs, and accessing relevant information. The rise of insurance telematics is also boosting market growth. Insurance companies are increasingly using telematics data to assess driving behavior and offer customized insurance premiums. This has led to a surge in the adoption of connected car technologies and the associated car owner information services. Furthermore, the expanding adoption of smartphone apps offering vehicle-related information and services is further accelerating market expansion. These apps provide convenient access to diagnostic information, maintenance scheduling, and other valuable tools, leading to increased user engagement. Finally, government regulations and safety initiatives promoting vehicle maintenance and data transparency are also contributing to the market's growth by increasing the demand for reliable and accurate information services.

Despite the significant growth potential, the car owner information service market faces several challenges. Data security and privacy concerns are paramount. The collection and storage of sensitive vehicle and driver data necessitate robust security measures to prevent data breaches and protect user privacy. Maintaining data security while ensuring seamless service delivery is a continuous challenge for providers. Another hurdle lies in the integration with diverse vehicle systems. The automotive industry uses various communication protocols and data formats, making it challenging to develop services compatible with all vehicle makes and models. Ensuring seamless integration across diverse platforms is crucial for widespread adoption. The cost of implementation and maintenance of these services can also act as a restraint. Developing and maintaining sophisticated data infrastructure, software applications, and customer support systems require substantial investment, potentially limiting smaller companies' participation. Furthermore, consumer awareness and adoption of these services vary significantly across different demographics and geographic regions. Bridging the knowledge gap and effectively educating consumers about the benefits of car owner information services is a crucial task. Lastly, competition from existing players in the automotive aftermarket and the emergence of new technologies could impact market growth. Maintaining a competitive edge in a rapidly evolving market requires continuous innovation and adaptation.

The Vehicle Condition Inspection Service segment is poised for significant growth within the car owner information service market. This is driven by a multifaceted combination of factors.

Increased vehicle complexity: Modern vehicles are increasingly sophisticated, incorporating complex electronic systems and advanced technologies. Regular inspections are essential to identify potential issues early and prevent costly repairs.

Growing awareness of preventive maintenance: Car owners are becoming increasingly aware of the importance of regular maintenance to ensure vehicle longevity, safety, and optimal performance. Vehicle condition inspection services provide crucial information in this regard.

Insurance requirements: Many insurance providers are mandating or incentivizing regular vehicle inspections to assess risk and promote safe driving practices. This requirement directly drives demand for condition inspection services.

Technological advancements: Technological advancements in diagnostic tools and data analytics are making vehicle inspections more efficient, accurate, and accessible. Remote diagnostics and automated reporting are making these services more streamlined.

Convenience and Accessibility: Online platforms and mobile applications are making vehicle condition inspection services more accessible and convenient for car owners. The ability to schedule inspections, receive reports, and manage maintenance online is highly attractive.

Geographically, regions with high vehicle ownership rates, robust automotive industries, and developed digital infrastructures are expected to lead market growth. These include:

North America: High car ownership rates and the presence of major players in the automotive and technology sectors contribute to significant market potential.

Europe: Stringent regulations regarding vehicle safety and maintenance are driving demand for reliable vehicle condition inspection services.

Asia-Pacific: Rapid economic growth, increasing vehicle sales, and expanding digital infrastructure are driving market growth, particularly in countries like China and Japan.

While other segments like ETC Promotion and Service are also experiencing growth, the Vehicle Condition Inspection Service is arguably the fastest-growing and offers the highest potential return due to its direct impact on vehicle safety, maintenance, and insurance compliance.

Several catalysts are propelling the growth of the car owner information service industry. Advancements in telematics and connected car technologies are enabling more comprehensive data collection and analysis, leading to more personalized and proactive services. The increased focus on preventative vehicle maintenance and the integration of these services with insurance telematics programs are creating new market opportunities. Moreover, the rising adoption of mobile apps and online platforms providing convenient access to vehicle information and services further contributes to market expansion.

The car owner information service market is experiencing rapid growth, driven by technological advancements, changing consumer behavior, and regulatory initiatives. This comprehensive report provides an in-depth analysis of market trends, growth drivers, challenges, key players, and future prospects, offering valuable insights for stakeholders across the automotive and technology sectors.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.39% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 23.39%.

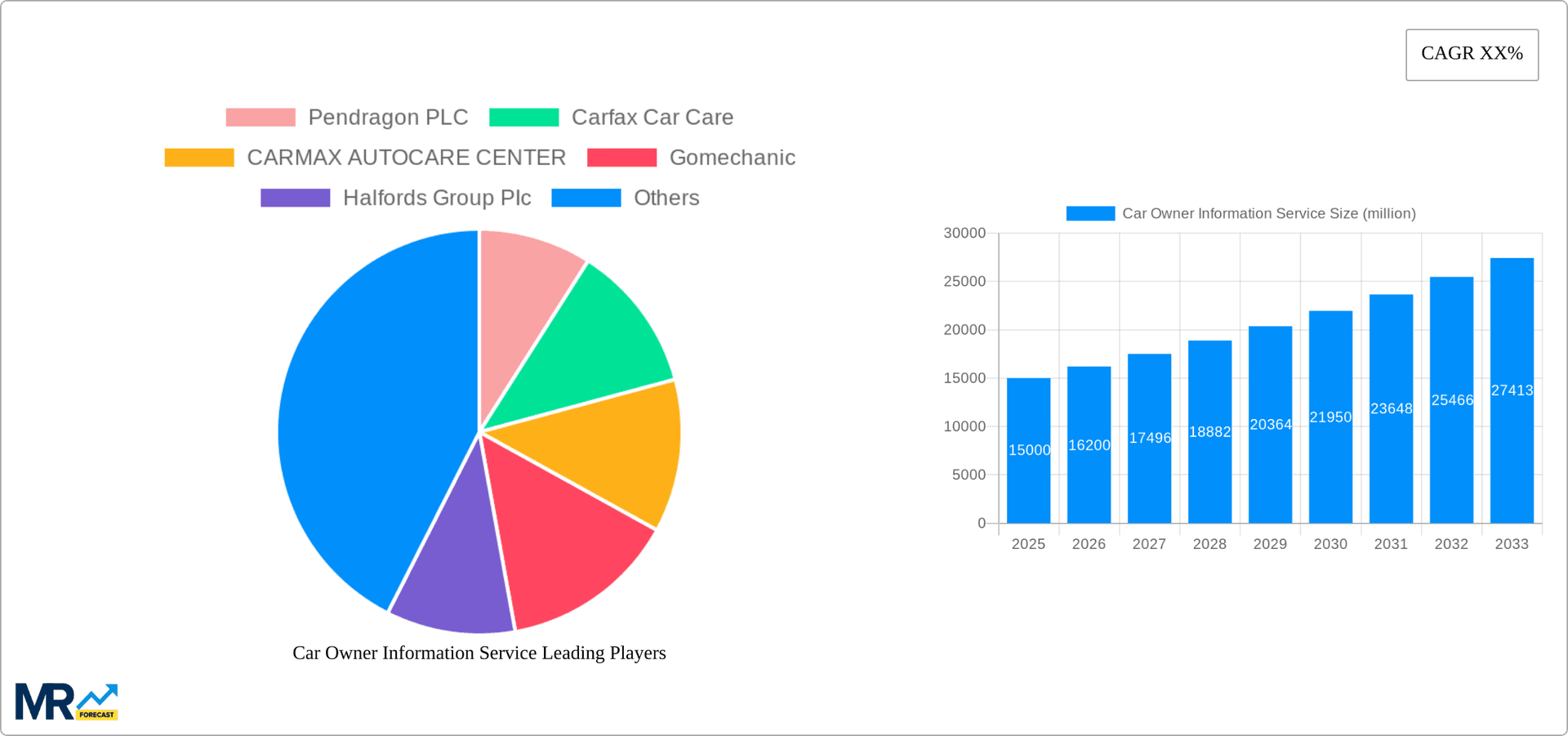

Key companies in the market include Pendragon PLC, Carfax Car Care, CARMAX AUTOCARE CENTER, Gomechanic, Halfords Group PIc, Jiffy LubeInternational, Inc, Monro Muffler Brake, Harman International Industries, Inc, UberTechnologies Inc, Bayerische Motoren Werke Aktiengesellschaft, LyftInc, Shijihengtong Technology Co., Ltd, Shanghai OnStar Telematics Service Co., Ltd. (OnStar), Shenzhen Altron Technology Co., Ltd, .

The market segments include Application, Type.

The market size is estimated to be USD 4.96 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Car Owner Information Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Car Owner Information Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.