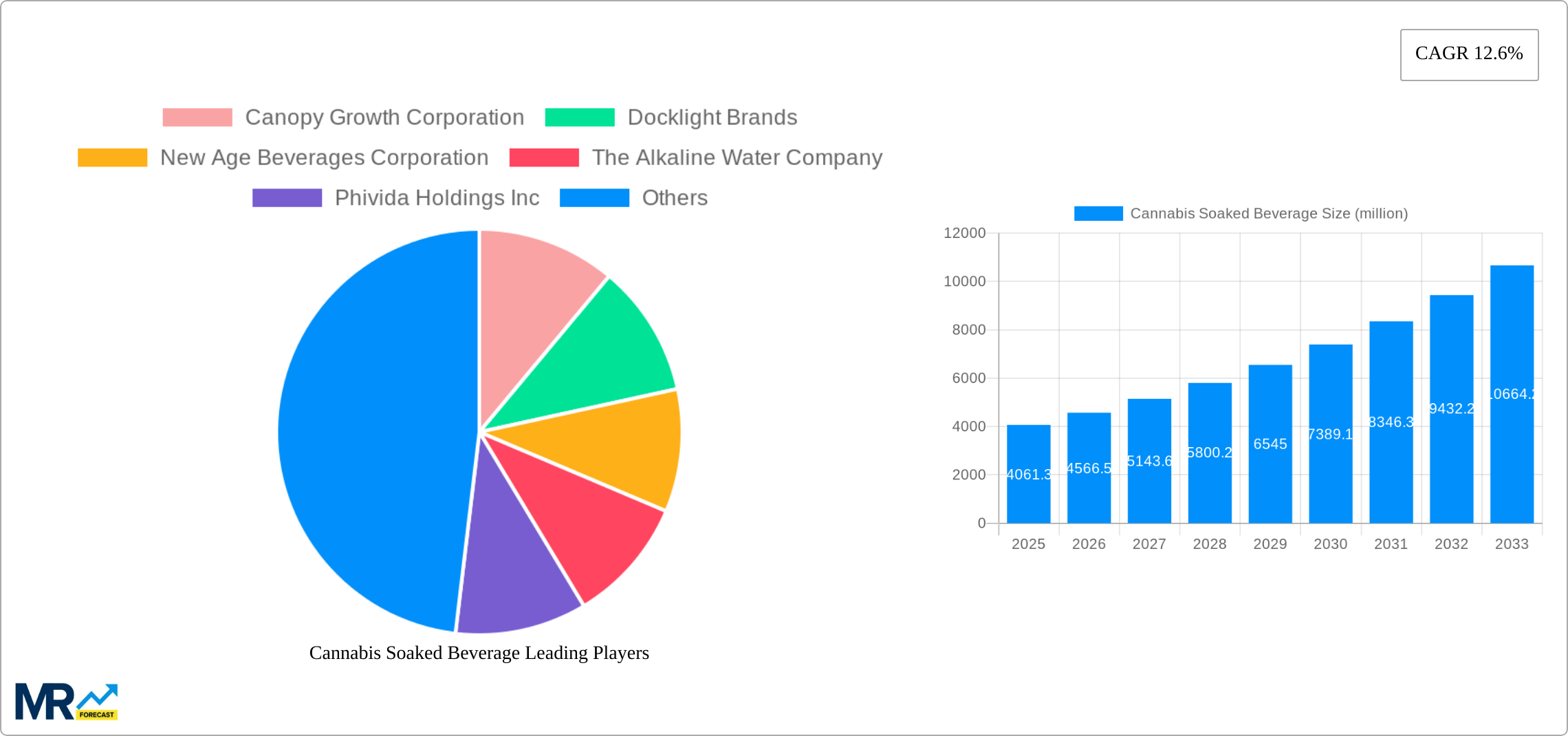

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cannabis Soaked Beverage?

The projected CAGR is approximately 12.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cannabis Soaked Beverage

Cannabis Soaked BeverageCannabis Soaked Beverage by Type (Alcohol, Nonalcoholic), by Application (Tea, Carbonated Drinks, Energy Drinks, Fruit Juice, Alcohol, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

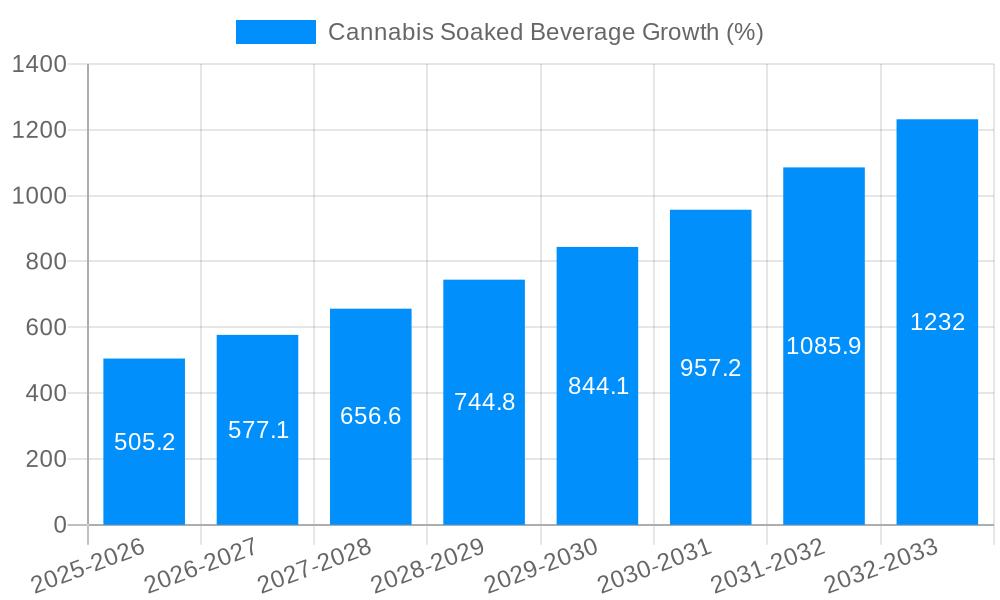

The cannabis-infused beverage market is experiencing robust growth, projected to reach $4061.3 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.6% from 2019 to 2033. This surge is fueled by several key factors. Increasing consumer acceptance of cannabis for recreational and medicinal purposes is a primary driver, alongside the expanding legalization of cannabis products across various regions globally. Consumers are increasingly seeking convenient and discreet methods of cannabis consumption, making ready-to-drink beverages an attractive alternative to smoking or vaping. Innovation in product development, including the creation of diverse flavors and formulations catering to specific consumer preferences (e.g., low-calorie, functional beverages), is also contributing to market expansion. The market segmentation reveals strong demand across various beverage types, with alcohol and non-alcoholic options catering to diverse consumer needs and preferences. The application segments, including tea, carbonated drinks, energy drinks, and fruit juices, demonstrate the versatility of cannabis infusion in the beverage industry. Competition among established and emerging players, including Canopy Growth Corporation, Docklight Brands, and others, is driving innovation and further market growth.

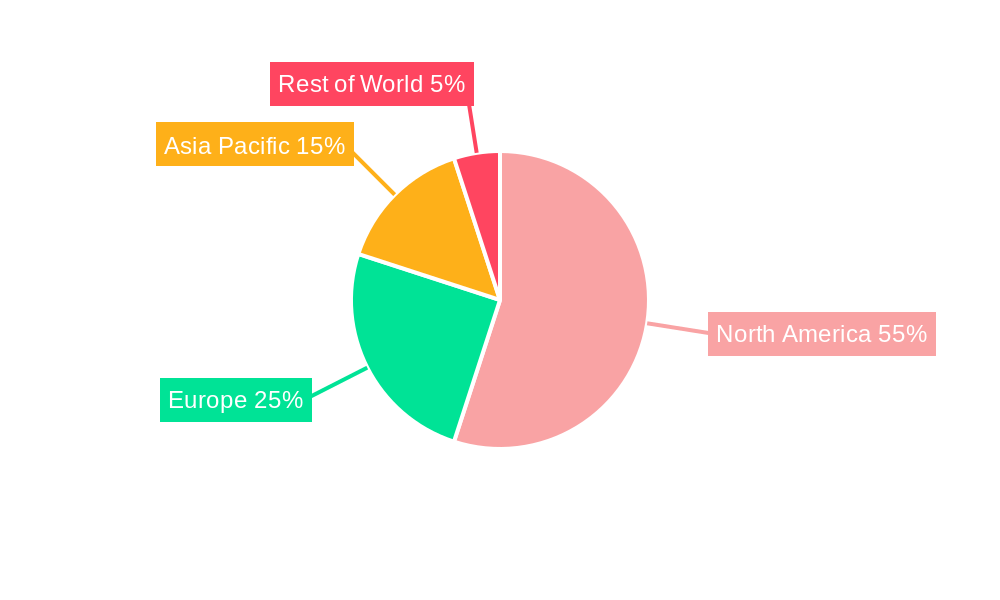

The geographical distribution of the market reveals significant regional variations. North America, particularly the United States and Canada, currently holds a substantial market share due to early legalization and a more established cannabis culture. However, Europe and the Asia-Pacific regions are poised for significant growth as regulations evolve and consumer awareness increases. While challenges such as regulatory hurdles, varying legal frameworks across different regions, and potential concerns related to health and safety remain, the overall market outlook remains positive, with continued growth predicted through 2033. The diverse range of products, combined with increasing consumer acceptance and evolving regulations, indicates that the cannabis-infused beverage market is likely to experience substantial expansion in the coming years.

The cannabis-infused beverage market is experiencing explosive growth, projected to reach multi-billion-dollar valuations within the next decade. Driven by shifting social attitudes towards cannabis and advancements in extraction and infusion technologies, this market segment is rapidly diversifying beyond simple THC-infused drinks. The study period (2019-2024) reveals a significant upward trajectory, with the base year (2025) showing substantial market penetration. The forecast period (2025-2033) anticipates even more remarkable expansion, with estimations reaching hundreds of millions of units sold annually. This growth is fueled by consumer demand for convenient and discreet methods of cannabis consumption, especially among younger demographics. The market is witnessing a surge in innovation, with companies introducing a wide array of product formats, including sparkling waters, teas, energy drinks, and even alcoholic beverages (where legally permissible). Competition is fierce, with established beverage companies partnering with cannabis producers to leverage existing distribution networks and brand recognition. However, regulatory hurdles, varying legal frameworks across different jurisdictions, and consumer concerns regarding accurate dosage and product safety remain significant challenges that need careful navigation. The market is witnessing a clear shift toward premiumization, with consumers increasingly willing to pay more for high-quality, organically sourced, and ethically produced cannabis-infused beverages. This trend is further shaping product development and marketing strategies across the industry. The emergence of sophisticated extraction techniques is also playing a vital role in delivering consistent and reliable dosages, enhancing consumer trust and driving market expansion.

Several key factors are accelerating the growth of the cannabis-soaked beverage market. Firstly, the increasing legalization and decriminalization of cannabis across various regions are significantly expanding the market's addressable population. This legal shift is coupled with a growing societal acceptance of cannabis for both recreational and medicinal purposes, breaking down historical stigmas and boosting consumer confidence. Secondly, the innovative product development within the industry is attracting a wider consumer base. The range of flavors, formats (carbonated, still, etc.), and cannabinoid profiles cater to diverse preferences, appealing to both experienced and new cannabis users. Thirdly, the convenience factor of consuming cannabis via beverages is a major draw. It offers a smoother, less intense experience compared to smoking or vaping, while also being more discreet. This ease of consumption is particularly attractive to consumers seeking a less conspicuous way to enjoy cannabis. Furthermore, the investment from major beverage companies and established players in the alcohol sector demonstrates the growing recognition of the market’s immense potential. This investment is driving innovation and enhancing distribution channels, further accelerating market growth and making cannabis-infused beverages readily available to consumers. The integration of technological advancements in extraction and infusion processes allows for greater accuracy in dosage and product consistency, addressing previous consumer concerns and building trust.

Despite its rapid growth, the cannabis-infused beverage market faces substantial challenges. Stringent regulations and varying legal landscapes across different jurisdictions create significant hurdles for companies aiming for national or international expansion. Navigating diverse legal requirements, licensing processes, and compliance standards can prove costly and time-consuming, limiting market access and hindering growth. Furthermore, consumer concerns surrounding product safety and accurate dosage remain a major obstacle. Ensuring consistent potency and reliable labeling is crucial for building consumer trust and overcoming skepticism. The lack of widespread consumer education about the effects of cannabis-infused beverages can also lead to misuse and negative experiences, potentially impacting market perception. Competition is extremely intense, with numerous established beverage companies and emerging cannabis brands vying for market share. This requires significant investment in marketing, brand building, and distribution networks to gain a competitive edge. Finally, the evolving scientific understanding of cannabis's long-term health effects necessitates ongoing research and transparent communication to address any potential safety concerns and maintain consumer confidence.

The North American market, particularly the United States and Canada, is currently leading the cannabis-infused beverage sector, driven by progressive cannabis legalization policies. However, other regions with emerging regulatory frameworks are poised for substantial growth. Within the segment breakdown, the non-alcoholic beverage sector is demonstrating exceptional growth potential. This is driven by broader consumer health consciousness and the desire for healthier alternatives to traditional alcoholic beverages. Among application types, the carbonated drinks segment displays high market traction due to its familiar and widely accepted format. The ease of integration with various flavors and the existing consumer familiarity with carbonated beverages facilitate rapid market adoption.

North America (US & Canada): The leading market due to advanced legalization and established cannabis culture. Early adoption by consumers and robust distribution channels contribute significantly to its dominance. Millions of units are sold annually in these regions.

Non-Alcoholic Segment: This segment benefits from the increasing health consciousness among consumers seeking recreational and functional beverages without alcohol. The market is also attractive for its potential to reach a broader consumer base. The projected growth for this segment over the forecast period is significant, reaching a substantial volume in the millions of units.

Carbonated Drinks Application: The familiarity and established infrastructure for carbonated drinks make this application a highly successful segment for cannabis infusions. The potential for innovative flavors and the broad consumer appeal contribute to its strong growth. The projected figures suggest a massive growth in this area within the forecast period, with millions of units expected to be sold.

The combined effect of these factors—market maturation in North America and the rapidly expanding non-alcoholic, carbonated segment—positions the cannabis-infused beverage market for continued, substantial expansion, with projections reaching hundreds of millions of units sold annually by the end of the forecast period.

The cannabis-soaked beverage industry's growth is propelled by several key catalysts. The increasing acceptance of cannabis for both recreational and medicinal purposes is a significant driver. Moreover, the innovation in product formulations, flavors, and delivery methods caters to diverse consumer preferences, broadening the market's appeal. Finally, partnerships between established beverage companies and cannabis producers accelerate market penetration by leveraging existing distribution networks and brand recognition. These factors work in synergy to fuel the industry's remarkable expansion.

The cannabis-soaked beverage market is poised for substantial growth, driven by legalization, innovation, and consumer acceptance. This report provides a detailed analysis of the market dynamics, including key trends, growth drivers, challenges, and leading players. It offers valuable insights into the various segments and regional markets, providing a comprehensive overview for businesses and investors navigating this rapidly evolving industry. The report's projections and forecasts offer a clear picture of the market's future trajectory, helping stakeholders make informed decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 12.6%.

Key companies in the market include Canopy Growth Corporation, Docklight Brands, New Age Beverages Corporation, The Alkaline Water Company, Phivida Holdings Inc, Koios Beverage Corporation, VCC Brand, Dixie Brands Inc, Keef Brand, Hexo Corp, Aphria, Averi, BevCanna, .

The market segments include Type, Application.

The market size is estimated to be USD 4061.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cannabis Soaked Beverage," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cannabis Soaked Beverage, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.