1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Owner Information Service?

The projected CAGR is approximately 23.39%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Car Owner Information Service

Car Owner Information ServiceCar Owner Information Service by Type (ETC Promotion and Service, Vehicle Condition Inspection Service), by Application (Telecom Operators, Insurance Client, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

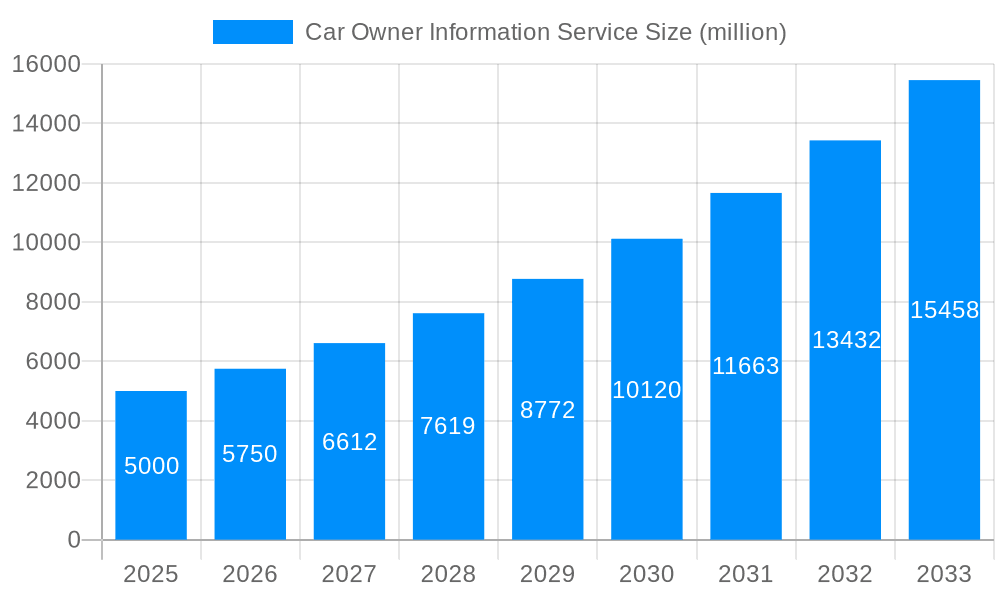

The global Car Owner Information Service market is poised for substantial expansion, propelled by the accelerating integration of connected car technologies, escalating demand for comprehensive vehicle maintenance and repair services, and the robust growth within the insurance and telematics sectors. This dynamic market is segmented by service type into ETC Promotion and Service, and Vehicle Condition Inspection Service, and by application, including Telecom Operators, Insurance Clients, and Others. Based on current trends and projections, the market size is estimated to reach $4.96 billion by 2025, reflecting a significant increase from previous periods. The projected Compound Annual Growth Rate (CAGR) is anticipated to be 23.39% during the forecast period of 2025-2033. This growth trajectory is underpinned by the pervasive integration of advanced data analytics into service offerings, enhancing predictive maintenance capabilities and optimizing operational efficiencies. Furthermore, the widespread adoption of smartphones and the increasing reliance on digital platforms for information access are pivotal drivers, catering to consumer demand for convenient and accessible vehicle data.

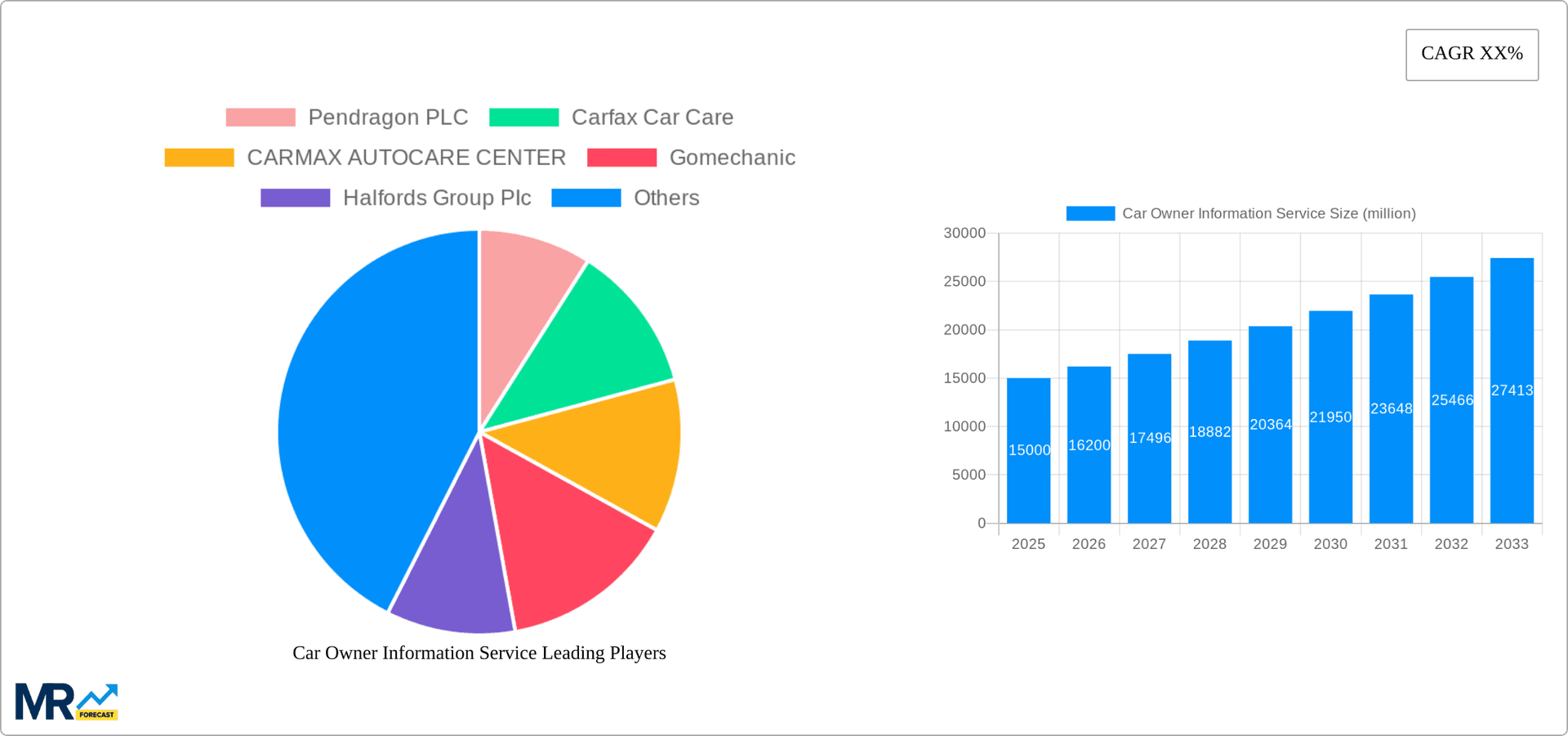

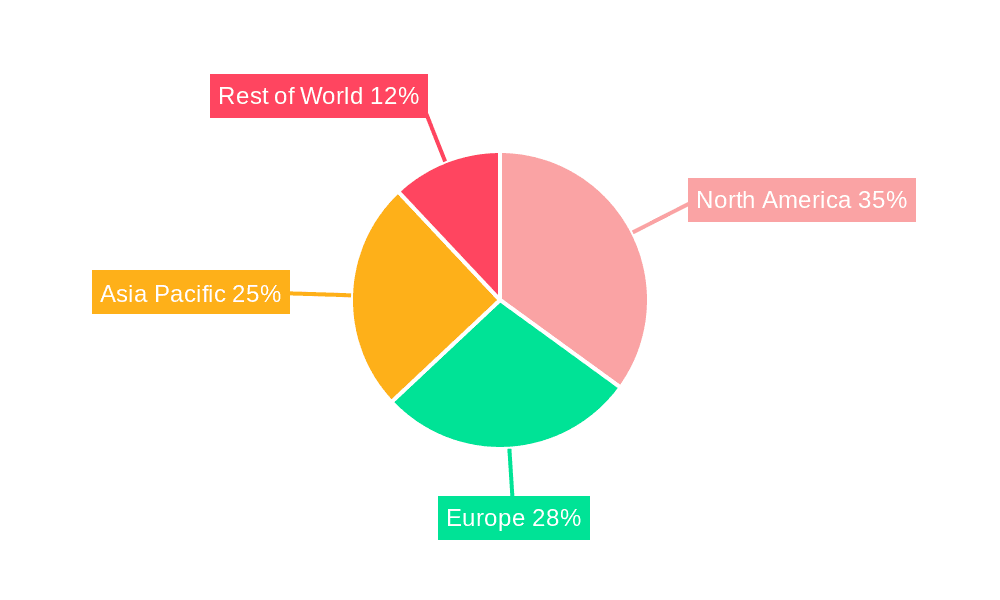

Anticipated growth is robust across all market segments. The ETC Promotion and Service segment is bolstered by governmental initiatives promoting electronic toll collection, while the Vehicle Condition Inspection Service segment benefits from heightened consumer awareness regarding vehicle upkeep and the associated cost-saving advantages of proactive maintenance. The insurance industry remains a critical growth catalyst, with telematics data offering invaluable insights for accurate risk assessment and optimized premium structuring. Geographically, North America and Asia Pacific are projected to lead market expansion, driven by significant technological advancements and mature automotive industries. Leading market participants, including Pendragon PLC and Carfax, are actively innovating, fostering market dynamism and competitive intensity. The sustained potential for future market growth is considerable, with ongoing innovation expected to fuel further expansion.

The global Car Owner Information Service market is experiencing robust growth, projected to reach multi-million unit figures by 2033. Driven by technological advancements, rising vehicle ownership, and increasing demand for convenient and efficient vehicle management solutions, this sector shows significant promise. The historical period (2019-2024) witnessed steady expansion, laying the groundwork for the impressive forecast period (2025-2033). Key market insights reveal a shift towards integrated platforms offering comprehensive information, spanning vehicle maintenance needs, insurance details, and even roadside assistance. The rise of connected cars and the proliferation of telematics data are further fueling this trend. Consumers increasingly value the convenience of accessing all their vehicle-related information in one place, leading to a surge in demand for integrated service offerings. This consolidated approach not only streamlines vehicle management but also contributes to improved safety and reduced operational costs. The base year (2025) establishes a crucial benchmark, indicating the current market maturity and the springboard for future expansion. The estimated year (2025) projections reflect an optimistic outlook, showcasing the sector's resilience and ability to adapt to evolving consumer expectations and technological innovations. The market's success hinges on the continuous development of user-friendly interfaces, secure data management, and the integration of advanced analytics to offer personalized and proactive service recommendations. Competition is fierce, with established players and innovative startups vying for market share. The focus on data privacy and security is paramount, as consumer trust is crucial for market sustainability and growth. The overall trend points towards a highly dynamic and evolving market characterized by continuous technological advancements and increasing consumer expectations.

Several factors are driving the expansion of the Car Owner Information Service market. The increasing penetration of connected cars and the subsequent generation of vast amounts of vehicle data are pivotal. This data empowers service providers to offer proactive maintenance alerts, personalized recommendations, and improved risk assessment for insurance providers. The growing demand for convenience and efficiency is another key driver. Consumers are seeking streamlined solutions that simplify vehicle management, reducing the time and effort required for tasks such as scheduling maintenance or filing insurance claims. Furthermore, the rising adoption of telematics technologies allows for real-time monitoring of vehicle performance and location, providing valuable insights for both owners and service providers. This data-driven approach leads to better preventative maintenance, reduced downtime, and improved overall vehicle safety. Government regulations promoting road safety and efficient vehicle maintenance also indirectly contribute to market growth. The integration of car owner information services into broader ecosystems, such as insurance and roadside assistance platforms, enhances the overall value proposition, attracting a wider range of users. Finally, the continuous technological advancements in areas such as artificial intelligence and machine learning are further enhancing the capabilities of these services, offering increasingly sophisticated and personalized experiences.

Despite the significant growth potential, the Car Owner Information Service market faces several challenges. Data security and privacy concerns are paramount. The sensitive nature of the data handled by these services requires robust security measures to prevent breaches and protect consumer information. Maintaining consumer trust is crucial for the long-term success of the market. The high initial investment required for developing and deploying advanced telematics systems and software platforms can be a barrier to entry for smaller players. This can lead to market consolidation, with larger players dominating the landscape. Furthermore, the integration of various data sources and systems can be technically complex, requiring significant expertise and resources. Ensuring interoperability between different platforms and systems is also crucial for a seamless user experience. Finally, the market's success hinges on the ability of service providers to adapt to rapid technological advancements and evolving consumer preferences. Failure to innovate and keep pace with the changing landscape can quickly lead to obsolescence.

The Vehicle Condition Inspection Service segment is poised for significant growth within the Car Owner Information Service market. This is primarily driven by increasing awareness of vehicle maintenance needs, the growing demand for preventative maintenance to extend vehicle lifespan, and the rising adoption of connected car technologies. The increasing availability of mobile apps and online platforms offering convenient access to vehicle inspection services also fuels this segment's expansion.

North America and Europe are expected to dominate the market due to high vehicle ownership rates, advanced technological infrastructure, and a strong regulatory framework supporting vehicle safety and maintenance.

Within North America, the United States will remain a key market owing to its large vehicle population and robust insurance sector, both directly driving demand for condition inspection services.

In Europe, countries with well-established vehicle inspection regulations and a high adoption rate of connected car technologies, such as Germany, France, and the UK, are likely to witness robust growth.

The Insurance Client application segment shows considerable potential for growth. Insurance companies are increasingly leveraging vehicle condition inspection data to assess risk, personalize insurance premiums, and develop targeted preventative maintenance programs. This symbiotic relationship contributes to both cost savings and enhanced risk management for insurance providers and enhanced service for clients. The data-driven insights enable insurers to accurately assess vehicle risk, leading to fairer premiums and better risk management. This reduces the cost of claims and enhances the overall efficiency of the insurance process.

The Telecom Operators application segment also shows promising growth, as telecommunication companies leverage their existing infrastructure and customer base to offer integrated vehicle management services. This expansion leverages their pre-existing networks and customer relationships, making this a natural and efficient integration opportunity.

In the Asia-Pacific region, particularly in rapidly developing economies like China and India, the market is expected to witness significant growth, although the growth rate might be slower than in North America and Europe due to infrastructural limitations and lower initial adoption rates of connected vehicle technologies. However, the rapid expansion of vehicle ownership and increasing smartphone penetration are creating immense potential for growth in the future.

Several factors are fueling growth in the car owner information service industry. The increasing affordability and accessibility of connected car technologies are lowering the barriers to entry, enabling a broader range of consumers to access these services. Government regulations promoting road safety and proactive vehicle maintenance further bolster the industry's expansion. The continuous development of user-friendly interfaces and innovative mobile applications enhances consumer engagement and overall user experience, leading to wider adoption. Furthermore, the development of advanced analytics and machine learning algorithms provides more personalized service offerings, tailored to individual user needs and driving behavior, improving efficiency and reducing operational costs.

This report provides a detailed analysis of the Car Owner Information Service market, covering historical data, current trends, and future projections. It examines key market drivers, challenges, and opportunities, offering valuable insights for industry stakeholders. The report includes comprehensive segmentation analysis, geographic market assessment, and competitive landscape overview, providing a holistic view of this rapidly evolving sector. The report’s projections are based on rigorous methodologies and incorporate data from various sources to ensure accuracy and reliability. It provides a comprehensive resource for understanding the dynamics of the Car Owner Information Service market and making informed business decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.39% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 23.39%.

Key companies in the market include Pendragon PLC, Carfax Car Care, CARMAX AUTOCARE CENTER, Gomechanic, Halfords Group PIc, Jiffy LubeInternational, Inc, Monro Muffler Brake, Harman International Industries, Inc, UberTechnologies Inc, Bayerische Motoren Werke Aktiengesellschaft, LyftInc, Shijihengtong Technology Co., Ltd, Shanghai OnStar Telematics Service Co., Ltd. (OnStar), Shenzhen Altron Technology Co., Ltd, .

The market segments include Type, Application.

The market size is estimated to be USD 4.96 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Car Owner Information Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Car Owner Information Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.