1. What is the projected Compound Annual Growth Rate (CAGR) of the Cannabis Drinks?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cannabis Drinks

Cannabis DrinksCannabis Drinks by Type (CBD, THC), by Application (Mass Merchandiser, Specialty Stores, Online Retail, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

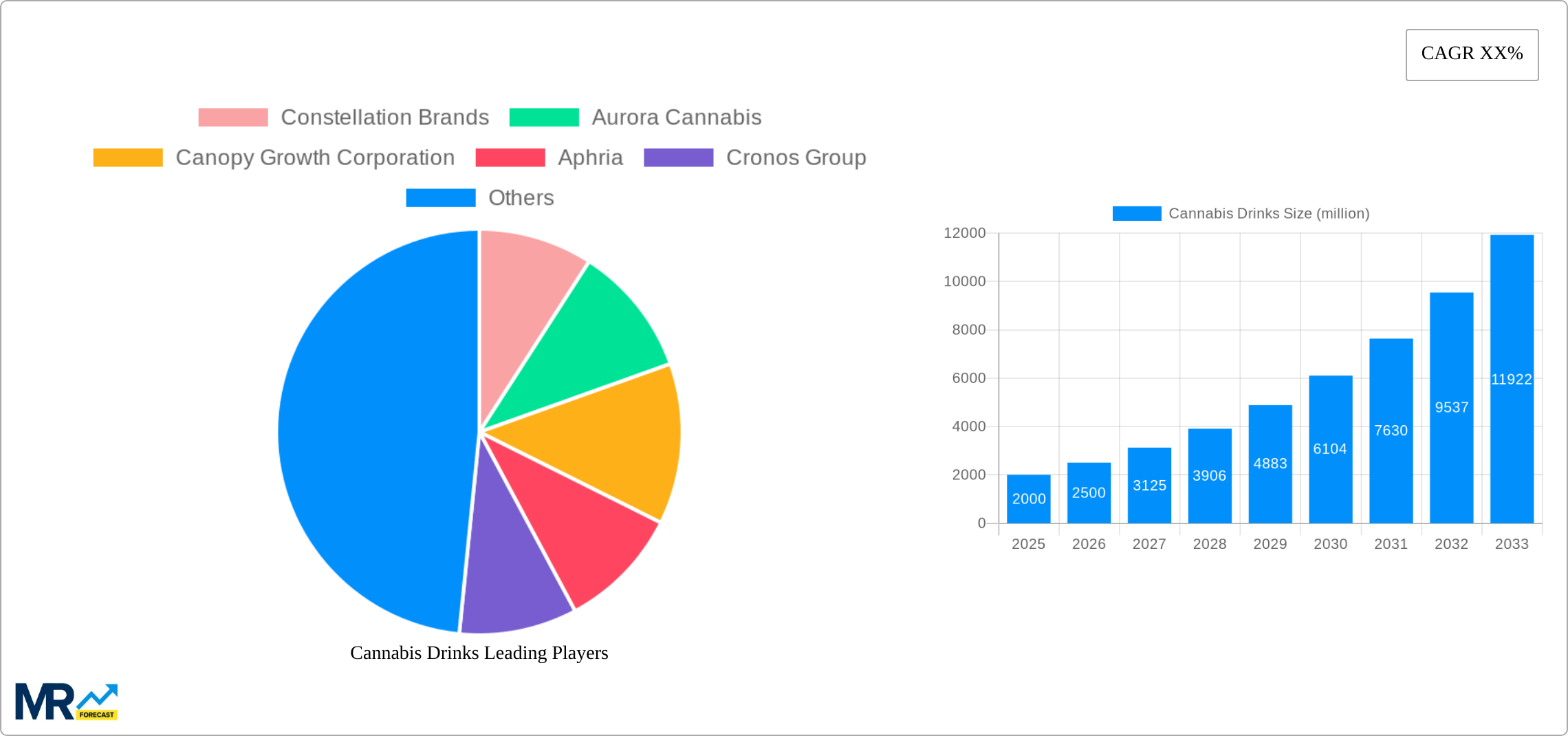

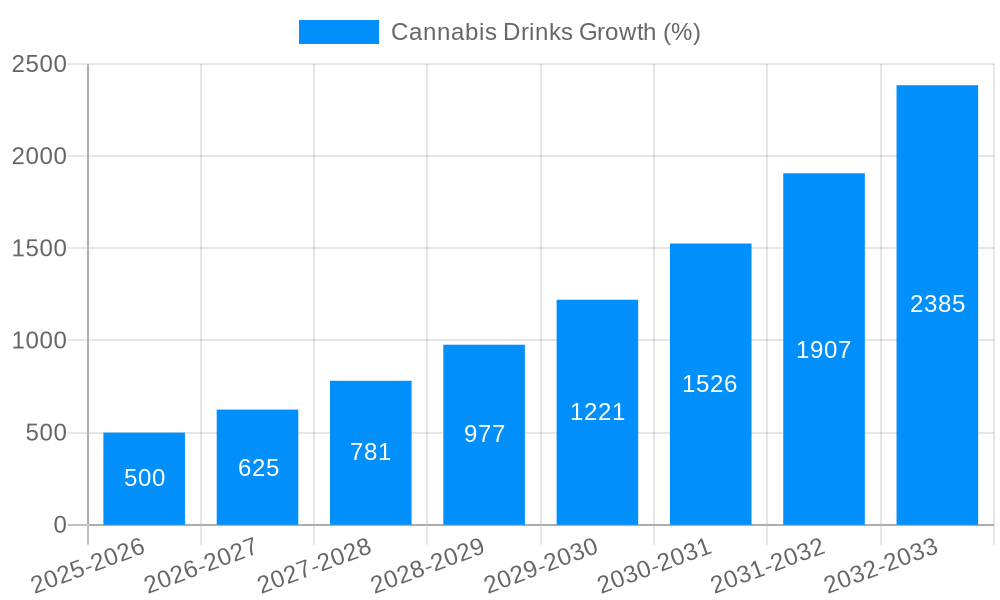

The global cannabis drinks market is experiencing robust growth, driven by increasing consumer acceptance of cannabis-infused products and the expanding legalization of cannabis across numerous regions. The market's value, while not explicitly stated, can be reasonably estimated based on the provided context and industry reports. Considering a similar CAGR for other beverage segments and the high growth potential of cannabis-infused products, a conservative estimate for the 2025 market size would be around $2 billion, with a Compound Annual Growth Rate (CAGR) projected at 25% for the forecast period (2025-2033). This growth is fueled by several key drivers, including evolving consumer preferences towards healthier and functional beverages, the rise in popularity of CBD and THC infused drinks, and continuous innovation in product formulations and delivery methods. Major market segments include CBD and THC-based drinks, distributed through mass merchandisers, specialty stores, and online retail channels. Leading companies, including Constellation Brands, Canopy Growth, and Tilray, are heavily investing in research and development to expand their product portfolios and capture market share. While regulatory hurdles and varying legalization statuses across different regions represent significant restraints, the overall positive trajectory of cannabis acceptance and expanding market access points toward sustained high growth for the foreseeable future.

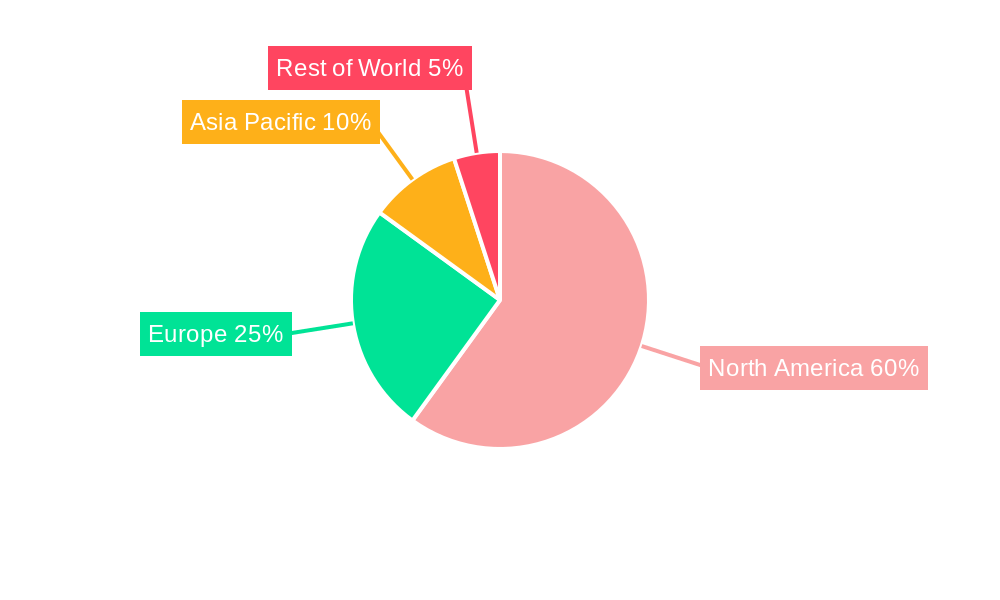

The market segmentation demonstrates clear distinctions in consumer preferences and purchasing behaviors. The CBD segment currently holds a larger market share compared to the THC segment due to the broader legal landscape surrounding CBD products. However, with the gradual shift towards legalization of THC-based products, the THC segment's growth is projected to accelerate significantly within the forecast period. Regarding distribution channels, online retail is expected to exhibit the highest growth rate, aligning with evolving consumer shopping habits. Geographically, North America currently dominates the market, particularly the United States and Canada, due to the more established cannabis industry and progressive legalization policies. However, other regions, including Europe and Asia-Pacific, are showing substantial growth potential, presenting lucrative opportunities for market expansion as legalization efforts progress and consumer awareness increases.

The cannabis drinks market is experiencing explosive growth, transitioning from a niche sector to a mainstream contender within the broader beverage industry. The study period from 2019 to 2033 showcases a remarkable trajectory, with the estimated market value in 2025 reaching several billion units. This surge is fueled by several converging factors: increasing consumer acceptance of cannabis, particularly in its infused beverage form, the expansion of legal cannabis markets across North America and Europe, and continuous innovation in product development resulting in improved taste profiles and functional benefits. The market is characterized by a dynamic interplay between established beverage giants like Constellation Brands, who are leveraging their existing distribution networks and brand recognition, and smaller, agile cannabis-focused companies pushing the boundaries of product innovation. The market is further segmented by type (CBD vs. THC), application (mass merchandisers, specialty stores, online retail), and consumer demographics, each exhibiting unique growth patterns. While CBD-infused beverages currently hold a larger market share due to less stringent regulations and broader appeal, THC-infused drinks are poised for significant growth as legalization expands and consumer preferences evolve towards experiences with more pronounced psychoactive effects. The competitive landscape is fierce, with companies vying for shelf space and consumer loyalty through targeted marketing campaigns, brand storytelling, and strategic partnerships. The future of the cannabis drinks market hinges on regulatory clarity, technological advancements, and continued consumer education to dispel misconceptions and promote responsible consumption. The projected forecast period of 2025-2033 suggests a continued, albeit potentially moderated, growth rate as the market matures and regulatory frameworks stabilize. The historical period from 2019-2024 has served as a crucial learning phase for both producers and consumers, shaping the trajectory of this rapidly evolving sector.

Several key factors are driving the rapid expansion of the cannabis drinks market. Firstly, the increasing legalization and decriminalization of cannabis in various jurisdictions globally are creating significant opportunities for market expansion. This shift in legal landscapes is directly translating into increased consumer acceptance and reduced stigma surrounding cannabis consumption. Secondly, the inherent convenience and discreet nature of cannabis drinks are contributing to their popularity. Unlike smoking or vaping, consuming cannabis through beverages offers a smoother, more palatable experience, appealing to a broader range of consumers. Thirdly, the innovation within the industry is a pivotal driver. Companies are constantly developing new formulations, flavors, and delivery methods to cater to diverse consumer preferences and improve the overall sensory experience. This includes advancements in emulsification techniques to enhance bioavailability and the creation of low-calorie, healthier options. Finally, the marketing and branding strategies employed by major players are effectively shaping consumer perception and driving demand. Clever campaigns that focus on wellness, relaxation, and social experiences are successfully attracting new consumers to the category. These combined factors are fostering a rapid expansion of the market, pushing it beyond its initial niche status into a larger segment of the overall beverage industry.

Despite the significant growth potential, the cannabis drinks market faces several challenges and restraints. Regulatory hurdles remain a significant obstacle, particularly concerning THC-infused beverages where regulations vary significantly across different jurisdictions. Inconsistencies in labeling, packaging, and distribution regulations create complexities for companies seeking to operate nationally or internationally. Furthermore, consumer education and awareness about responsible cannabis consumption remain crucial. Misinformation and misconceptions can deter potential consumers and lead to negative perceptions of the industry. The development and enforcement of clear guidelines regarding product safety, labeling, and marketing are essential to build trust and mitigate risks associated with cannabis consumption. Competition within the market is also intense, with both established beverage companies and smaller cannabis-focused businesses vying for market share. This necessitates significant investment in marketing, branding, and product differentiation to achieve sustained growth. Finally, the ongoing evolution of consumer preferences and emerging trends in the broader beverage industry necessitates ongoing innovation and adaptation to maintain relevance and competitiveness. Addressing these challenges proactively is crucial for the continued healthy growth of the cannabis drinks market.

The North American market, particularly the United States and Canada, is projected to dominate the global cannabis drinks market. This is primarily due to the relatively advanced state of cannabis legalization in these regions, creating a larger pool of potential consumers and a favorable regulatory environment (although still evolving).

United States: Significant growth is expected across states with established recreational or medical cannabis markets. The sheer size of the US market and the evolving regulatory landscape contribute heavily to this dominance. The acceptance of CBD products has already created a large consumer base and there is a potential for similar adoption for THC beverages.

Canada: As one of the earliest countries to legalize recreational cannabis, Canada is building a mature and diversified cannabis industry, contributing a large share of the market. Its focus on regulation is leading to safer and better products.

Within the segments, the CBD-infused beverages segment is projected to maintain a larger market share in the near term due to its broader appeal and less stringent regulations compared to THC-infused beverages. However, the THC-infused segment is poised for rapid growth as legal frameworks evolve and consumer acceptance increases. Furthermore, the specialty stores application segment, including dispensaries and cannabis-focused retailers, is expected to exhibit higher growth rates in the initial phases, owing to their focused target audience and ability to educate consumers. However, the mass merchandiser channel (supermarkets, convenience stores) has immense long-term potential as regulations ease and consumer acceptance broadens. Online retail also offers substantial growth opportunity for convenience and discreet purchasing.

Several factors are accelerating growth within the cannabis drinks sector. The rising consumer demand for convenient and socially acceptable cannabis consumption methods is a key driver. Technological advancements are also leading to improved product formulations, enhanced bioavailability, and more appealing flavors, thus broadening the market appeal. Furthermore, strategic partnerships between established beverage companies and cannabis producers are crucial in scaling production, distribution, and marketing. Finally, ongoing research and development aimed at uncovering the health and wellness benefits of cannabis components, along with increasing regulatory clarity, are contributing to broader acceptance and adoption.

This report provides a detailed analysis of the cannabis drinks market, covering historical data, current market trends, and future growth projections. It offers insights into key market drivers, challenges, and opportunities, alongside detailed profiles of major players. The report is designed to help businesses make informed strategic decisions and capitalize on the growth potential of this rapidly expanding market sector. The report’s comprehensive nature includes a segmentation analysis of the market based on type (CBD, THC), application (mass merchandiser, specialty stores, online retail, other), and key geographic regions. A forecast for the period 2025-2033, based on robust market research and data analysis, enables stakeholders to plan future investments and strategies.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Constellation Brands, Aurora Cannabis, Canopy Growth Corporation, Aphria, Cronos Group, CannTrust Holdings, VIVO Cannabis, Tilray, OrganiGram Holdings, American Premium Water, The Supreme Cannabis Company, Joybird Hemp Beverage, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cannabis Drinks," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cannabis Drinks, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.